Ethereum

Ethereum falls below major support level: Is this ETH’s market bottom?

Credit : ambcrypto.com

- Ethereum falls below the realized value and sign potential capitulation and doable market base.

- Whale accumulation through the dip of Ethereum suggests an opportunity for lengthy -term patrons regardless of market panic.

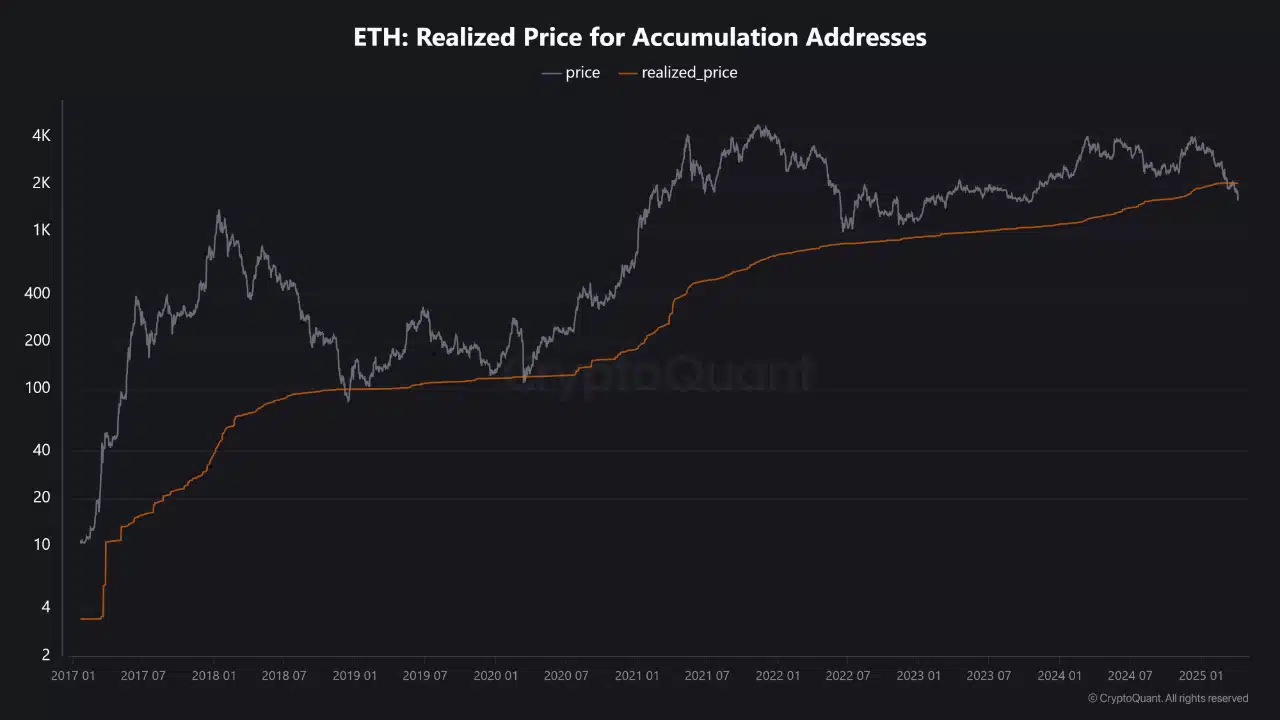

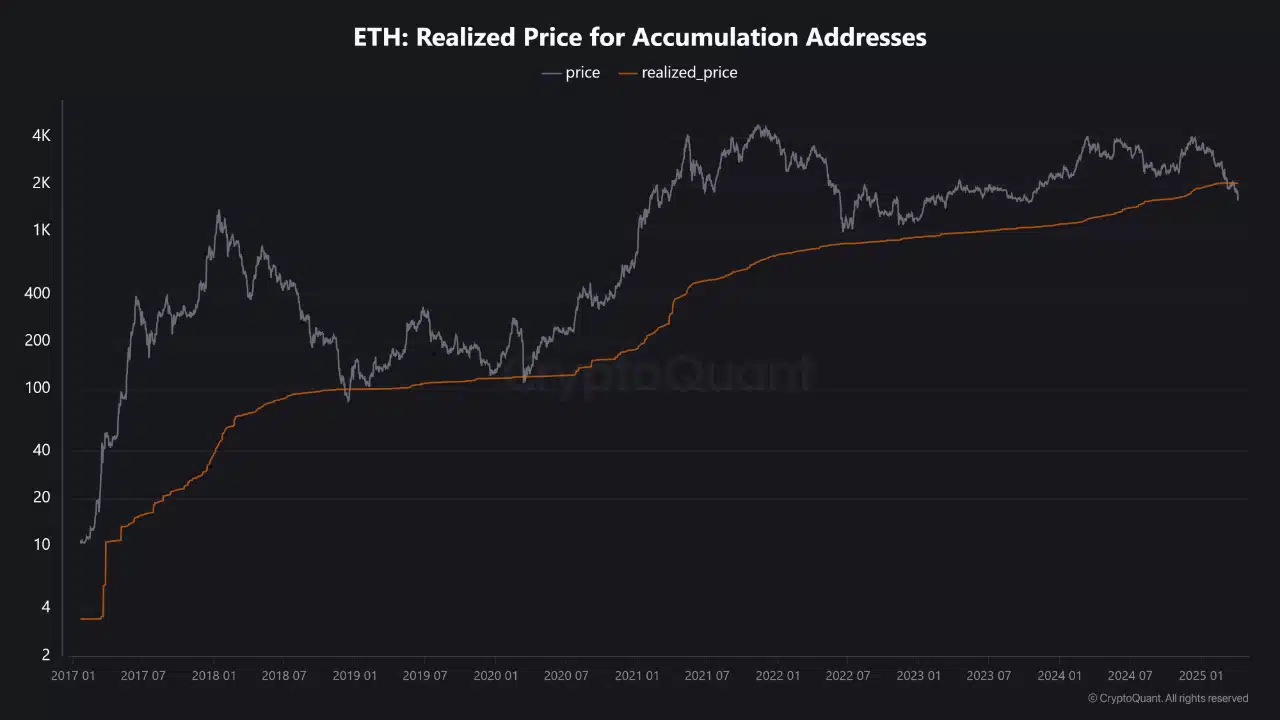

Ethereum [ETH] Has slid below the realized value for the primary time since March 2023 – a stage that traditionally signifies the capitulation of traders and potential market bases.

This drop comes within the midst of a wave of Altcoin sale, attributable to the fading of optimism of the mutual price of President Trump.

With the ETH/BTC ratio at a low-five-year low and market sentiment that Tilts Bearish, the fears unfold. However whereas retail traders flee, knowledge on chains reveal whales that quietly accumulate.

Is the collapse of Ethereum a remaining dip earlier than restoration – or the beginning of a deeper demolition in Altcoin’s confidence?

Ethereum: An indication of capitulation

For the primary time in additional than a 12 months, the market value of Ethereum has fallen Under the realized price For accumulation addresses – a stage that often signifies a deep market stress.

This statistics displays the typical price foundation of lengthy -term holders who’re recognized for purchasing and retaining ETH by way of volatility.

Supply: Cryptuquant

Such cross-overs have historically been essential moments within the value cycle of Ethereum, usually coincide with capitulation zones and long-term soils.

The info reveals that ETH is immersing under this necessary stage of help, a improvement that might both trigger additional loss-driven gross sales or if a stealth purchase sign for optimists in the long run can serve.

The place panic

Each time Ethereum has fallen below the realized price-as will be seen in 2018, mid-2020 and on the finish of 2022-it will probably be marked the tail finish of brutal down rends and the beginning of highly effective restoration.

These dips usually sign capitulation, by which weaker arms exit and lengthy -term believers are available quietly.

Though immediately’s value motion can really feel like a disaster, patterns recommend previously that it may be a disguised probability. Sensible Cash has handled these moments traditionally as entry factors with plenty of conviction and never.

If historical past repeats itself, Ethereum approaches a kind of uncommon accumulation home windows earlier than the following upward development unfolds.

Whales step in

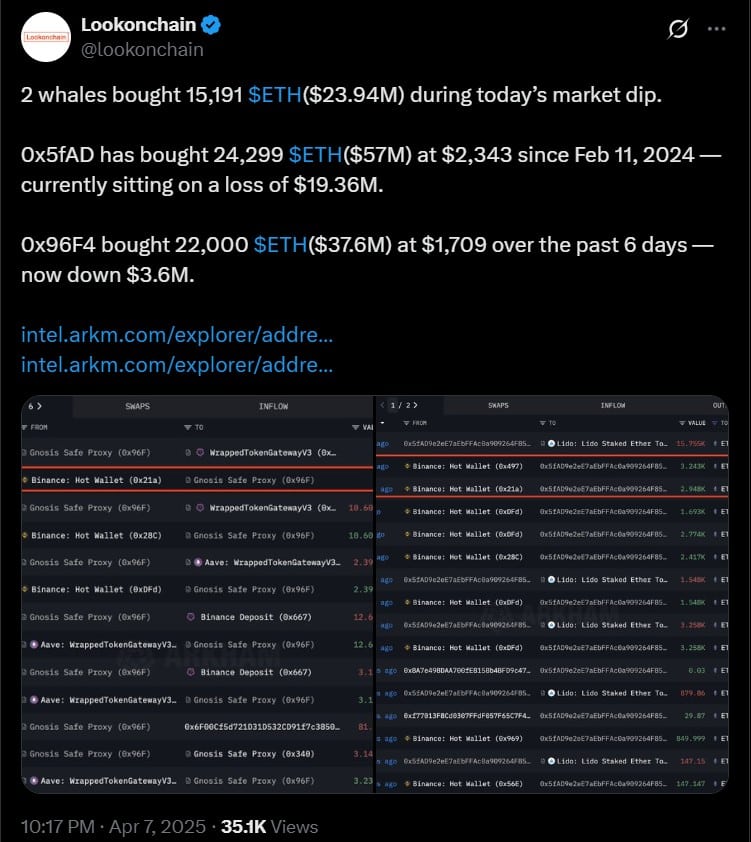

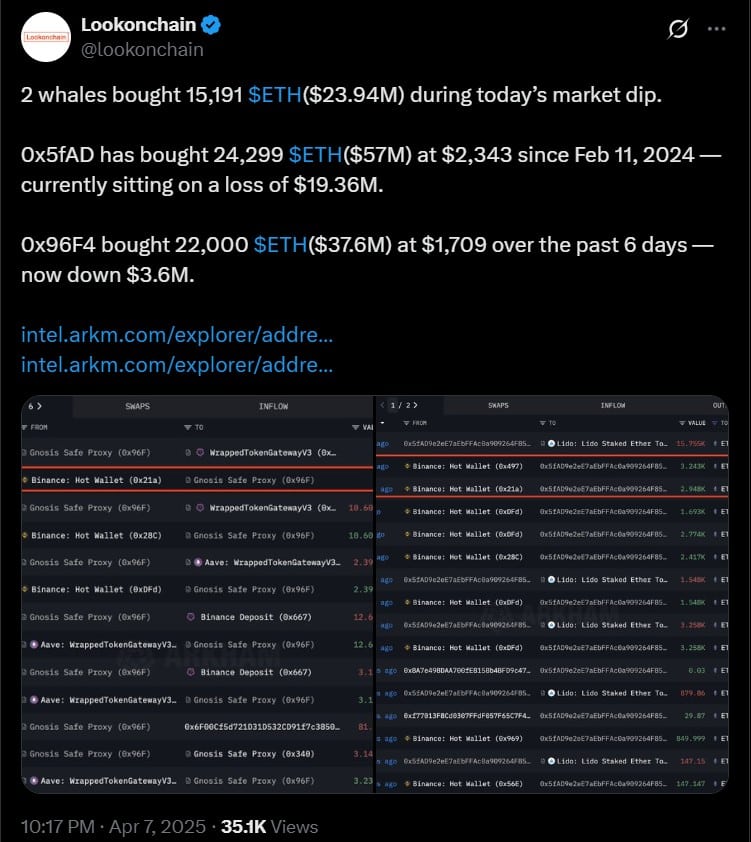

Whereas Ethereum fell under $ 1,600 on 7 April, whale exercise rose dramatically. Data on chains Exhibits two massive entities collected 15,191 ETH – value round $ 23.94 million – within the midst of the dip.

Supply: X

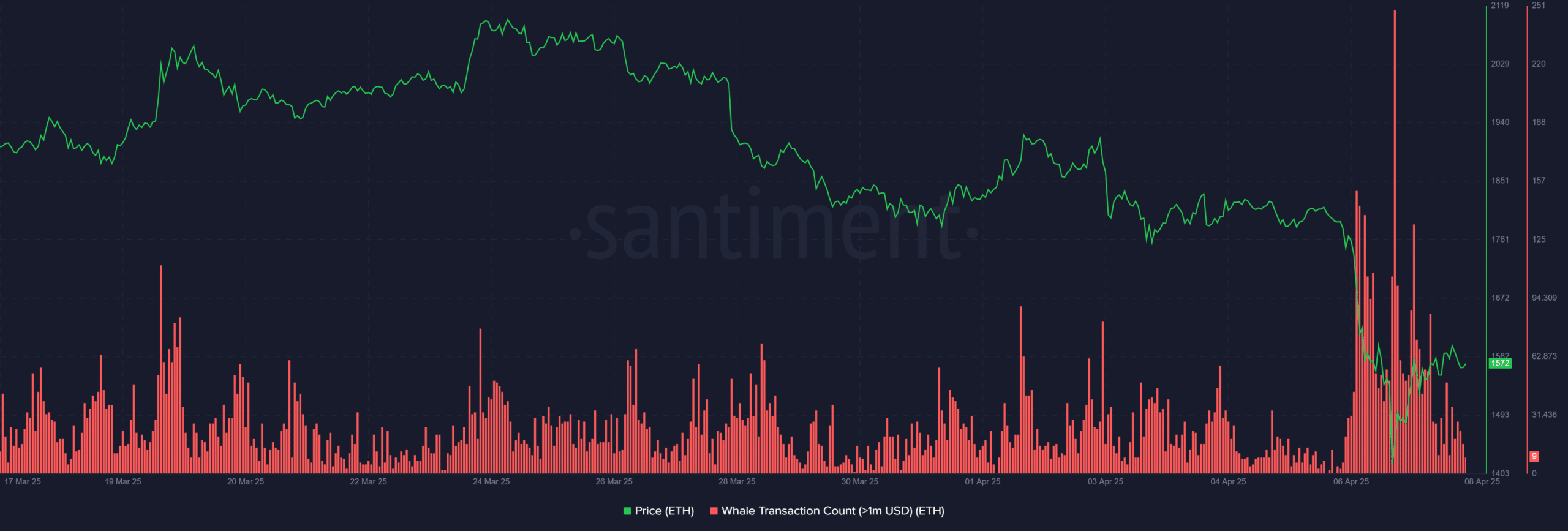

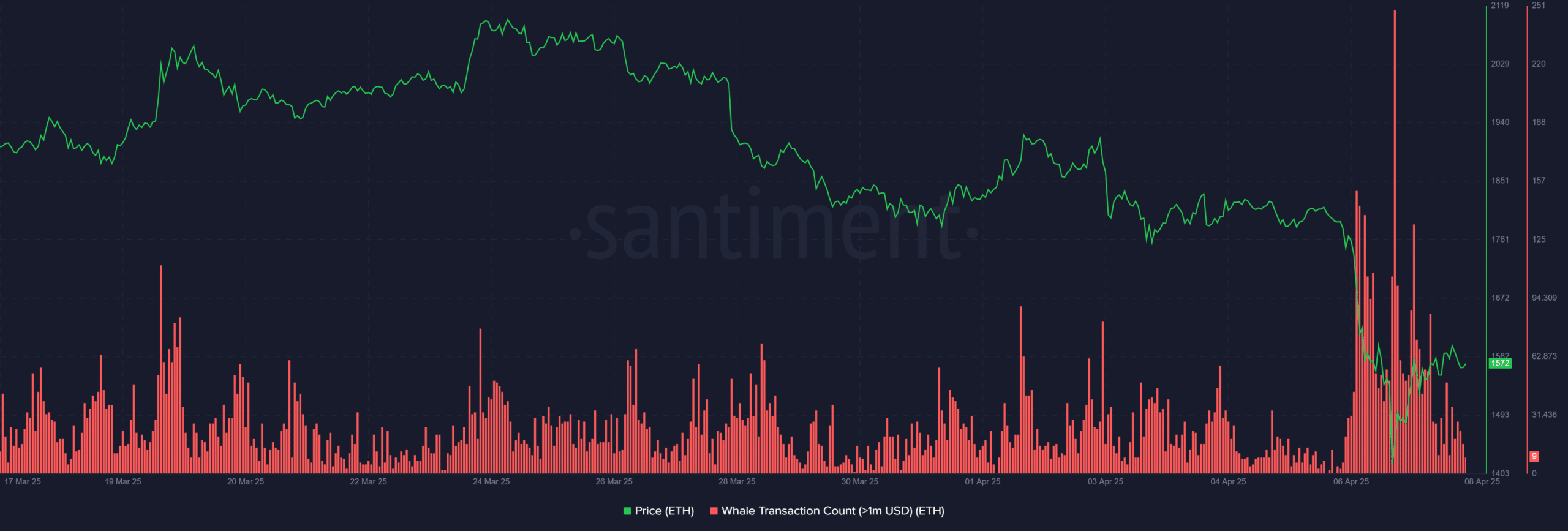

Santiment knowledge unveiled a outstanding peak in whale chanties of greater than $ 1 million, in accordance with the worth base.

Supply: Santiment

Traditionally, such massive -scale purchases throughout instances of worry usually precede market stabilization or reversal.

Though the retail sentiment stays shaky, this type of conviction of gamers with a excessive cap can present that the present ranges of Ethereum are thought of undervalued and doubtlessly opportunistic.

Market lose belief in Ethereum?

The weekly ratio of Ethereum towards Bitcoin has fallen to 0.12 ranges that haven’t been seen for the reason that starting of 2020. The persistent downward development, which is raring for 2 years, signifies a deep erosion of relative power.

As soon as praised as the first rival of Bitcoin, ETH now performs chased in the course of the shifting from investor choice to BTC and newer L1S.

Supply: TradingView

The breakdown suggests a structural lack of belief within the story and the usefulness of Ethereum, with out clear reversal in sight.

Until ETH will quickly be again on necessary historic ranges, the market can proceed to run the capital – a sobering sign for Ethereum Bulls.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024