Ethereum

Ethereum (ETH) Will Soar 11% If This Key Trigger Hits

Credit : coinpedia.org

After consolidating for every week, Ethereum (ETH), the world’s second largest cryptocurrency per market capitalization, is prepared for an enormously upward momentum. On March 18, 2025, the final cryptocurrency market once more witnesses a worth improve. Within the midst of this, ETH has reached the higher restrict of its consolidation and is about to get out of an outbreak.

Ethereum (ETH) Technical evaluation and upcoming degree

In line with the technical evaluation of specialists, ETH is in a good attain between $ 1,840 and $ 1,955 for the previous week. As the costs concerning the cryptomarkt rise, nonetheless, it actively reaches the higher restrict of this vary and it’s now just a few factors after the outbreak.

Primarily based on current worth motion and historic momentum, if ETH infringes and closes above the $ 1,960 degree, there’s a robust chance that it might rise by 11% within the coming days to succeed in $ 2,200.

Within the midst of the current fall in worth, ETH has fallen significantly and acts beneath the 200 exponential advancing common (EMA) on the each day interval, indicating that it’s actively in a downward pattern.

Bullish on-chain statistics

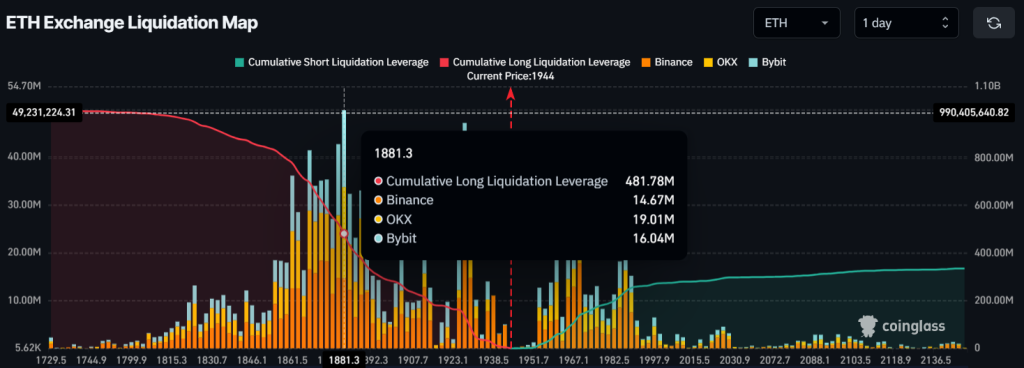

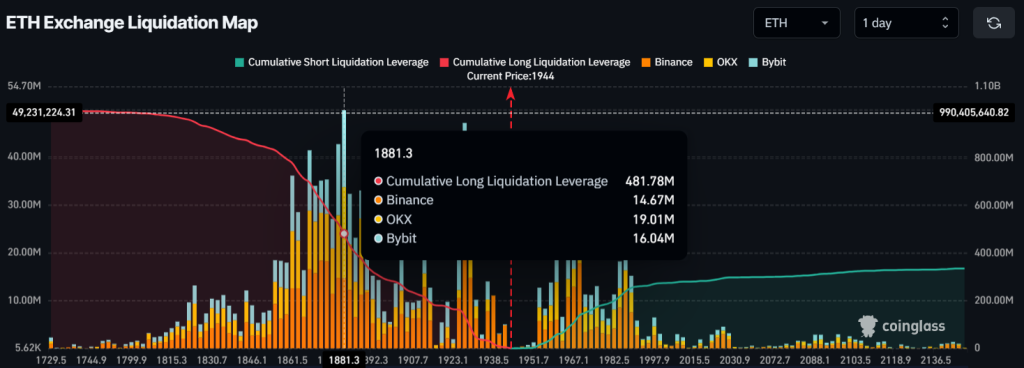

Even if ETH is in a downward pattern, intraday merchants appear to be bullish as a result of they wager strongly on the lengthy aspect, in keeping with the unchain evaluation firm Coinglass.

$ 480 million in lengthy positions

Information reveals that merchants are presently getting used an excessive amount of for $ 1,880 on the backside, the place they’ve constructed $ 480 million in lengthy positions. Within the meantime, $ 1,970 is one other survival degree, by which merchants have constructed up $ 140 million in ETH brief positions, which clearly signifies a bullish prospect amongst merchants.

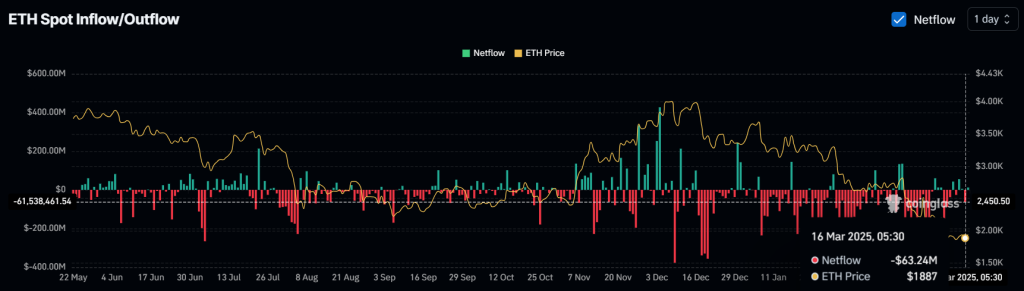

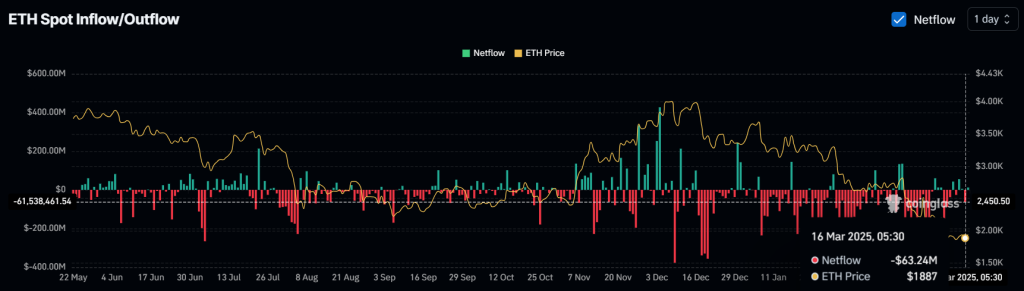

$ 50 million in ETH outflow

Along with the bullish prospects of merchants, buyers and holders additionally appear to be bullish in the long run, as a result of they appear to gather it actively and use the current worth lower, in keeping with the on-chain evaluation firm Coinglass.

Information from Spot Influx/Outflow reveals that exchanges have skilled ETH outflows for almost $ 50 million prior to now 48 hours, which signifies potential accumulation and presenting a super instance of a ‘purchase the dip’ likelihood.

Present worth momentum

ETH is presently being traded close to $ 1,950 and has registered an upward enhance of 5% for the previous 24 hours. Throughout the identical timeframe, nonetheless, it was a witness to appreciable participation of merchants and buyers due to his bullish prospects, leading to a bounce of 30% within the commerce quantity.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now