Ethereum

Ethereum ‘Extremely Undervalued Against BTC’ – Supply Pressure May Delay Recovery

Credit : www.newsbtc.com

Cause to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by consultants from the business and thoroughly assessed

The very best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Ethereum has lastly damaged a key resistance stage and acts above $ 1,900 after being pushed previous the lengthy -existing $ 1,850 barrier. This motion marks the beginning of an outbreak that many hoped for – however few anticipated to reach so rapidly. After weeks of hesitation, bearish stress and unsure momentum, ETH reveals renewed energy, simply as the broader market sentiment begins to shift.

Associated lecture

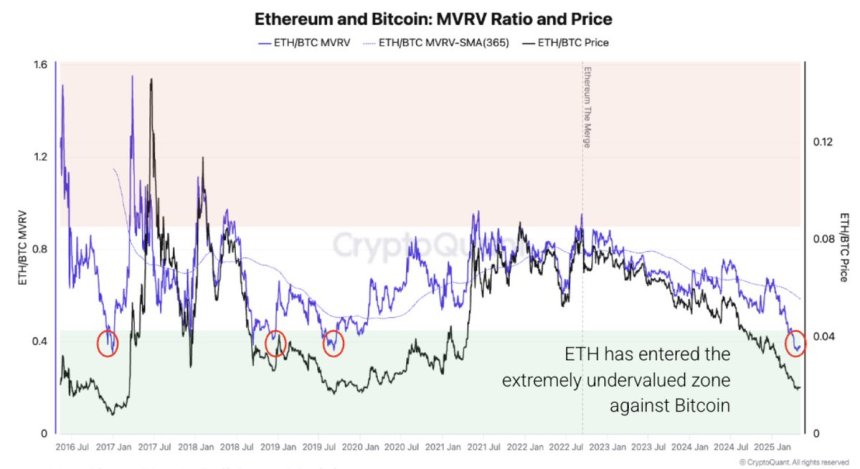

By including weight to the outbreak, new insights from cryptoquant reveal that Ethereum is now extraordinarily undervalued in comparison with Bitcoin, the primary time this has taken place since 2019. Traditionally, such ranges of ETH/BTC preceded intervals of robust Ethereum -outformance. Though worth promotion is on the forefront, on-chain information reinforce the bullish case, indicating that ETH can introduce a good section in its cycle.

This renewed profit comes within the midst of low expectations and broad skepticism, making it all of the influence. Since ETH acts above $ 1,900, merchants and buyers are intently looking ahead to follow-through and potential continuation to $ 2,000 after which. If historical past is a information, the current step of Ethereum is probably not only a peak within the quick time period it may be the beginning of a bigger pattern removing, particularly if the ETH/BTC valuation hole begins to shut.

Ethereum flirts with $ 2,000 as undervaluation arouses bullish hope

Ethereum is now approaching the crucial aim of $ 2,000, a stage that, if recovered and retained, would affirm a technical outbreak and probably herald a wider bullish section. After weeks of sluggish motion and bearish stress, ETH positive factors energy and reveals indicators of energy over each worth motion and on-chain statistics. A close to $ 2,000 would mark a significant shift in sentiment, which signifies renewed belief for each buyers and merchants.

Nonetheless, dangers stay. The fixed tensions between the US and China proceed to inject uncertainty within the worldwide markets, and the American Federal Reserve has proven no indicators of pivot level. As a result of the rates of interest are anticipated to stay elevated and nonetheless quantitative tightening (QT) will stay in pressure, the macro -economic background stays a headwind. If these geopolitical and financial components relieve it, the outbreak of Ethereum may get persistent traction.

According to cryptoquantThe Ethereum-to-bitcoin MVRV (market worth and realized worth) Ratio emphasizes that ETH is now extraordinarily undervalued in comparison with BTC-De first time that this has taken place since 2019. Traditionally, such circumstances have led to robust intervals of Ethereum Outperance.

Nonetheless, the bullish setup is confronted with some inner friction. Supply stress, weak demand on chains and flat community exercise can block the momentum if the market sentiment doesn’t enhance any additional. Though the present push of Ethereum is encouraging, the affirmation solely comes with persevering with motion over resistance and stronger Fundamentals. Till then, ETH will proceed to slide at a crucial second, with the potential to steer the following a part of the Crypto rally – or to slide again in consolidation as exterior and inner stress.

Associated lecture

ETH -Value evaluation: Technical particulars

Ethereum is traded at $ 1,933 after a powerful outbreak above the $ 1,900 resistance zone, which marks the best stage for the reason that starting of April. On the 4 -hour graph, ETH rose with an elevated quantity of roughly $ 1,850, with a consolidation vary of a number of weeks breaking. This motion confirms Bullish Momentum and clearly brings the psychological stage of $ 2,000 into sight.

The outbreak is additional supported by the value that’s now far above the EMA of 200 intervals ($ 1,791) and the 200-Interval SMA ($ 1,700) is supported. These lengthy -term superior averages had beforehand acted as a resistance, however have now been reversed in potential dynamic assist. The energy of this rally signifies renewed buy curiosity and a potential shift in market sentiment.

Nonetheless, the following problem lies in sustaining this upward momentum. Ethereum has to carry above the extent of $ 1,900 – $ 1,920 to forestall a faux out and to verify this outbreak as sustainable. A clear push by $ 2,000 would additional validate the bullish construction and open the door for larger objectives.

Associated lecture

On the whole, the graph displays a decisive technical outbreak, supported by quantity and construction. If bulls stay underneath management and macro circumstances stay steady, ETH may put together for a stronger pattern within the coming days.

Featured picture of Dall-E, graph of TradingView

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now