Ethereum

Ethereum faces downward pressure as whale dumps $12 mln ETH

Credit : ambcrypto.com

- An ICO-era whale has dumped $12 million ETH on Kraken.

- Market sentiment and demand for ETH had been nonetheless weak.

Ethereum [ETH] recorded the principle promoting strain of a notable whale of the ICO (Preliminary Coin Providing) period of 2017.

In response to analyst EmberCN, the whale obtained 150,000 ETH (price) by way of the ICO.

Nonetheless, on October 8, the entity transferred 5K ETH ($12.22 million). In response to the analyst, the whale has reportedly dumped greater than $113 million ETH (45,000 cash) since September.

“The whale that obtained 150,000 ETH by way of the ICO transferred one other 5,000 ETH ($12.22 million) to Kraken 4 hours in the past. He has bought 45,000 ETH ($113.2 million) within the final two weeks, with a median worth of $2,516.”

Regardless of the newest sell-off, the whale nonetheless held over $200 million price of ETH.

ETH’s worth response

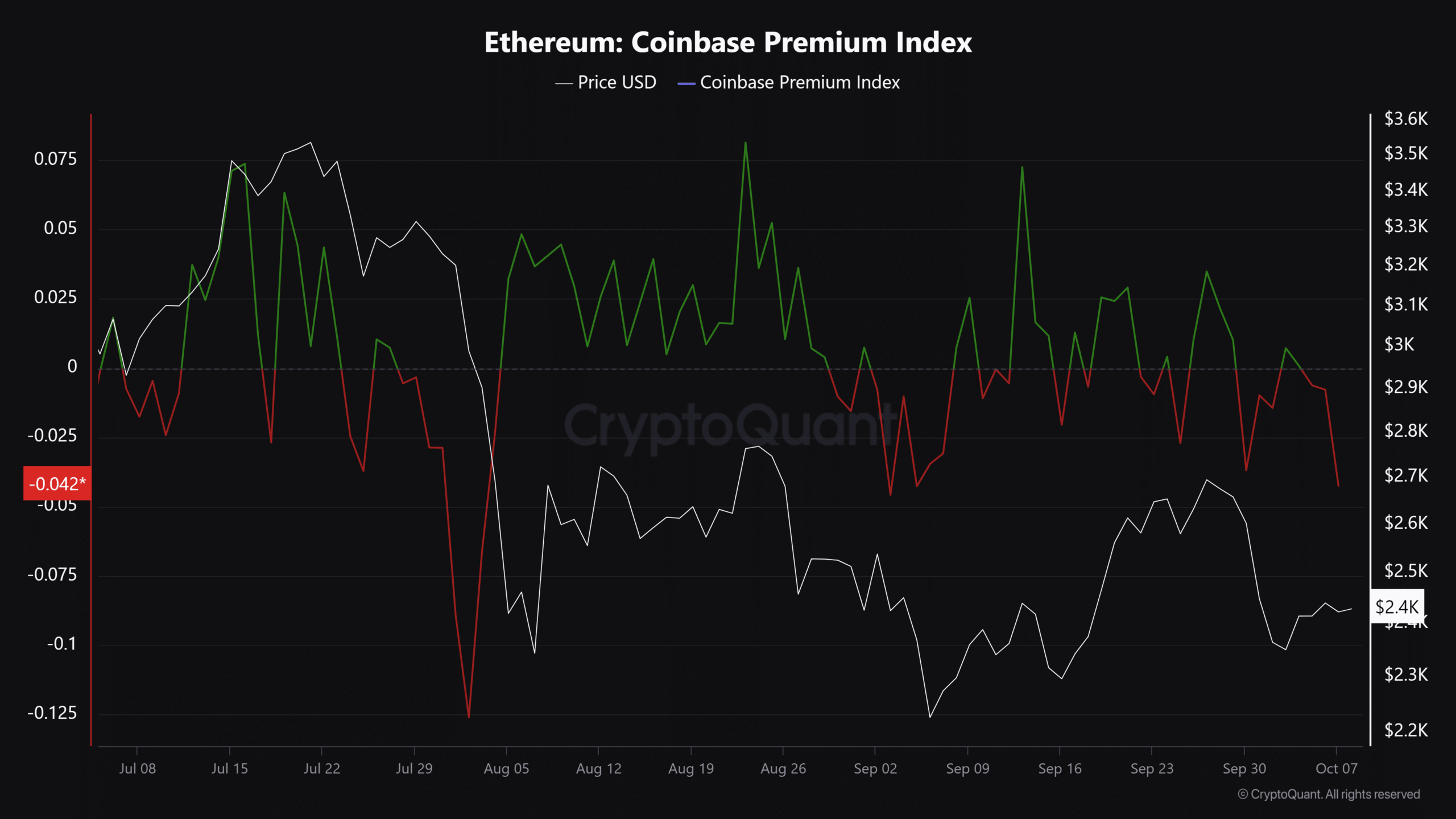

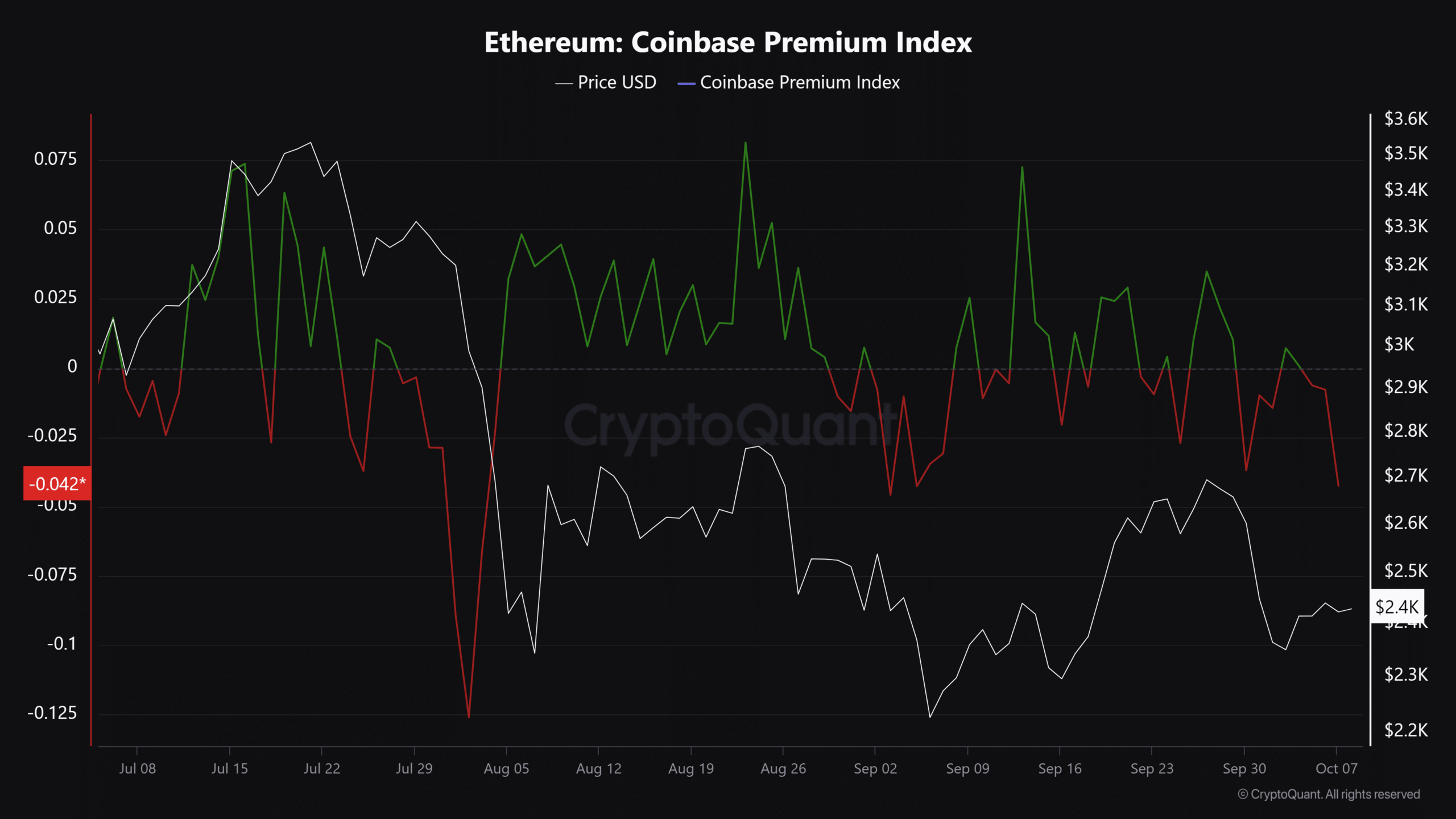

Supply: CryptoQuant

Apparently, the whale dump mirrored the general weak demand for ETH from US traders. As illustrated by the damaging worth of the Coinbase Premium Index, there was little curiosity in ETH on the time of writing.

That stated, low demand may delay anticipated robust demand bounce again for ETH after the latest dip under $2500.

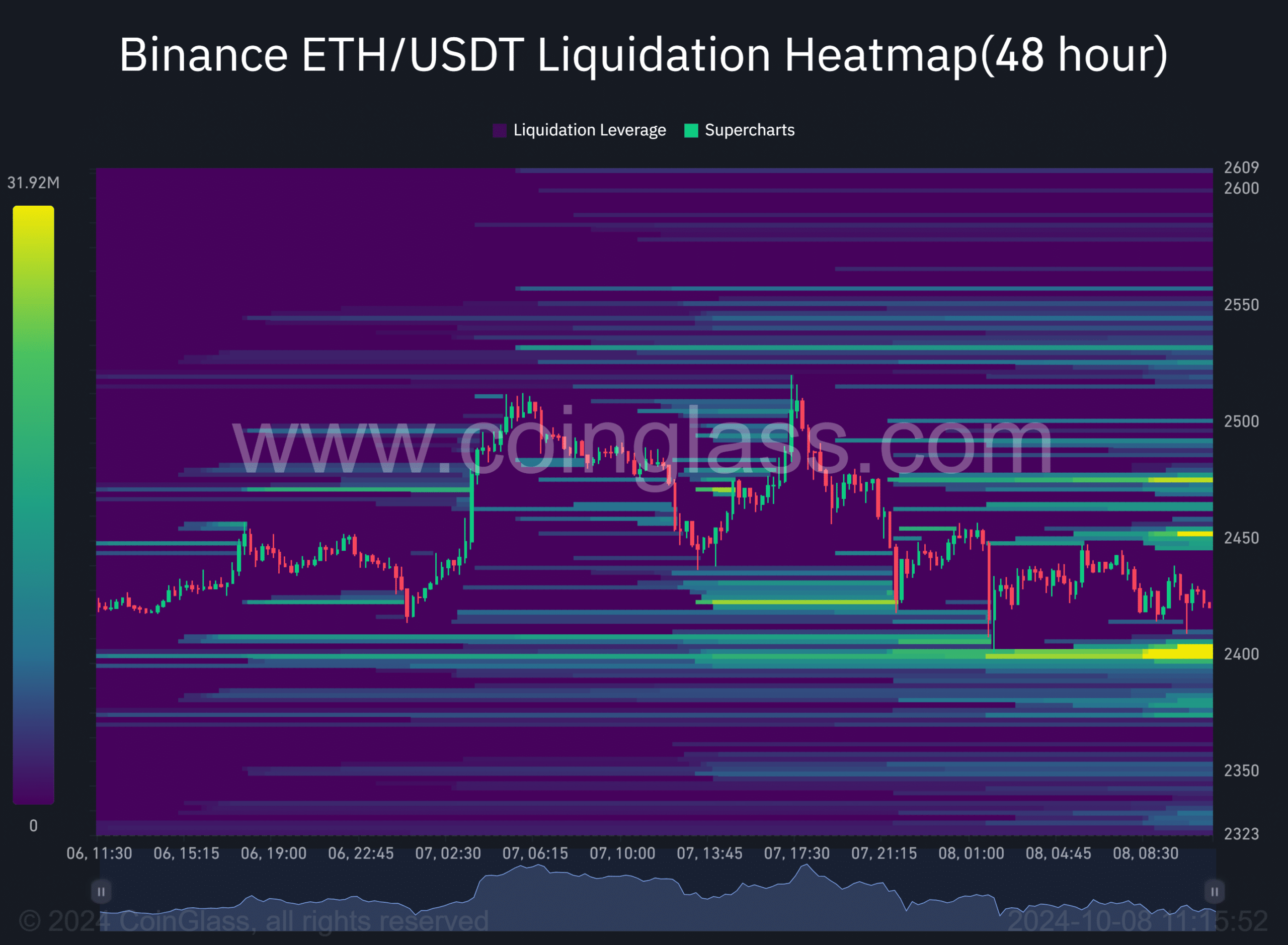

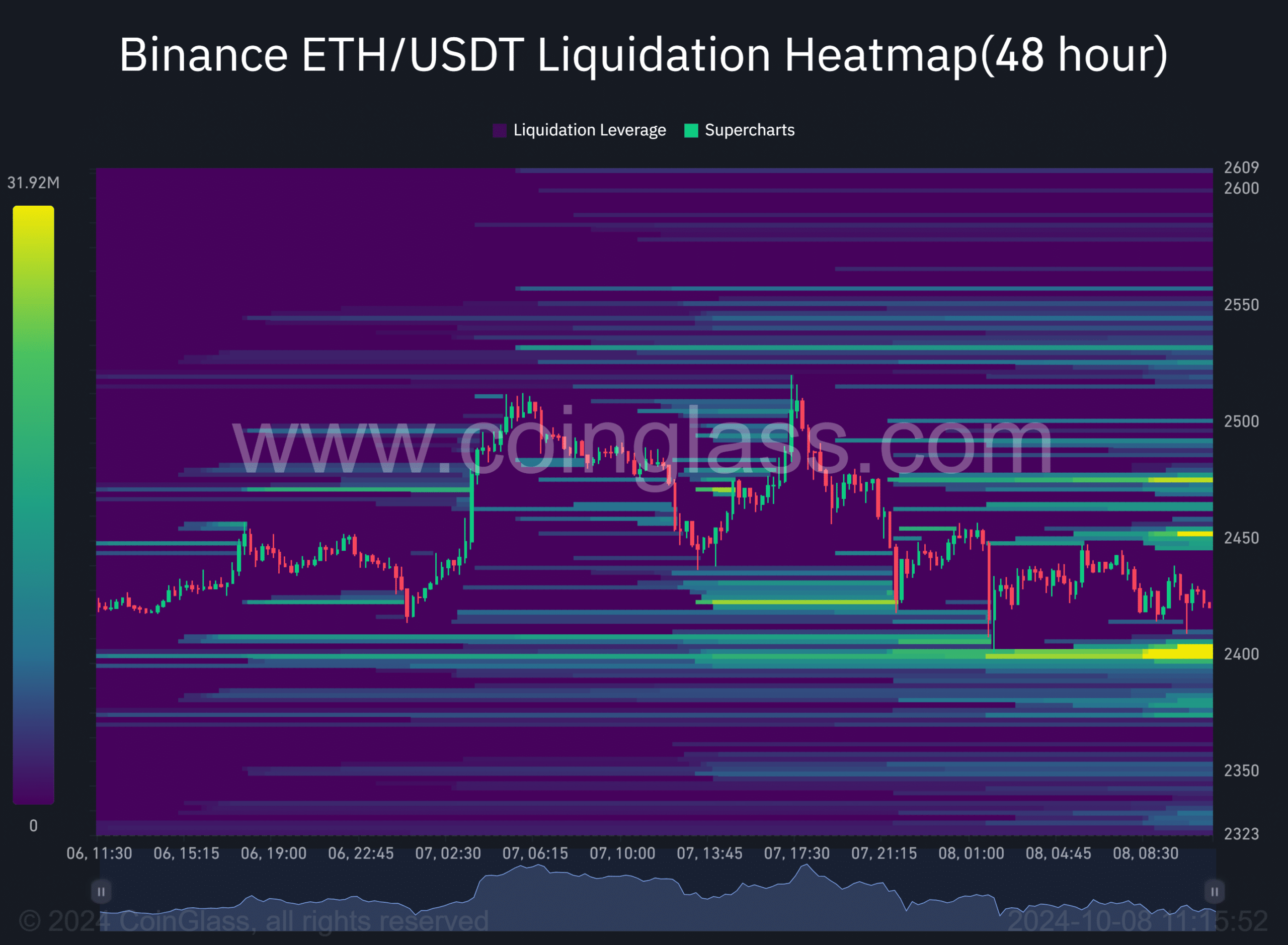

Within the brief time period, whale order information and liquidation heatmaps recommended that $2400 and $2550 had been essential targets to look at.

If a liquidity seize had been to happen, important lengthy positions of $2400 could possibly be liquidated (brilliant cluster). This might appeal to worth motion.

Supply: Coinglass

Then again, important overhead brief positions constructed up round $2450 and $2550.

Whale order analytics information supported the above liquidation information. Notably, on the time of writing, the Binance change had a promote wall of $2500-$2520 (pink strains) and a purchase wall of $2400 (inexperienced strains).

Supply: Coinglass

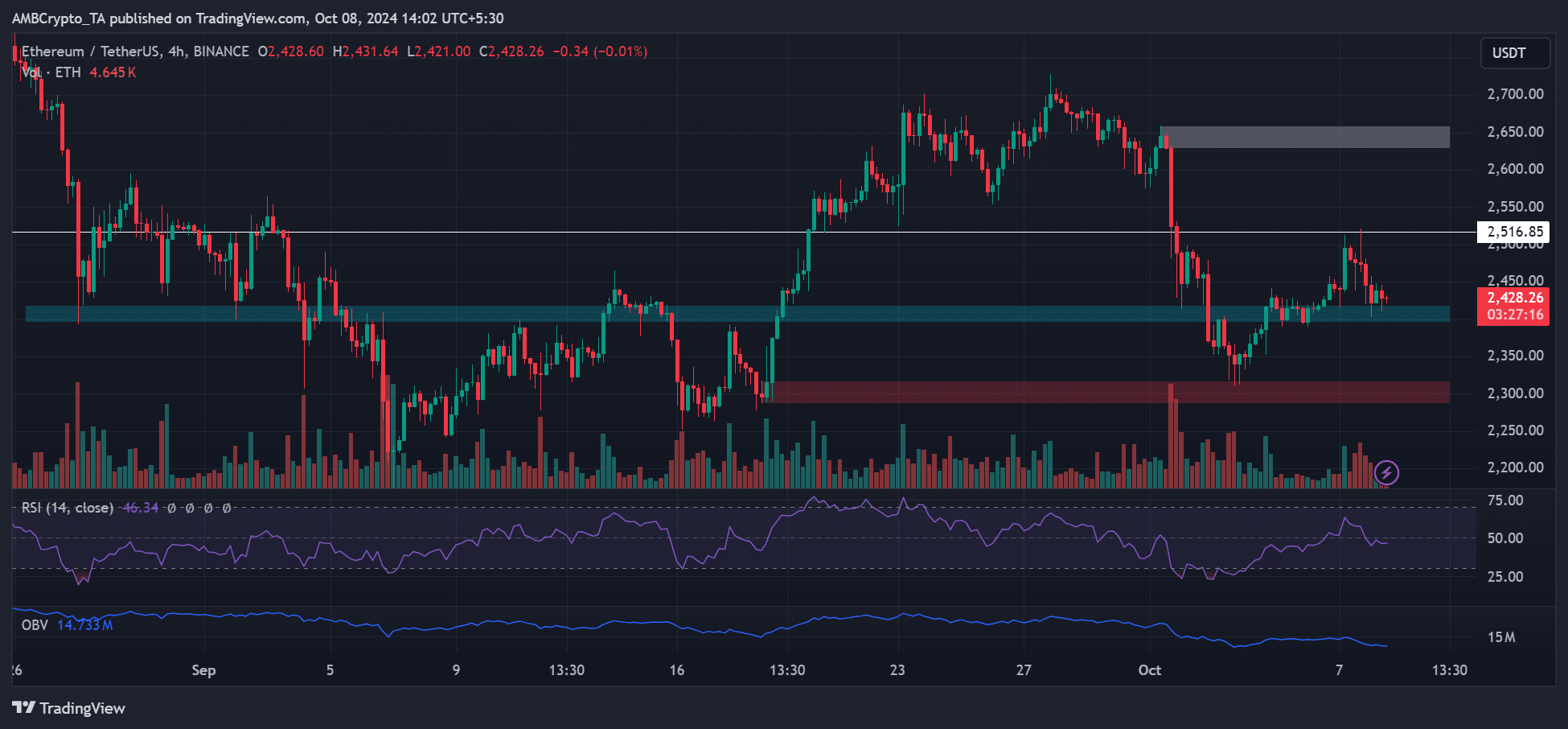

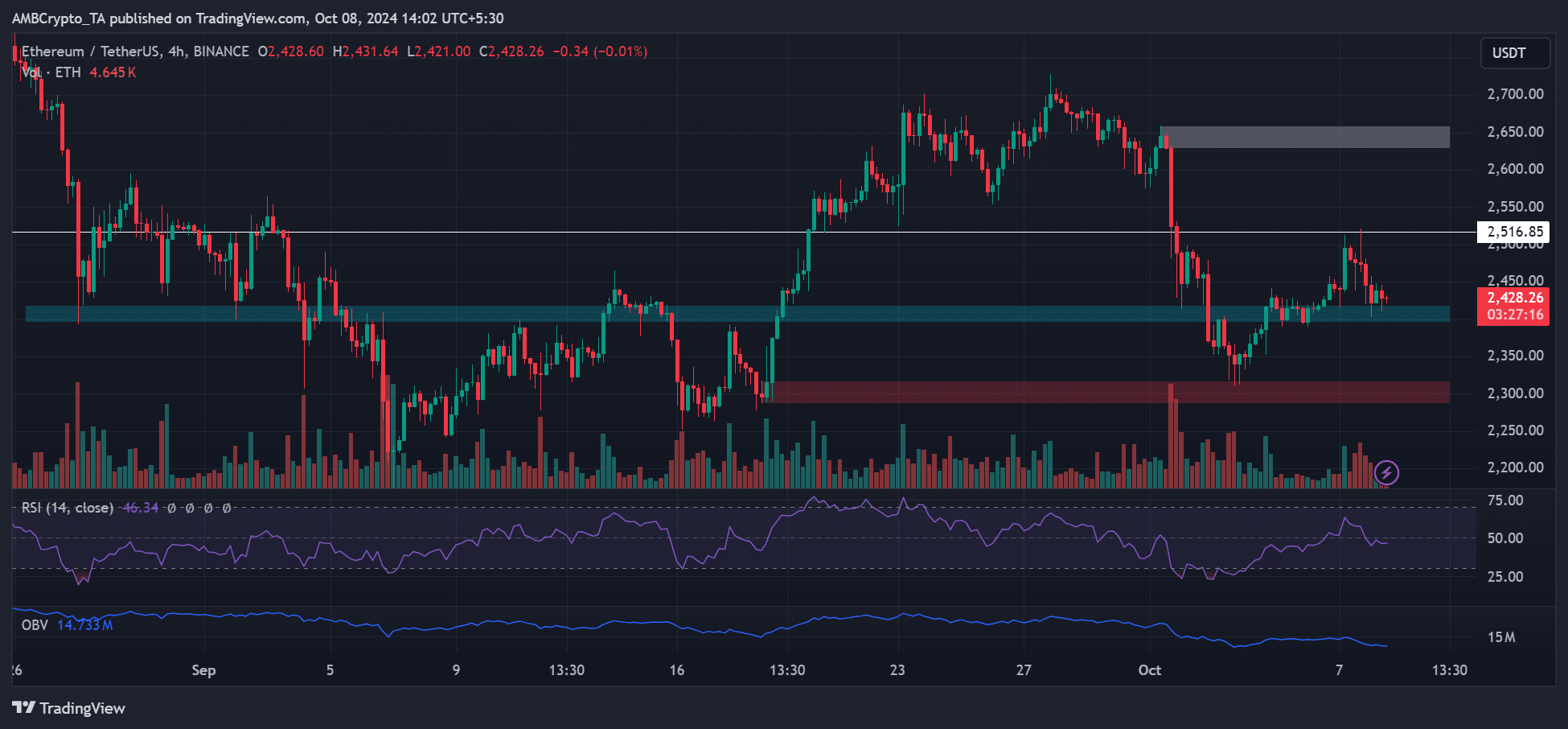

On decrease timeframe charts, ETH has fallen to short-term help simply above $2400. On the time of writing, it was valued at $2.42K, down 8% within the final seven buying and selling days.

Nonetheless, the technical indicator figures had been weak. With the RSI under common and buying and selling quantity declining, ETH’s near-term restoration may rely upon staying above $2400 and regaining the $2500 degree.

Supply: ETH/USDT, TradingView

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September