Ethereum

Ethereum hits $5.2K realized price band: New rally for ETH?

Credit : ambcrypto.com

- Ethereum’s realized value cap at $5.2K displays the extent of the 2021 bull market peak, elevating breakout expectations

- Rising forex inflows and elevated exercise point out the opportunity of profit-taking.

Ethereum [ETH] is teetering on the sting of a serious breakout, with the realized value higher sure reaching $5.2K – mirroring ranges final seen through the 2021 bull market peak.

On-chain metrics confirmed robust demand, fueling hopes of a rally above $5,000.

However as market dynamics evolve, traders proceed to marvel: Is Ethereum able to regain its former glory, or are circumstances orchestrating a elementary shift in its trajectory?

How the realized value will influence this present cycle

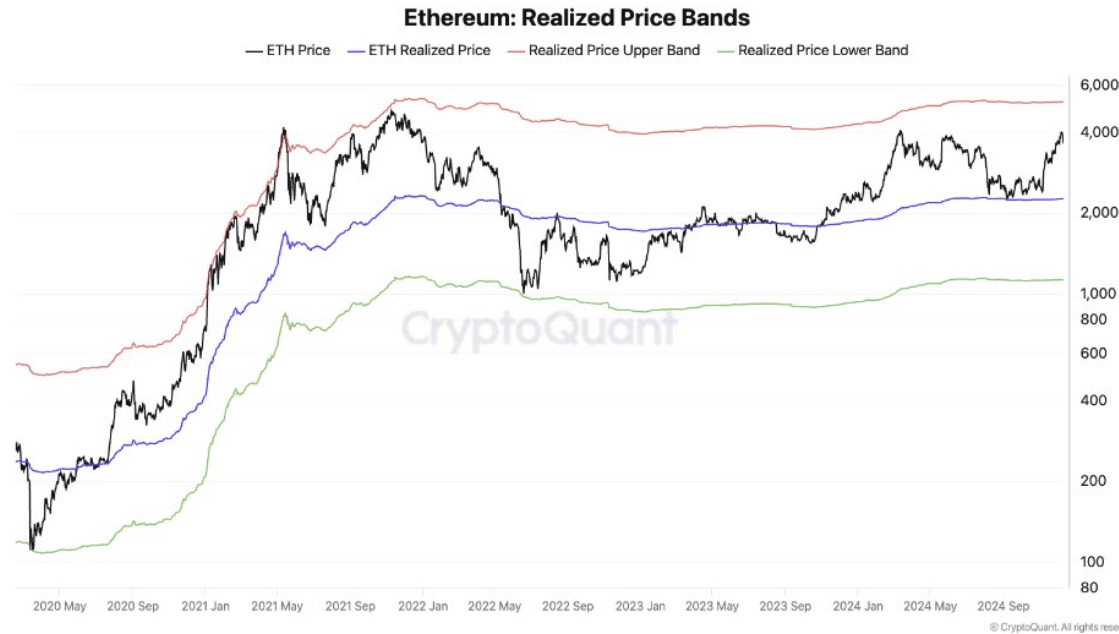

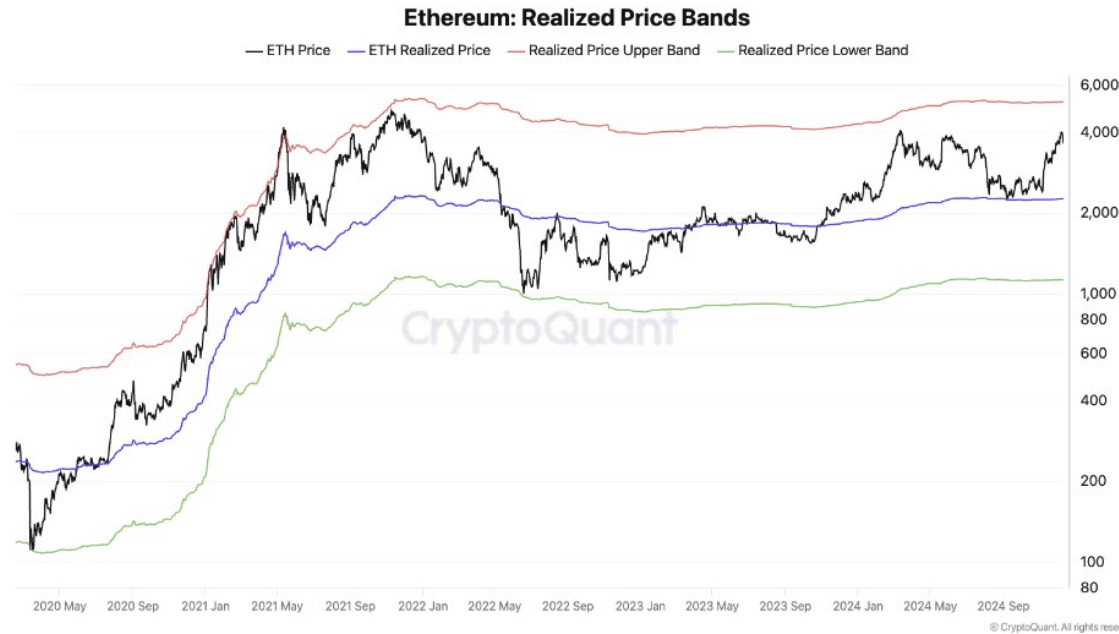

Supply: CryptoQuant

Ethereum’s realized value cap, which stood at $5.2K on the time of writing, is a crucial indicator for understanding potential market actions.

This metric, which tracks the typical value at which every unit of ETH final moved, performs an important position in figuring out market developments.

In line with AMBCrypto’s have a look at CryptoQuant knowledge, the present value alignment displays the height of the 2021 bull run, when the realized value higher band coincided with a speedy enhance.

Traditionally, these increased band ranges point out overheated circumstances or robust bullish momentum, which has usually preceded vital value actions.

Revenue taking first?

Supply: TradingView

The market is displaying combined alerts. The energetic addresses chart exhibits a 10-15% enhance in person engagement over the previous week, indicating elevated community exercise and investor participation.

On the identical time, buying and selling volumes have elevated by virtually 20%, as a consequence of elevated liquidity and buying and selling momentum.

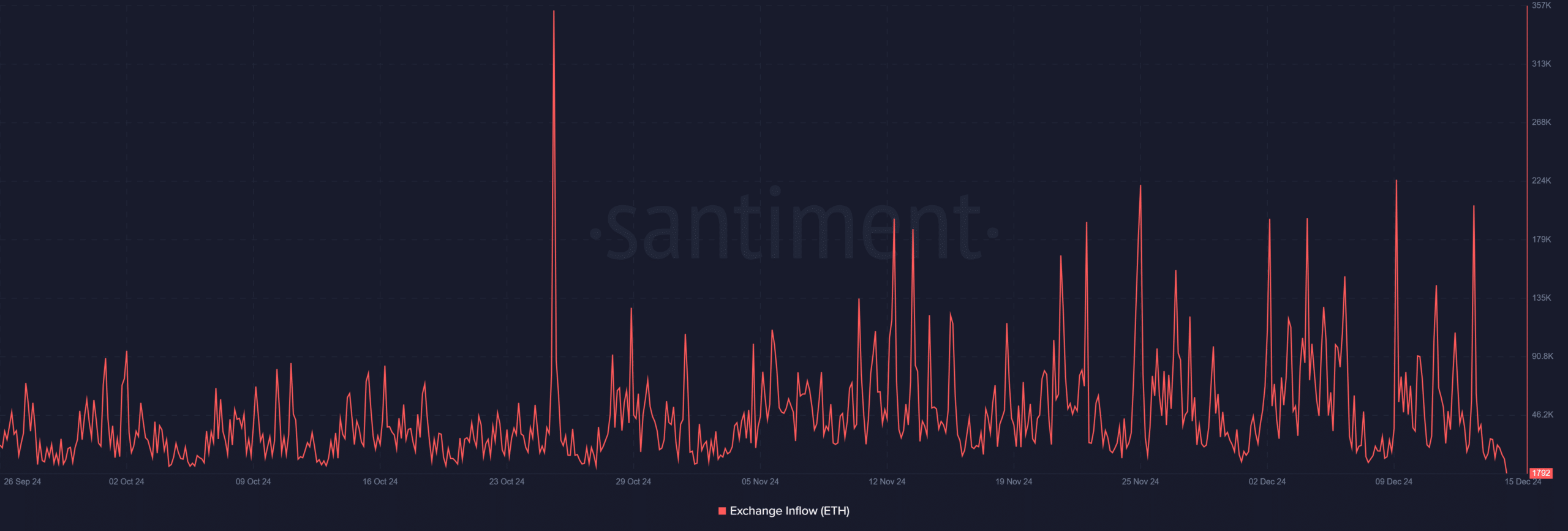

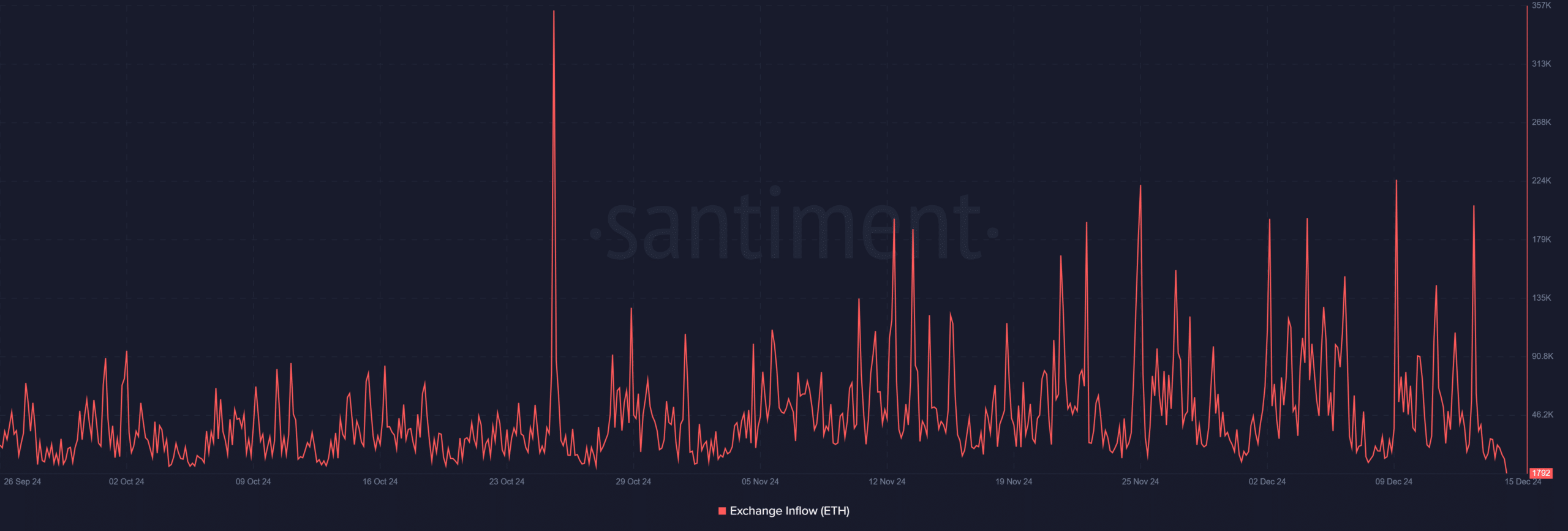

Nevertheless, the spike in forex inflows, which have elevated by 25%, raises issues about doable profit-taking habits.

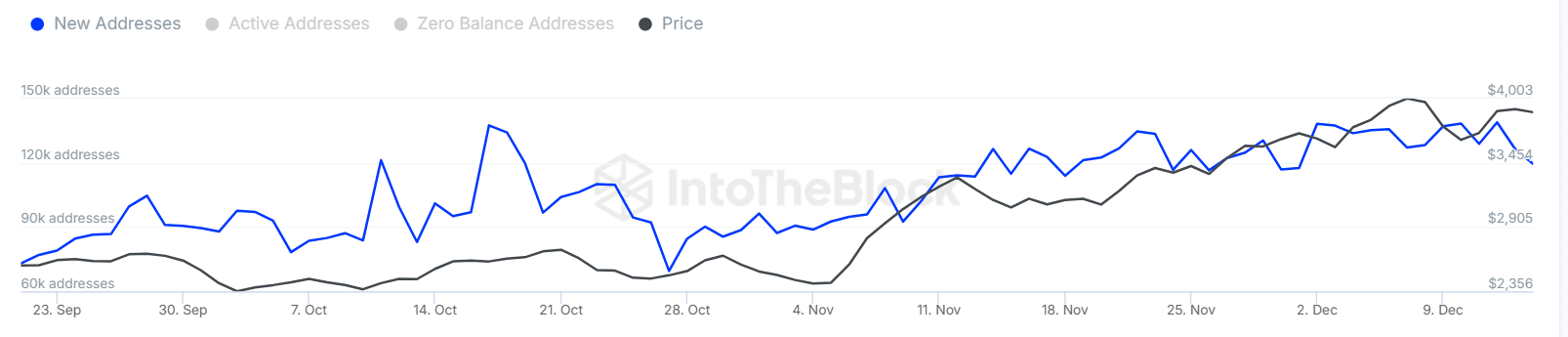

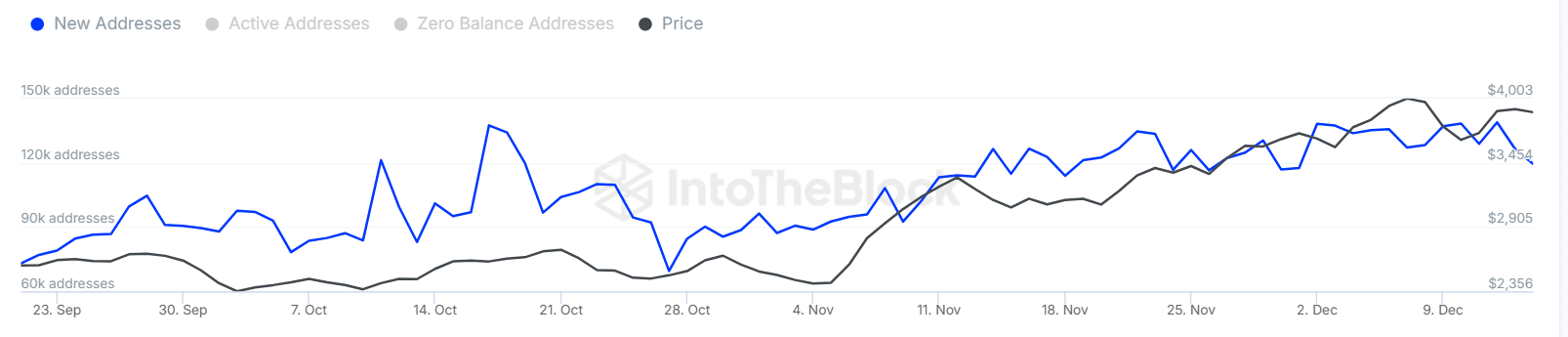

Supply: IntoTheBlock

Traditionally, such spikes in inflows point out that traders can place belongings for a sell-off, particularly when accompanied by rising exercise.

This sample is according to earlier market tops, the place elevated engagement coincided with short-term corrections.

Supply: Santiment

The info factors to a fragile steadiness: whereas robust participation and buying and selling volumes point out optimism, inflows point out warning. If influx continues, look ahead to doable downforce.

Whether or not the market consolidates or faces a correction will rely on the value resilience of the approaching periods and broader sentiment shifts.

Market sentiment and the best way ahead

Latest knowledge exhibits a shift in sentiment as Ethereum approaches an important stage. The rise in new addresses is offset by growing forex inflows, suggesting traders could also be benefiting from the features.

Learn Ethereum’s [ETH] Value forecast 2024-25

With value volatility growing, a deeper correction might observe as market contributors start to exit positions at these elevated ranges.

As Ethereum faces vital technical resistance, understanding whether or not this rise is a sustained rally or a ultimate push for a much bigger pullback will likely be crucial to gauging market stability.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024