Ethereum

Ethereum exchange reserves hit record lows – Good news for ETH?

Credit : ambcrypto.com

- Ethereum has didn’t maintain ranges above $2,800, with the current uptrend displaying indicators of weakening.

- Regardless of the supply-to-exchange ratio being at report lows, the worth of ETH continues to wrestle.

Ethereum [ETH] jumped to a multi-week excessive above $2,800 on August 24 because the broader cryptocurrency market recovered. ETH has since misplaced a few of these beneficial properties, falling barely by 0.6% previously 24 hours to commerce at $2,742 on the time of writing.

Knowledge from Whale alert confirmed that some massive ETH holders could also be trying to money of their earnings after a whale lately moved $34 million price of ETH to Coinbase.

With the current uptrend displaying indicators of weakening, the place does ETH go subsequent?

Bearish alerts emerge

Ethereum buying and selling volumes had been down 18% on the time of writing CoinMarketCap details. The falling volumes coincide with the slight drop in costs, as fewer consumers assist the upward development.

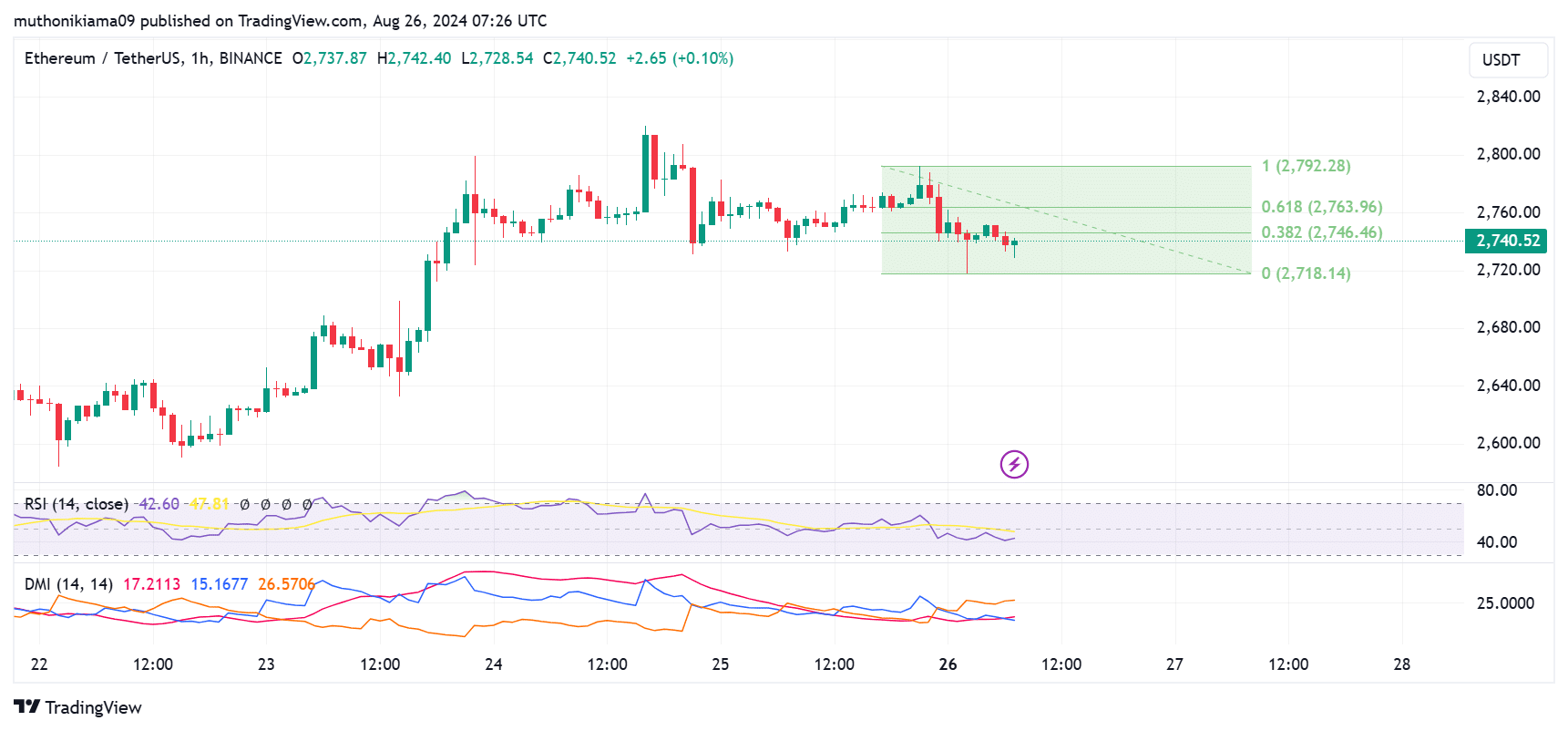

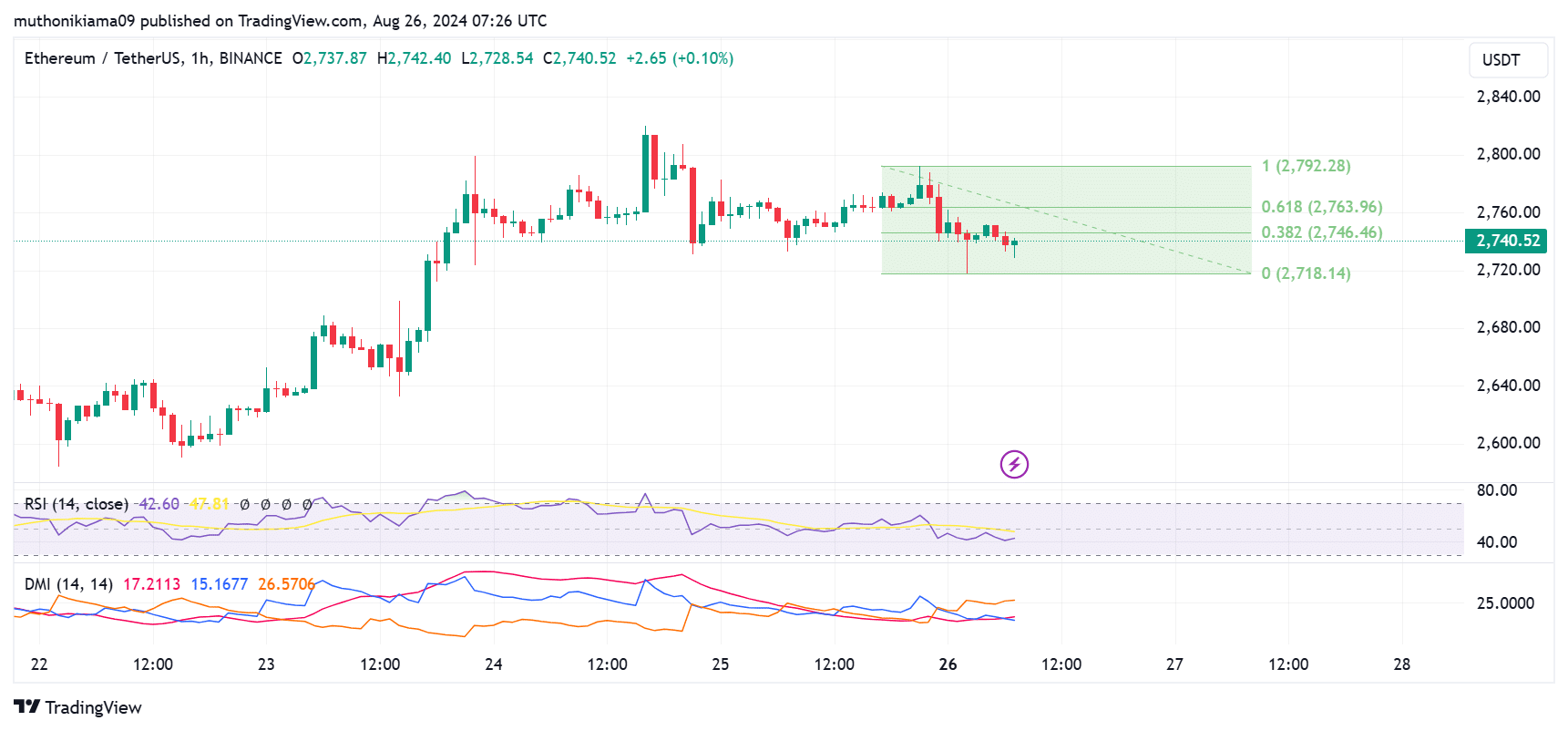

The Relative Energy Index (RSI) of 42 signifies that sellers have entered the market. The RSI line can also be forming decrease lows on the hourly chart, displaying additional weakening of the uptrend.

With the RSI line crossing under the sign line, this confirms prevailing bearish momentum.

Supply: Tradingview

The Directional Motion Indicators (DMI) additionally present that bears are in management. The +DI (blue) is under the -DI (orange), indicating a bearish development. Nevertheless, with an Common Directional Index (purple) at 14, this reveals that the bearish development is weak.

If bearish momentum continues, ETH will probably transfer decrease to check the 0% Fibonacci degree ($2,718). If this value isn’t held, it might pave the way in which for additional declines.

Overseas change reserves proceed to say no

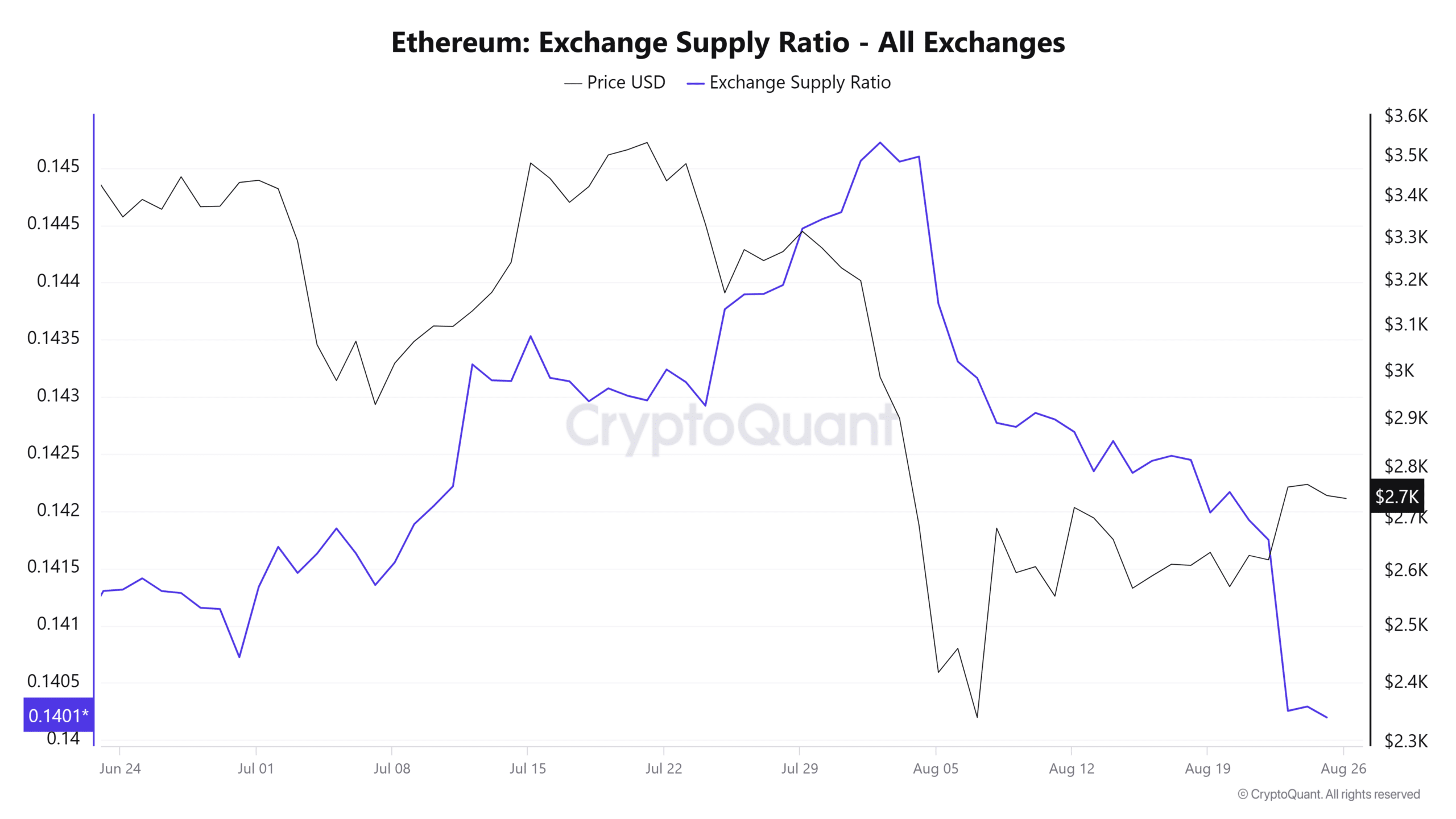

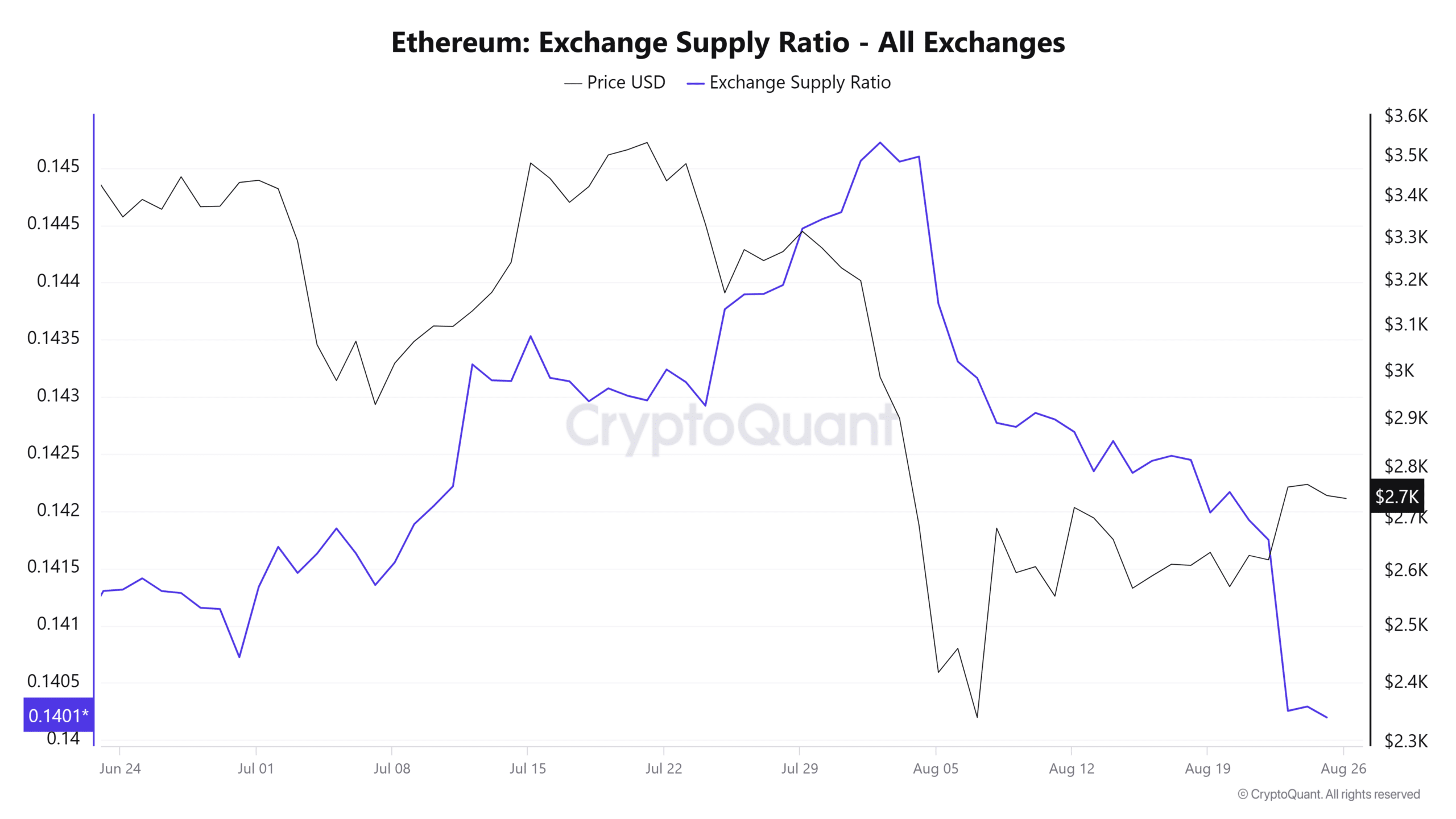

In accordance with CryptoQuantEthereum change reserves have fallen to a report low after peaking on August 5 when costs collapsed.

Low international change reserves point out that few traders are holding ETH on exchanges, decreasing short-term promoting strain and decreasing the probability that ETH will see a drastic value drop.

Ethereum’s provide ratio has additionally fallen sharply this month, displaying that merchants are much less prone to promote at present costs.

Supply: CryptoQuant

The elevated curiosity of traders in ETH is additional mirrored within the rising open curiosity.

Learn Ethereum (ETH) Value Prediction 2024-25

After falling under $10 billion in early August, Ethereum open curiosity has since risen to over $11.5 billion yearly on the time of writing. Mint glass details.

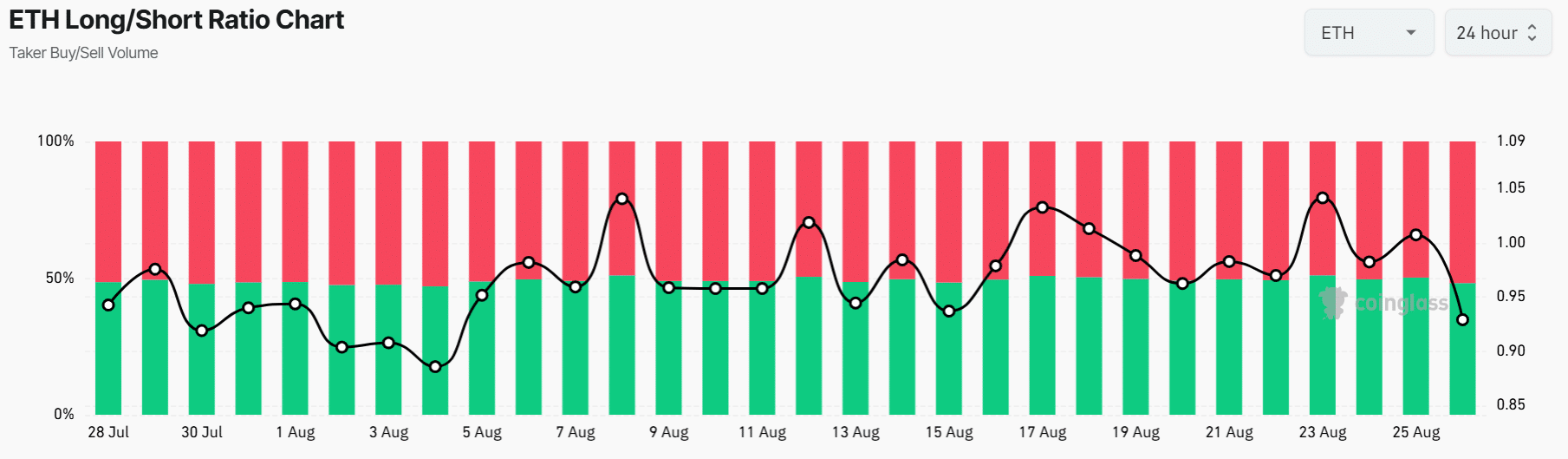

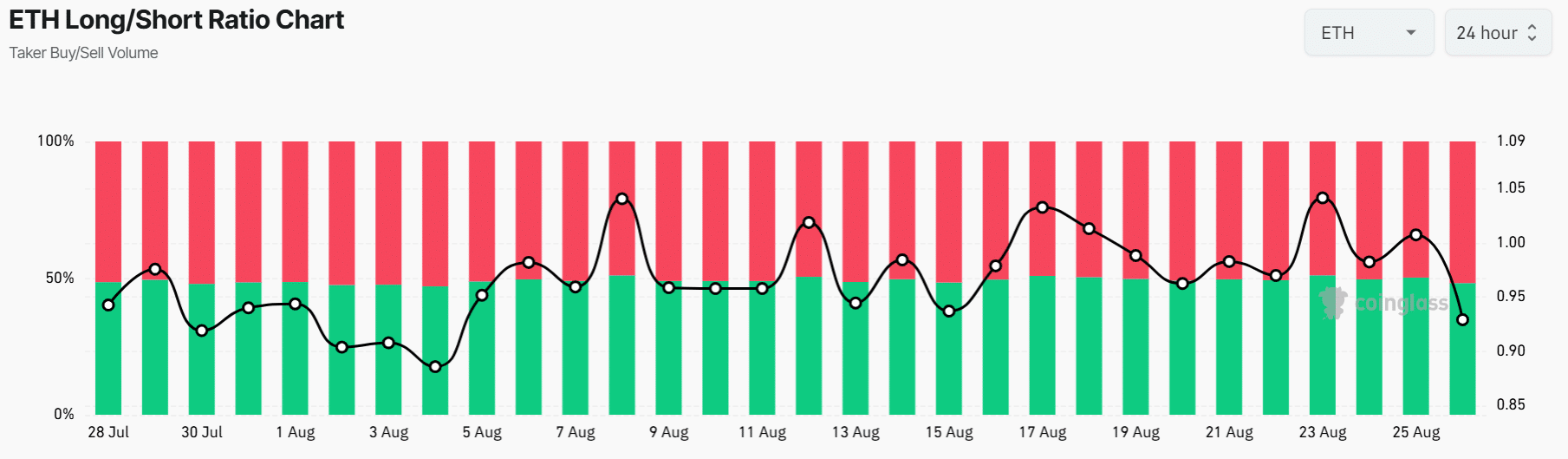

Nevertheless, with an extended/quick ratio of 0.92, extra merchants have opened quick positions on ETH, anticipating a value drop.

Supply: Coinglass

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September