Ethereum

Ethereum – Here’s why $1.6K could be the altcoin’s next price target

Credit : ambcrypto.com

- Ethereum appeared to have a Bearish market construction on a number of timetables

- Bears didn’t delay their sale and ETH may fall to $ 1.6k then

Ethereum [ETH] has fallen by 11.8% up to now week, with a technical evaluation that reveals that blackbird bears aren’t weakened. ETH Whale transfers to exchanges even underline the Bearish market sentiment.

On the time of writing, Eth Bulls swam in opposition to the tide and the prospect of additional losses would grew extra probably.

Ethereum sinks underneath the help of the start of March

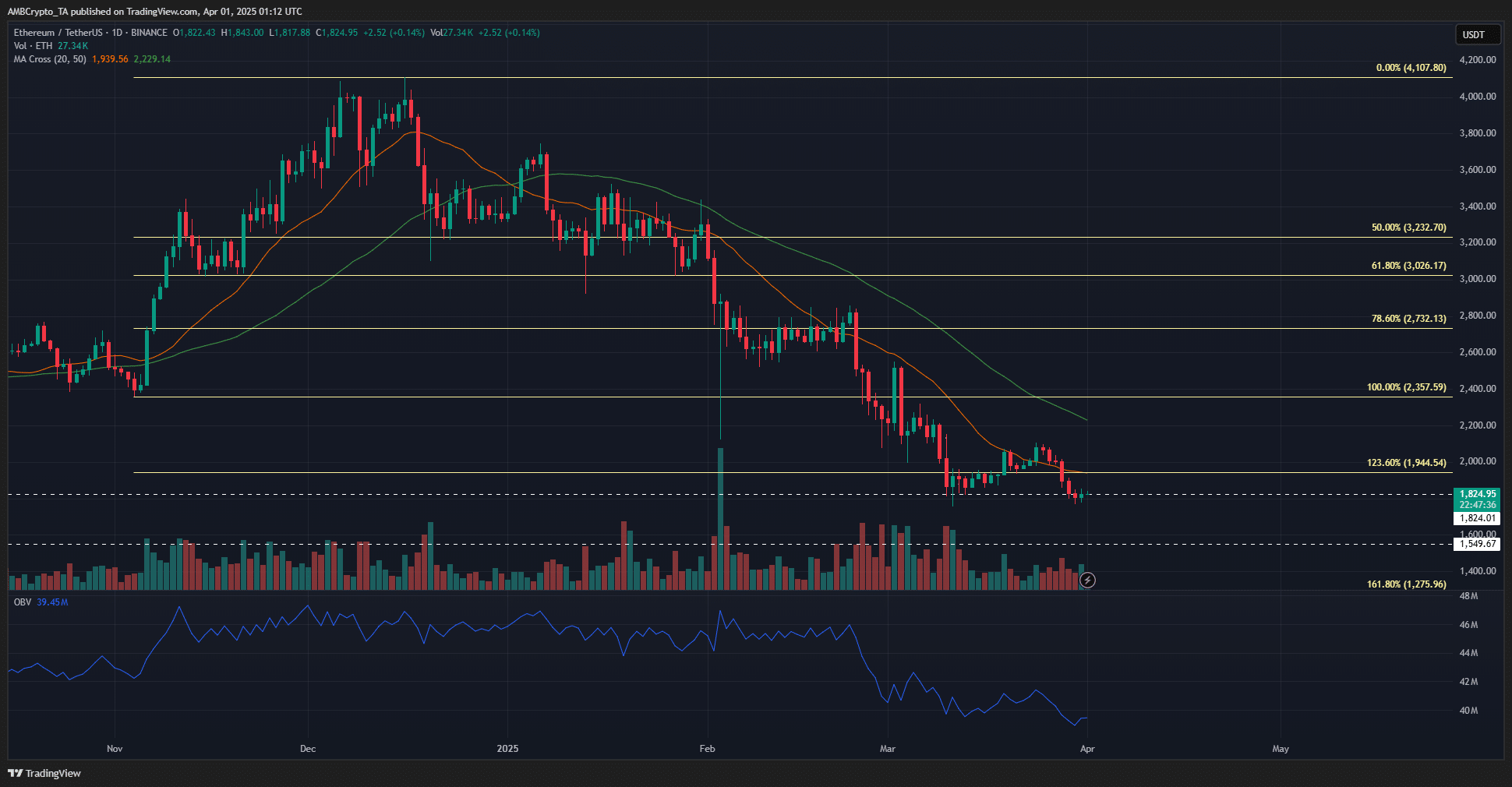

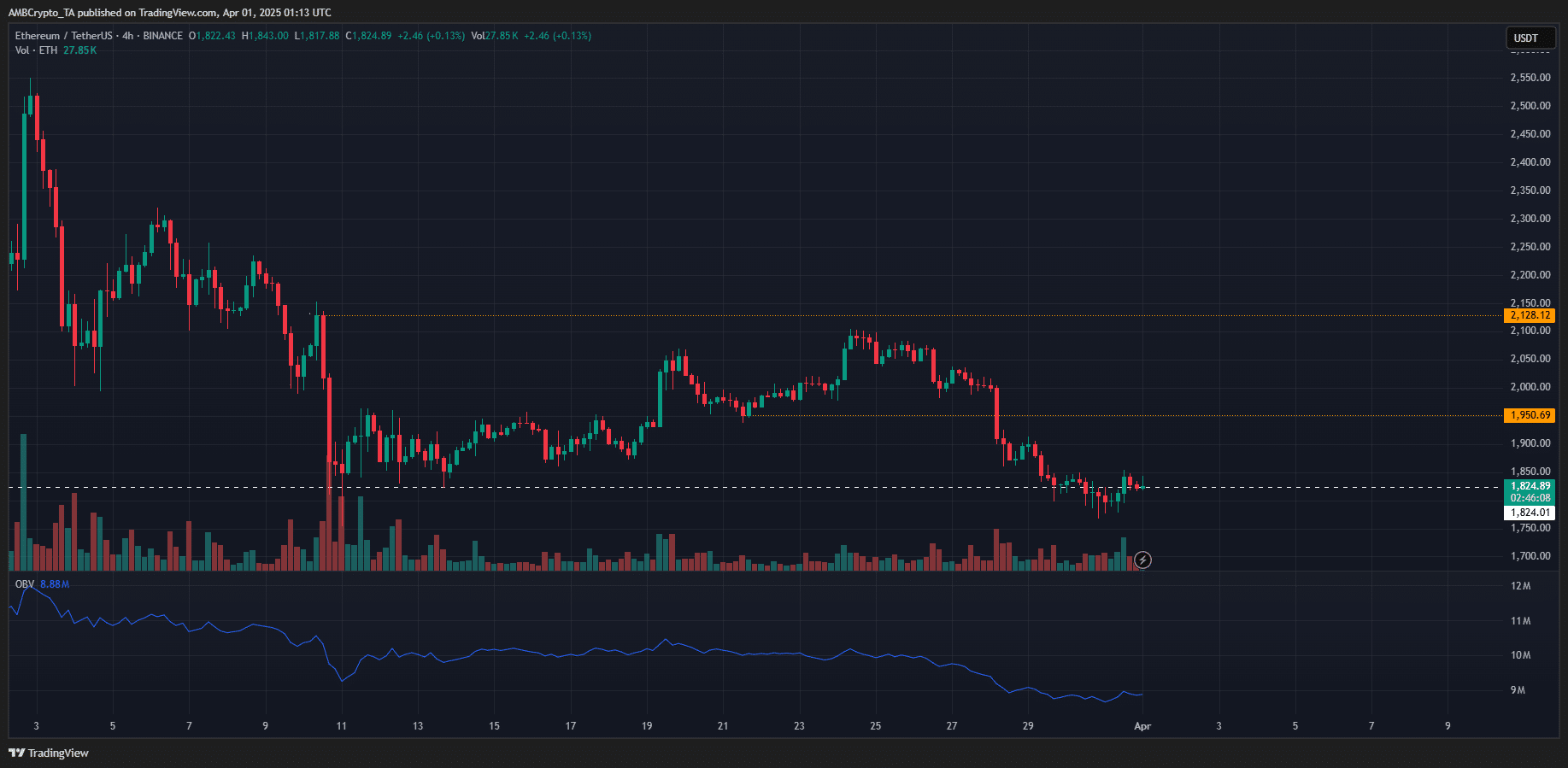

Supply: ETH/USDT on TradingView

Ethereum had a robust bearish have a look at the timeframe of 1 days. It was once more underneath the 20-day advancing common and was nearly all of 2025. The progressive averages additionally confirmed that the bearish Momentum didn’t delay both.

Nor does the gross sales stress handy when ETH fell under the $ 2,000-psychological stage. The OBV made decrease highlights and decrease lows and made a brand new decrease layer on 30 March. This meant a in progress in progress on the OBV and a gradual gross sales stress on Ethereum.

The help ranges of $ 1,824 and $ 1,550 from October-November 2023 could be the next worth targets for ETH. As a result of it closed a 1-day commerce session underneath $ 1,824, the bears would in all probability have management of the area.

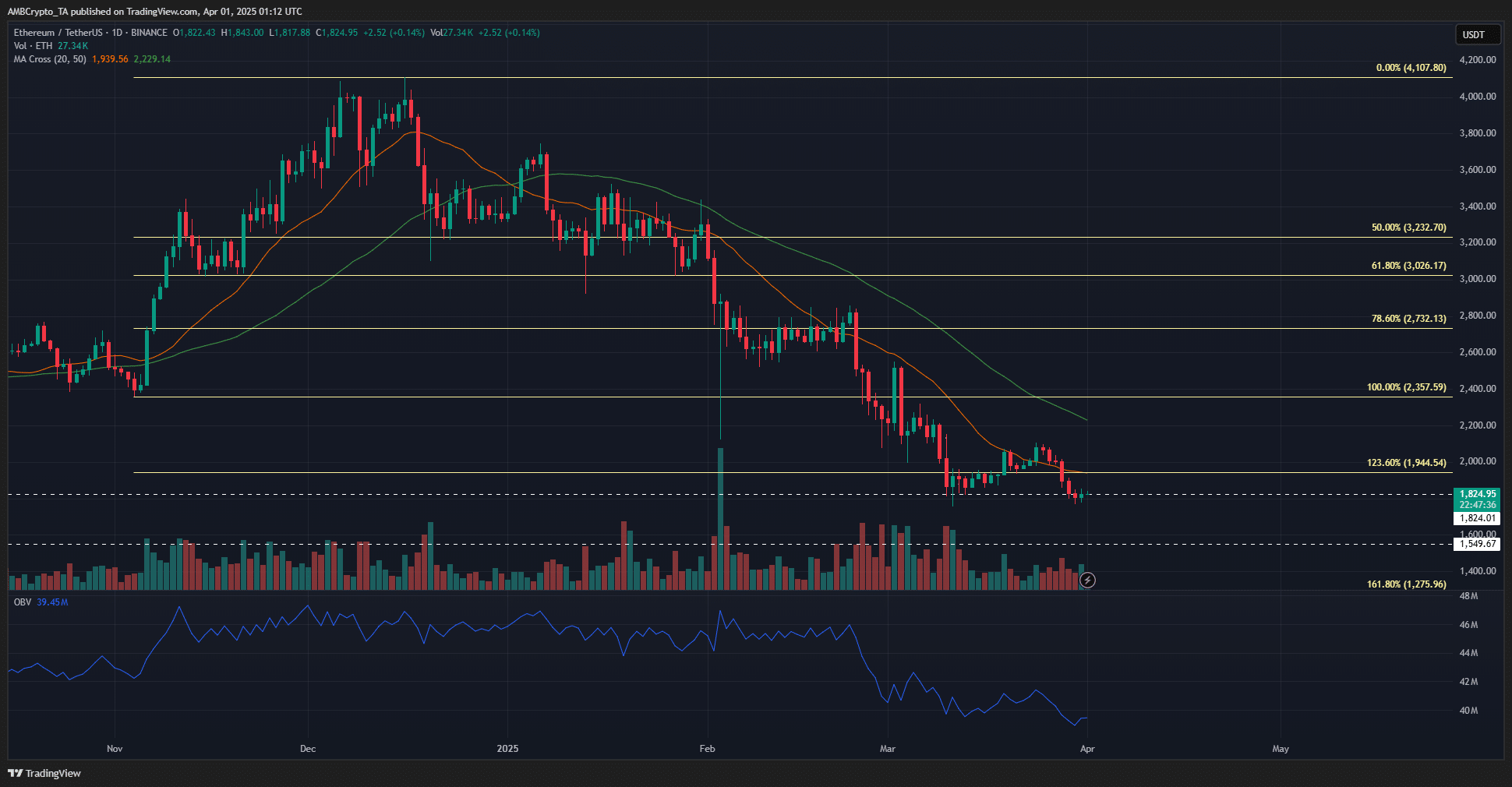

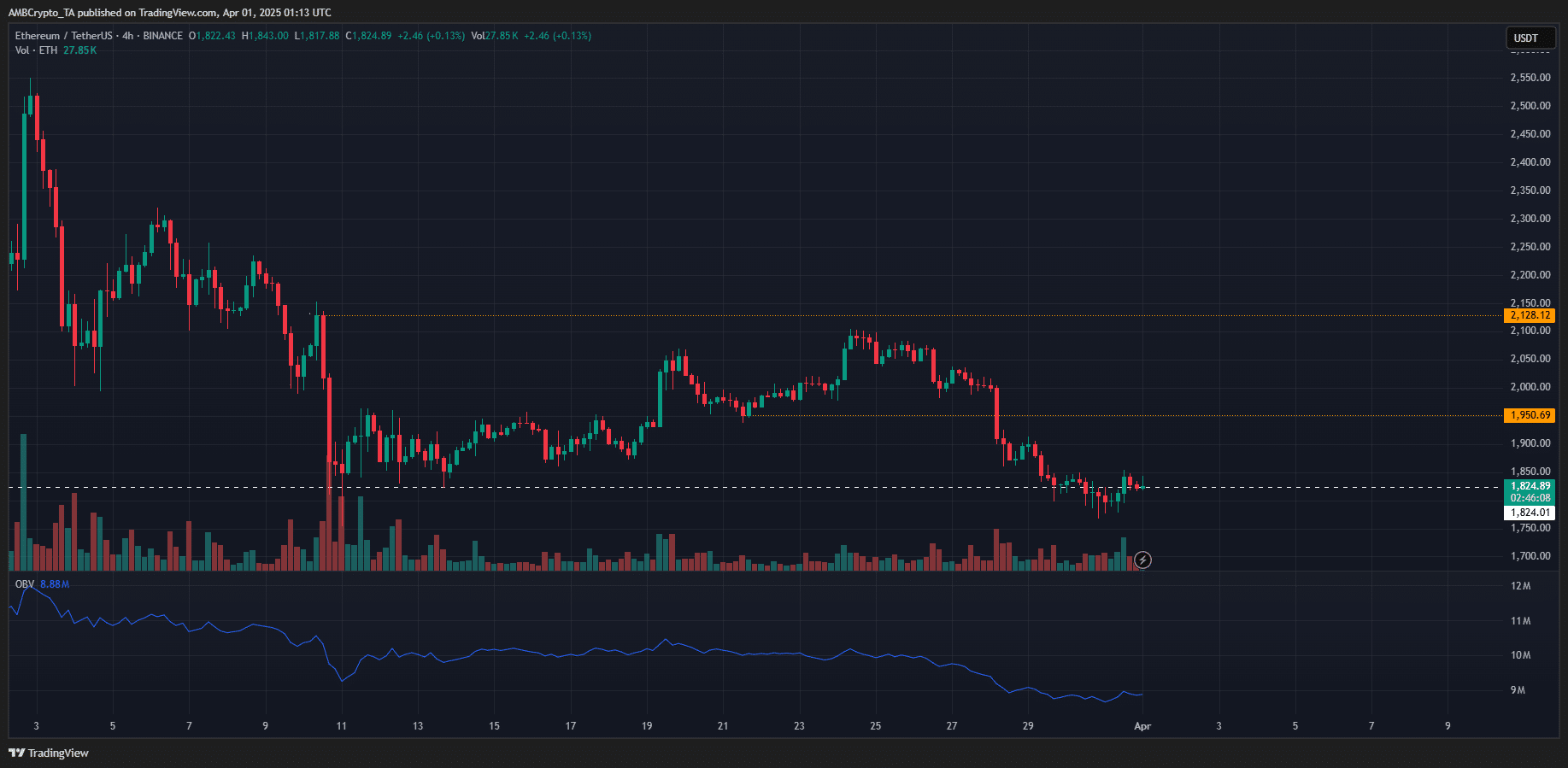

Supply: ETH/USDT on TradingView

The 4-hour graph confirmed that the $ 1,850 zone, which served as help in mid-March, is now appearing as a resistance. The market construction additionally appeared to be Bearish. The rally to $ 2,128 didn’t attain its objective, however returned to $ 2,100. The $ 1,950 larger layer was additionally not defended.

The OBV continued, because it did on the 1-day graph, his secure falling pattern. That’s the reason the value motion on the each day and 4 -hour graphs pointed to additional losses for the main Altcoin.

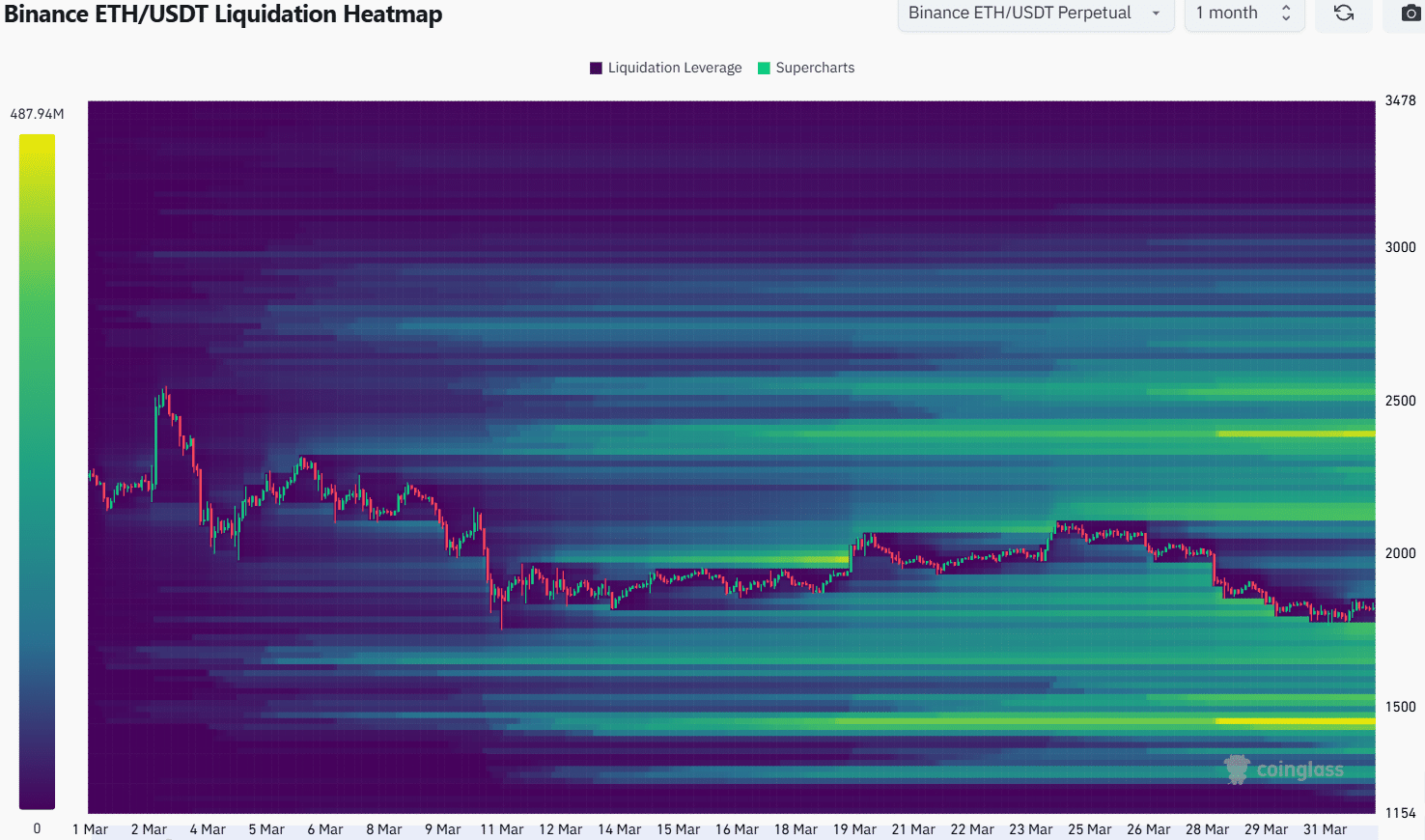

The liquidation warmth tamap sketched $ 2,150 as a magnetic zone that would entice costs larger. On the similar time, the $ 1,760- $ 1,640 space was created as a liquidity pocket a lot nearer to the value. This meant that Ethereum will in all probability fall decrease to $ 1.6k within the coming days.

Given the value promotion and market sentiment, extra losses can in all probability be within the quick time period. The lengthy -term downward pattern has not stopped both.

Disclaimer: The offered info doesn’t kind monetary, investments, commerce or different kinds of recommendation and is barely the opinion of the author

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024