Ethereum

Ethereum faces key week as election nears – Will $3K be in sight?

Credit : ambcrypto.com

- Ethereum could expertise elevated liquidity because the election cycle involves a detailed.

- Nevertheless, a number of elements solid doubt on its restoration potential.

With only a week till the election, the crypto market is primed for elevated liquidity – a possible catalyst for Ethereum [ETH] to interrupt free from his downward stoop. Since ETH is on a positive greed index, this could possibly be a promising shopping for alternative.

Nevertheless, uncertainty clouds its restoration. If the earlier sample repeats, Solana may as soon as once more profit from Bitcoin’s market spikes, as lately with 4 days of robust each day beneficial properties whilst BTC pulled again, doubtlessly limiting ETH’s restoration prospects.

Because of this, this weekend could possibly be essential and pave the way in which for ETH to push for the $3,000 mark, offered market situations are favorable.

Ethereum’s core metrics are underneath stress

This cycle has been notably difficult for Ethereum. Regardless of a 40% enhance within the variety of each day energetic addresses throughout the nation predominant web and Layer 2 networks, ETH worth has not saved tempo, faltering almost 7% after closing at $2.7K only a week in the past.

To compound these issues, Ethereum’s community reimbursements have reached their lowest degree and have fallen behind rivals like Solana. This creates a further problem for Ethereum; with such low prices, issues about community safety could come up.

General, a confluence of things has prevented ETH from benefiting from Bitcoin’s spikes. Traders have gotten more and more unsure about the way forward for Ethereum, which is why they see better potential in different blockchains.

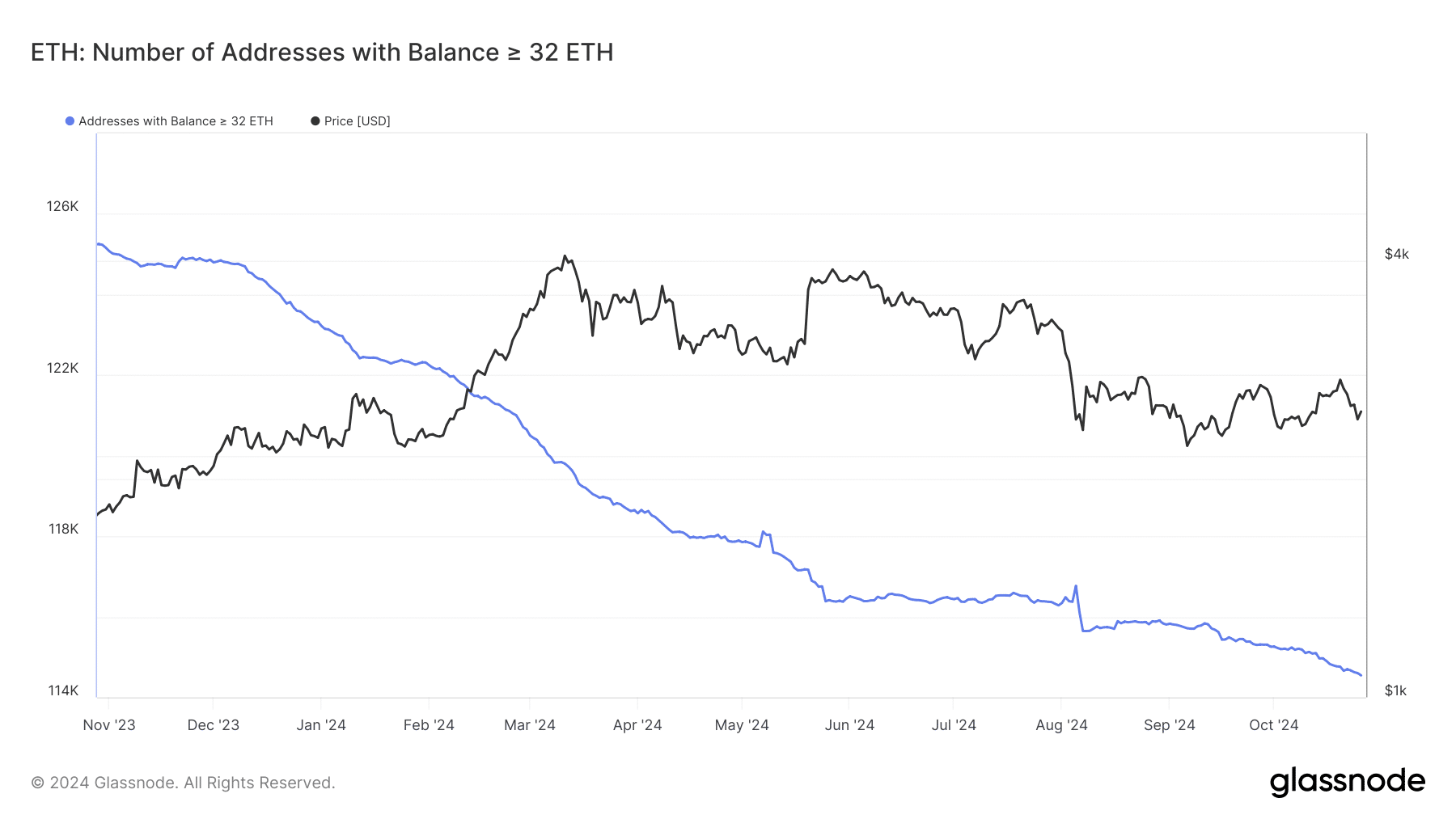

Supply: Glassnode

Supply: Glassnode

Compounding these challenges, the variety of validators on the Ethereum community has dropped considerably, with staked wallets at their lowest degree in a 12 months. The proof-of-stake (PoS) consensus mechanism requires a minimal of 32 ETH to stake, and this lower in validators raises issues in regards to the general well being of the community.

Delays in transaction validation can result in community congestion, driving customers away. This cycle has seen a notable migration from ETH to SOL, with Solana’s excessive throughput enabling increased transaction speeds and decrease charges.

This development underlines Ethereum’s wrestle to keep up its person base.

Electoral liquidity is not going to be sufficient

If the community doesn’t tackle these challenges, the election buzz could solely yield short-term beneficial properties for ETH, missing the energy wanted for an actual breakout.

Ethereum must revive its market dominance, which severely declined within the earlier market cycle and at present stands at simply 13% – the bottom degree in opposition to Bitcoin since April 2021.

Whereas excessive Bitcoin dominance sometimes alerts the beginning of an altcoin season, ETH could wrestle to regain its main place available in the market if this development doesn’t reverse.

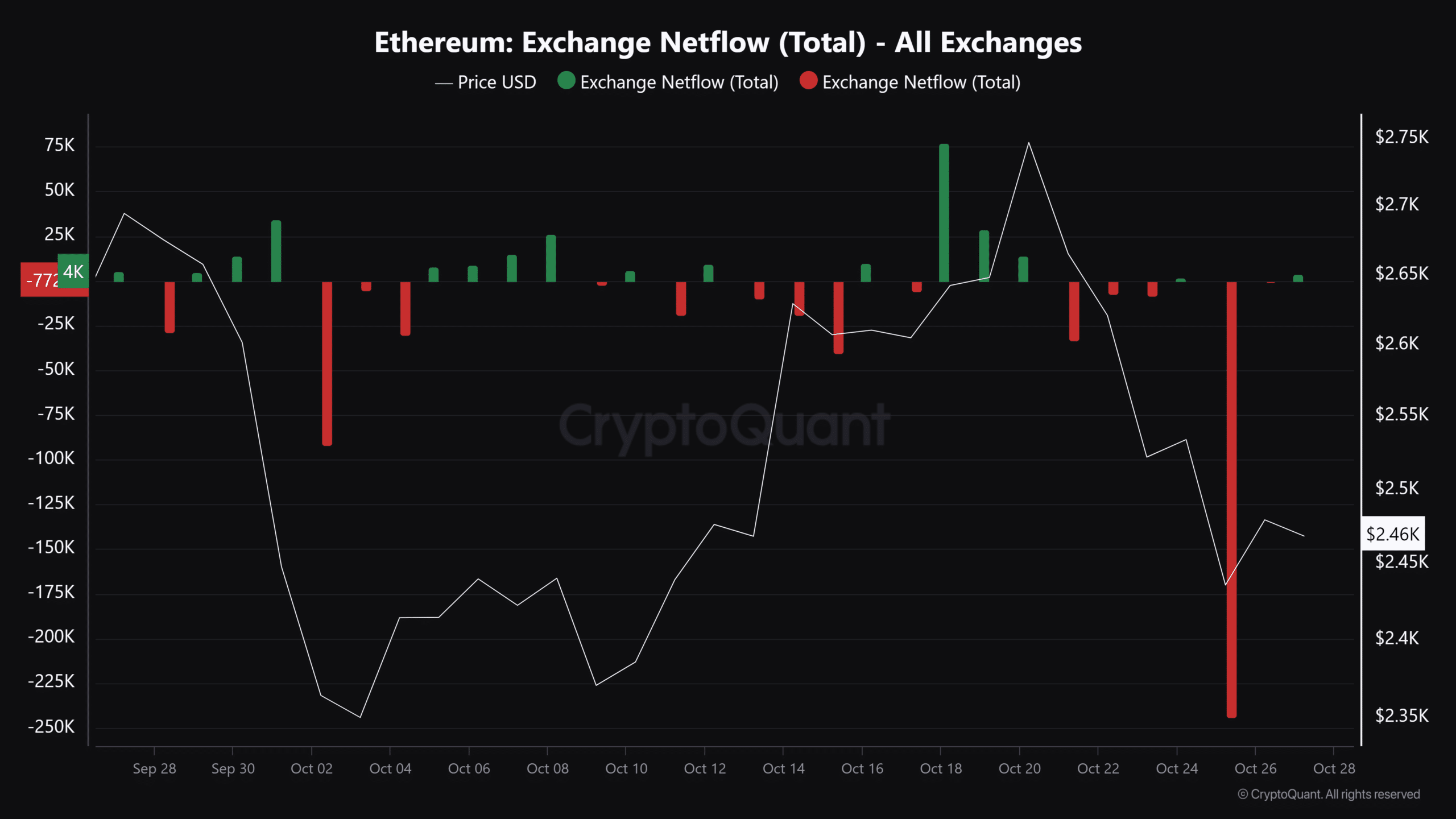

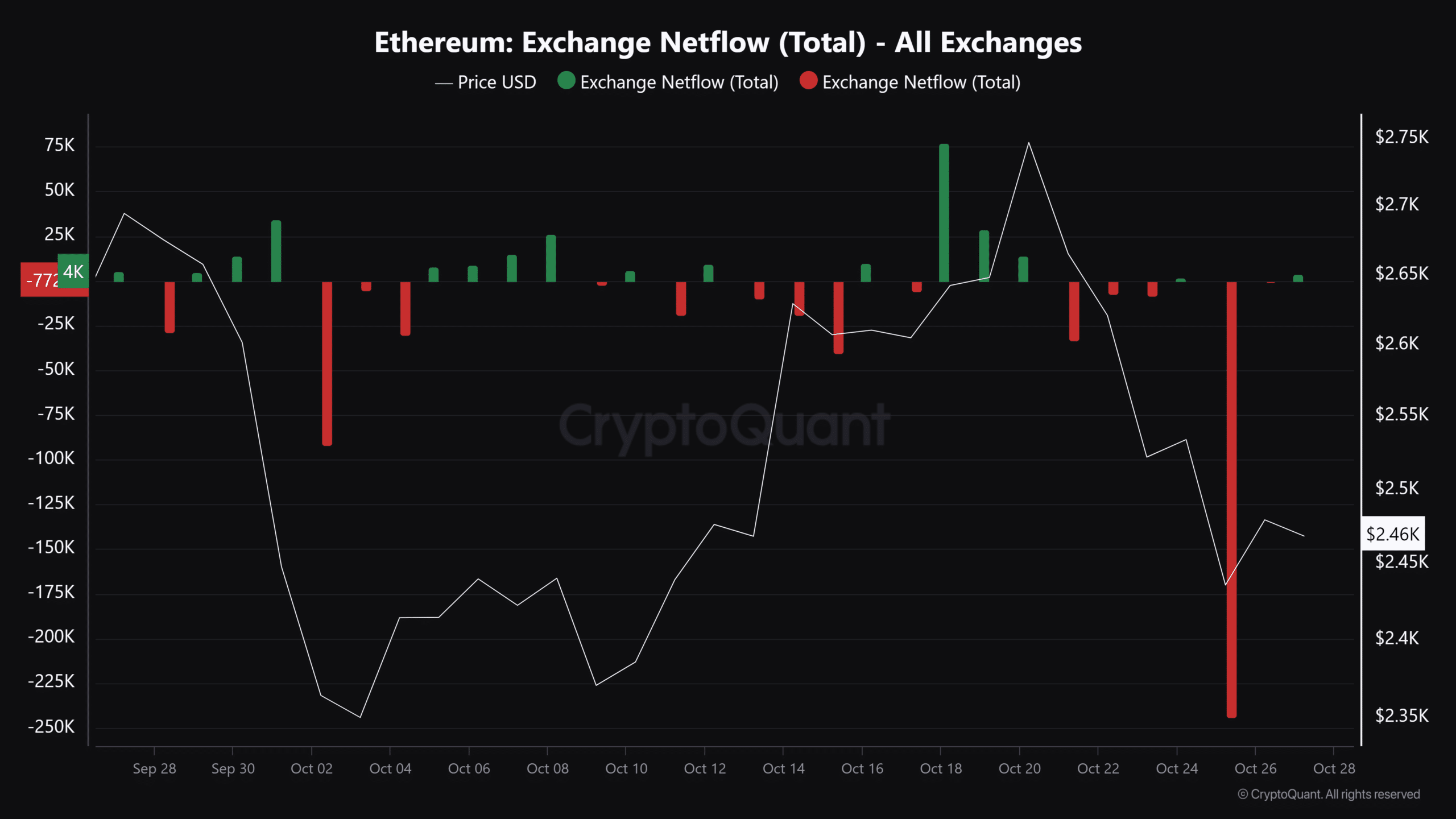

Supply: CryptoQuant

Curiously sufficient, a spike in ETH outflows occurred simply two days in the past, with 244,000 ETH being withdrawn from the exchanges. This implies that buyers are viewing the present worth as a dip, which may doubtlessly assist the bulls keep the $2.4K assist line.

Nevertheless, there was no affect on the worth.

Learn Ethereum’s [ETH] Worth forecast 2024–2025

That stated, because the elections close to their finish, there’s a important likelihood that ETH will make beneficial properties within the close to time period. This might assist reverse the present development and assist bulls management bearish stress.

Nevertheless, Ethereum’s prospects for rising from the disaster stay restricted until it manages to keep up community well being. If these points will not be addressed, there’s a important threat that the present underperformance may turn into a long-lasting development, placing ETH’s market place in danger.

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Solana6 months ago

Solana6 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?