Ethereum

Ethereum falls below $2,200: Assessing ETH’s odds of recovery

Credit : ambcrypto.com

- Ethereum fell 22% regardless of the approval of Eric Trump and growing whale exercise.

- Shopping for whales that peaked when massive buyers positioned themselves in opposition to a downward pattern.

On February 4, 2025, Eric Trump made waves by endorsing Ethereum’s [ETH] On his X (previously Twitter) account, he insists on followers to purchase Ethereum.

Since then, nonetheless, the value of Ethereum has fallen enormously, by 22%. Regardless of this decline, a rise in whale exercise has been registered, by which 110,000 ETH is collected in simply 72 hours.

Within the midst of blended alerts, individuals are questioning: Positioning massive buyers themselves for a rebound, or is the market nonetheless in a downward route?

Eric Trump’s approval and subsequent decline

Supply: X

The primary response to Trump’s approval was adopted by a brief value enhance, however the rally was filled with quick. Since then the value of Ethereum has been has fallen 22%Which results in questions concerning the lasting influence of his approval.

Supply: X

Varied components have contributed to the value fall. A major hack of $ 1.5 billion from the BYBIT alternate on 25 February undermined the belief of buyers, inflicting a wider market gross sales.

Furthermore, the fading of euphoria after the election of President Donald Trump, together with unfulfilled expectations for a pro-Crypto Regulatory Framework, has the market feeling.

Worldwide financial uncertainties have additionally put strain on Ethereum’s value.

Whale accumulation: a voice of belief or a tactical sport?

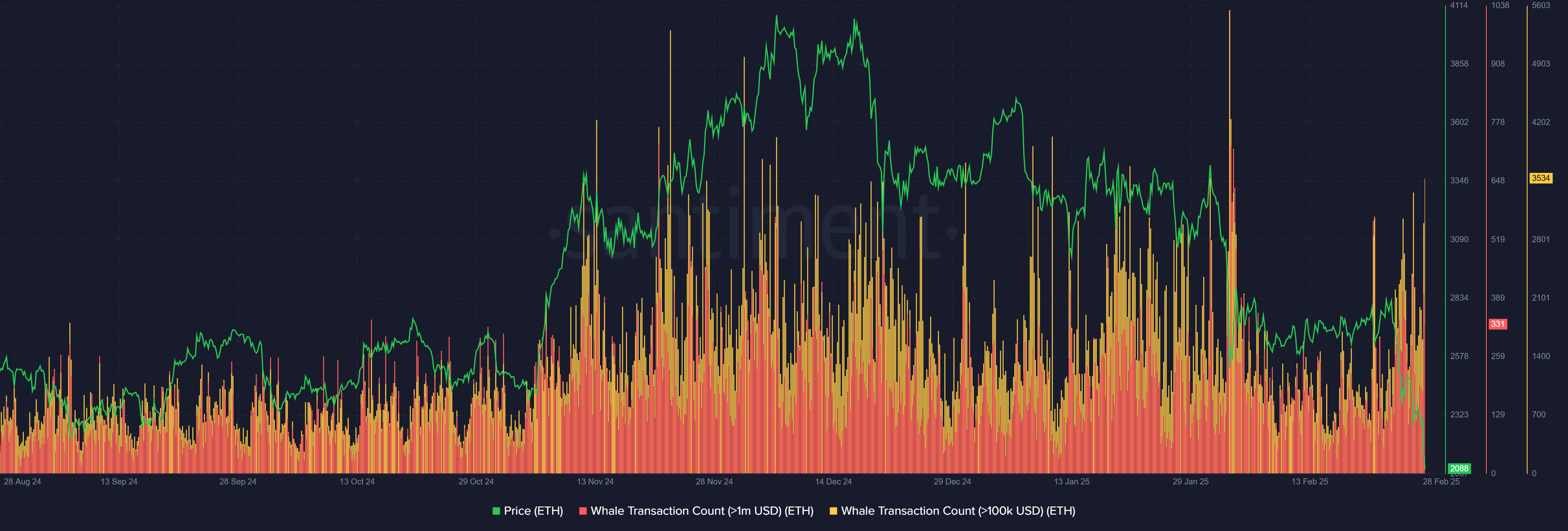

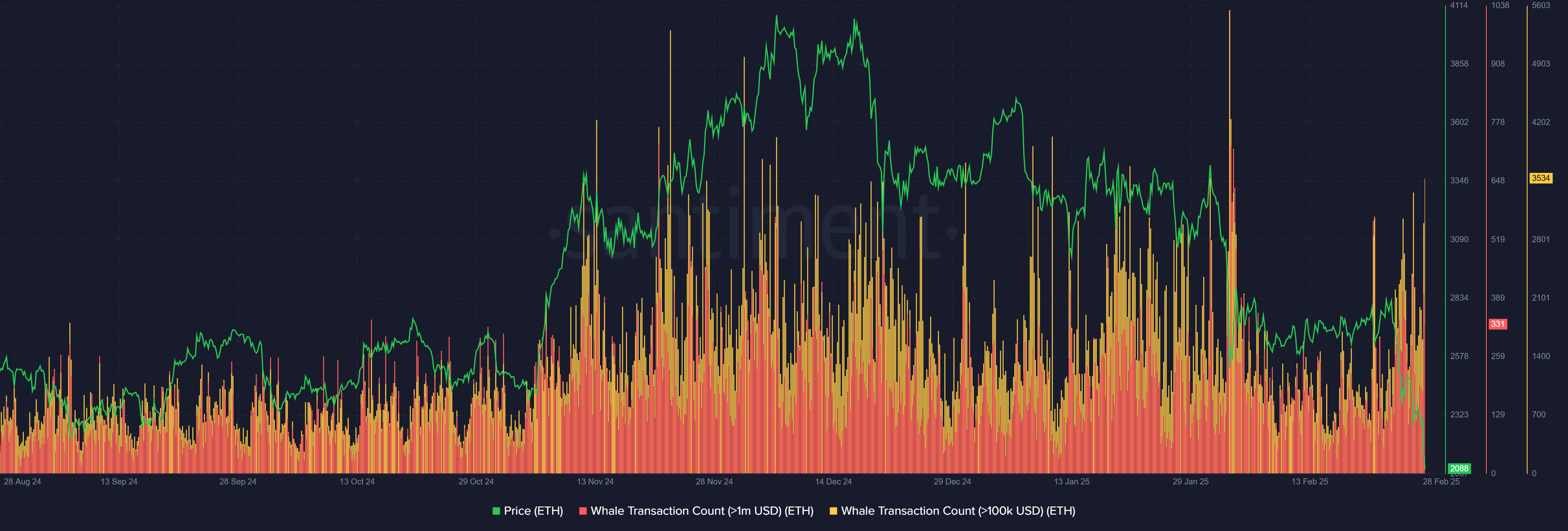

Regardless of the autumn in Ethereum’s 22%, whale exercise has risen, with 110,000 ETH collected in simply 72 hours. Santiment knowledge emphasizes a powerful enhance in whale chanties.

This implies that enormous buyers might place themselves for a rebound or capitalize at decreased costs.

Supply: Santiment

Traditionally, comparable accumulative phases are adopted by robust restoration, however not at all times.

For instance, severe whale exercise on the finish of December 2024 coincided with the height of ETH, and in mid -January the same accumulation that was defined with a brief bouncer.

If ETH possesses the vary of $ 2,100 – $ 2,135, this will strengthen the bullish sentiment. Nonetheless, a unbroken break under this degree can recommend that whales safe liquidity earlier than a deeper correction.

Ethereum: Whale confidence versus Bearish Momentum

Ethereum’s RSI transferred at 38.90 and an in -depth MacD Bearish -Crossover point out a protracted -term downward pattern. The 50-day SMA at $ 2,929 stays significantly above the present value of $ 2,109, which reinforces Bearish.

If whales purchase to run a restoration, recovering the $ 2,200-$ 2,300 attain might validate a short-term bounce.

Supply: TradingView

Retail buyers should stay cautious. If ETH doesn’t maintain necessary help, the subsequent massive demand zone is round $ 1,900 – $ 2,000.

Shopping for whales just isn’t at all times a definitive bullish sign, particularly in a market -wide decline. Retail buyers have to be cautious for confirming a pattern comment earlier than the whale feeling follows.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024