Ethereum

Ethereum – Examining why these institutions dumped $123M in ETH

Credit : ambcrypto.com

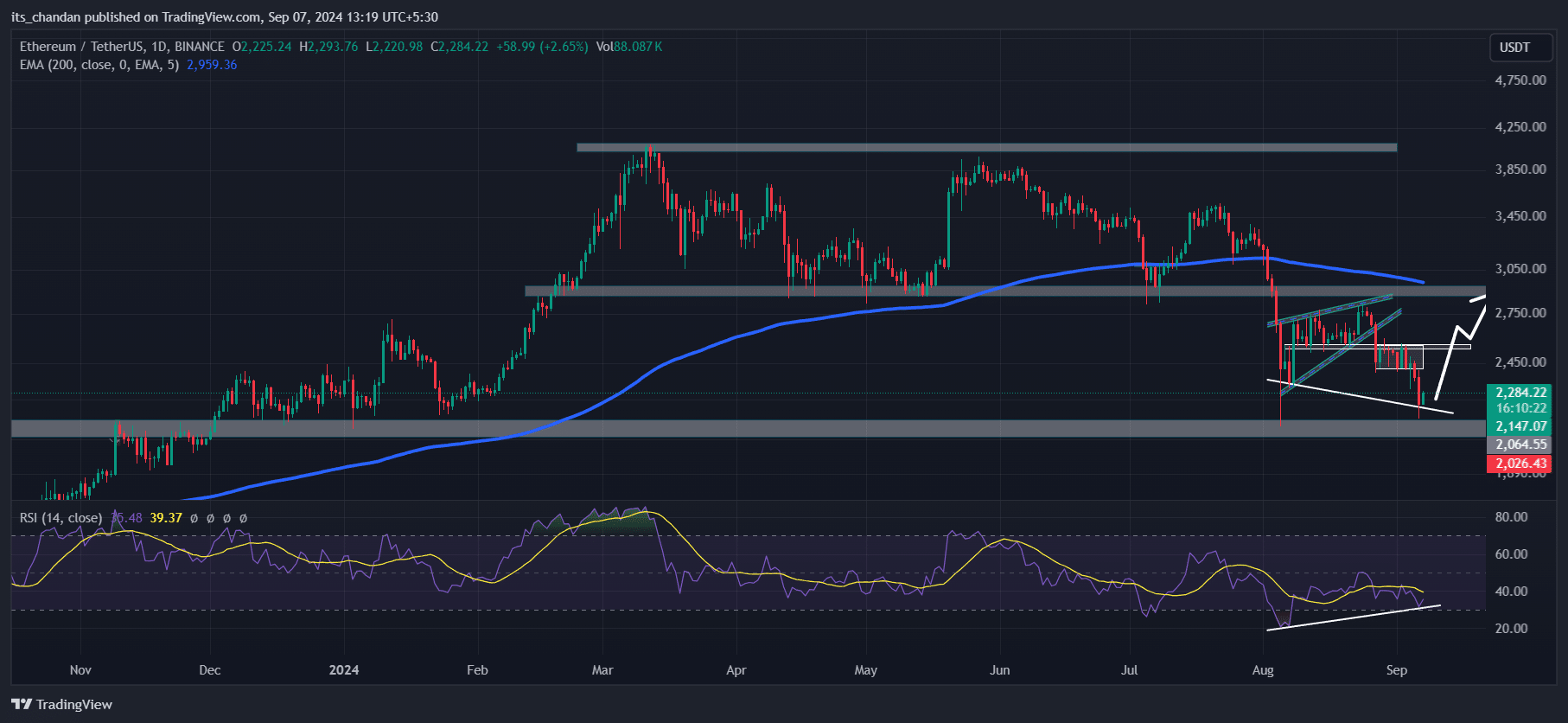

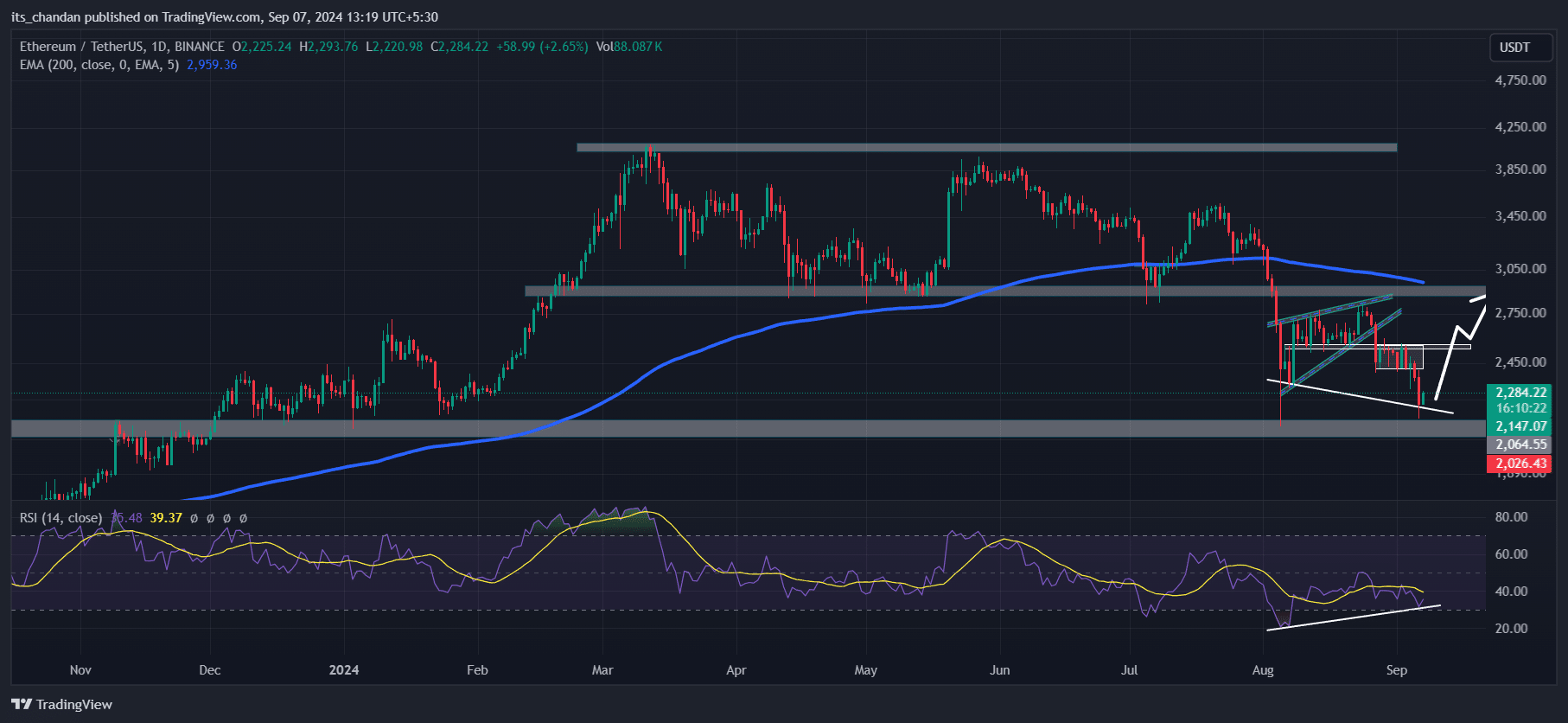

- ETH’s RSI fashioned a bullish divergence on the day by day timeframe

- 53.88% of prime merchants now maintain lengthy positions, whereas 46.12% maintain brief positions

In mild of the bearish market, Ethereum (ETH), the second largest cryptocurrency on this planet, is consistently being dumped by establishments and whales. This has resulted in notable worth drops within the charts.

In accordance with a put up on X (previously Twitter), establishments dumped a big 55,035 ETH value $123 million to Binance throughout Asian buying and selling hours.

Establishments offload hundreds of thousands of ETH

The on-chain evaluation platform confirmed that the establishments concerned have been Wintermutea number one algorithmic buying and selling firm, and Metalfa a digital asset supervisor.

Collectively, they dumped 46,947 ETH value $104.74 million and eight,088.8 ETH value $18.05 million respectively in simply two hours. This vital dump has the potential to impression the worth of the altcoin.

Doable cause behind the latest dump

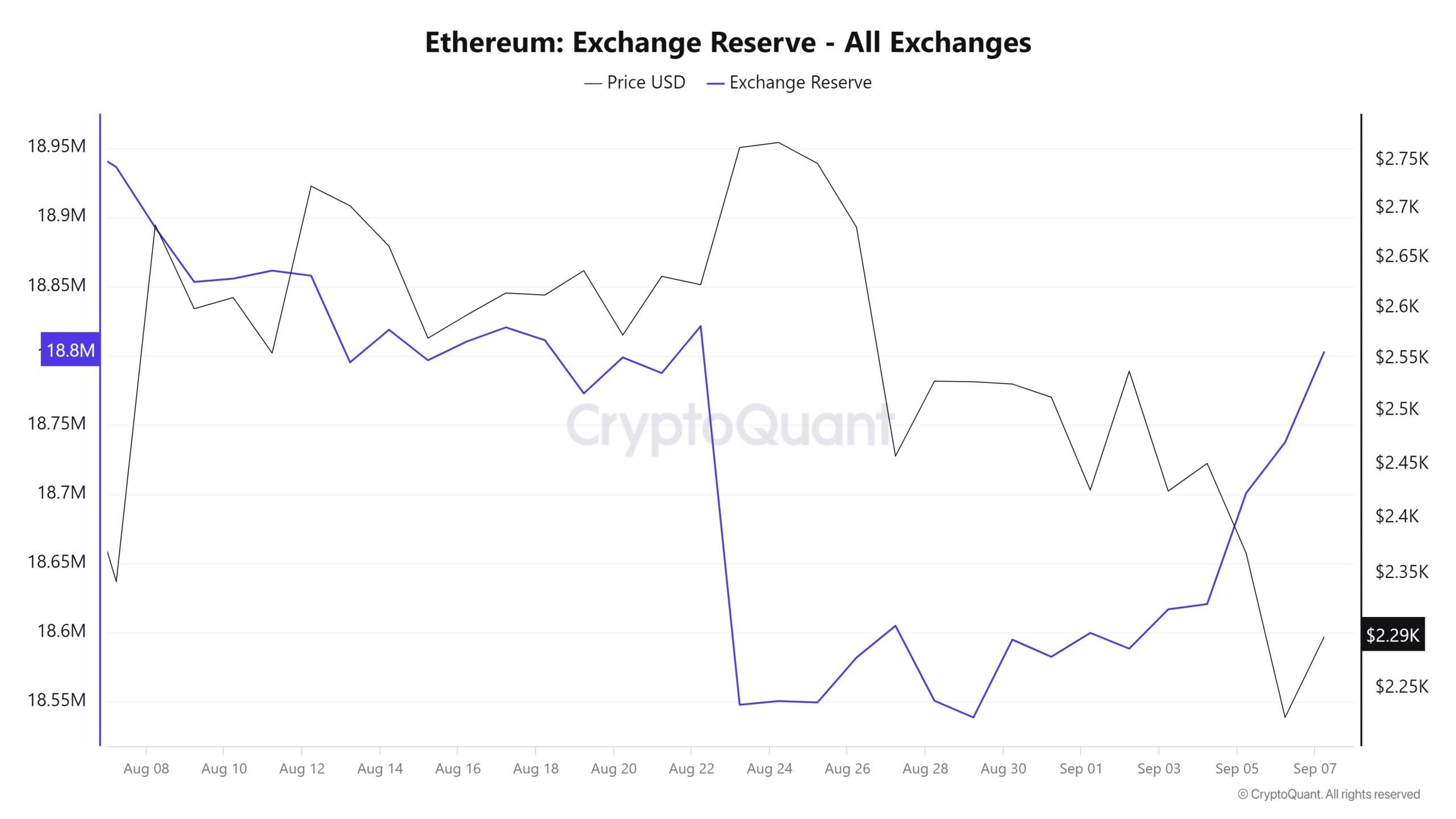

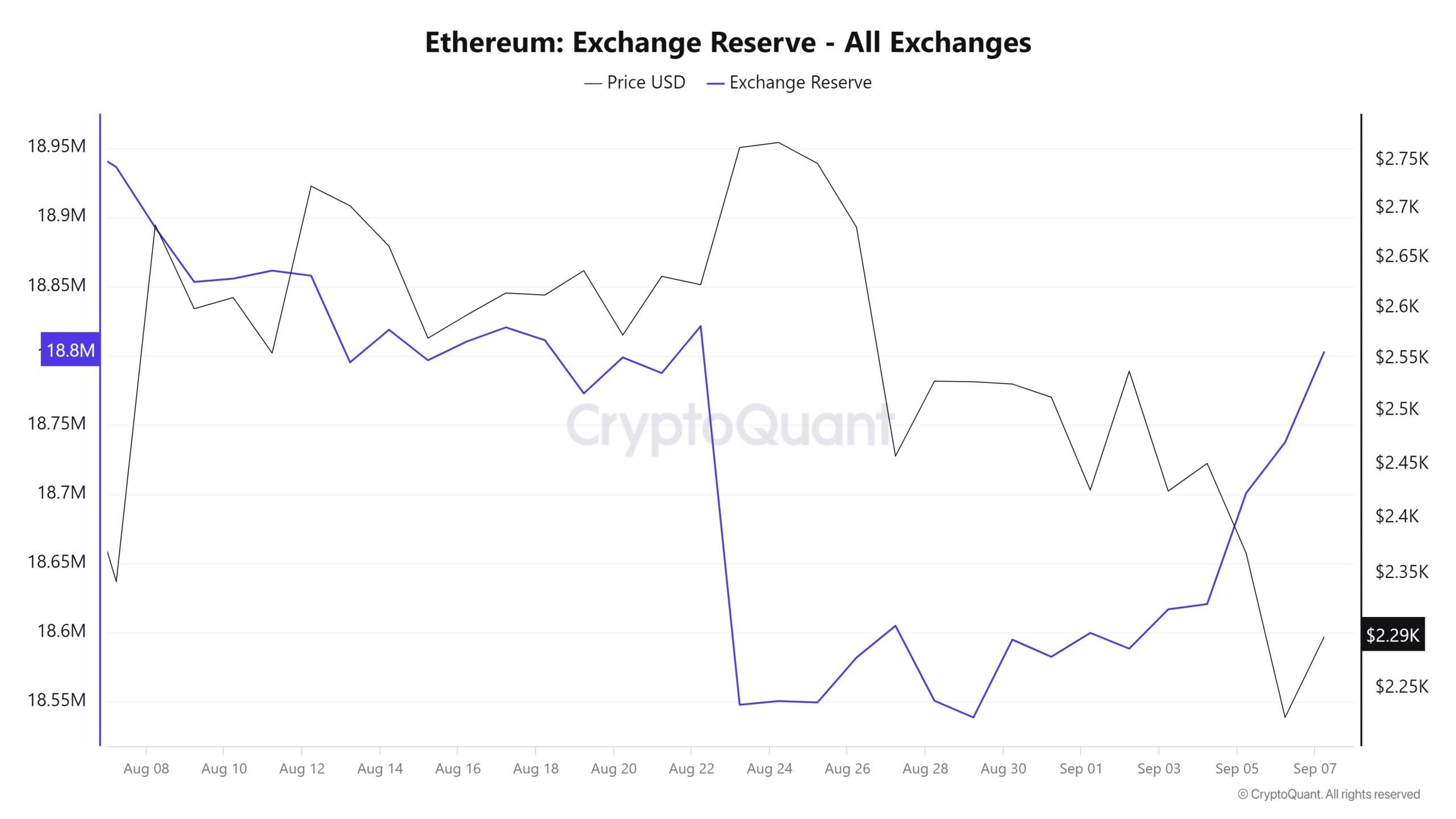

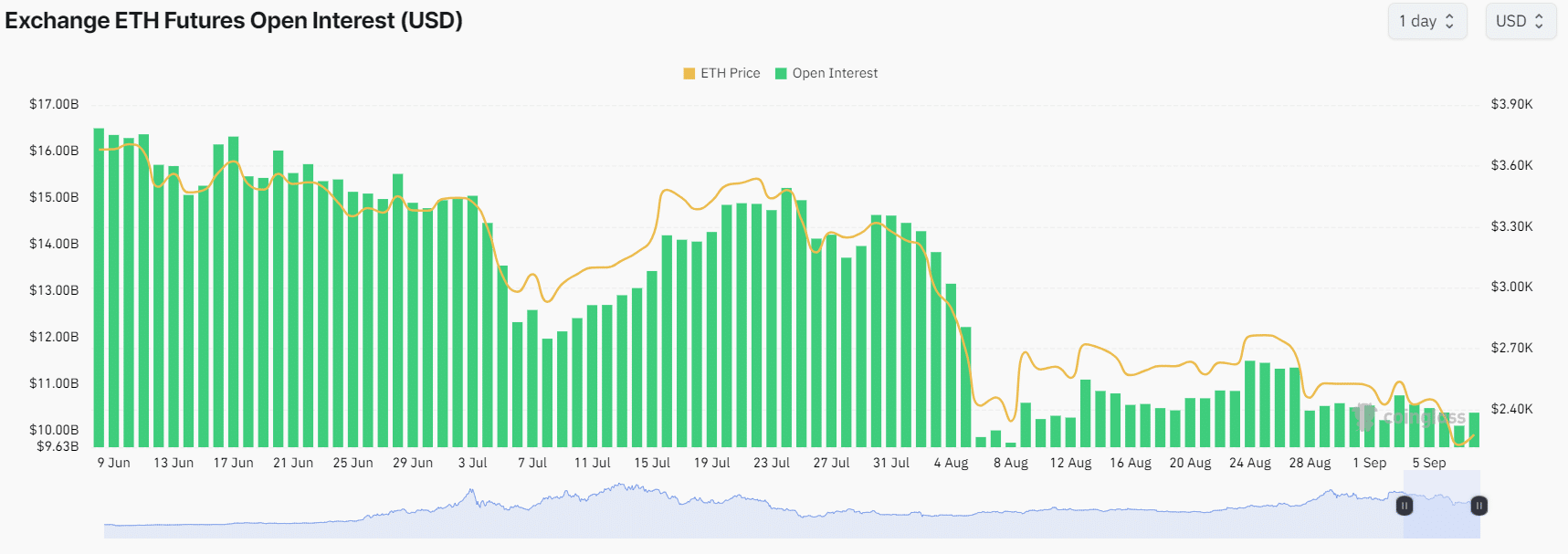

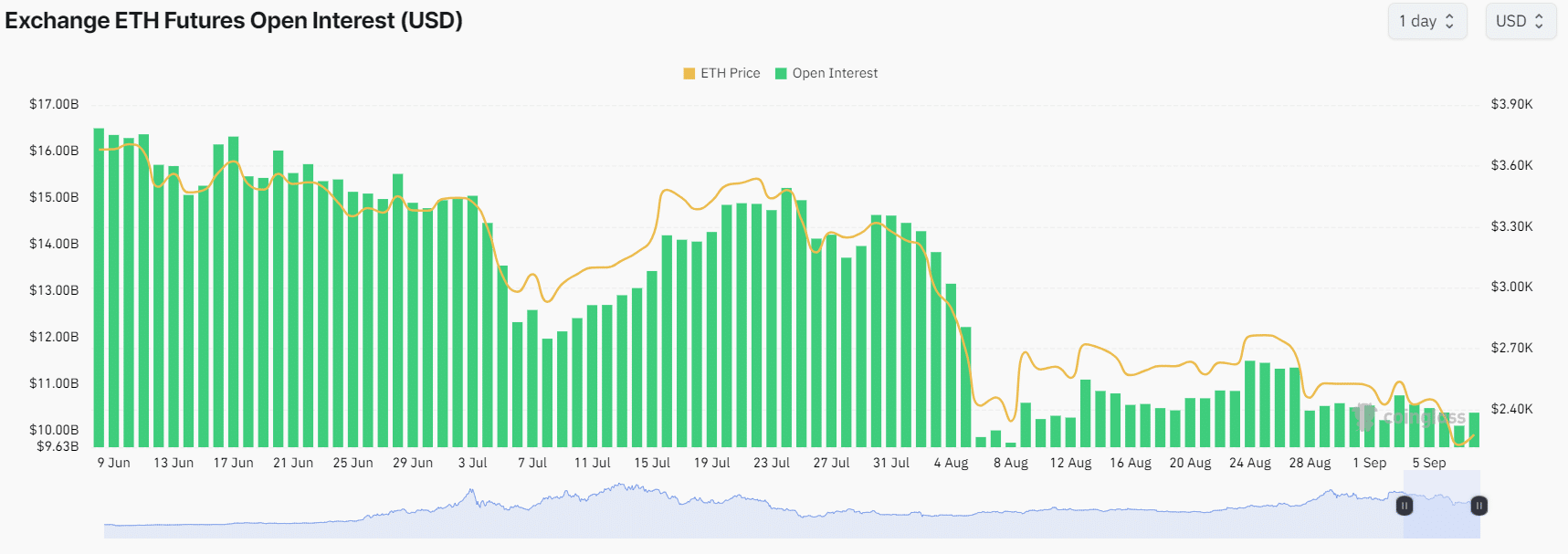

The attainable causes behind this dump are the continued bearish market sentiment, the continued enhance in ETH reserves within the overseas change market, and the decline within the Futures Open Curiosity for 3 consecutive months.

In accordance with CryptoQuant, Ethereum change reserves have been steadily rising since August 28. Which means that whales, traders or establishments can transfer their belongings to exchanges in anticipation of a attainable sell-off.

Supply: CryptoQuant

CoinGlass’ Futures Open Curiosity inventory has additionally fallen repeatedly. This highlighted the liquidation of lengthy positions or the expiration of futures contracts, with out constructing new positions.

Supply: Coinglass

Right here it’s value mentioning that September is commonly thought-about a bearish month or a interval of worth correction for cryptocurrencies, earlier than doubtlessly skyrocketing in October.

Technical evaluation of Ethereum and key ranges

In accordance with a have a look at the worth charts, Ethereum has retested its essential help stage at $2,140. Since late 2023, this stage has acted as robust help for ETH.

Nonetheless, ETH’s Relative Energy Index (RSI) fashioned a bullish divergence on the day by day timeframe, indicating a pattern reversal.

Supply: Tradingview

As a result of latest retest of help and the formation of a bullish divergence, there may be now a excessive likelihood that the worth of ETH might rise by 25% or 30% to $2,500 or $2,550.

Bullish outlook in accordance with on-chain metrics

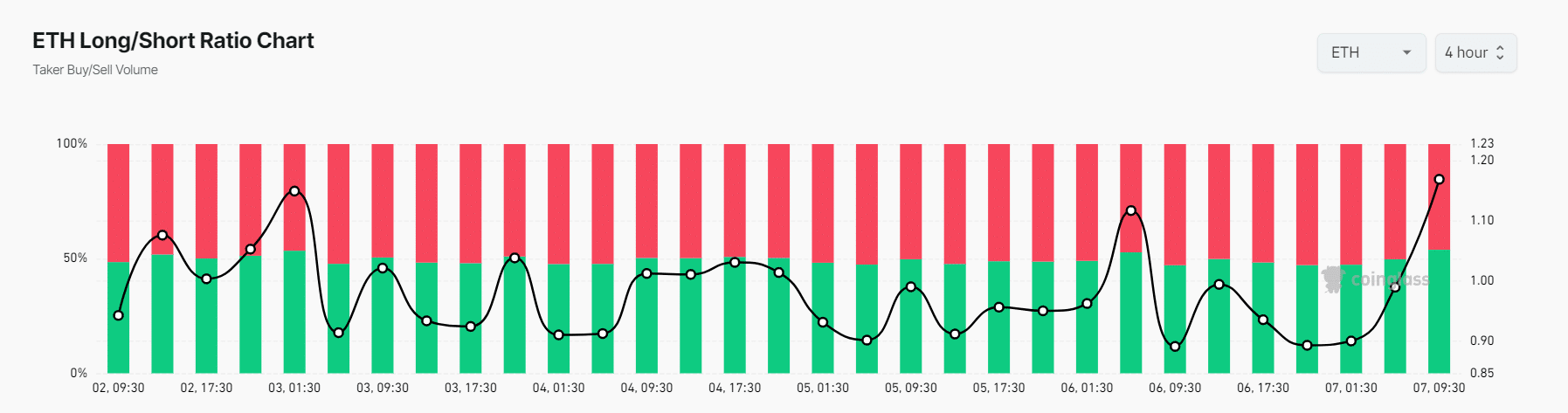

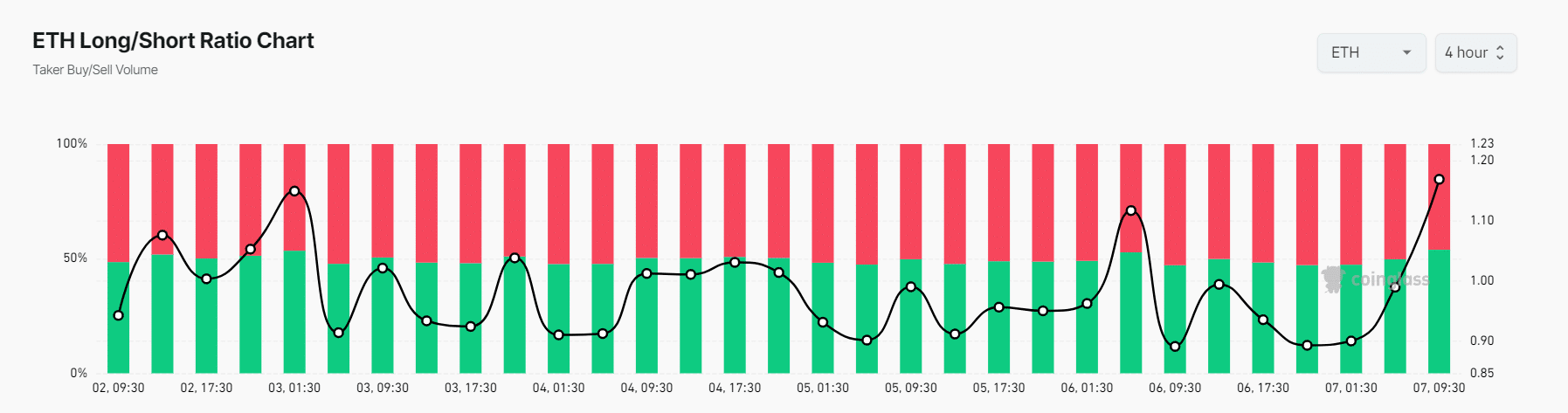

On the shorter timeframe, ETH additionally had some bullish indicators.

For instance, CoinGlass’s ETH Lengthy/Quick ratio indicated bullish sentiment. In accordance with the identical report, this ratio, over a four-hour interval, stood at 1.168 on the time of writing (a price above 1 signifies bullish sentiment).

Supply: Coinglass

The information additionally confirmed that 53.88% of prime merchants had lengthy positions, however 46.12% had brief positions.

Moreover, complete ETH Futures Open Curiosity elevated by 1.80% over the identical interval. This highlighted dealer participation as ETH revisited its robust help stage.

Ethereum’s worth efficiency

On the time of writing, ETH was buying and selling across the $2,280 stage, having dropped 2% up to now 24 hours.

In the meantime, buying and selling quantity skyrocketed by nearly 100% over the identical interval, indicating better participation from merchants and traders.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September