Ethereum

Ethereum Faces The Level That Decides Everything: Analyst

Credit : www.newsbtc.com

Cause to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by consultants from the business and punctiliously assessed

The very best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

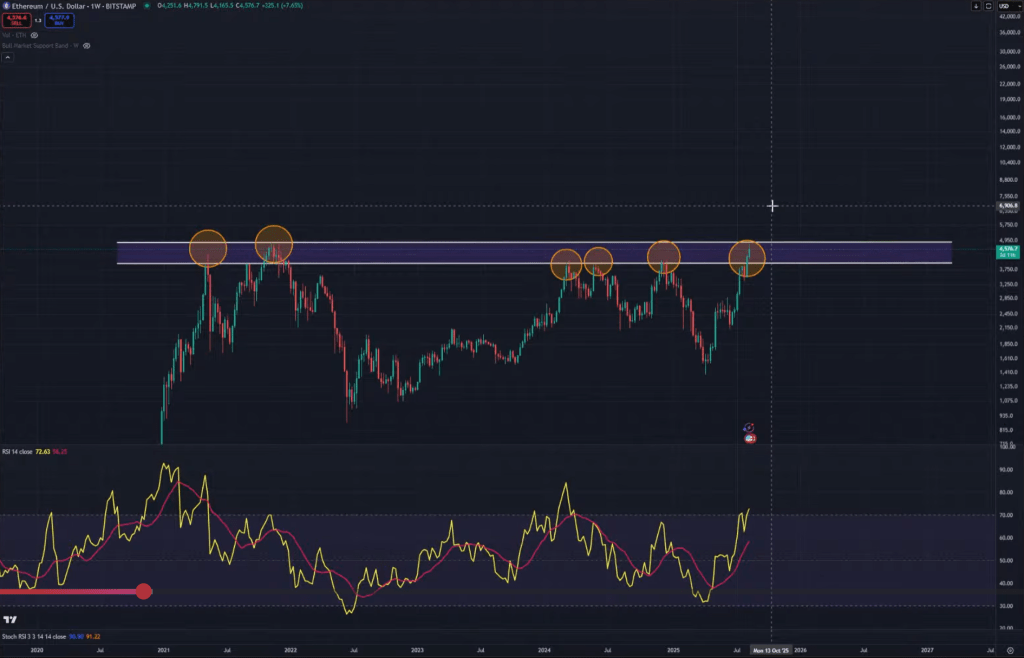

Ethereum arrived straight into his 4 -year ceiling, with a value promotion that presses on the $ 4,700 band that Kevin (@kev_Capital_ta) repeatedly calls the extent that positively calls all the things ‘. His latest momentary frames ETH’s setup as Binary: a decisive break by this resistance confirmed by a clear weekly closure and a break of the Down-Trending weekly RSI line or one other rejection that extends sample of weakening conferences for months.

Ethereum stagnates at $ 4,700 – Breakout ear bloodbath?

“The catching up is over,” Kevin saidIt notes that EHH “lastly overtaken the place Bitcoin is positioned … It’s in its nice resistance.” In his lecture, the $ 4,700 space will not be a single tick, however a meals zone outlined by the height of the sooner cycle and strengthened by a “weekly downward development on the RSI” that has closed each advance for the reason that starting of 2024. “Breaking resistance and the actual bull will begin,” he added. Till that occurs, he characterizes this band because the ‘line within the sand’.

Momentum within the check was actual. Kevin described the advance of the cash movement and “stunning patterns that kind on some altcoins”-including “textbook inverse head and shoulders”-the following failed and ETH was upright in resistance. He pointed to the shortage of continuation of the Asia session and, extra highly effective, to a macro shock that hit the market whereas the market leaned for a very long time.

Associated lecture

That shock was the American producer Value Index. “The PPI got here in significantly hotter than anticipated,” mentioned Kevin, and emphasised each the dimensions and the place the strain appeared: month-over month +0.9% versus +0.2% anticipated, year-on-year 3.3% versus 2.5%, with core PPI +0.9% m/m versus 3.2%.

In his opinion, this tariff -controlled prices that ‘the producer Brenken’ displays, and subsequently the height has surfaced in PPI as an alternative of CPI. The open query – and the danger for ETH within the occasion of resistance – is whether or not these prices “drip into the CPI” and, with enlargement, PCE. He underlined how shortly the velocity of the velocity velocity on the Fedwatch software Intraday: September nonetheless closely favored, October largely intact, and December “a 3rd curiosity discount export” earlier than turning again because the day progressed. “This has been fleeting this morning … Let it settle,” he warned, and added that subsequent week’s Jackson Gap’s feedback from Stoel Powell are the subsequent massive macro catalyst.

Technically, Kevin’s Guidelines for Ethereum doesn’t change with one knowledge print. He emphasizes two confirmations: Get the horizontal inventory round $ 4,700 with authority and “Break the weekly downward development on the RSI” to destroy the Bearish divergence that has existed since Q1 2024. “Resistance is resistance till it’s not,” he mentioned. Failing there, and ETH dangers one other corrective leg, as a result of late lungs are pressured within the worst attainable place. Success, and ‘your complete dialog modifications’, opening a highway to what he calls a ‘actual bull’ in Eth and, as a result of knock-on impact, on the broader alt-market.

Associated lecture

He connects the destiny of ETH to a broader market construction with out diluting the main focus. Total2 being ETH-PLUS-Alts Proxy-“” got here as much as 1,69 trillion “towards a well-moldable breakout set off on” 1.72 trillion “, whereas he tapped on his personal weekly RSI-Downtrend. The lack to push these final dozens of billions subsequent to the PPI shock explains the abrupt reversal about ETH and Alts. Kevin additionally marked the dynamics of Stablecoin and seasonal liquidity as background variables, and famous that USDT -Dominance stays elevated and that September “is” normally “will not be a fantastic month, as a result of conventional funds return from summer season, handle taxes and put together for the This autumn threat.

Operational, he claims that the appropriate buying and selling location was behind us, not towards resistance. “There isn’t a cause to purchase in these loopy ranges,” he mentioned and suggested persistence for everybody who’s positioned from decrease. His framework is straightforward and strict: view the weekly ETH graph, the $ 4,700 band and the RSI trendline. If macro stays ‘secure’, he expects the break; If it deteriorates, he’ll re -assess. Anyway, the Pivot doesn’t come from lower-time body noise, however ETH can lastly be solved his four-year wall.

“Give attention to these graphs and nothing else,” concluded Kevin. For Ethereum meaning one check, one stage and one sign: delete $ 4,700 and sturge the divergence retirement – or wait.

On the time of the press, ETH traded at $ 4,619.

Featured picture made with dall.e, graph of tradingview.com

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024