Bitcoin

Ethereum Faces Validator Bottleneck With 2.5M ETH Awaiting Exit

Credit : www.coindesk.com

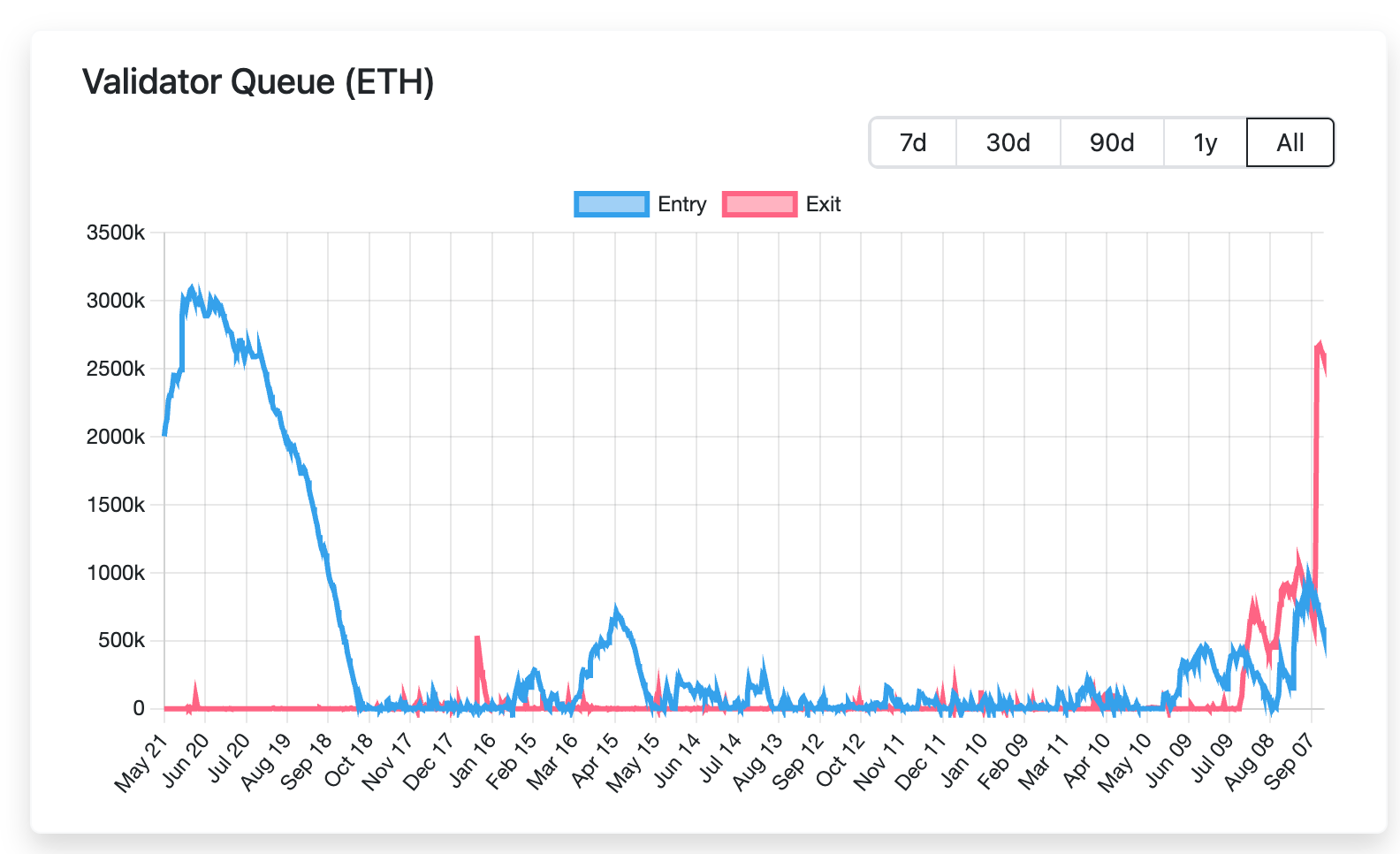

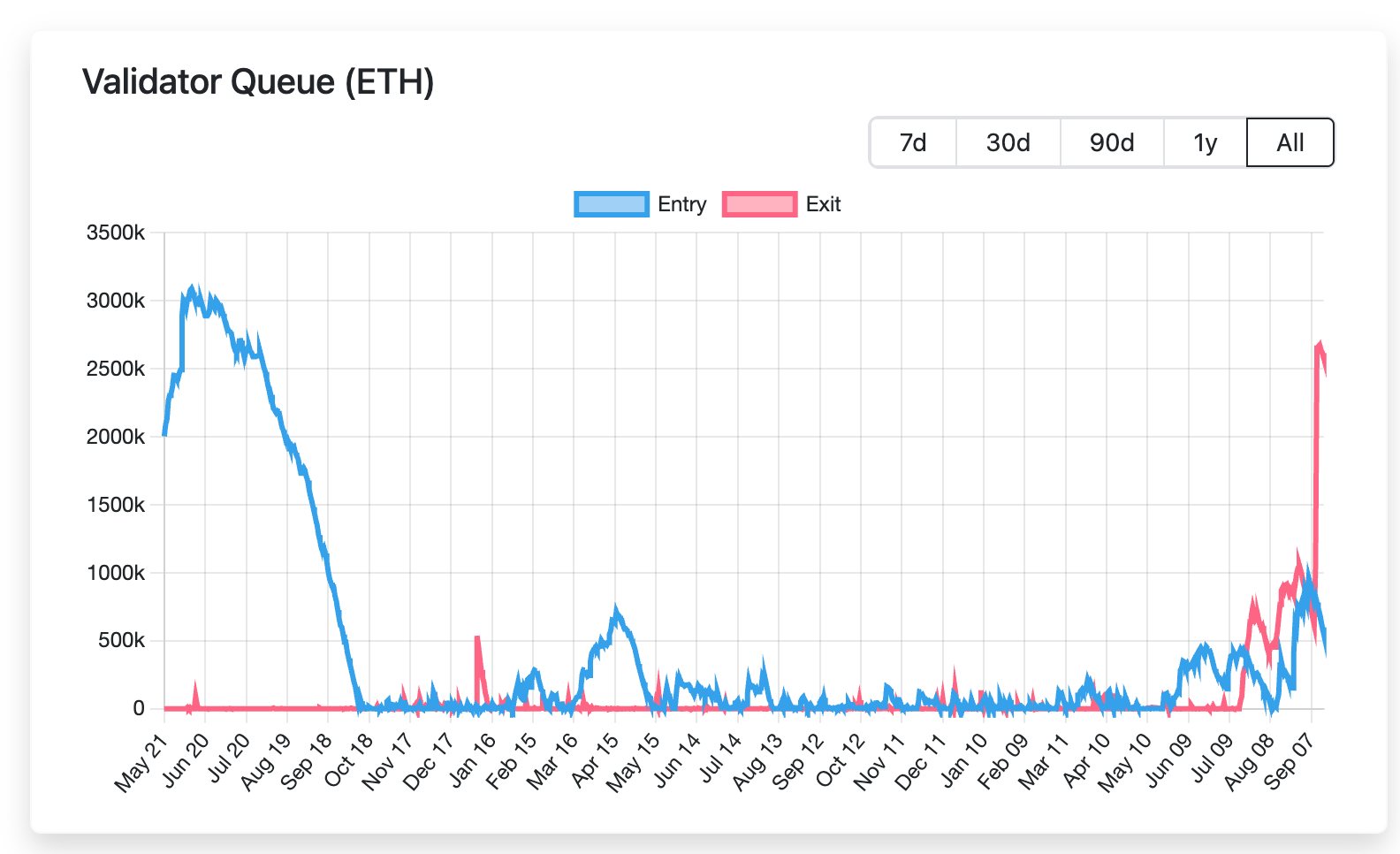

The Ethereum’s proof-of-stake system is thus far confronted with the most important take a look at. From mid-September, round 2.5 million ETH with a worth of roughly $ 11.25 billion guard awaits the validator set, in accordance with Validator queue Dashboards.

The backlog pushed the ready instances of the exit to greater than 46 days on Monday, the longest within the brief deployment historical past of Ethereum, Dashboards show. The final peak, in August, positioned the exit quarrel row in 18 days.

The primary spark got here on September 9, when Kiln, a big infrastructure supplier, selected to go away all his validators as a security measure. The relocation, activated by latest safety incidents, together with the NPM Provide Chain assault and the Swissborg infringement, pushed, About 1.6 million ETH Within the queue within the queue on the identical time. Though not associated to the Ethereum strike protocol itself, the hacks rattled sufficient for Kiln to succeed in a break, and emphasised how occasions within the wider crypto eco system can movement into the validator dynamics of Ethereum.

In A blog post from setting up provider Figment, senior analyst Benjamin Thalman famous that the present construction of exit -queue isn’t just about safety. After ETH has returned to greater than 160% since April, some strikers merely take a revenue. Others, particularly institutional gamers, shift their publicity to portfolios.

On the identical time, validators who introduce the Ethereum ecosystem have steadily elevated. The assertion of the SECs that clarifies that setting shouldn’t be safety has the pursuits within the turnout. Anticipation on ETH ETF inspections is one other driver, whereas funds are making ready for regulated methods to catch an look, Thalman famous.

The Churn restrict of Ethereum, a protocol safety that holds what number of validators can enter or depart over a sure interval, is at the moment being put to 256 ETH per eras (roughly 6.4 minutes), in order that the how rapidly validators can be part of the community or depart the community, and supposed to maintain the community stabel.

With greater than 2.5 million ETH, strikers are confronted with even the Cooldown step on Wednesday for 44 days.

Thalman believes that a lot of the present ETH will simply be repeated beneath new validators, which implies that if even 75% of the present queue is deposited once more, virtually 2 million ETH will flood the activation queue, in order that delays for brand new ETH deployment and a backlog can be delivered to each side of the Validator-Koop row.

“The activation quarrel is at the moment 13 days, add the ~ 2m ETH of those that are at the moment departing (35 days) and 4.7 m of ETFs (81 days), and the whole is 129 days. This assumes that there are not any different ETH holders who select to place the queue in and enter, reminiscent of enterprise forces,” “” Thalman wrote Within the weblog.

The swelling queue underlines a paradox: Ethereum works “as supposed”, Thalman notes, and the demand for each exit and re -introduction emphasizes the central function of the assertion within the ecosystem. The community due to this fact experiences the rising pains of an grownup, institutionalized system the place infrastructure photographs, revenue cycles and authorized shifts all collide in actual time.

Learn extra: Ethereum strike queue catches up the outputs as a concern of a sale disappear

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024