Ethereum

Ethereum Eyes $5,500 Amid Illiquid Supply Crunch And ETF Momentum

Credit : www.newsbtc.com

After a rejection of $ 4,946 on 24 August, Ethereum (ETH) is now being traded within the low stage of $ 4,000. Nevertheless, some analysts are nonetheless hopeful that ETH will most likely enhance greater than $ 5,000 within the coming weeks, due to the rising illiquid provide and the constructive trade -related fund (ETF) momentum.

Ethereum to hit $ 5,500 in September?

In keeping with a cryptoquant Quicktake put up of the Arab chain of the contribution, the final Upswing of Ethereum in August, which pushed the digital asset of a spread of $ 3,700-$ 4,000 to its newest all-time excessive (ATH) of $ 4,946, largely disturbed by wider Marktrallyy and constructive rule.

Associated lecture

The analyst famous that ETH reserves in Binance Crypto Trade in August witnessed a pointy enhance. The fast enhance within the inflow of tokens to the inventory market reveals that holders select to promote or make a revenue at larger costs.

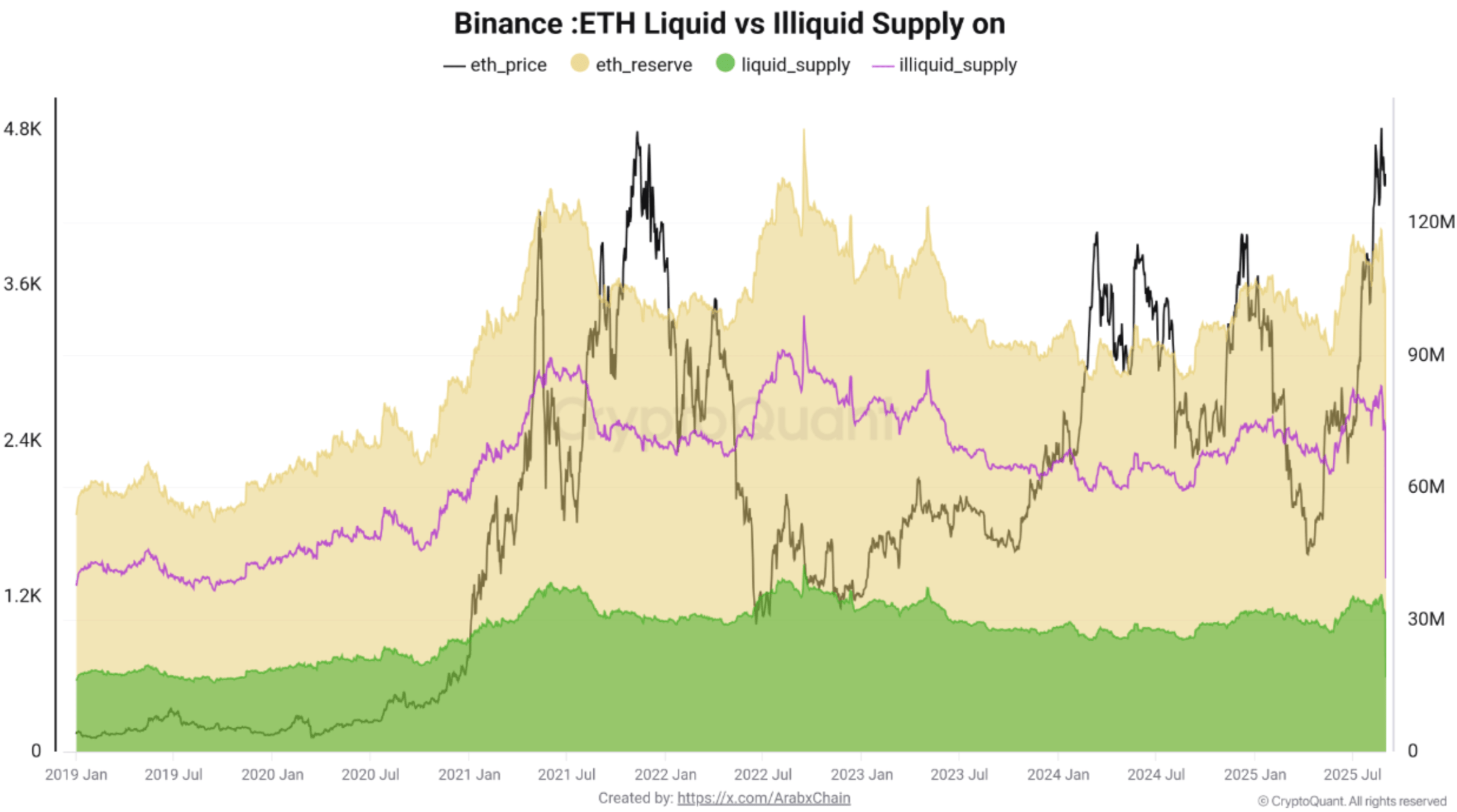

Arabic chain shared the next graph that reveals each liquid (inexperienced) and illiquid (beige) ETH vitamin. In keeping with the graph, the overwhelming majority of ETH meals stays illiquid, making a structural scarcity of inventory.

However, the graph reveals a slight enhance in liquid provide, which means that a part of the ETH has returned to the circulation and may contribute to the gross sales stress within the quick time period. The analyst observed:

The general illiquidity of the provide reinforces the long-term bullish entrance views. Cautious indicators within the short-term-increasing Binance reserves mixed with a small enhance in liquid provide suggesting a potential correction after the current robust revival.

If the expansion in ETH reserves on Binance reveals indicators of delay or withdrawal CV, the supply deficit of the digital belongings stays pronounced. Consequently, a transparent and decisive break might propel the resistance stage of $ 4,800 ETH to $ 5,200 – $ 5,500 within the quick time period.

The cryptoquant analyst concluded by saying that September will most likely see sideways to a considerably bullish step for ETH between $ 4,300 to $ 5,000. Nevertheless, an absence to interrupt the $ 4,800 stage – together with rising trade reserves – can, nevertheless, enhance the potential of correction to $ 4,200.

What’s in retailer for ETH?

Though an outbreak above $ 4,800 is feasible, some analysts pent by means of their expectations proverb That ETH can check the psychologically essential stage of $ 4,000 earlier than he resumes his upward development.

Associated lecture

Within the meantime, information on the chains that acquire whales within the area of file tempo. In keeping with a current report, ETH whales added A minimum of 260,000 ETH to their pockets on 1 September.

Ethereum-MEDE founder and Consensys CEO Joseph Lubin presents a extra bold prediction, Ethereum stated That “Eth will most likely be 100 instances right here.” On the time of the press, ETH acts at $ 4,429, a rise of two% within the final 24 hours.

Featured picture of Unsplash, graphs of cryptoquant and tradingview.com

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024