Ethereum

Ethereum Funding Rates surge: Multi-month highs signal bullish sentiment

Credit : ambcrypto.com

- Ethereum’s funding price reached 0.03%, indicating bullish sentiment and rising market curiosity.

- The important thing ranges to observe are the USD 3,800 resistance and the USD 3,700 assist as momentum builds.

Ethereum funding charges have surged to a multi-month excessive, reaching ranges final seen in January 2024, when ETH rallied 88%. This improve displays rising bullish sentiment within the derivatives market, pushed by an increase in open curiosity and shifts in merchants’ positions.

The numbers point out potential upside momentum for Ethereum because the market eyes essential worth ranges.

Ethereum Funding Charges have reached a serious milestone

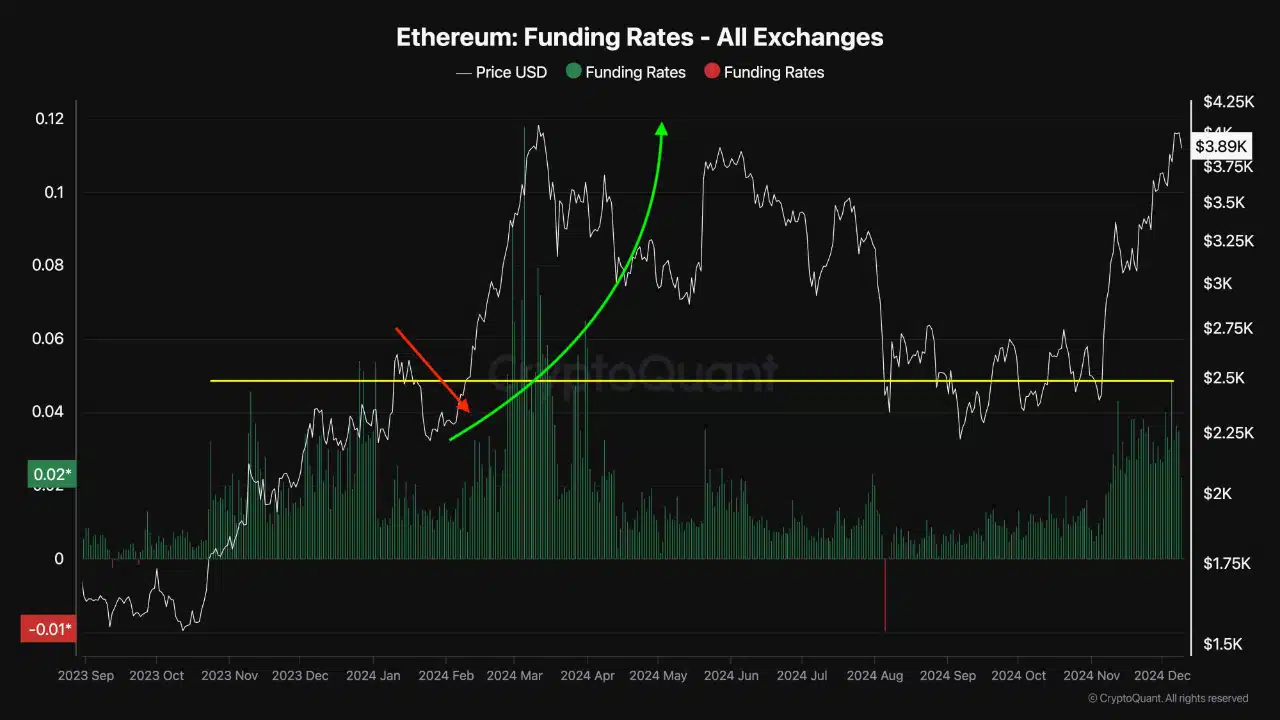

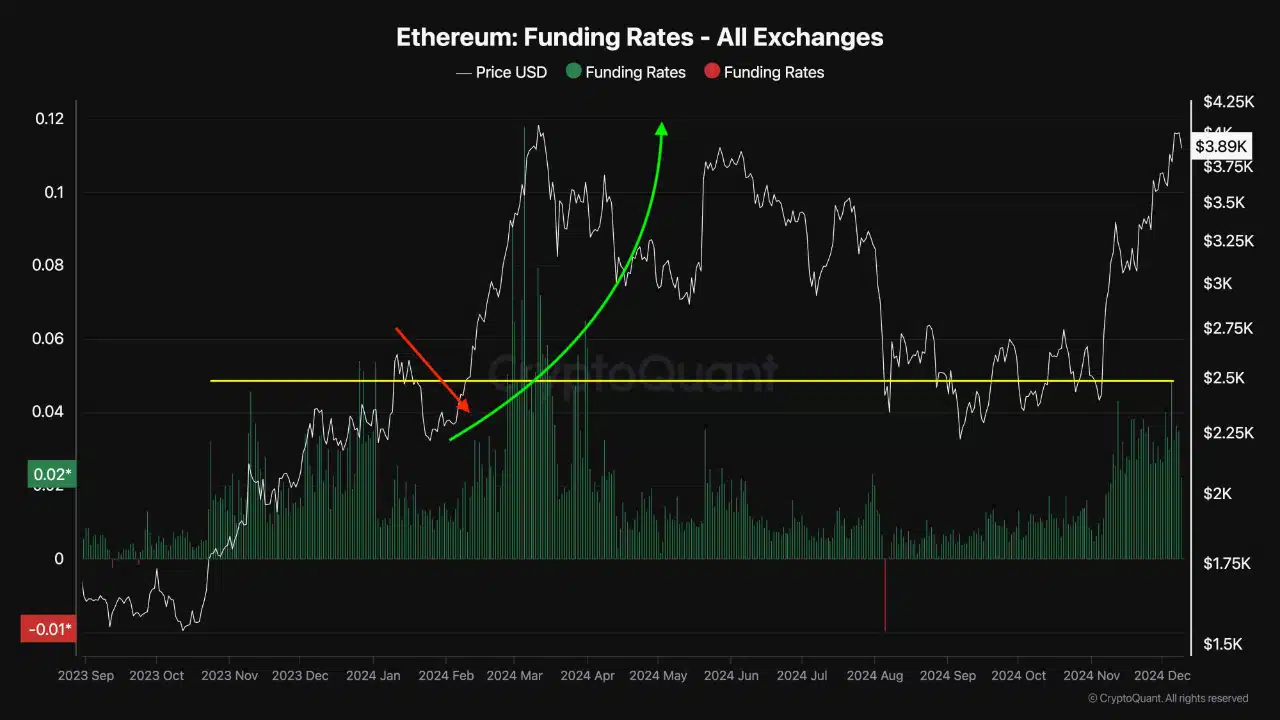

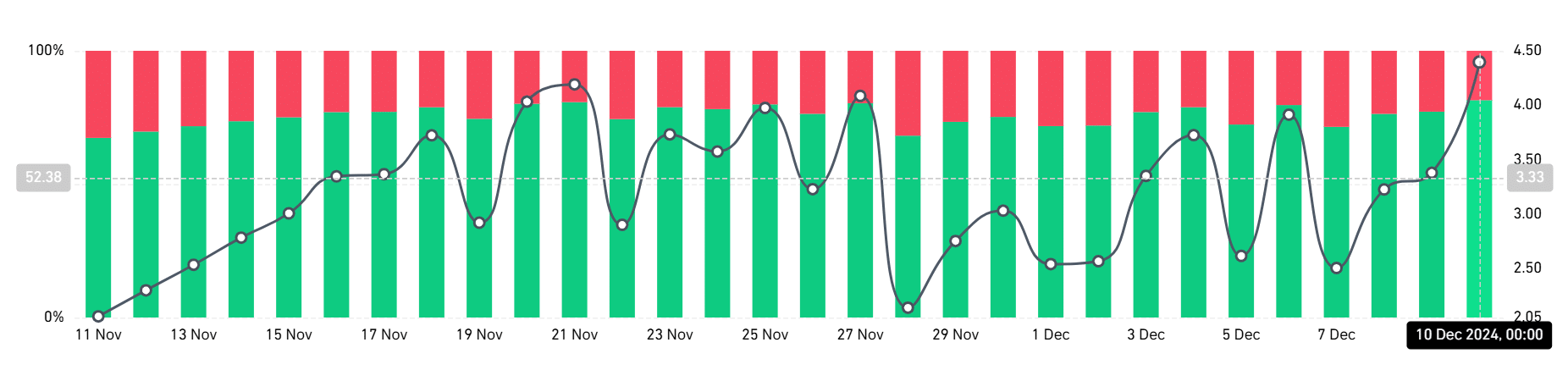

The Ethereum Funding Charges chart, per CryptoQuantexhibits a big improve to 0.03%, marking a pivotal second in market dynamics.

Excessive funding charges traditionally point out that merchants are leaning closely towards lengthy positions, reflecting expectations of additional worth progress. In January 2024, when funding charges reached related ranges, Ethereum started a pointy upward rally.

This funding price milestone might now herald renewed bullish traits if historic patterns maintain.

Supply: CryptoQuant

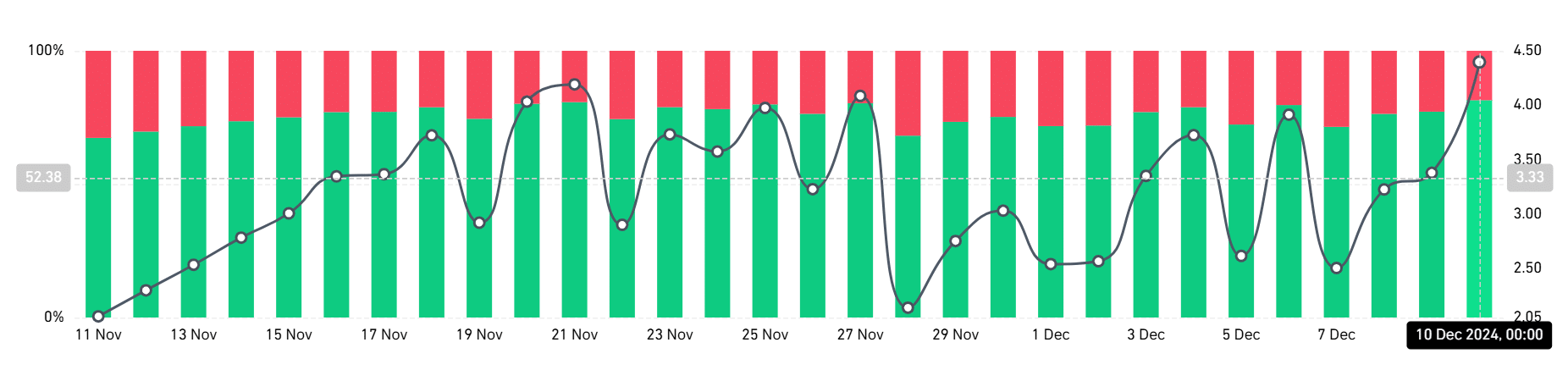

The lengthy/brief ratio exhibits a nuanced market sentiment

The lengthy/brief ratio, per Mint glasswas 0.9301% on the time of writing, with lengthy positions accounting for 48.18% and brief positions 51.81%.

Nevertheless, the evaluation of the variety of service provider accounts exhibits a stark distinction, with lengthy accounts at 81.47% and brief accounts at 18.53%, leading to a long-to-short account ratio of 4.40.

This disparity highlights a market the place fewer merchants are holding massive brief positions, whereas a big majority are betting on Ethereum’s long-term worth appreciation.

This imbalance might result in better volatility, as any substantial liquidation might set off sharp worth actions.

Supply: Coinglass

Open curiosity: rising market participation

Ethereum’s open curiosity rose to over $19.5 billion, reflecting elevated buying and selling exercise and rising investor curiosity in ETH derivatives. This regular improve in open curiosity, mixed with larger Ethereum Funding Charges, signifies sturdy capital inflows into the market.

Traditionally, such situations have preceded main worth strikes, and the present pattern means that Ethereum could also be poised for one more main rally.

Nevertheless, open curiosity has fallen considerably lately. The evaluation confirmed a decline to about $17.5 billion. Regardless of the decline, bullish sentiment stays excessive.

Momentum is constructing round key Ethereum ranges

Ethereum is buying and selling at $3,722.55 and sustaining constructive momentum. The each day chart displays a robust bullish construction, with key technical indicators aligning to assist additional progress.

The 50-day shifting common, presently $3,140, gives strong assist, whereas the 200-day shifting common of $3,003 confirms a long-term uptrend. The Relative Power Index (RSI) stands at 57.74, indicating reasonably bullish sentiment.

Supply: TradingView

Ethereum lately examined resistance round $3,800 however skilled promoting strain, resulting in a slight pullback. A profitable breakout above $3,800 might pave the best way for Ethereum to check the psychological barrier of $4,000.

On the draw back, quick assist is at $3,700, with stronger assist close to the 50-day shifting common.

Buying and selling volumes have additionally elevated because of open curiosity and Ethereum Funding Charges, indicating sturdy market participation and decreasing the prospect of false breakouts. This convergence of metrics strengthens the constructive case for Ethereum’s worth motion.

The rise in Ethereum Funding Charges, rising open curiosity and a nuanced lengthy/brief ratio replicate the market’s rising optimism about Ethereum’s future.

Learn Ethereum (ETH) worth forecast 2024-25

Whereas historic traits level to the potential for a big rally, merchants ought to contemplate the potential volatility attributable to overleveraged positions.

Ethereum’s capacity to interrupt above key resistance ranges will decide whether or not this bullish momentum could be sustained within the coming days.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now