Ethereum

Ethereum investors choose to go long? Staked supply climbs to 29%

Credit : ambcrypto.com

- Lengthy-term accumulation Ethereum addresses now maintain over 19 million ETH, practically doubling since January 2024.

- With practically 29% of ETH’s complete provide deployed, decreased market liquidity might help future worth stability.

Ethereum [ETH] skilled a pointy enhance in long-term accumulation, with over 19 million ETH held at addresses on October 18.

This marks a major enhance from the 11.5 million ETH in the beginning of the yr, reflecting rising confidence amongst traders about Ethereum’s long-term prospects.

Ethereum accumulation is rising

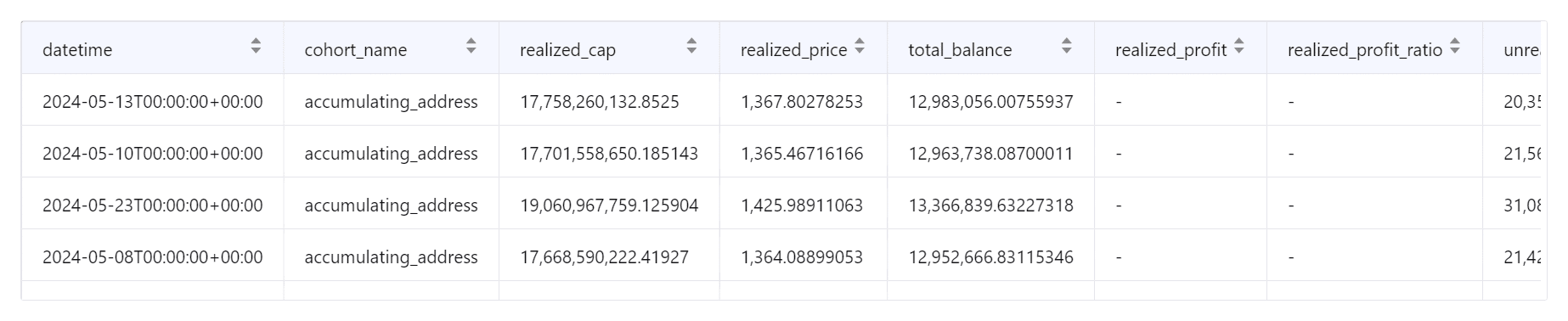

Knowledge from CryptoQuant revealed a considerable enhance in Ethereum in accumulation addresses. In January 2024, these addresses held 11.5 million ETH, and by October this determine had virtually doubled.

Consultants counsel that by the top of the yr the quantity held at these addresses might exceed 20 million ETH, persevering with this upward development.

Supply: CryptoQuant

This enhance in long-term positions signifies that enormous traders and ETH supporters are constructing their positions with the expectation of future progress.

The adoption of Spot ETFs in early 2024 has additionally contributed to this accumulation by drawing extra mainstream consideration to ETH. The rise within the variety of ETH strikes is one other driving drive behind the elevated accumulation.

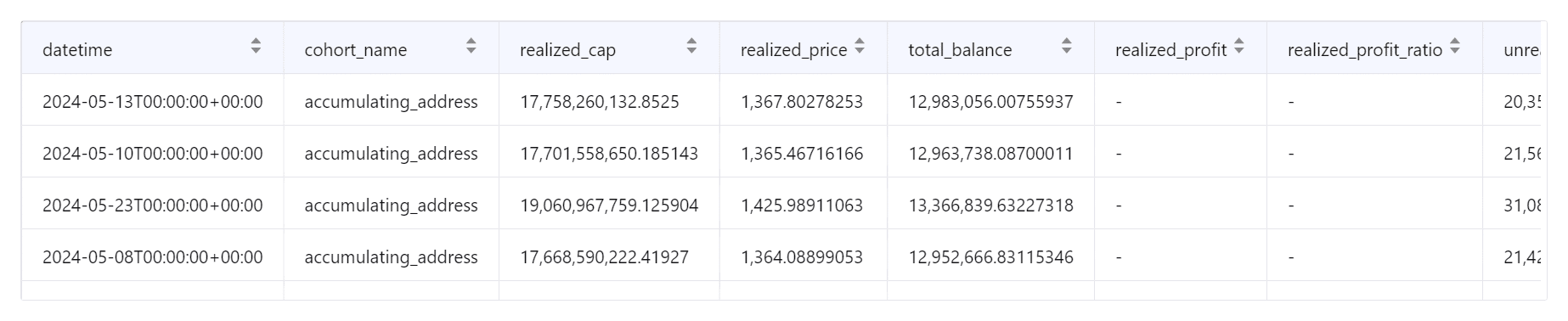

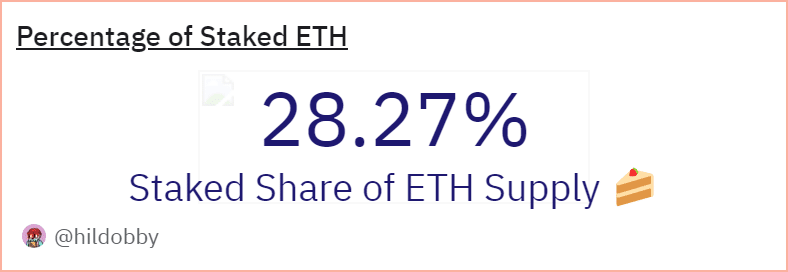

Ethereum has deployed virtually 30% of the availability

As accumulation grows, staking has additionally grow to be a key consider Ethereum market dynamics. Knowledge from Dune Analytics exhibits that on the time of writing, 34,600,896 ETH had been staked, representing virtually 29% of the entire provide of ETH.

Supply: DuneAnalytics

With a good portion of ETH locked up in strike contracts, the general market could expertise much less stress on the promote aspect.

This might present help to Ethereum’s worth within the close to future as there may be much less ETH out there for buying and selling, which might contribute to cost stability and even additional worth appreciation.

Ethereum maintains a constructive development

On the time of writing, Ethereum was buying and selling at $2,649, barely above the important thing help ranges.

The 50-day transferring common of $2,476 has supplied sturdy help, whereas the 200-day transferring common of $3,022 has served as important resistance.

A break above this resistance stage will likely be important for ETH to maintain a rally in the long term.

Supply: TradingView

The Relative Power Index (RSI) stands at 61.61, indicating average bullish momentum with out getting into overbought territory.

Learn Ethereum’s [ETH] Worth forecast 2024-25

In the meantime, the Chaikin Cash Stream (CMF) was barely unfavourable at -0.07, reflecting restricted shopping for stress, however not sufficient to sign a bearish development reversal.

Whereas Ethereum maintains a constructive outlook, surpassing the USD 3,022 resistance is essential for a stronger upside trajectory. If market volatility arises, the 50-day transferring common of $2,476 might act as essential help.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024