Altcoin

Ethereum flashes once in a decade bull signal, says analyst

Credit : www.newsbtc.com

Cause to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by specialists from the business and thoroughly assessed

The very best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

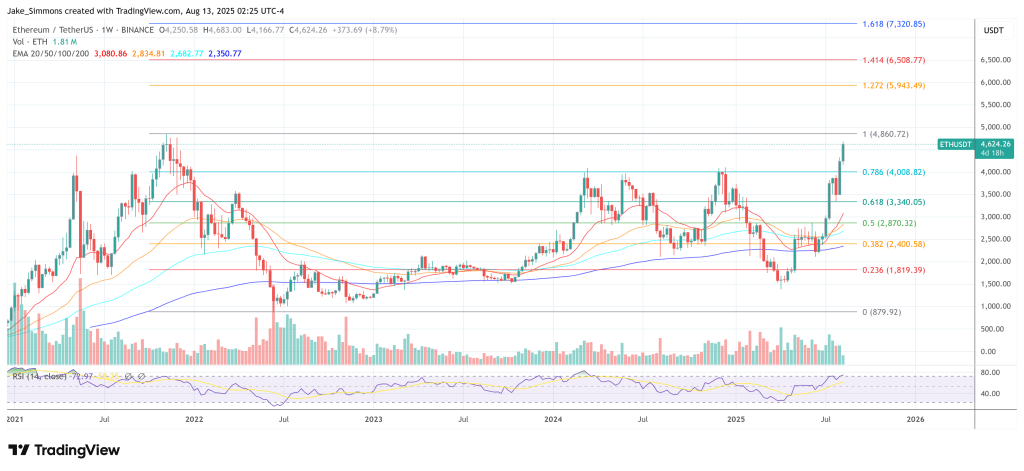

The graph of Ethereum illuminates a “one-off” confluence of bullish alerts and indicators that he says they haven’t appeared within the historical past of the belongings. In a video replace on August 12, Kevin revise His prediction of Could for “ETH season” and detailed why the rally unfolds virtually precisely as projected, whereas warning that the ultimate technical barrier remains to be intact.

Ethereum is on the final impediment

Two months in the past, when sentiment in opposition to Ethereum was essentially the most pessimistic in years, Kevin gave a warning based mostly on the ETH/USD, ETH -Dominance and ETH/BTC month-to-month graphs. “We had been most likely the primary folks to flash these warning alerts … It was so apparent and so apparent … one thing historic,” he mentioned. Since that decision, ETH has gained greater than 150%, with associated “beta video games” akin to Chainlink, Uniswap and Ethereum Traditional that sees triple figures of their low level.

The catalyst, Kevin defined, began with a uncommon month-to-month demand candle with nice assist – a formation that preceded stable rallies in earlier cycles. This was supported by a number of momentum indicators who ran from excessive over -sold ranges.

Associated lecture

The month-to-month RSI shares confirmed what he described as an unprecedented ‘V-shaped turnaround’, the MacD histogram had been coding and whaling stream tighter for the reason that finish of 2019 from the bottom lectures within the historical past of Ethereum. “Now you can see the month-to-month MacD cross on high of this sample … precisely on the zero line,” he famous, the framed because the technical ignition level for a persistent outbreak.

On ETH dominance, Kevin pointed to the identical alignment from Multi-Indicator: transferred RSI and Inventory RSI, an imminent MacD cross, and value that achieved the identical assist that underlined the 2019-2020 cycle. In line with him, that soil meant the beginning of a sustainable section of ETH -Outformance, a section that may lead Altcoins increased. The ETH/BTC graph, he argued, confirmed the timing: “The Lead Altcoin confirmed the highway … The underside is clearly inside.”

However, Kevin emphasised that Ethereum isn’t but in open value discovery. Crucial resistance stays its earlier of all time at round $ 4,850. “We aren’t within the clear … to not purchase in 4 -year massive historic resistance ranges. That’s by no means good. That may damage you,” he warned, and famous that on the broader “Whole 2″ market cutter for all altcoins excluding Bitcoin, the $ 1.71- $ 1.72 trillion is the $ 1,72. ” Till these ranges are damaged on the highest time frames, he sees the market in a high-risk, high-reward perspective.

Associated lecture

Macro circumstances can faucet the scales. With CME FedWatch now the worth in a likelihood of 90%+ of an American rate of interest discount in September, and additional cutbacks for October and December, Kevin believes that the combo of enjoyable the financial coverage and technical outbreak buildings creates a “good recipe” for Altcoin’s outperformance. However, he warned that macro -shocks might derail the momentum and that merchants ought to place with withdrawal as a substitute of haunting resistance.

For now, Kevin is glad with recognizing a uncommon technical coordination that he has already written historical past. “The ETH Dominance Name, the ETH versus Bitcoin name that we did just a few months in the past, performed fantastically … I feel there shall be withdrawal, however generally we’re on the again of this bull market,” he mentioned. Whether or not that again burst half erupts in value discovery relies on one quantity: $ 4,850. Till that point, the once-a-decennium Stir sign from Ethereum loaded however not but fully unleashed.

On the time of the press, ETH traded at $ 4,624.

Featured picture made with dall.e, graph of tradingview.com

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now