Ethereum

Ethereum ETFs’ changing landscape – Monochrome, VanEck, and more outflows

Credit : ambcrypto.com

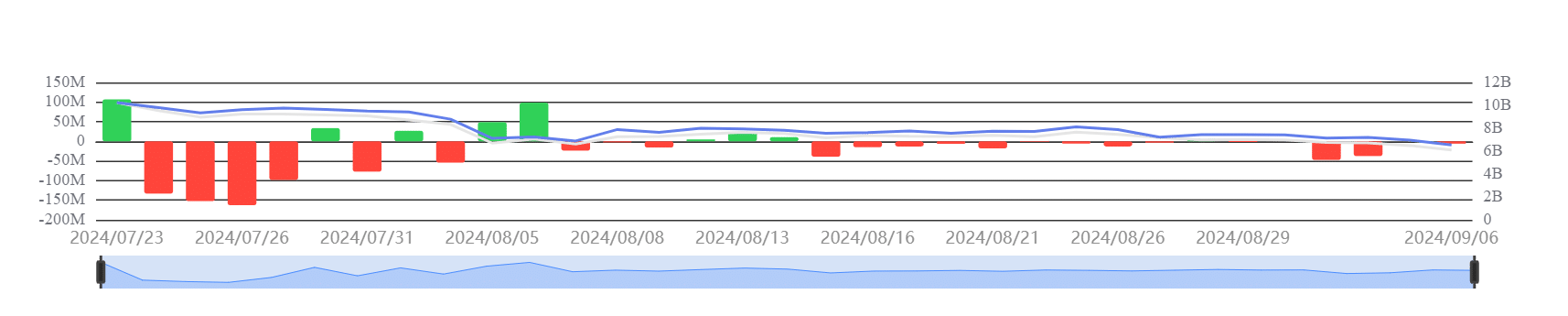

- Spot ETH ETFs had web flows of -$91 million this week.

- The ETH ETF quantity has not elevated in comparison with the BTC ETF

Ethereum has seen notable occasions surrounding its ETFs this week. A significant asset supervisor introduced it was discontinuing one in all its Ethereum-based options. On the similar time, one other firm filed for a brand new spot Ethereum ETF.

These developments occurred throughout every week the place Spot ETH ETFs noticed just about no inflows, additional contributing to the combined sentiment surrounding ETH.

New Ethereum ETF characteristic in Australia

Earlier this week, the Australian asset supervisor stated Monochrome Asset Management announced that it has utilized to record the Monochrome Ethereum ETF (Ticker: IETH) on Cboe Australia. The announcement highlighted that the asset supervisor plans to carry ETH passively, making it the primary ETF in Australia to take action. This transfer marks Monochrome’s continued growth into the cryptocurrency ETF area, following the launch of its BTC ETF in June 2024.

Whereas Monochrome is making progress with its Ethereum ETF, VanEck, one other main asset supervisor, has introduced it’s discontinuing one in all its ETH ETF options.

VanEck will shut Ethereum Futures ETF

In a September 6 announcement VanEck revealed that the board has authorised the liquidation of its VanEck Ethereum Technique ETF (EFUT) – a futures-based Ethereum ETF.

The choice to liquidate the fund was attributed to inadequate demand. It stated merchants confirmed a desire for spot ETFs over futures choices. In response to the assertion, EFUT shares will stop buying and selling on September 16. Additionally, the fund’s belongings might be liquidated and returned to buyers on or round September 23.

The contrasting strikes of Monochrome and VanEck spotlight the rising reputation of spot ETFs within the cryptocurrency market. The spot launch of Monochrome Ethereum ETF (IETH) is in step with this pattern. On the similar time, VanEck’s choice to part out its Futures ETF displays the declining enchantment of Futures merchandise in favor of direct publicity by way of spot ETFs.

Nevertheless, regardless of the obvious desire for spot ETFs, the general pattern for these merchandise over the previous week has been characterised by outflows.

Spot ETH ETF information consecutive outflows

Spot Ethereum ETFs recorded consecutive outflows throughout most exchanges over the previous week, in keeping with evaluation of knowledge from SoSoValue. On the shut of buying and selling on September 6, outflows had been roughly $6 million, bringing whole web outflows for the week to $-91 million.

Supply: SoSoValue

– Learn Ethereum (ETH) value forecast 2024-25

Moreover, whole web flows for spot ETH ETFs now stand at roughly $-568.30 million, indicating a continued pattern of investor withdrawals.

What this implies is that market situations have prompted buyers to withdraw their ETH positions in current weeks.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024