Ethereum

Ethereum headed for short squeeze? What’s going on with ETH

Credit : ambcrypto.com

- ETH retreated beneath $2,600 after encountering sturdy resistance above $2,700.

- The pullback might be a lure that would set ETH up for a possible quick squeeze as leverage rises.

Ethereum [ETH] was on the third day of a bearish retracement after encountering resistance above $2700. Nonetheless, there may be hypothesis that the downturn might be short-lived.

A latest one CryptoQuant Analysis urged that ETH quick positions have risen above the $2,700 value degree.

This confirmed that many had been anticipating a retracement on account of earlier resistance at this value degree. Presently, promoting stress has overtaken demand, pushing the value to $2584 on the time of writing.

The evaluation warned that the rise in shorts and demand for leverage might expose ETH to a short-squeeze situation.

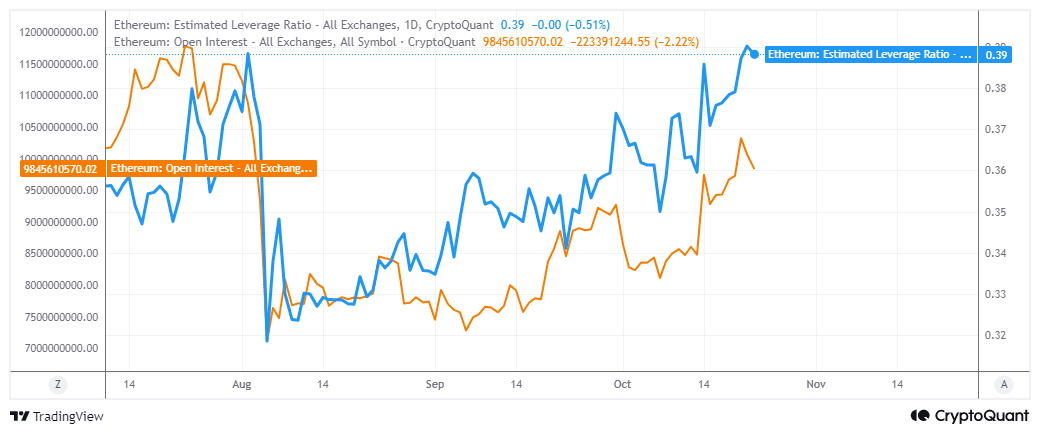

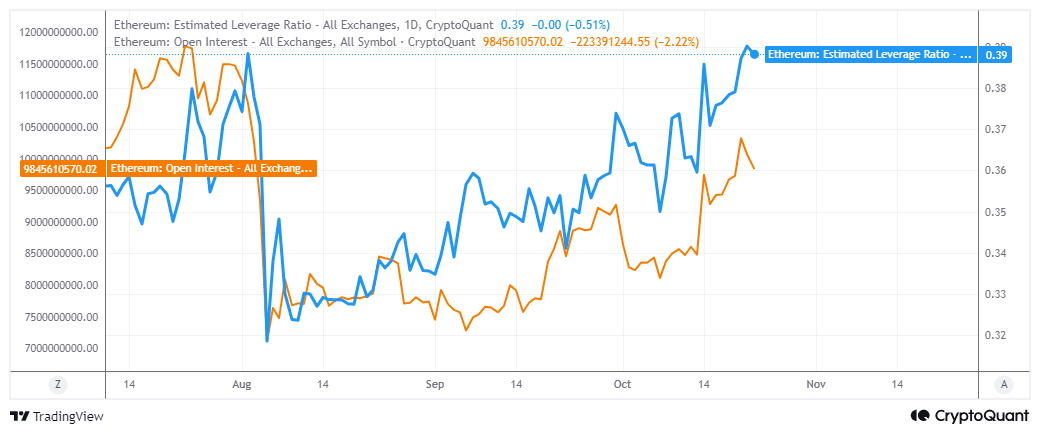

Ethereum’s open curiosity has elevated since September 6. This indicated a renewed curiosity within the derivatives phase.

Extra importantly, ETH’s estimated leverage ratio has lately risen to ranges final seen in early July.

Supply CryptoQuant

An increase in over-indebted quick positions might underline fertile floor for whales to shake issues up by driving up costs. However what are the probabilities of this occurring?

Assessing ETH Demand to Set up a Brief Squeeze

The most important signal {that a} quick squeeze might be coming was if the whales began to rally aggressively.

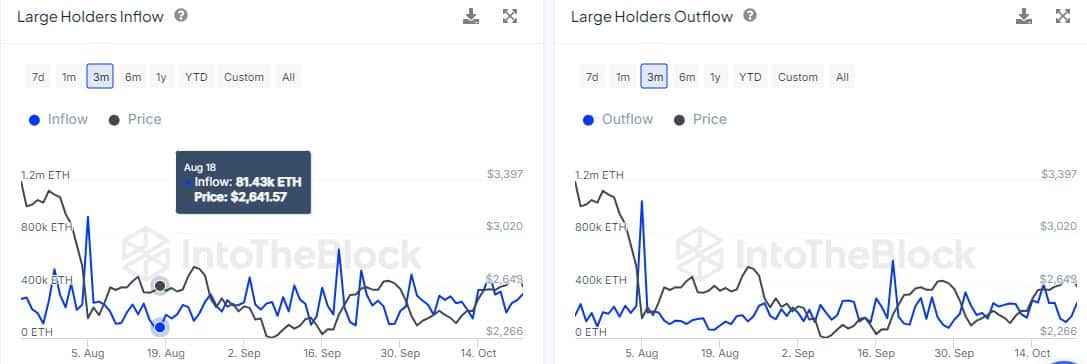

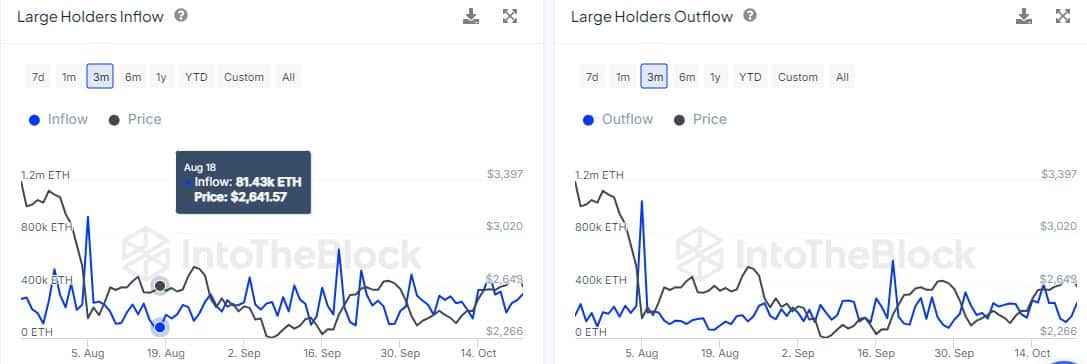

In line with statistics from IntoTheBlock, ETH circulate to main holder addresses grew from 194,280 cash on October 19 to 335,870 cash on October 22.

This confirmed that enormous holders have gathered extra ETH as costs fell.

Supply: IntoTheBlock

Alternatively, giant holder outflows grew from 122,380 ETH on October 20 to 267,180 ETH on October 22.

This meant that the quantity of Ethereum offered was barely larger than the web purchases, which is in keeping with the bearish value motion throughout the identical interval.

Though bears dominated, giant holders purchased extra cash than they offered. Within the final 24 hours, they bought 68,690 ETH, value over $177 million.

The info means that an try by the whales to push the value again up might already be in play.

Learn Ethereum’s [ETH] Worth forecast 2024-25

This implies the coin might be poised for an attention-grabbing second half of the week, probably marked by one other rally and an try to interrupt previous the most recent resistance zone.

Ethereum has been liable to risky circumstances, and the extent of Open Curiosity and want for leverage have elevated.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024