Ethereum

Ethereum Exchange Balance Just Went Negative For The First Time Ever, Why This Is Very Bullish For Price

Credit : www.newsbtc.com

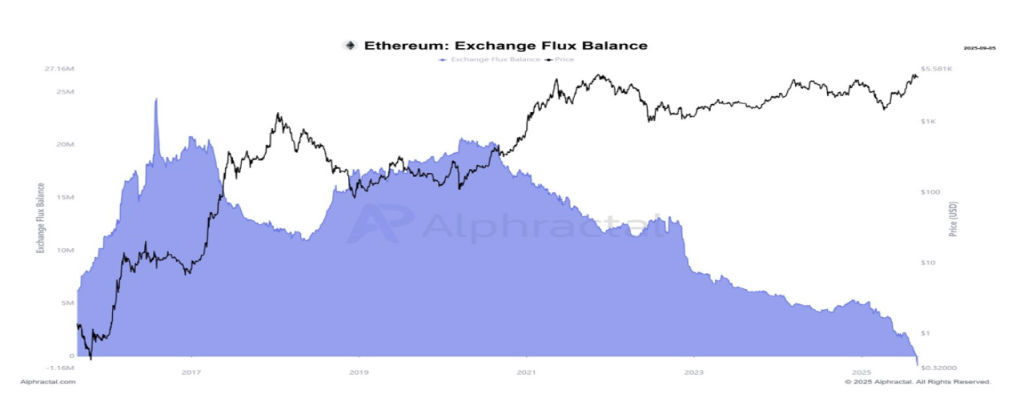

Ethereum (ETH) has simply written historical past with a improvement that may reform its market trajectory. For the primary time, the Ethereum Exchange Balance Has grow to be adverse, which signifies that extra tokens are withdrawn from buying and selling platforms than deposited. This structural shift in provide dynamics has analysts who label it an vital bullish sign for The next rally of the market.

Ethereum Trade Stability = adverse

Crypto -marktexpert Cas Abbe shared A brand new report displaying that the EXTERHEUM trade flux went into the adverse territory for the primary time. He means that the most recent improvement will be Bullish for ETH, because it indicators Reduced sales pressure and rising investor confidence.

Associated lecture

Traditionally, the Trade Stability Metric served as one of many clearest indicators of Investor habits. When the balances rise, this often signifies that the gross sales stress is mounted as a result of merchants transfer cash for liquidation functions. Conversely, once they fall, this means that Cash are withdrawn into personal portfolioswhich can be offered much less rapidly.

The graph of the analyst illustrates a pointy and accelerating lower in Ethereum’s trade skirt lately, culminating on this historic low level. Billions of ETH have been faraway from centralized platforms, coinciding with the advance of the energetic to a aim above $ 5,500. This means a transparent discount in liquid provide throughout Raised question.

In keeping with Abbe, the significance of this decline can’t be overestimated. He seen that Market decide In Crypto usually seems after the influx movement in these centralized platforms, not when balances are Taking as much as new lows. In different phrases, Ethereum will not be positioned for a sale however for accumulation.

Because the gross sales stress decreases, holders have extra management over the provide in the long run, in order that the situations are created for attainable sturdy upward value momentum. If historical past is a information, Abbe means that the shrinking trade charge steadiness will be the scene for Ethereum’s subsequent leg up.

Analyst units $ 7,000 as the following aim of ETH

Whereas the Trade Provide of Ethereum is unknown lows, technical analysts similar to Crypto -Goos are more and more bullish. The markt skilled announced In a put up on X that ETH is formally damaged from a Lengthy-lasting samplewhat the value motion has restricted since 2021.

The accompanying graph lastly illustrates ETH after years of Sideways Buying and selling. Crypto Goos factors to the breakout degree round $ 3,600, and with Ethereum now significantly above it, the transfer appears to be confirmed.

Associated lecture

Though Ethereum has skilled a variety of value fluctuations in latest weeks, Crypto Goos stays positive that one New all time high soon. The projection of the analyst of De Wig -Breakout focuses on the $ 7,000 area, which represents a possible good thing about round 62% in comparison with the present value ranges above $ 4,300. If the momentum persists, the cryptocurrency may even transcend the milestone of $ 7,000.

Featured picture of Unsplash, graph of TradingView

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024