Ethereum

Ethereum inflows hit $2.2B: Could $10K be next for ETH?

Credit : ambcrypto.com

- Ethereum units a brand new influx document of $2.2 billion year-to-date, surpassing the 2021 excessive.

- ETH may attain $10,000 within the medium time period if extra on-chain actions proceed to flourish.

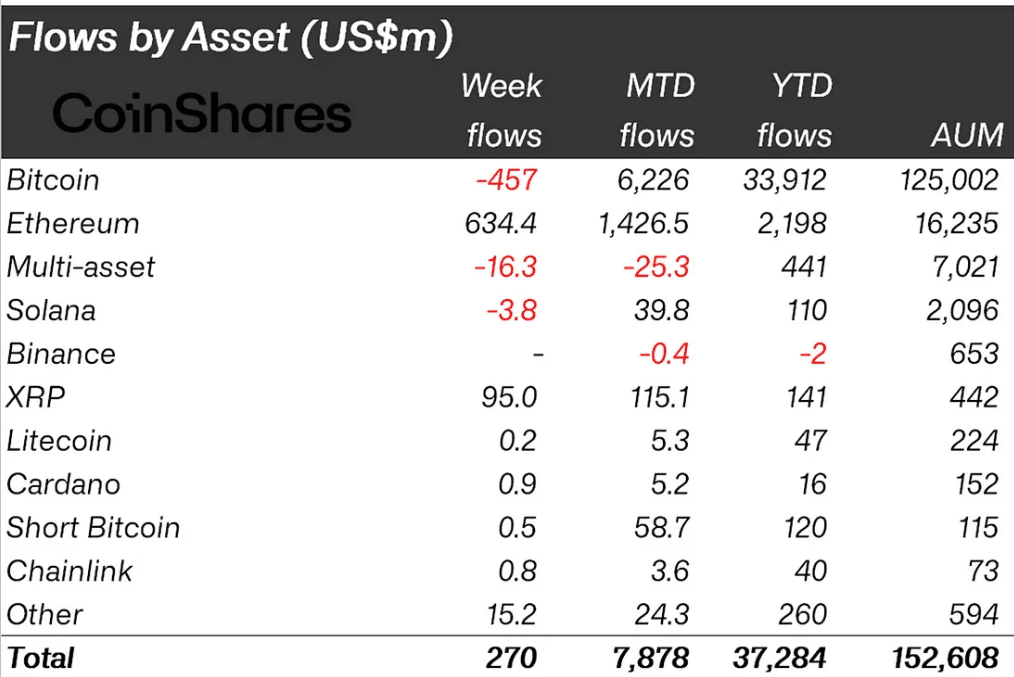

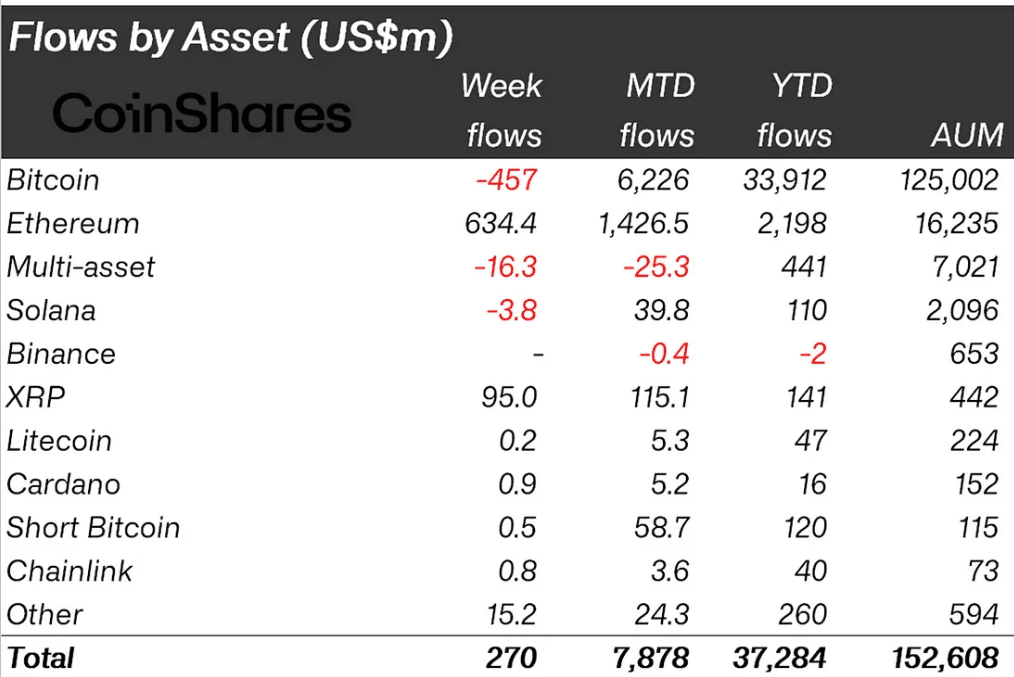

Ethereum [ETH] set a brand new document for inflows, reaching $2.2 billion this 12 months, surpassing the earlier document set in 2021.

Current inflows amounted to $634 million, indicating a big improve in investor confidence and market sentiment.

The rise was attributed to the sturdy efficiency of Ethereum ETFs. These ETFs have change into a most well-liked car for traders as they supply publicity to ETH with out direct funding within the digital forex.

The rising institutional curiosity was clearly seen as giant sums of cash proceed to be spent on Ethereum-based funding merchandise.

Supply: Bloomberg, Coinshares

Regardless of some fluctuations and market volatility, the general pattern for Ethereum appeared bullish, with elevated institutional help offering a strong basis for future development.

These developments coincided with the general growing influx into crypto ETPs, with Ethereum taking the lead alongside Bitcoin.

Inflows from ETH TVL and Spot ETFs

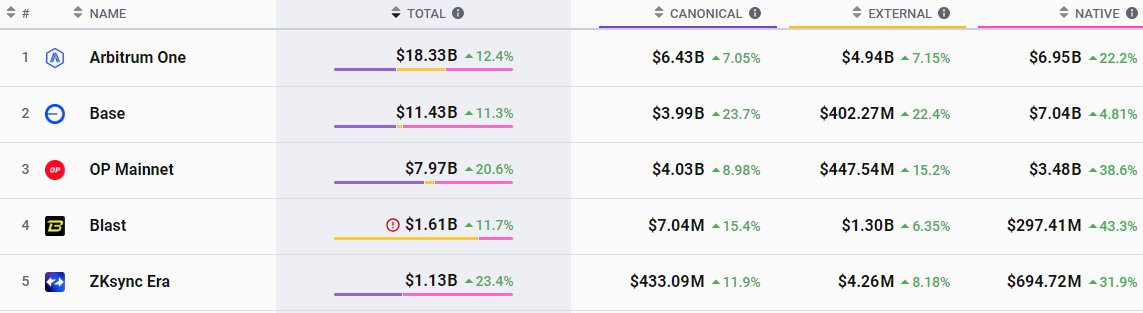

Previously week, Ethereum has skilled a big influx of $4.81 billion, resulting in a notable improve within the whole worth locked (TVL). reported from Lookonchain.

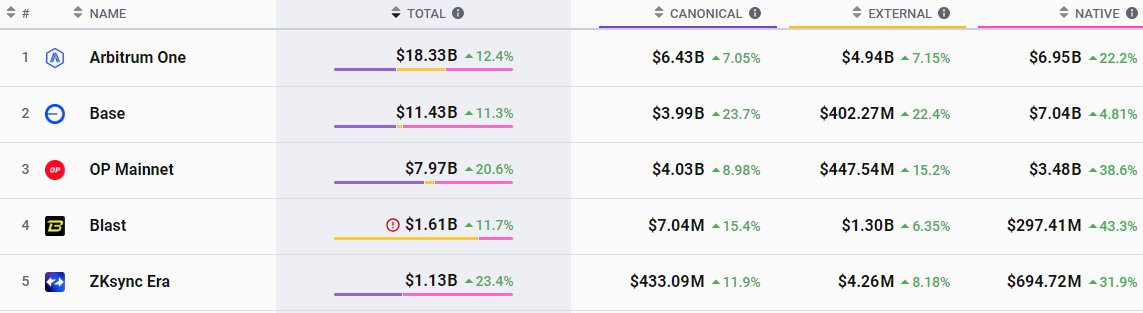

These inflows have pushed Ethereum’s Layer-2 networks to a brand new excessive, with mixed TVL reaching a document $51.5 billion – up 205% over the 12 months.

Moreover, Base’s TVL elevated by $302.02 million, attributable to elevated exercise and scalability enhancements.

Ethereum L2 Market Cap | Supply:

This document development in DeFi TVL has not solely revisited the November 2021 highs, however has additionally been diversified with elevated liquid stake choices, Bitcoin DeFi integrations, and enhanced contributions from Solana and different Layer-2 networks.

Additionally, Ethereum’s spot ETFs reported substantial web inflows of $24.23 million, marking six consecutive days of constructive inflows

Supply: SoSo worth

BlackRock’s ETHA ETF led the rise, seeing a notable influx of $55.92 million in someday. Equally, Constancy’s FETH ETF confirmed sturdy efficiency, with web inflows of $19.90 million.

Collectively, the whole web asset worth of ETH spot ETFs has reached $11.13 billion, underscoring continued and rising curiosity in Ethereum as a serious asset within the digital forex house.

Value promotion to achieve $10,000

These developments may push ETH to new highs because the chart reveals a breakout of a consolidation triangle and a pointy rise on a three-day timeframe.

Because the starting of 2021, the worth of ETH has maintained an general bullish pattern, with some intervals of corrections and consolidation.

ETH is about to interrupt away from a triangular sample and is aiming for increased ranges with an anticipated rise in direction of $10,000.

Supply: TradingView

Learn Ethereum’s [ETH] Value forecast 2024–2025

The uptrend, which prolonged simply previous $3,600, recommended that Ethereum may doubtlessly attain $10,000 within the medium time period if on-chain exercise continues to flourish.

Such a transfer indicated sturdy purchaser curiosity and strong market sentiment, doubtlessly heralding a brand new section for Ethereum’s development.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now