Ethereum

Ethereum Holds Key Support Amid Volatility – Can Bulls Break $2.3K To Regain Momentum?

Credit : www.newsbtc.com

Cause to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by consultants from the business and thoroughly assessed

The very best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Up to now month, Ethereum (ETH) has confronted with mass gross sales strain and volatility whereas the crypto market traits push down, inflicting ETH to push to essential demand ranges. With uncertainty that the market engages, analysts count on much more volatility when merchants reply to main developments within the crypto house.

Associated lecture

Based on Crypto van het Witte Huis and Ai Tsar David Sacks, President Donald Trump signed an govt order on Thursday to arrange a strategic Bitcoin reserve. This surprising step has led to renewed hypothesis about how the federal government’s involvement in crypto can affect broader market traits.

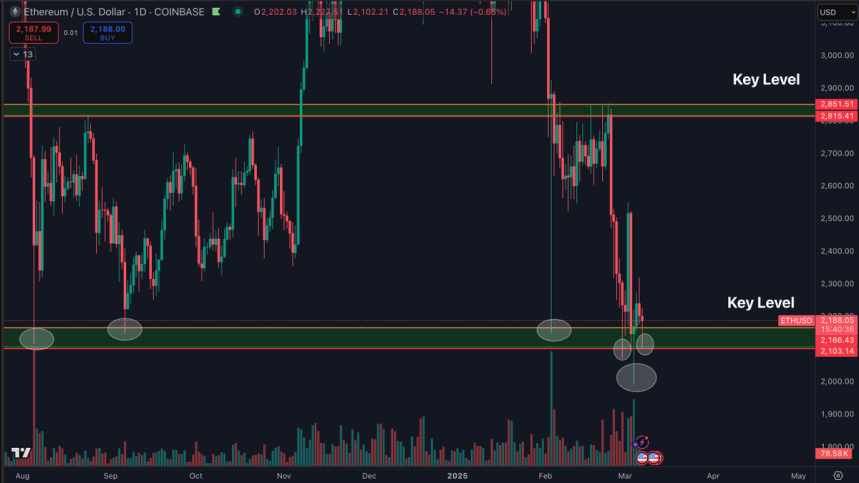

Regardless of the chaos, Ethereum has succeeded in sustaining an important assist zone of $ 2,000 $ 2,100, an important stage that intently displays merchants. High analyst Daan shared insights about X, with the emphasis on that ETH has defended this excessive stage of demand to this point, regardless of the acute volatility.

The following few commerce classes will probably be essential, with Ethereum floating close to a essential value vary. If ETH can preserve assist and recuperate Momentum, a reversal may be on the horizon. Nonetheless, not sustaining these ranges may cause a unique sale of the wave of gross sales, in order that the present market correction is deepened.

Ethereum stands for an important take a look at

The market enters a essential second. The value of Ethereum has misplaced greater than 50% of its worth for the reason that finish of December, inflicting mass anxiousness and panic. The steep decline has many buyers ask if the long-awaited alto season will even occur this 12 months, as a result of Ethereum and most Altcoins have issue profitable Bullish Momentum.

As a result of ETH has not established a powerful upward pattern, analysts stay divided on whether or not a restoration is feasible within the brief time period. Some consider that the present value promotion signifies a deeper weak spot, which means that Ethereum might stand additional down earlier than he sees a significant reversal. Nonetheless, others see potential for a rebound, particularly as a result of ETH continues to maintain an important demand zones.

Daan’s technical analysis on X It factors out that Ethereum has succeeded in conserving a essential query as an excellent signal within the midst of latest market dynamics. This assist, round $ 2,000, has been examined a number of occasions and stays an important space for bulls to defend.

Daan additionally famous that Ethereum has fashioned a better low low decrease schedules, which signifies a potential reversal when the momentum builds. He emphasised that for ETH to regain the bullish construction, it should break it above $ 2,300 and fill the inefficiency that has been left behind from the complete withdrawal from Monday. A decisive motion above this stage might verify the energy and will activate a push within the route of upper value objectives.

Associated lecture

Though the prospects of Ethereum stay unsure, the power to retain necessary ranges suggests {that a} restoration remains to be potential. The following couple of commerce classes will probably be essential to find out whether or not ETH Bullish Momentum can recuperate or battle within the midst of a wider market weak spot.

ETH -price promotion: Technical ranges

Ethereum has entered into an intense part during which uncertainty dominates the worth motion and hypothesis stimulates market sentiment. With merchants searching for route, ETH is at the moment being traded at $ 2,200, with an necessary assist above $ 2,000. Nonetheless, this stage stays fragile and bulls should proceed to defend it to forestall additional drawback.

To verify Ethereum a restoration rally, it has to push $ 2,500, recovering misplaced soil and shifting momentum in favor of consumers. A motion above this stage would point out a renewed energy, making ETH potential for a powerful rebound. Nonetheless, till Bulls break past the resistance ranges, ETH stays in a dangerous zone the place volatility can stimulate value fluctuations in each instructions.

The $ 2,000 assist zone stays an important think about figuring out the destiny of Ethereum for the approaching 12 months. If ETH possesses this stage, it might function a foundation for lengthy -term progress. Nonetheless, if it breaks down, the gross sales strain can intensify, which ends up in a protracted -term bearish pattern.

Associated lecture

Now that Ethereum is buying and selling at an important second, within the coming weeks will probably be essential in shaping its market trajectory. Whether or not ETH sees an outbreak or one other decline depends upon how effectively bulls can defend necessary assist zones.

Featured picture of Dall-E, graph of TradingView

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024