Ethereum

Ethereum (ETH) Price Slides ; Mirrors 2017 & 2020 Patterns—Is a Breakout Ahead ?

Credit : coinpedia.org

Following Bitcoin’s worth plunge beneath the essential assist of $84,000, as a result of collapse of bid-side liquidity, the crypto markets have been shocked. The ripple results unfold to different altcoins like Ethereum and Solana, whose costs fell greater than Bitcoin. The ETH worth fell sharply this week, falling again to the mid-$2,700s as broader crypto market volatility pushed buyers into threat mode. Whereas the short-term technical information seems weak, a deeper evaluation of strike flows, historic worth construction, and long-term accumulation zones means that the most recent decline could have much less to do with weak point and extra to do with alternative for longer-term gamers.

ETH is returning to its ‘low cost zone’: a degree at which main rallies traditionally start

Ethereum has as soon as once more entered a serious multi-year “low cost zone” – a worth area that has constantly functioned as a long-term accumulation vary. The chart reveals that ETH worth remains to be transferring inside an ascending parallel channel relationship again to early 2022.

Earlier troughs on this decrease band (late 2022, mid 2023 and early 2025) all produced robust rallies, usually marking the beginning of multi-month uptrends. The present return to the low cost zone displays these earlier developments, suggesting that the detrimental influence could also be extra restricted than current market sentiment implies.

This structural pattern stays intact regardless of the pullback and gives an necessary perception: ETH’s macro uptrend is uninterrupted.

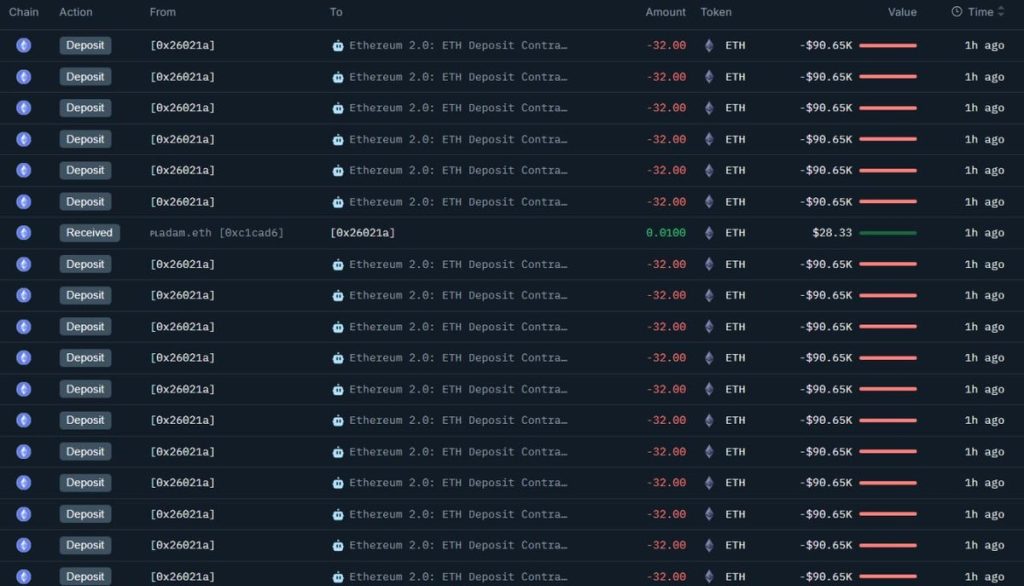

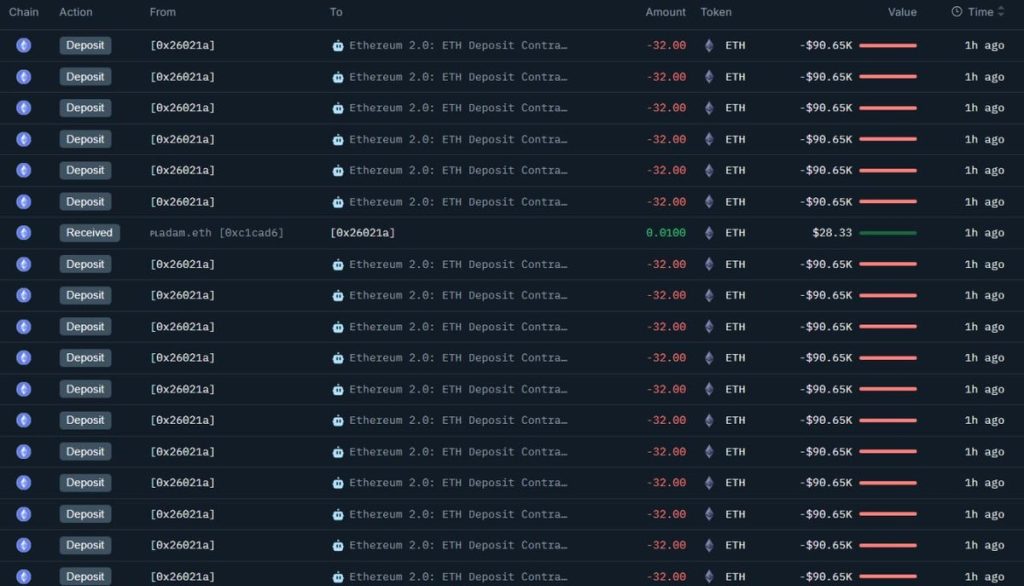

Whales are deploying extra ETH – even through the correction

Whereas the weak point in spot costs may point out that confidence is waning, on-chain information reveals the other. Main validators – often whales or establishments – proceed to ship repeating batches of 32 ETH to the Ethereum Deposit Contract.

The information above means that an early Ethereum whale simply staked 40,000 ETH price $120 million after 10 years of inactivity. This conduct signifies persistent accumulation and long-term dedication. When whales enhance their bets throughout market downturns, it’s usually an indication that they view the transfer as non permanent and never structural.

Traditionally, the inflow of aggressive strikes has aligned with main cycle expansions as they cut back the provision of liquidity and tighten international alternate reserves. The sample appears to repeat itself.

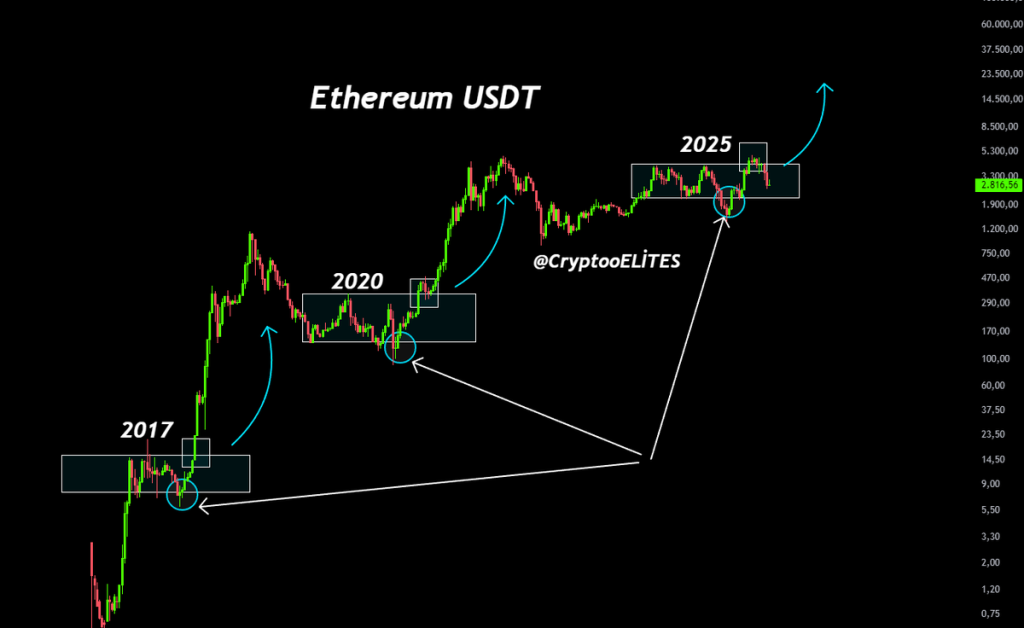

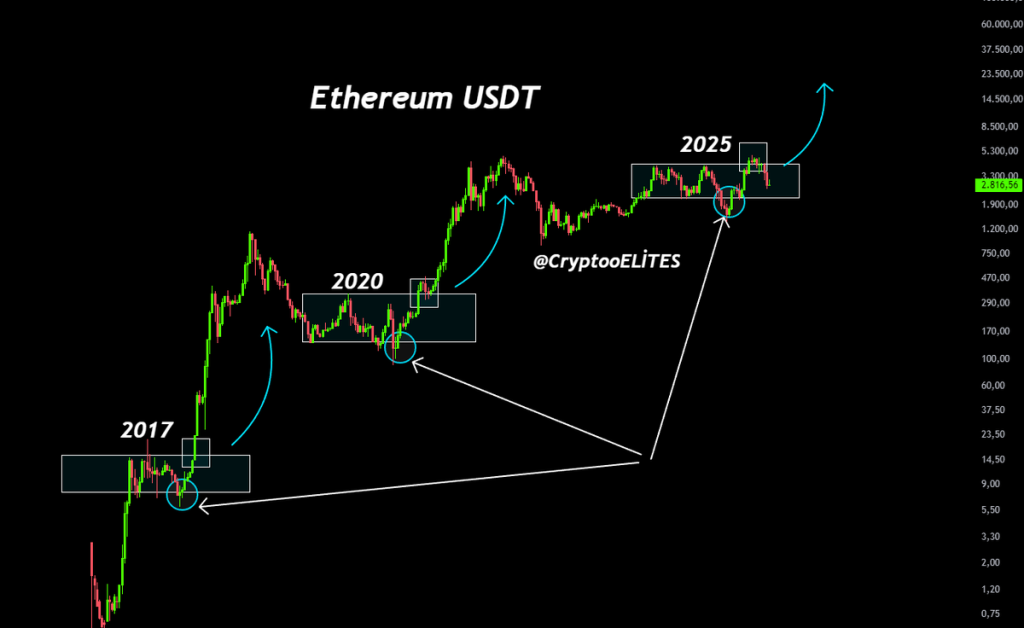

Ethereum’s present construction displays the 2017 and 2020 accumulation phases

Zooming out, Ethereum’s present consolidation zone appears to be like strikingly just like earlier cycle setups in 2017 and 2020 – each of which resulted in explosive breakouts.

Every cycle adopted a repeated sample of conduct:

- Lengthy consolidation close to the midpoint of the macro pattern

- A closing shakeout or drop in the direction of assist

- A speedy growth part as soon as liquidity returned

Within the chart, the 2025 worth motion mimics the identical construction, suggesting that ETH could possibly be nearing the tip of its consolidation fairly than beginning a deeper downtrend.

What comes subsequent for the ETH worth?

Ethereum’s newest correction has pushed the asset again right into a historic “worth zone,” however on-chain information suggests the pullback could possibly be a possibility fairly than a setback. Whales proceed to build up, stake deposits stay robust, and ETH’s broader market construction nonetheless resembles earlier phases earlier than the outbreak. Whereas short-term volatility could persist, underlying fundamentals level to a community strengthening beneath the floor, paving the best way for a possible restoration as soon as market sentiment stabilizes.

If ETH can reclaim the $3,100-$3,250 band on robust quantity, the following large leg in the direction of the $3,800-$4,200 area turns into more and more probably. And if historical past continues to rhyme, Ethereum may place itself for a a lot greater transfer later in 2025.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our knowledgeable panel of analysts and journalists, following strict editorial pointers based mostly on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our evaluate coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We try to offer well timed updates on every thing crypto and blockchain, from startups to business majors.

Funding Disclaimer:

All opinions and insights shared symbolize the creator’s personal views on present market situations. Please do your individual analysis earlier than making any funding choices. Neither the author nor the publication accepts accountability on your monetary decisions.

Sponsored and Advertisements:

Sponsored content material and affiliate hyperlinks could seem on our website. Advertisements are clearly marked and our editorial content material stays utterly unbiased from our promoting companions.

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International