Ethereum

Ethereum ICO address shifts 3,000 ETH – Is a repeat of July 24 on the way?

Credit : ambcrypto.com

- Ethereum whale, which can have signaled the July draw back, has began promoting in bulk once more

- It’s value assessing the potential of a help bounce being canceled

What occurs if a whale begins offloading among the ETH it already obtained within the Ethereum ICO section? The sort of situation not too long ago performed out, based on Lookonchain. And it may possibly have vital penalties.

New findings point out {that a} whale that participated within the Ethereum ICO simply unloaded 3,000 ETH. Lookonchains analysis revealed that the identical whale tackle beforehand bought 7,000 ETH in early July this 12 months. Why is that this necessary? Effectively, it might underline some correlation with the altcoin’s worth motion.

Following the July sell-off, an ETH worth drop of 15% occurred, suggesting that information of such a big sell-off might be seen as a promoting occasion. This additionally hints on the risk that the market might reply with robust promoting stress within the coming days.

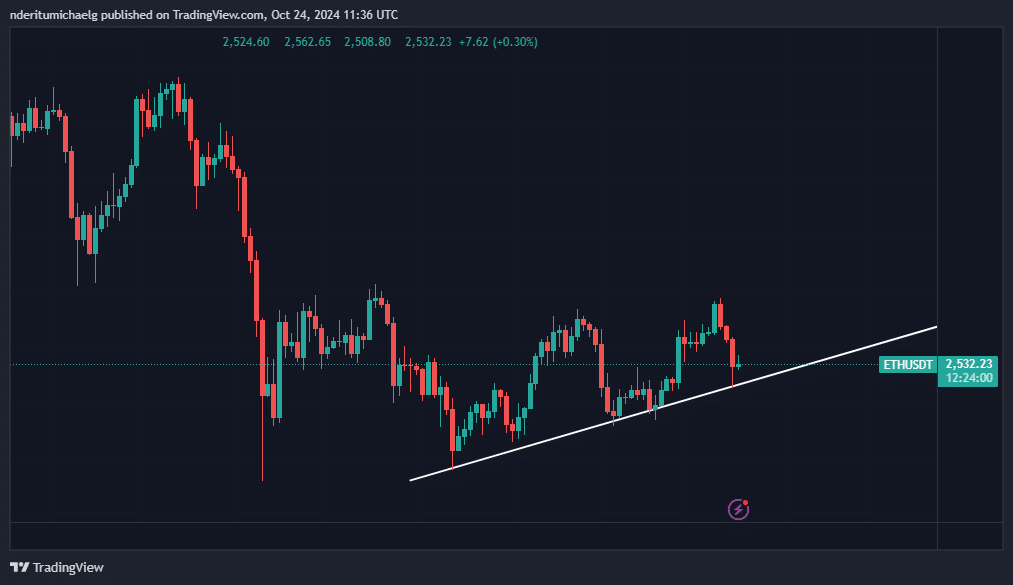

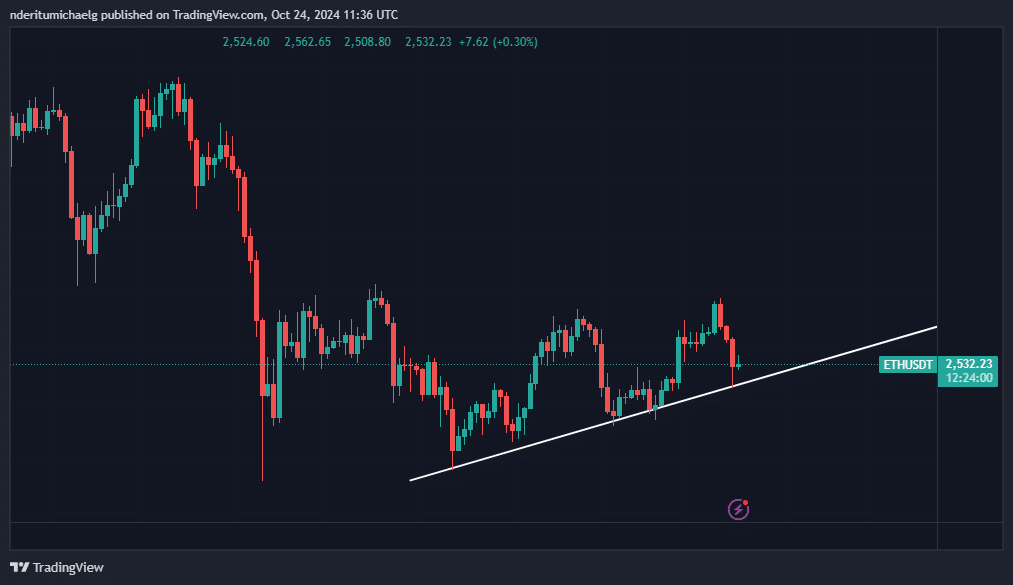

ETH was already underneath heavy promoting stress on the time of writing. On the time of writing, the inventory had fallen to $2,526 after retreating round 8% from its weekly excessive. Extra importantly, it has retested a near-term ascending help line over the previous 24 hours, with some restoration.

Supply: TradingView

Merely put, Lookonchain’s evaluation of the Ethereum ICO whale means that extra promoting stress might be coming within the coming days. This may be an reverse consequence to the chance that ETH might bounce off the aforementioned rising help.

Extra ETH volatility is coming, however which route?

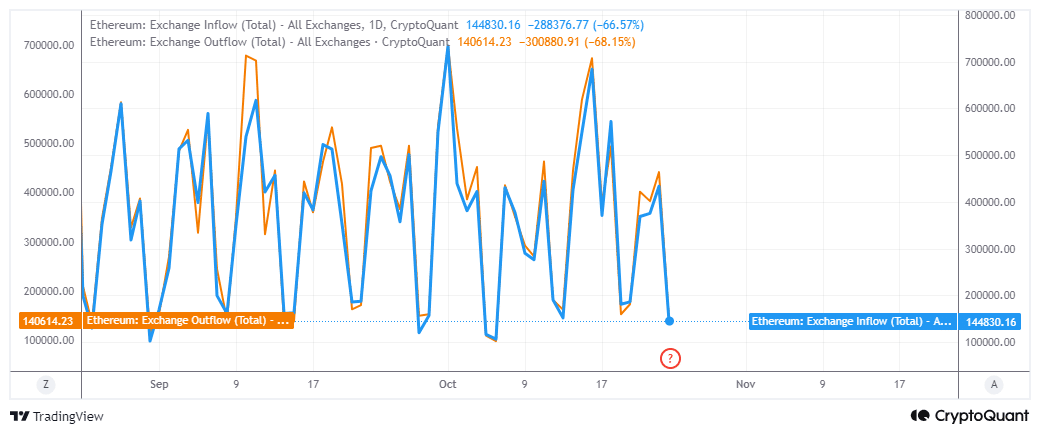

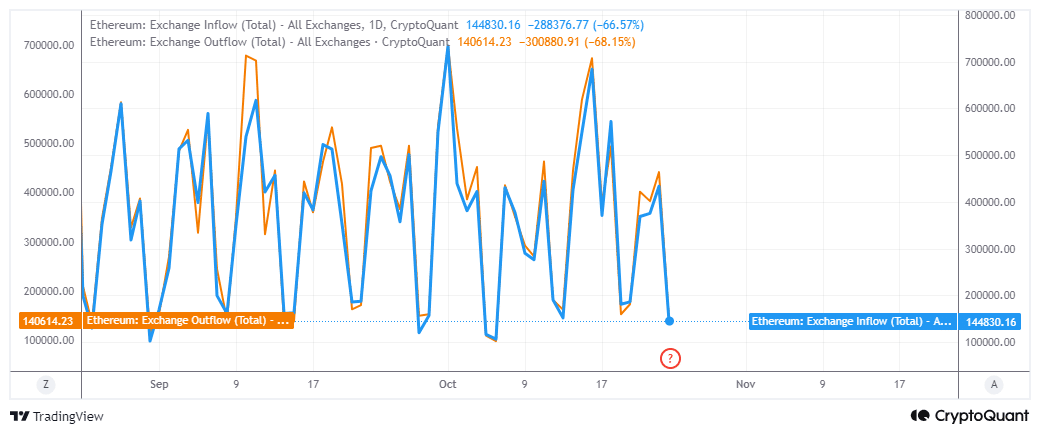

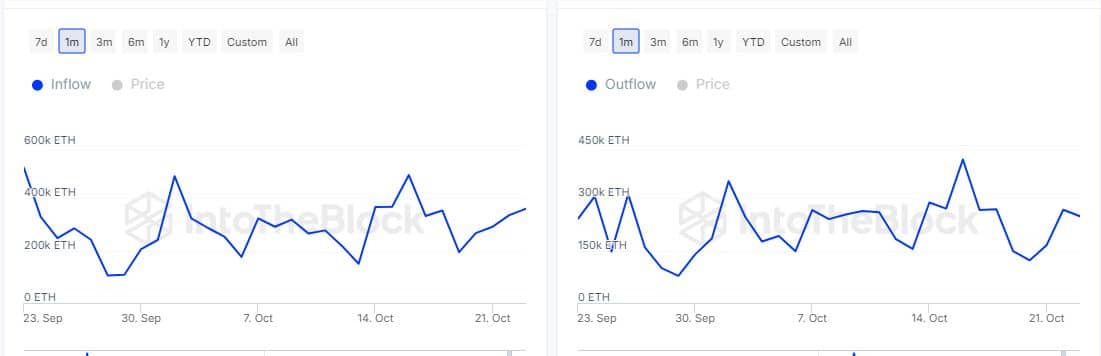

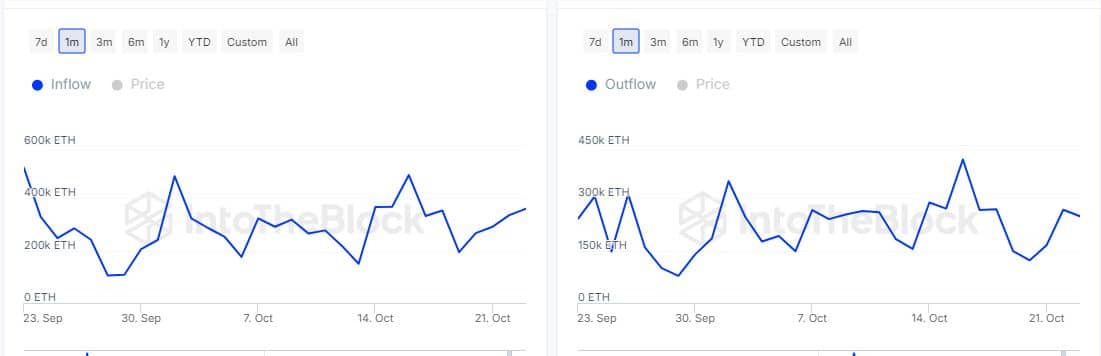

ETH’s trade movement information confirmed that each trade inflows and outflows fell to a degree the place they’re prone to reverse within the coming days.

This implies we might see a brand new wave of volatility. Nevertheless, this could nonetheless go both approach.

Supply: CryptoQuant

The trade’s inflows had been increased at 144,830 ETH over the previous 24 hours. As compared, the trade’s outflow information was decrease on the time of writing, at 140,614 ETH. This meant that there was increased promoting stress than shopping for stress. Nevertheless, the value appeared to have bottomed out on the help degree and the rationale for this may occasionally have been the whale exercise.

Knowledge from IntoTheBlock additionally confirmed that the quantity of ETH flowing to main holder addresses was increased, at 360,320 ETH. In the meantime, outflows from main addresses dropped to 248,590 cash.

Supply: IntoTheBlock

Lastly, property information confirmed that whales have congregated at current lows.

Nevertheless, the shortage of a big worth improve over the previous 24 hours confirmed a big diploma of uncertainty, which might result in weak demand.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024