Ethereum

Ethereum ETFs record sudden outflows: What changed post-election?

Credit : ambcrypto.com

- Ethereum ETF inflows peaked, however bearish sentiment is rising.

- Futures information underlined the cautious sentiment amongst merchants.

Moonvember has confirmed to be helpful for Ethereum [ETH] ETFs. Principally AMBCrypto reported that the ETFs reached document inflows of $515 million final week.

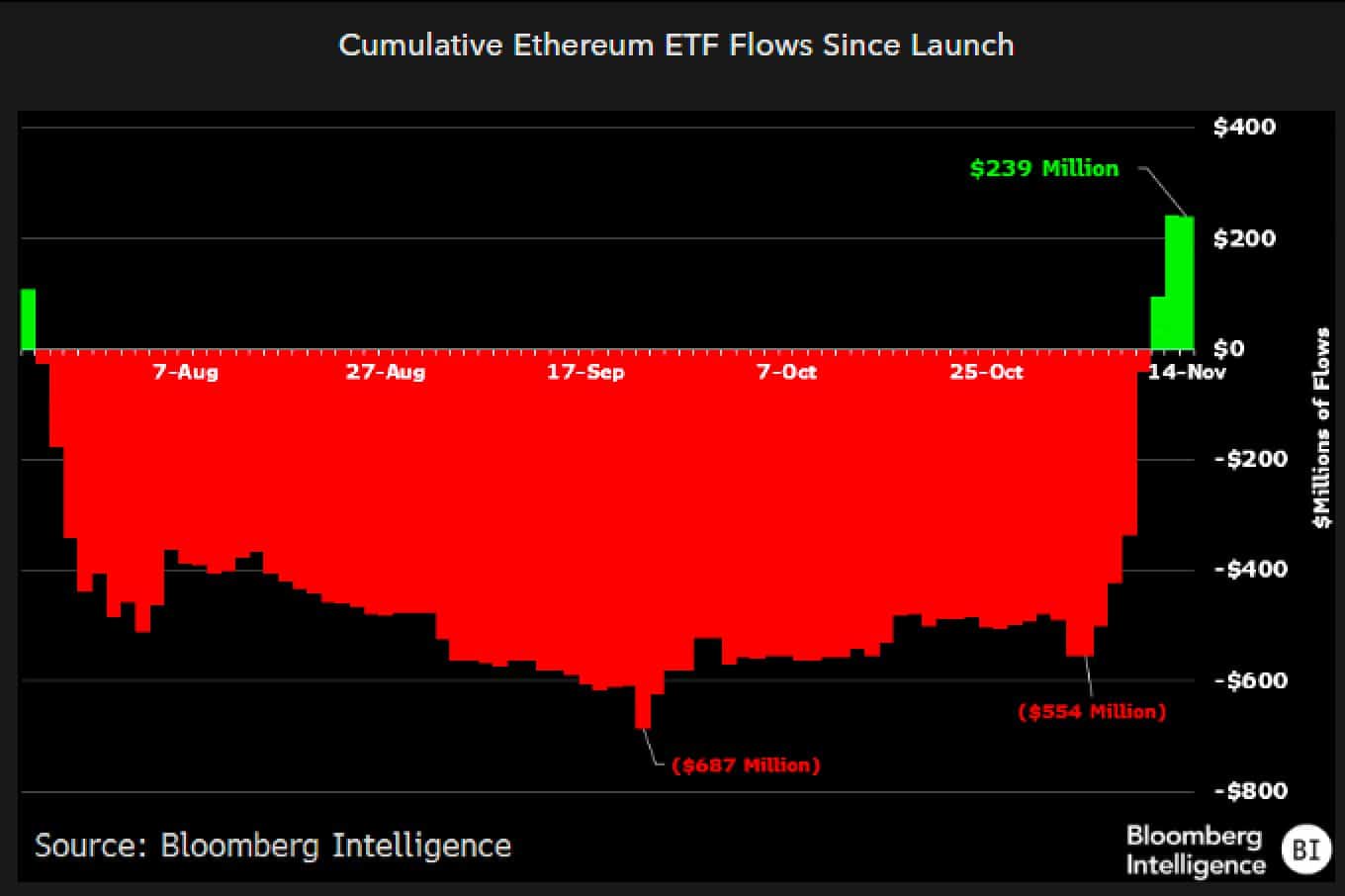

This milestone didn’t go unnoticed by sector analysts. Eric Balchunas, senior ETF analyst at Bloomberg, shared the ETF chart on X (previously Twitter), which reveals a notable transition from pink to inexperienced.

Supply: Eric Balchunas/X

He highlighted this as a big restoration for ETH ETFs, noting that the dramatic turnaround got here after a protracted interval of sustained outflows.

Publish-election optimism fuels Ethereum ETFs

It isn’t unknown that the crypto market has grown enormously since Donald Trump victory within the 2024 US presidential election. Analysts recommend this has acted as a catalyst for buyers’ renewed enthusiasm for ETH ETFs.

As Bloomberg ETF analyst James Seyffart put it in an X after,

“Ethereum ETF information will should be mentioned akin to BC and AD instances. Earlier than Trump’s election and after Trump’s election, BE & AE.”

Balchunas supplied a special perspective, to describe the latest exercise as,

“Beta with a touch of bitcoin is how I’d greatest describe the flows of the previous week, for the reason that election and really for all the 12 months.”

Regardless of the market displaying indicators of being considerably overextended, the director believes ETF buyers proceed to exhibit a remarkably upbeat and bullish outlook.

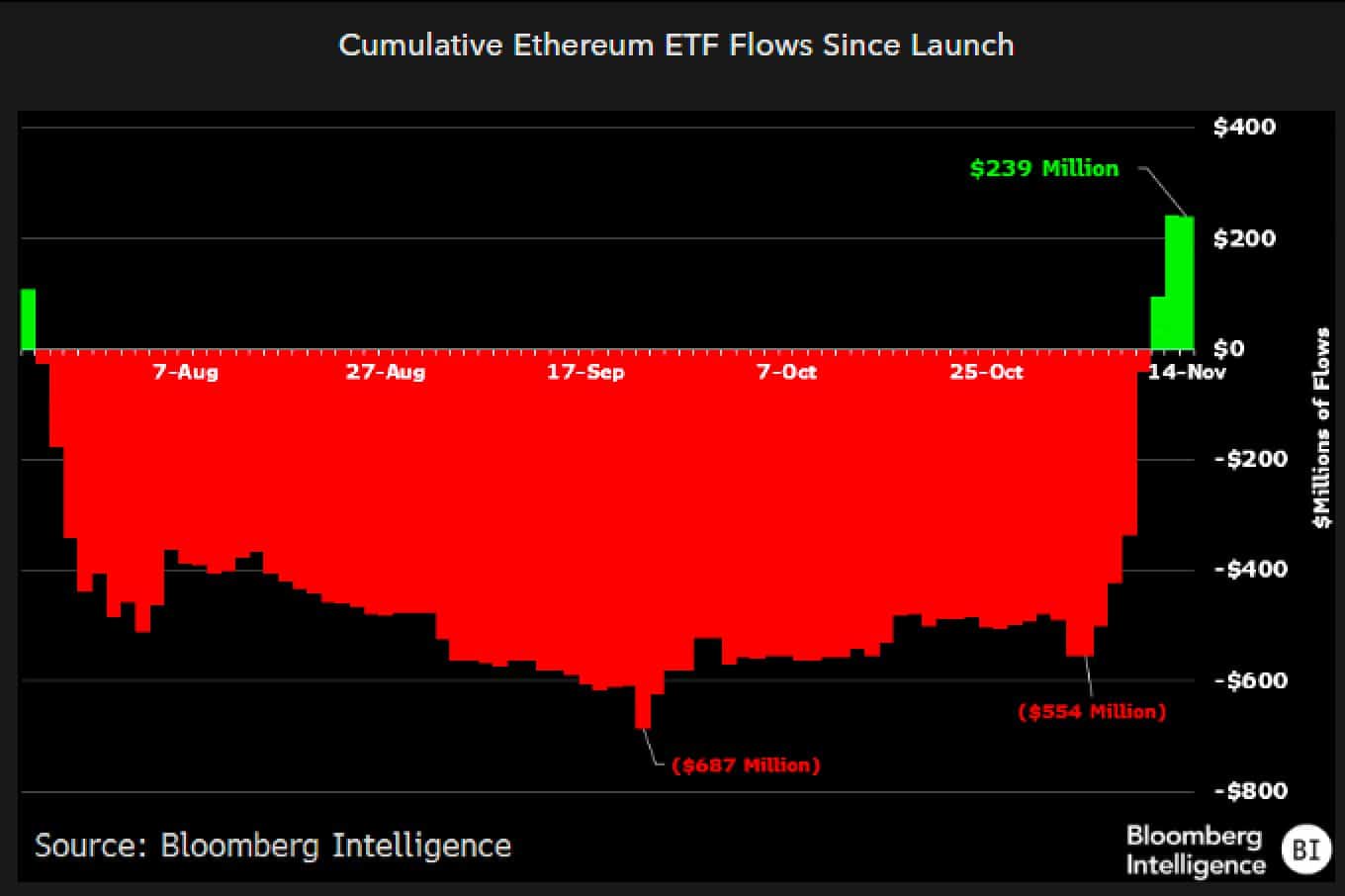

ETH ETF flows are going through a pink tide

Even with final week’s staggering influx milestone, Ethereum ETF flows seem to have adopted the other path.

Facts of SoSo Worth revealed web outflows within the closing days of final week, with $3.24 million on November 14 and $59.87 million on November 15.

The development continued this week, with one other $39.08 million in outflows going down on November 18. Of the 9 ETFs, solely Constancy’s FETH managed to submit inflows.

In the meantime, the three largest ETFs noticed outflows, whereas others noticed no outflows in any respect.

If this development continues, it could be the primary time since early November that ETH ETFs have ended every week within the pink – a pointy distinction to the optimism seen beforehand.

ETH is underneath stress

In the meantime, Ethereum’s worth surge, which initially adopted the election buzz, seems to be operating out. After a brief crossing $3,400ETH has since withdrawn.

On the time of writing, the altcoin was exchanging palms at $3,116.66 – down 6.33% previously week and down a modest 0.06% previously 24 hours, in response to CoinMarketCap facts.

Futures market information from Coinglass painted a combined image. Buying and selling exercise elevated, with quantity up 57.77%.

Nonetheless, Open Curiosity rose by solely 0.76%, indicating that merchants remained reluctant to wager. The Lengthy/Brief ratio of 0.9535 over the previous 24 hours was barely bearish, reflecting rising uncertainty.

Learn Ethereum’s [ETH] Worth forecast 2024–2025

Whereas Ethereum ETFs have made headlines for his or her spectacular inflows, the rising patterns of outflows and worth corrections level to a market which may be gearing up for a cooldown.

The query now could be whether or not this second of bullishness is a fleeting spark, or the beginning of an extended development.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now