Ethereum

Ethereum faces heavy sell-off – So how are investors still holding strong?

Credit : ambcrypto.com

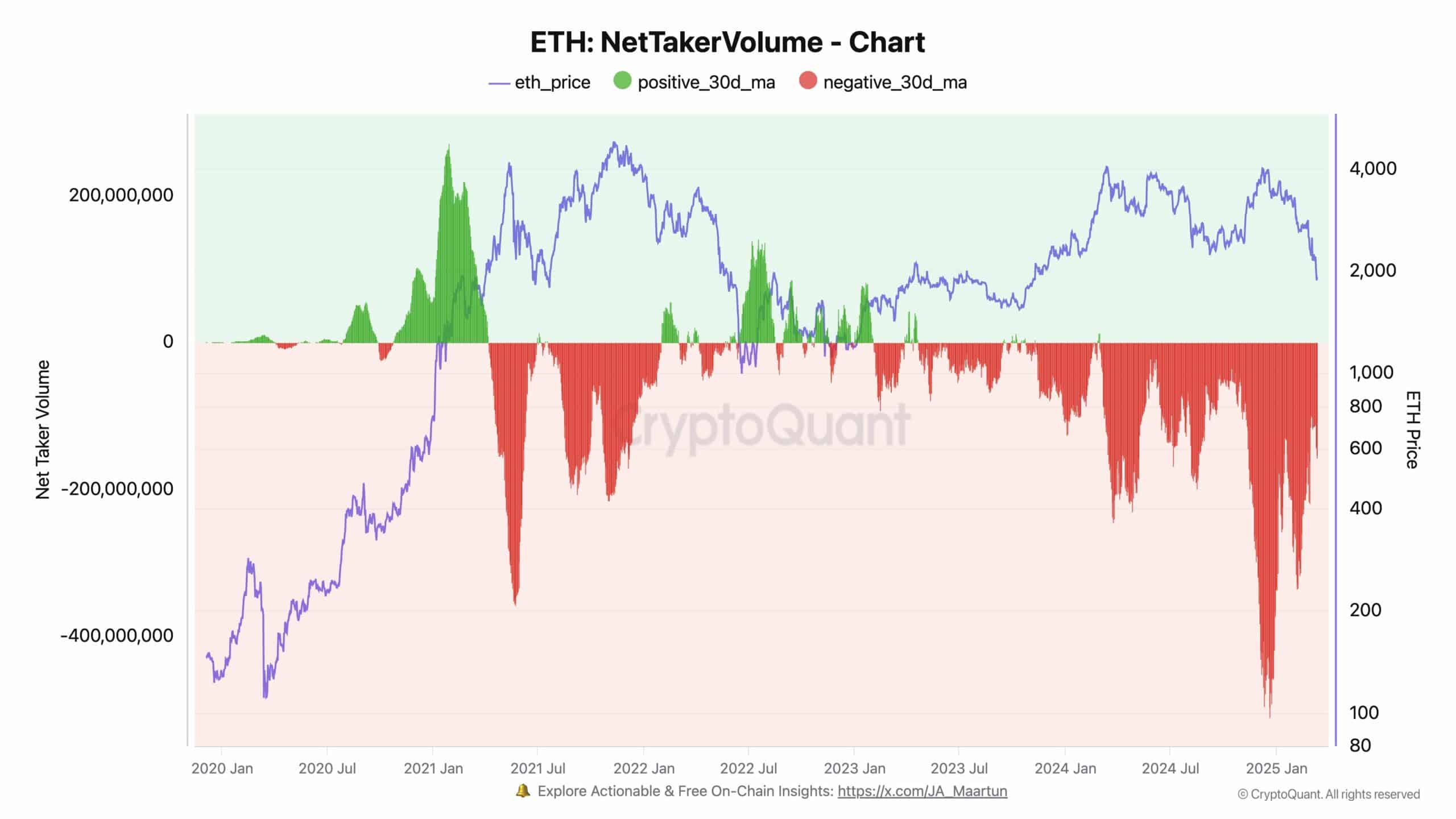

- The community quantity of Ethereum remained deep within the crimson, and signaled the lengthy -term gross sales strain in current months.

- Regardless of the gross sales strain, the overall variety of ETH holders continued to extend, which suggests a powerful accumulation.

Ethereum [ETH] has witnessed an extended -term interval of lively gross sales strain, with the online tone quantity that signifies an extended -term destructive momentum in current months.

This development suggests aggressive dominance on the gross sales facet, often related to the lowering market confidence or a broader risk-off sentiment.

However, the variety of ETH holders continues to climb, on account of which questions are requested whether or not traders accumulate in the long run within the midst of the sale or whether or not a worth reward is on the horizon.

Ethereum’s persistent gross sales strain

Information of Cryptoquant emphasised an in depth section of aggressive gross sales, with the online tone quantity that reveals deep crimson values.

Because of this gross sales orders have dominated shopping for orders, which a bearish deal with displays the market construction of Ethereum.

Traditionally, such an extended -term destructive firming quantity precedes massive corrections or capitulation occasions, which might result in additional down if the development persists.

earlier cycles, ETH has skilled comparable phases of intense gross sales strain, adopted by a reversal when shopping for impulse once more.

Nonetheless, the present development appears extra intensive, which means that the sentiment of traders stays cautious regardless of broader crypto market developments.

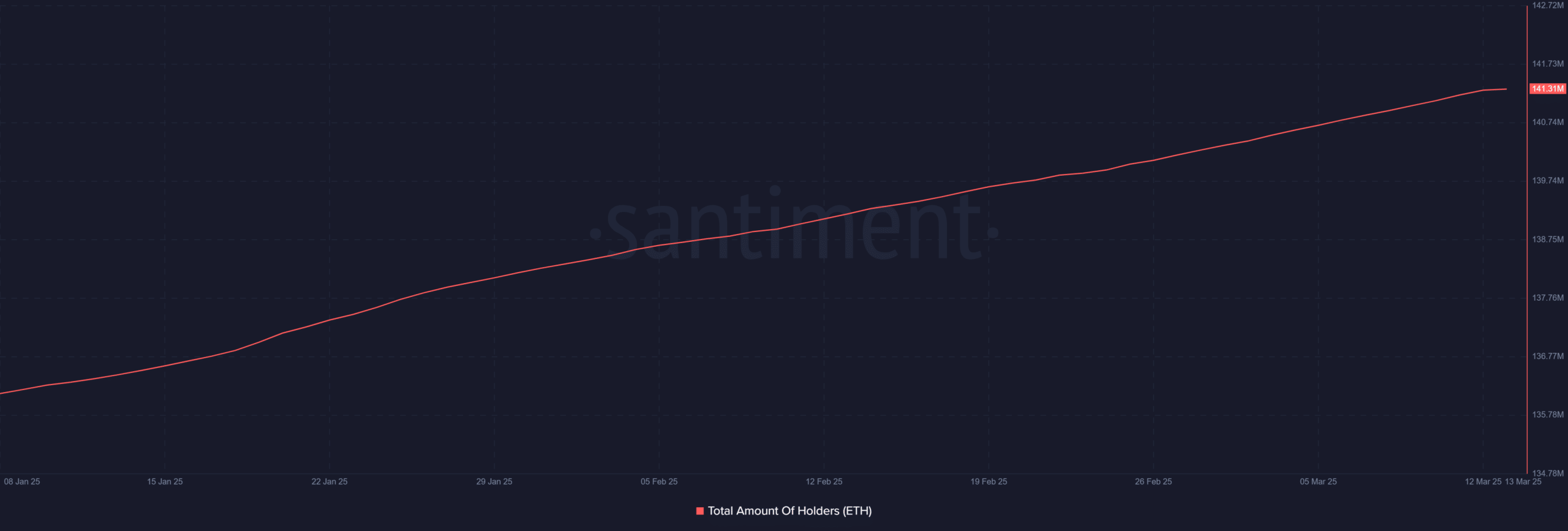

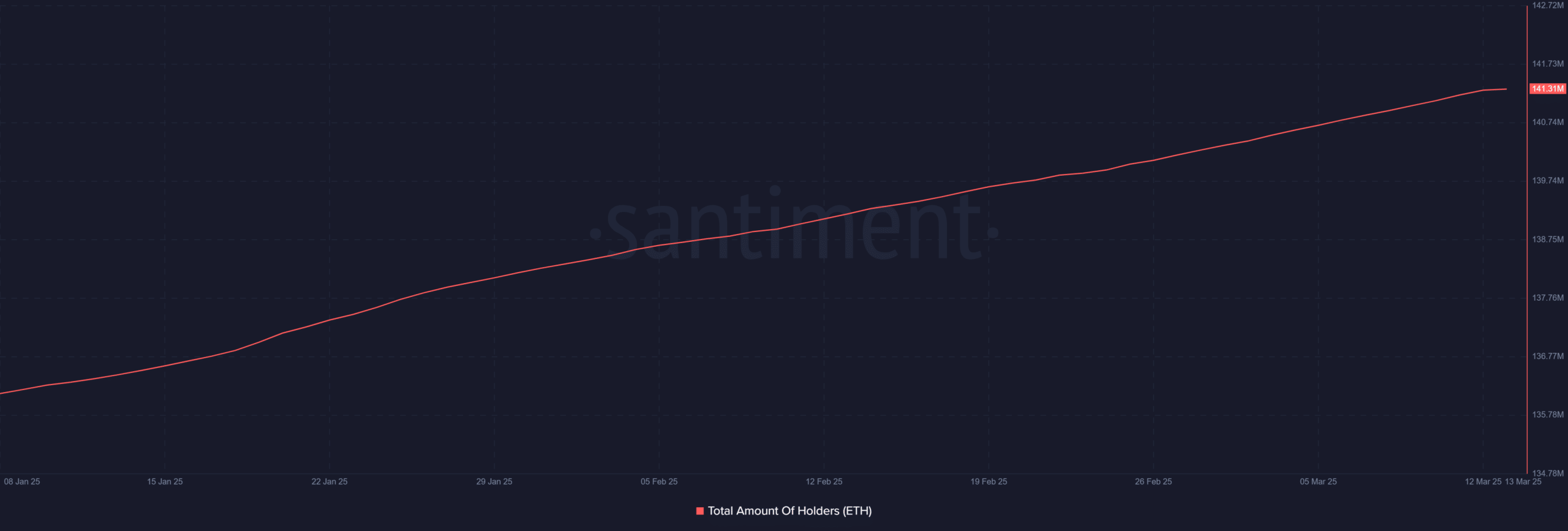

ETH holders proceed to develop

Whereas the value of Ethereum is struggling, the variety of holders has elevated steadily.

Information on Santiment chains confirmed that the overall ETH holders had reached round 141.31 million, in order that constant progress was marked regardless of the value within the worth.

This implies that though merchants have left their positions within the quick time period, lengthy -term traders proceed to see worth when amassing ETH on the present degree.

Supply: Santiment

A attainable rationalization for this divergence is that institutional and whale traders progressively purchase Ethereum, whereas retail merchants capitulate.

This accumulation sample might decide the stage for a probably restoration if the gross sales strain assortment and broader market circumstances enhance.

Value forecast: will ETH discover assist?

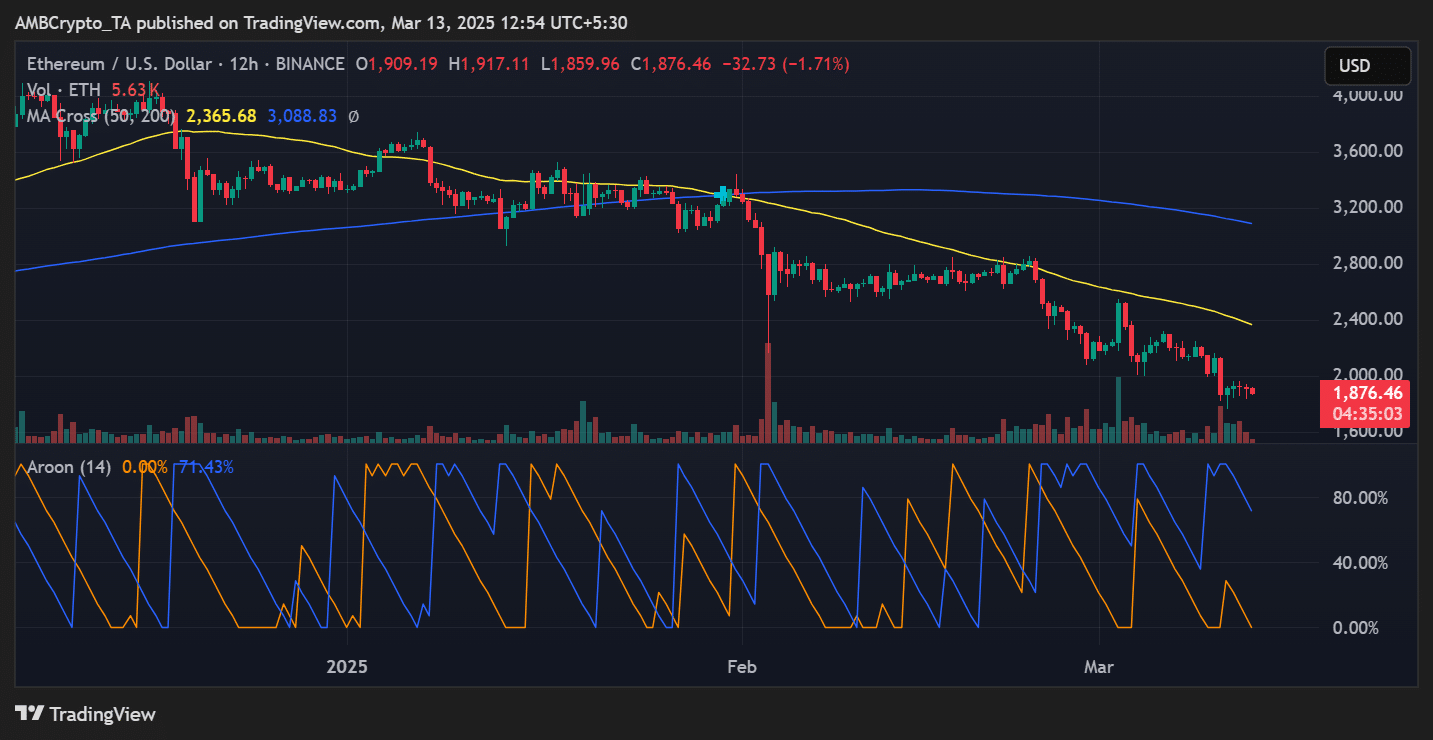

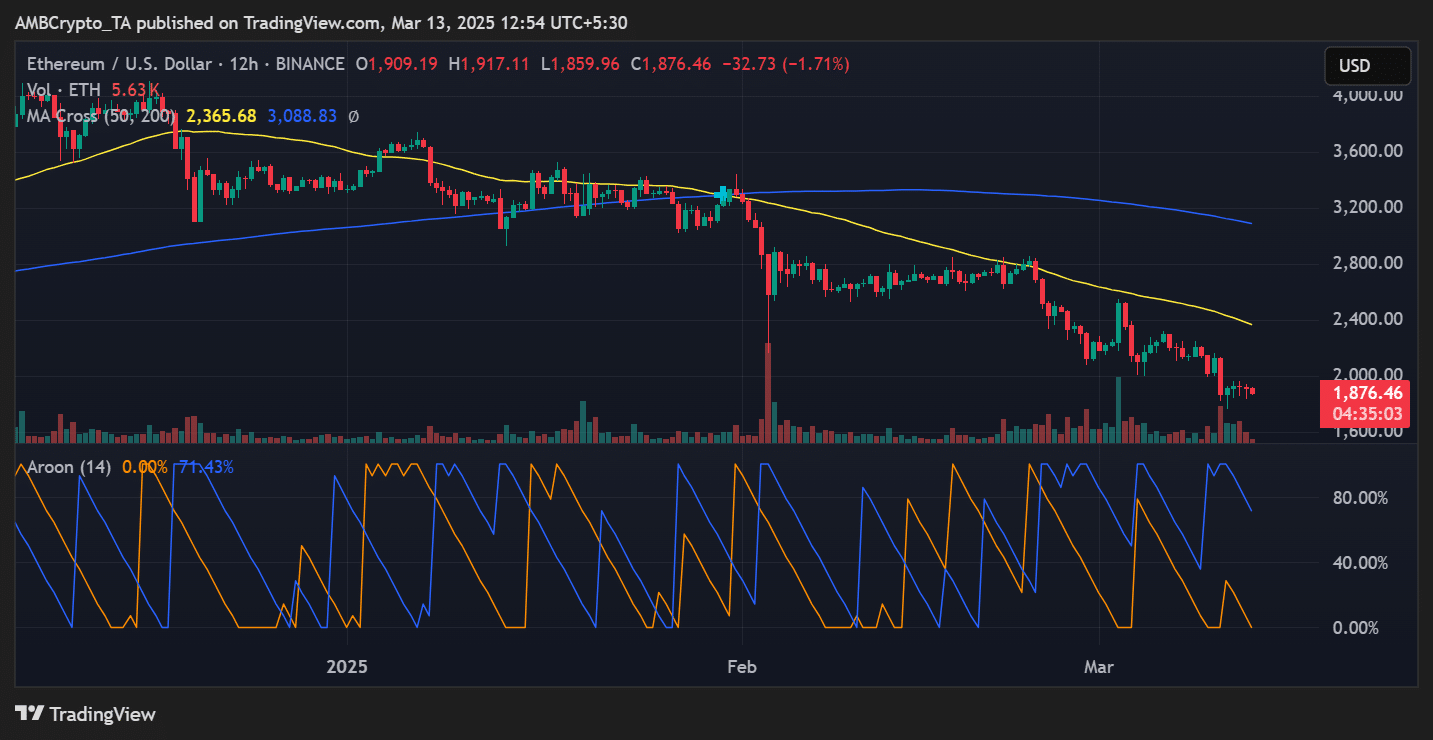

Ethereum traded at $ 1,876 on the time of the press, after he had had a gradual lower in current weeks. A very powerful assist ranges to look at have been $ 1,850, which historically served as a vital demand zone.

Supply: TradingView

If gross sales strain is rising, Ethereum might take a look at the $ 1,750 area, a degree that beforehand acted as a powerful accumulation zone.

Conversely, if ETH succeeds in stabilizing and reclaiming the $ 2,000, this might trigger a shift in sentiment.

The Aroon indicator, which measures the development power, at the moment signifies weak spot, which means that ETH remains to be in a downward development.

An outbreak above the 50-day advancing common [2,365] Would point out that renewed bullish momentum.

Conclusion

The Ethereum market stays beneath gross sales strain, as evidenced by persistent destructive web tone quantity.

Nonetheless, the regular enhance in ETH holders signifies that some traders regard the present worth vary as an accumulation possibility.

Whereas the downward dangers persist, a shift in sentiment or the aid of gross sales strain ETH can place for a restoration.

Merchants should hold a detailed eye on essential assist and resistance ranges, as a result of the following step from Ethereum will in all probability decide a wider market sentiment.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now