Altcoin

Ethereum – How ‘strong’ sellers can limit the benefit of ETH in the charts

Credit : ambcrypto.com

- The consolidation of Ethereum round $ 2.6k in February supplied some hope for restoration

- On-chain statistics revealed that the sellers of the Altcoin are usually not but exhausted

The Bybit -Hack noticed $ 1.46 billion in Ethereum [ETH] transferred from a chilly pockets. The trade noticed an unprecedented quantity of recordings, but it surely was in a position to course of them easily. On the time of writing, ETH had fallen by 2.64% within the final 24 hours.

Supply: X

Crypto analyst Rough -free famous a sample that in a single Post on X. The vary of Q1 2024 nonetheless gave the impression to be within the sport and the current occasions prompted a deviation from the lows. That is additionally a spot the place accumulation passed off from July-October 2024, earlier than the quick rally in November.

A comparability with Bitcoin [BTC] Making a cycle of lows on the again of Black Swan occasions corresponding to Covid or the FTX -Crash was additionally made. This implied that ETH might additionally make such lows. Nevertheless, is that this too good to be true?

Statistics confirmed that Ethereum has room to decrease

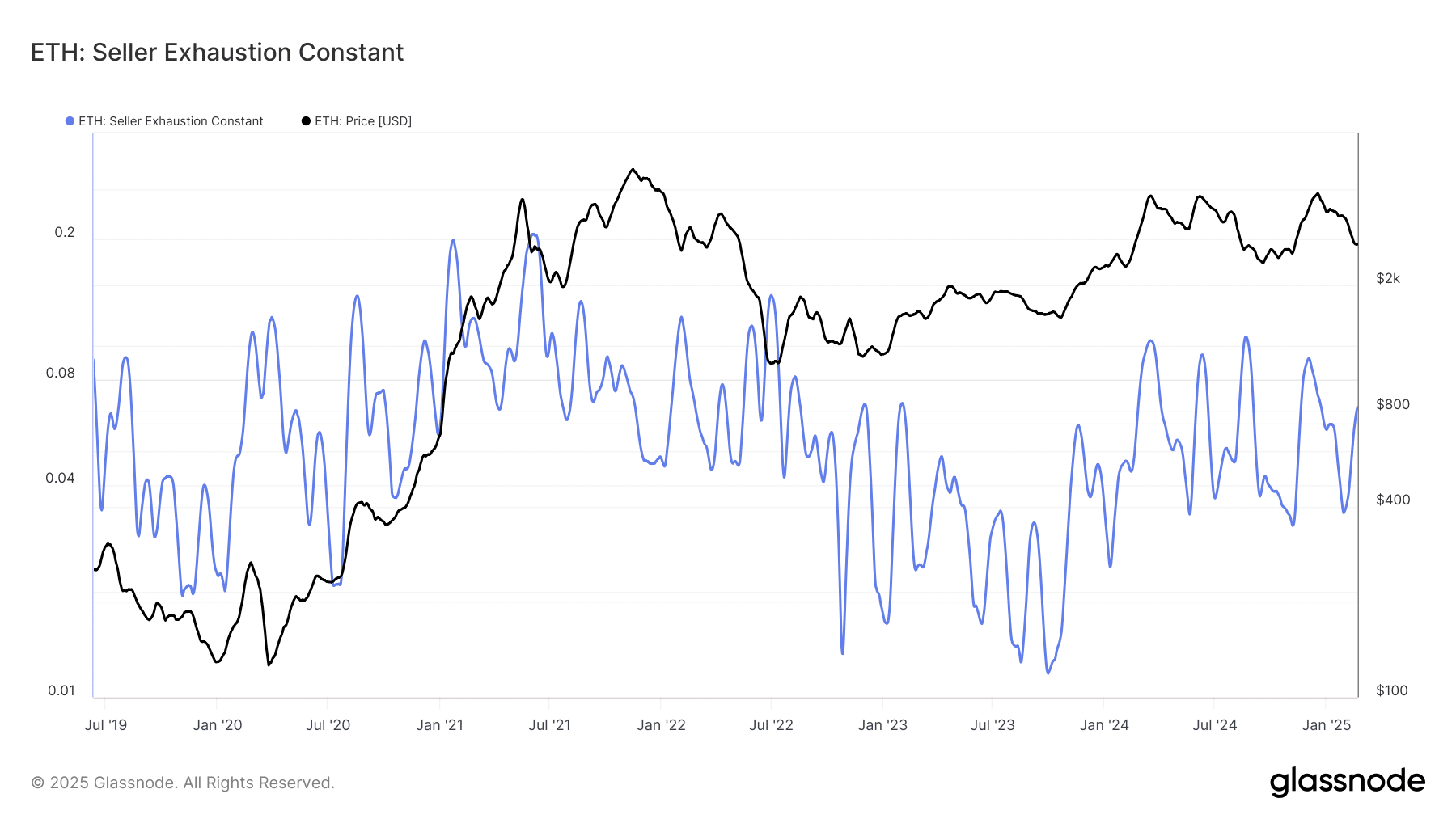

Vendor depleting statistics is a product of the share of revenue authority and the 30-day worth volatility. Volatility has been excessive in current weeks, whereas the revenue proportion has fallen.

This acknowledged the rise in exhausting statistics. It’s used to mark worth soils with a low threat when a considerable a part of the provide just isn’t in revenue and the value is below consolidation. Nevertheless, the prevailing market situations don’t replicate that, no less than not on the upper timetables.

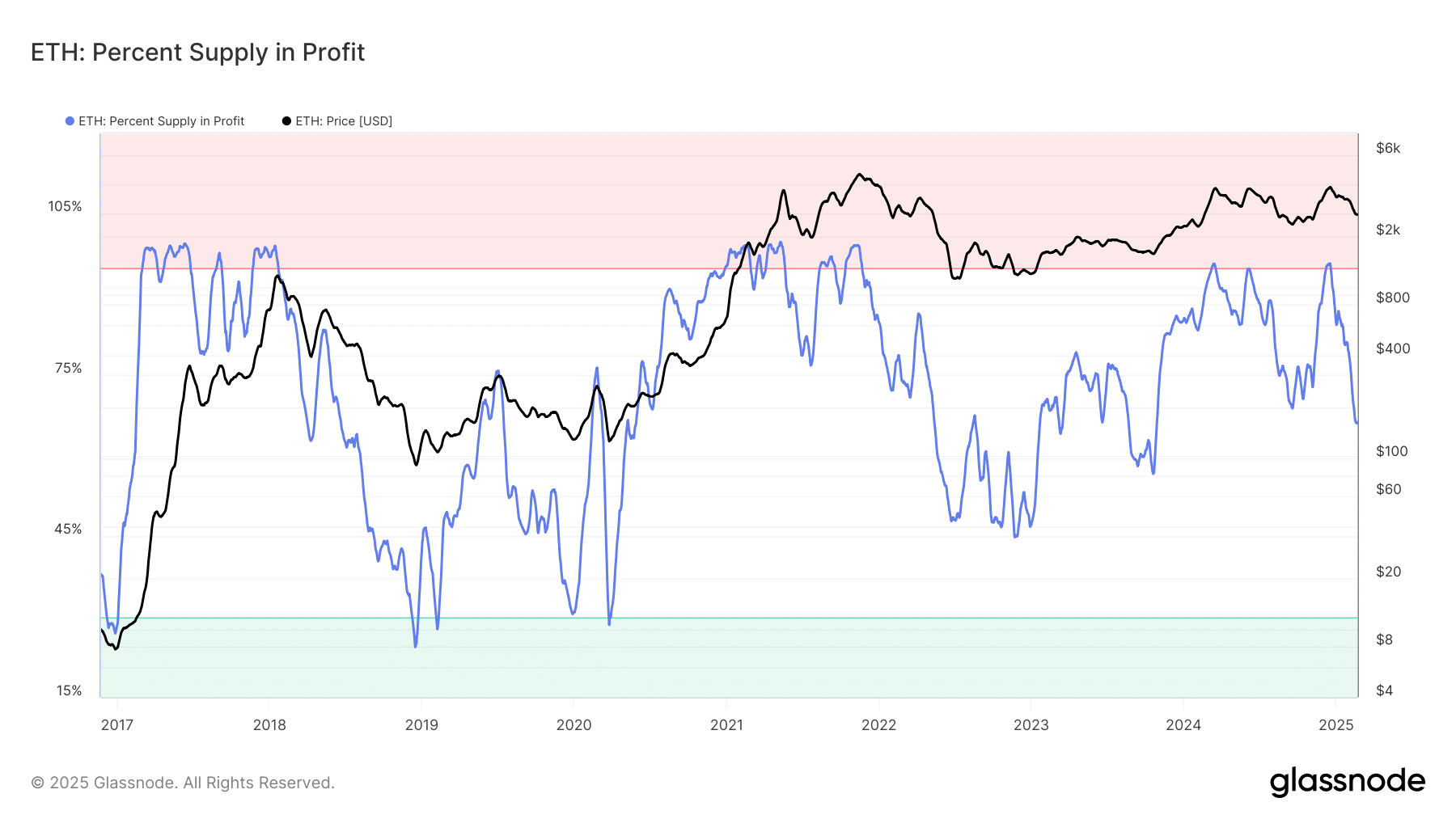

The proportion of revenue revenue has fallen because the worth was confronted with a rejection of $ 4K in December.

On the time of the press, the metric was decrease than at any time since October 2023. The weak achievements, whereas Bitcoin was traded close to $ 100k, has been a supply of frustration for holders.

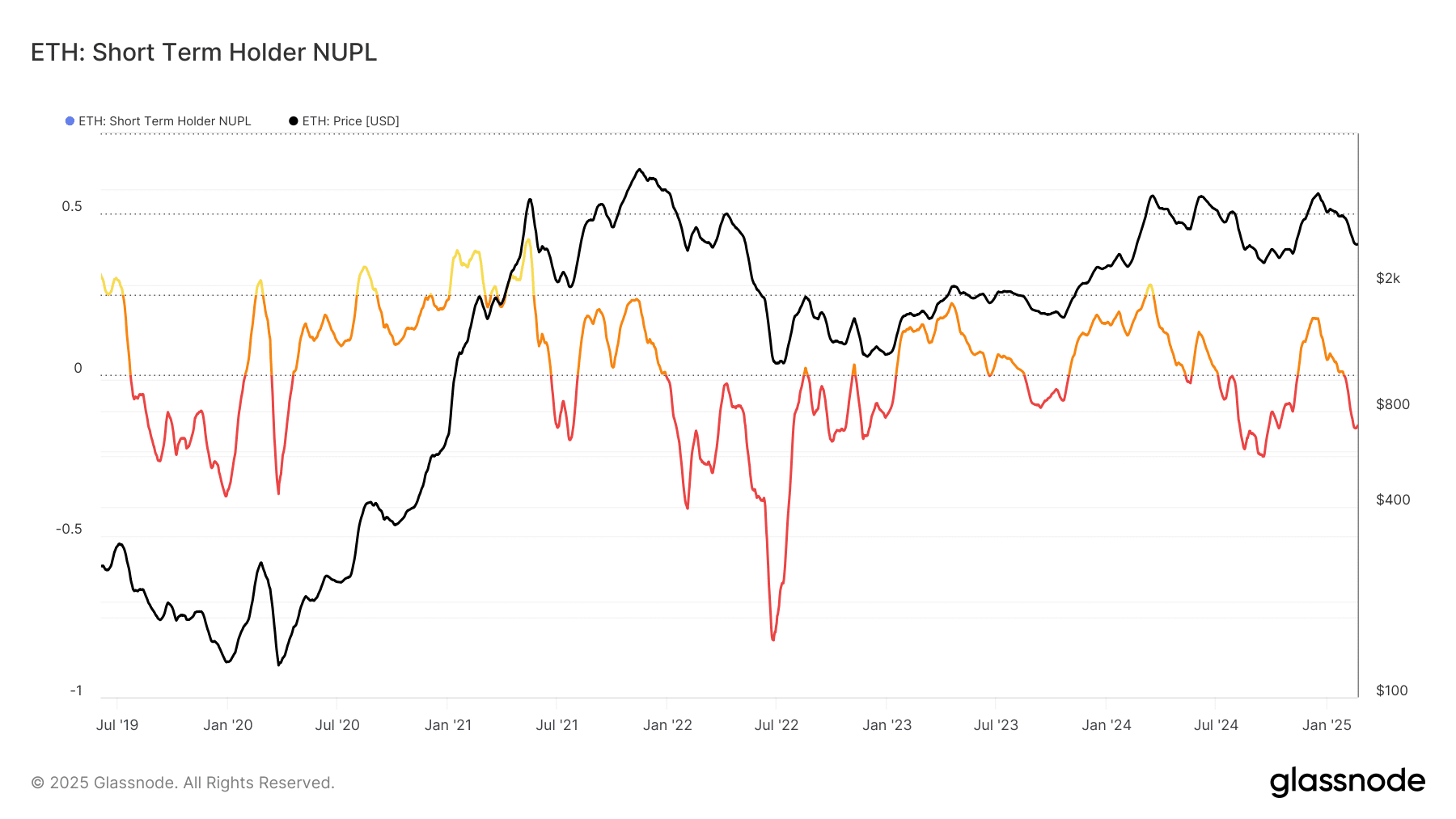

The short-term holder (STH) Web Non-Realized Revenue/Loss (NUPL) takes into consideration transactions youthful than 155 days. Values beneath 0 point out that STH’s are losses and on the time of the press was the metric at -0.164.

Mixed with the beforehand marked vary, it turned out that this may very well be an excellent shopping for for ETH. And but the NUPL just isn’t robotically the native soils.

In January 2022, for instance, the STH NUPL was at -0.018 and fell to -0.4 in February. After a number of weeks of worth consolidation across the $ 3K stage, Ethereum fell in June 2022 to $ 1.1k-Die de Nupl drove deeper.

Though this was an excessive case, it revealed that the statistics must be used contextually. By combining the value motion with the statistics that has been investigated up to now, we are able to see that there’s a likelihood that the ETH worth will fall to $ 2.1k.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024