Ethereum

Ethereum [ETH] ETF gets $500 mln boost in 2 days – What’s next?

Credit : ambcrypto.com

- The institutional influx highlighted Ethereum’s growing prominence in regulated monetary belongings resembling ETH ETF merchandise.

- Ethereum rose to $3,830 with a 24-hour buying and selling quantity of $39.3 billion, indicating momentum.

Ethereum [ETH] has attracted consideration once more, as ETFs managed by monetary powerhouses BlackRock and Constancy made a mixed buy of $500 million price of ETH in simply two days.

The transactions, executed primarily via Coinbase’s institutional-focused platform Prime, spotlight the rising institutional curiosity in Ethereum.

With ETH rising to $3,830 and 24-hour buying and selling quantity rising to $39.3 billion, this wave of ETF inflows marks a pivotal second for Ethereum’s trajectory, additional cementing its place as a cornerstone of the digital asset panorama.

Influence on market efficiency

Supply: Yahoo Finance

The mixed $500 million buy of Ethereum by BlackRock’s ETHA and Constancy’s FETH ETFs over the previous two days alerts a profound acceleration in institutional curiosity.

With buying and selling volumes for ETHA and FETH rising to $372.4 million and $103.7 million respectively on December 10, the dimensions of those inflows marks a pivotal second in ETF exercise.

Ethereum’s value, which stood at $3,830 on the time of writing, mirrored a 5.1% enhance, supported by 24-hour buying and selling volumes that reached $39.3 billion.

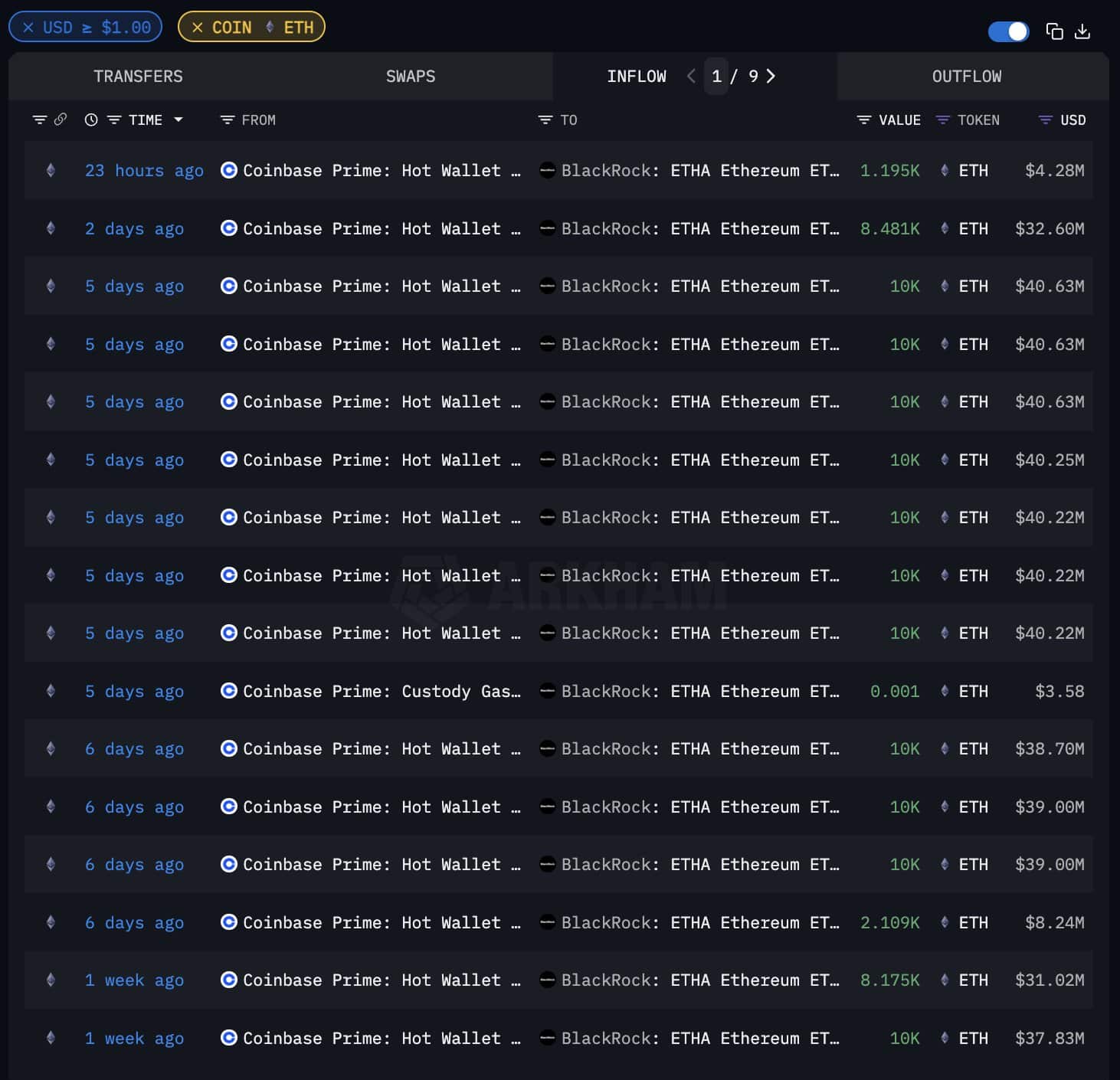

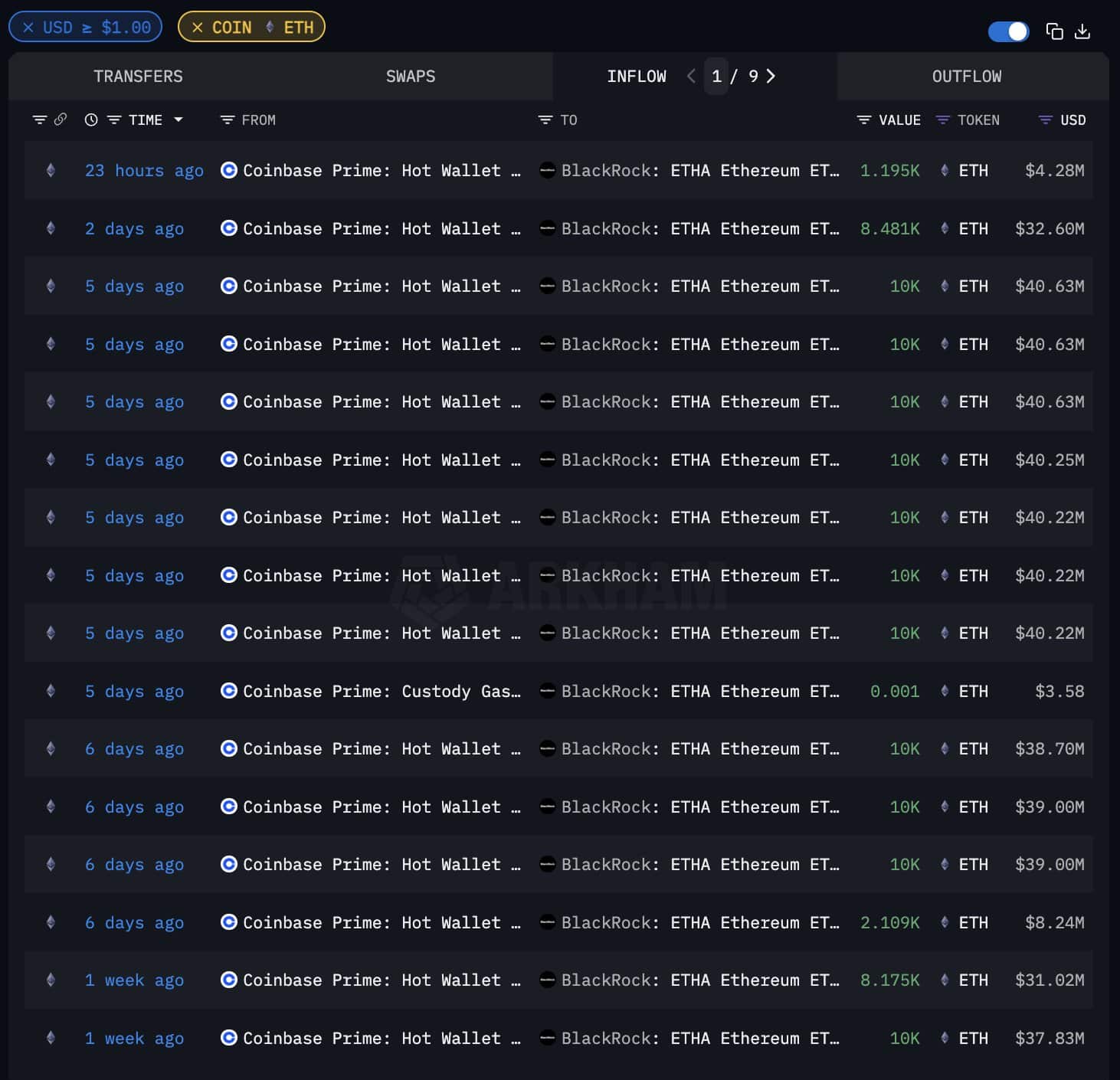

Supply: Arkham

This inflow additionally highlighted the dominant function that Coinbase Prime performs in facilitating large-scale institutional transactions, strengthening its place as an essential bridge between conventional monetary and crypto markets.

This capital injection not solely boosts liquidity but additionally reduces market volatility, strengthening Ethereum’s attraction to each retail and institutional members.

Supply: Arkham

What these purchases imply for ETH and the market

This $500 million funding represents greater than a brief revival; it underlines a strategic shift within the notion of Ethereum as a monetary asset.

The timing of those purchases, which coincided with Ethereum’s value round $3,830, displays a rising perception in its resilience and usefulness as a decentralized computing community and retailer of worth.

Moreover, these inflows strengthen Ethereum’s place within the post-adoption period of spot ETFs, the place regulatory readability has catalyzed confidence amongst institutional buyers.

The surge in ETF inflows additionally units a precedent for broader adoption in world markets, positioning ETH as a core asset in diversified crypto portfolios.

As ETFs combine Ethereum into conventional monetary merchandise, they additional validate its function as a cornerstone within the evolving digital asset financial system.

ETH ETF: Worth enhance and market sentiment

Supply: TradingView

The $500 million influx into ETH ETFs has had a major impression on the worth and market sentiment. ETH’s rally to $3,830 marked a 5.1% achieve, breaking earlier resistance ranges and signaling sturdy upside momentum.

Learn Ethereum [ETH] Worth forecast 2024-2025

The RSI on the worth chart confirms the bullish sentiment, with a worth above 60, indicating continued shopping for curiosity. In the meantime, the OBV development exhibits growing accumulation by each retail and institutional buyers.

This confluence of rising costs, buying and selling volumes and constructive technical indicators illustrates the rising market confidence in Ethereum as a long-term asset, additional strengthening its function as a number one participant within the crypto financial system.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024