Altcoin

Ethereum: Key supply zone to watch after ETH’s $200 million sell-off

Credit : ambcrypto.com

- Ethereum whales bought 60,000 ETH value over $200 million after the worth fell to a weekly low.

- On the identical time, optimistic web flows to the inventory markets have risen to a weekly excessive.

Ethereum [ETH] was buying and selling at a weekly low of $3,683, on the time of writing, after falling greater than 4% in 24 hours. Whereas this dip brings Ethereum’s seven-day losses to six%, the biggest altcoin continues to be posting month-to-month positive factors of 17%.

The latest dip introduced the full variety of ETH liquidations to $124 million, with $108 million being lengthy liquidations. Like lAs patrons rushed to shut out their positions, Ethereum whales additionally considerably lowered their holdings.

Ethereum whales transfer $200 million ETH

Knowledge from IntoTheBlock exhibits that on December 18, 18 Ethereum whales holding between 1,000 and 10,000 ETH noticed their holdings drop from 13.47 million to $13.41 million. This means that these addresses bought 60,000 ETH value over $200 million.

Supply: IntoTheBlock

As AMBCrypto reportedETH whales account for 57% of the altcoin provide. If this cohort reduces their holdings, this might due to this fact have a detrimental impact on the worth by rising strain on the promoting facet.

Enhance in forex inflows

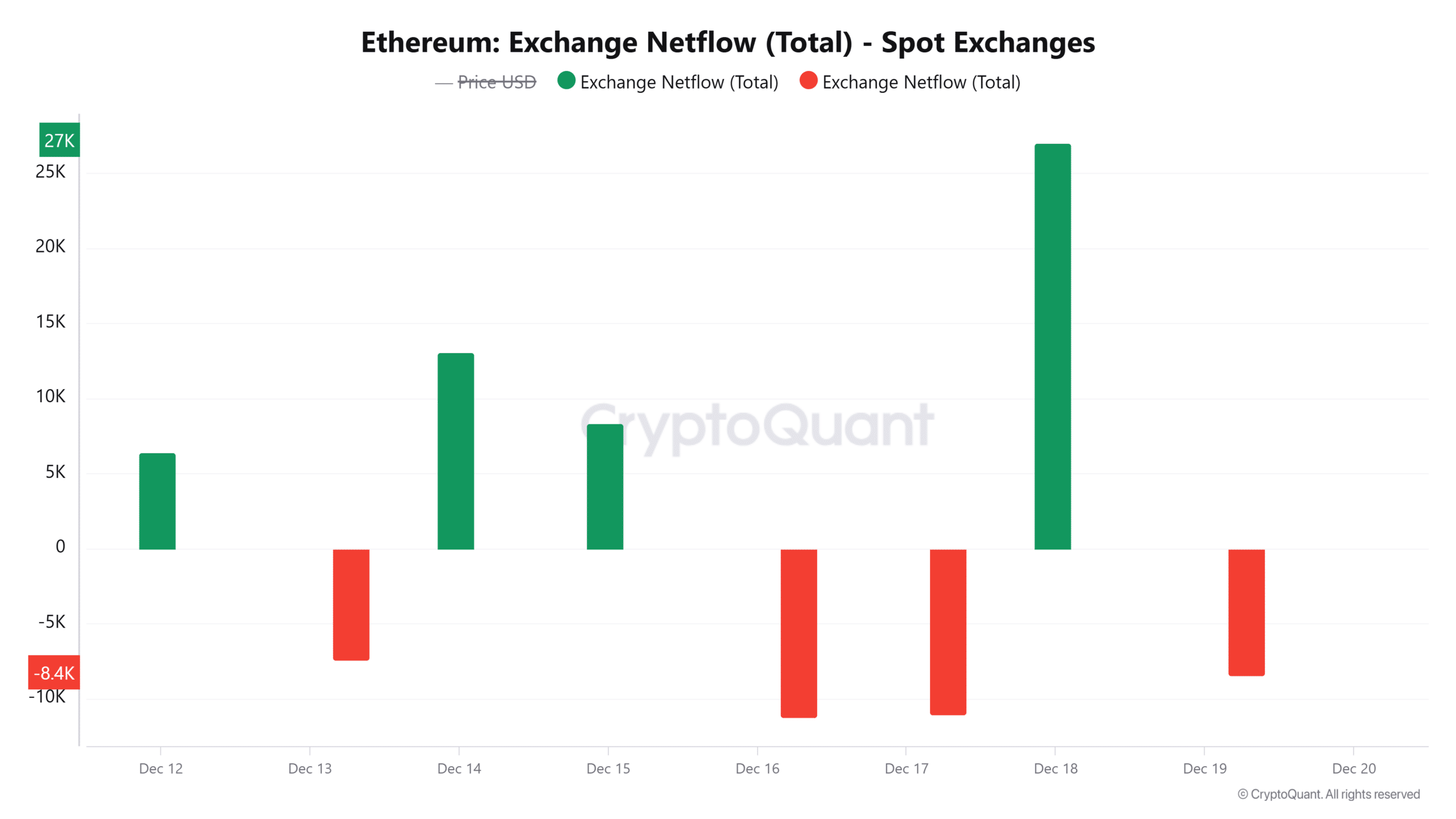

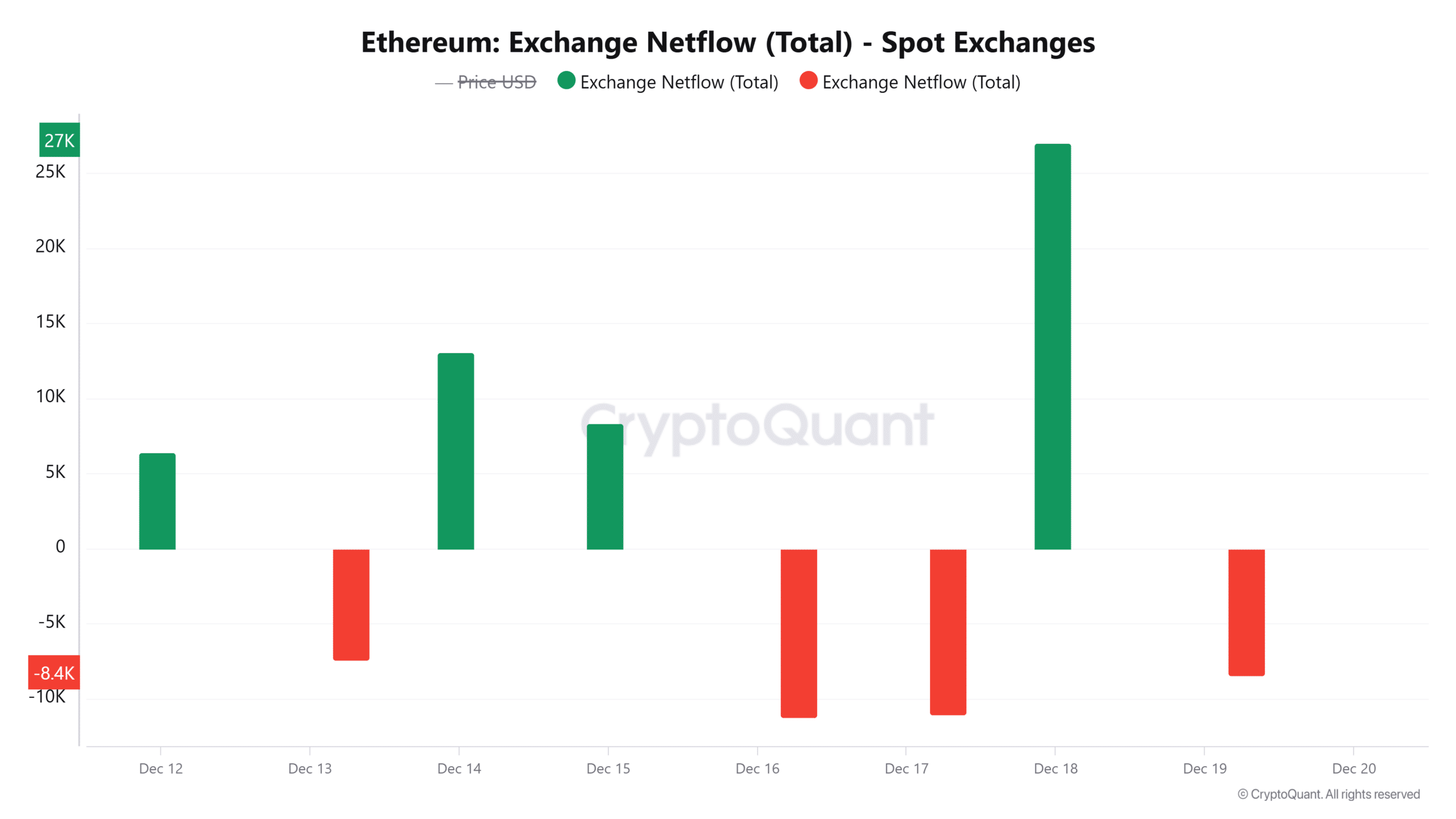

The rising gross sales exercise is additional mirrored in a spike in inflows to identify exchanges, after optimistic web flows to exchanges rose to their highest stage in every week.

Supply: CryptoQuant

This sell-off brought on a pointy reversal, sending ETH down from $3,900 to round $3,500. This promoting exercise may proceed, inflicting bearish strain on ETH if shopping for strain doesn’t improve.

Has institutional demand decreased?

Institutional demand for ETH has elevated considerably this month, as evidenced by the rise in inflows into spot ETFs. In keeping with SoSoValue, inflows into these merchandise have been optimistic for the previous 18 consecutive days.

On December 18, whole inflows reached $2.45 million, the bottom since late November. The Grayscale Ethereum Mini Belief noticed $15 million in outflows, its first detrimental circulate since November.

Rising inflows into these ETFs have fueled demand, pushing ETH previous $4,000. If demand weakens, this might trigger a value drop.

What is the subsequent goal for ETH?

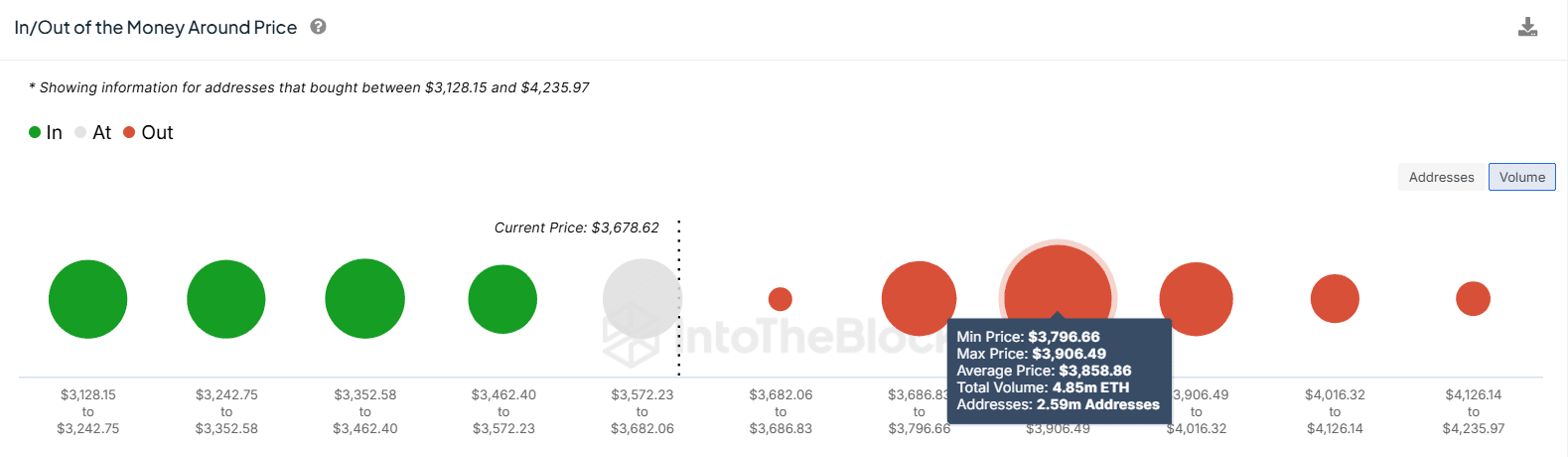

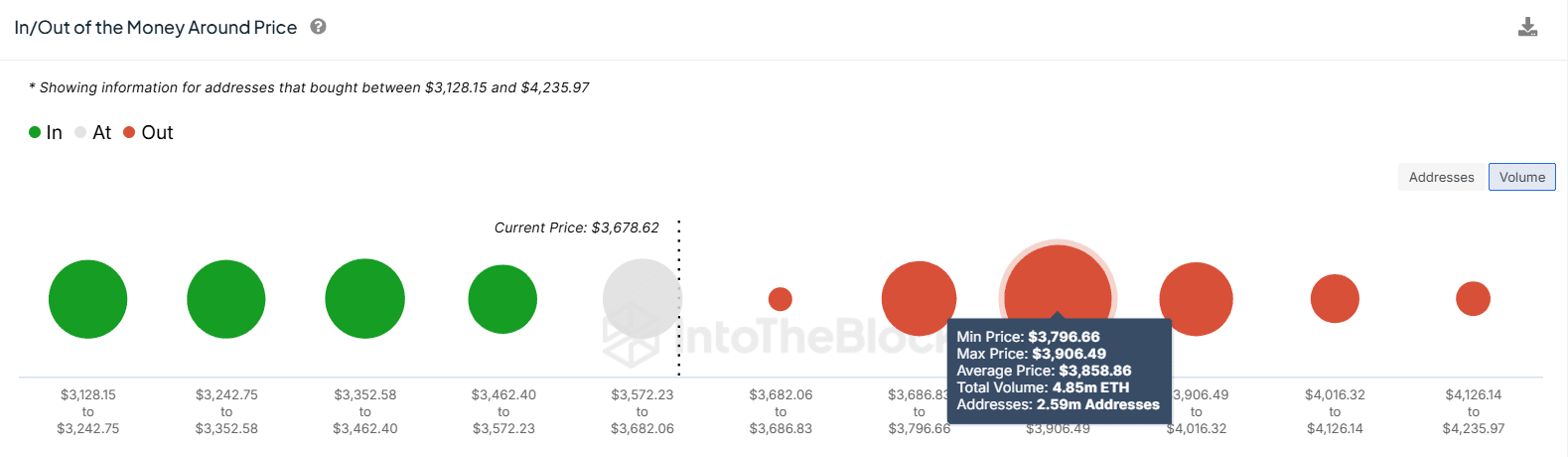

A provide zone looms for ETH between $3,800 and $3,900. In keeping with IntoTheBlock, 2.59 million addresses bought 4.85 million ETH at these costs.

Supply: IntoTheBlock

If patrons reenter the market, the ensuing uptrend may meet sturdy resistance on this zone as merchants look to ebook income. Nevertheless, if the altcoin strikes previous this zone, it may yield extra income.

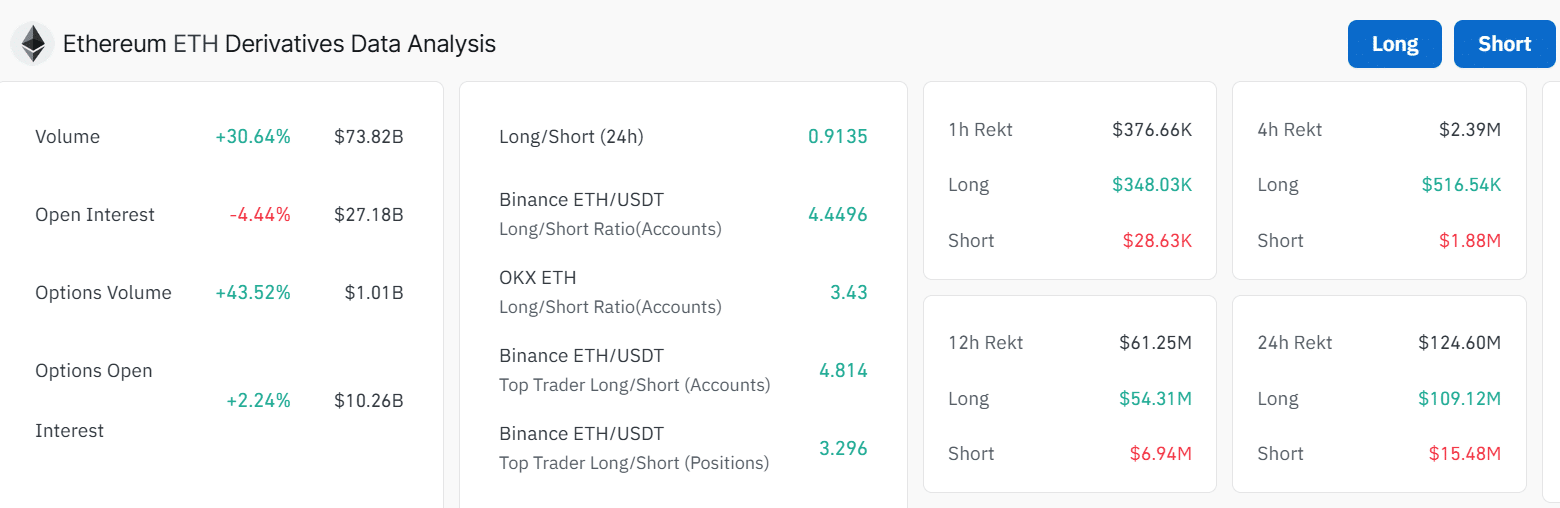

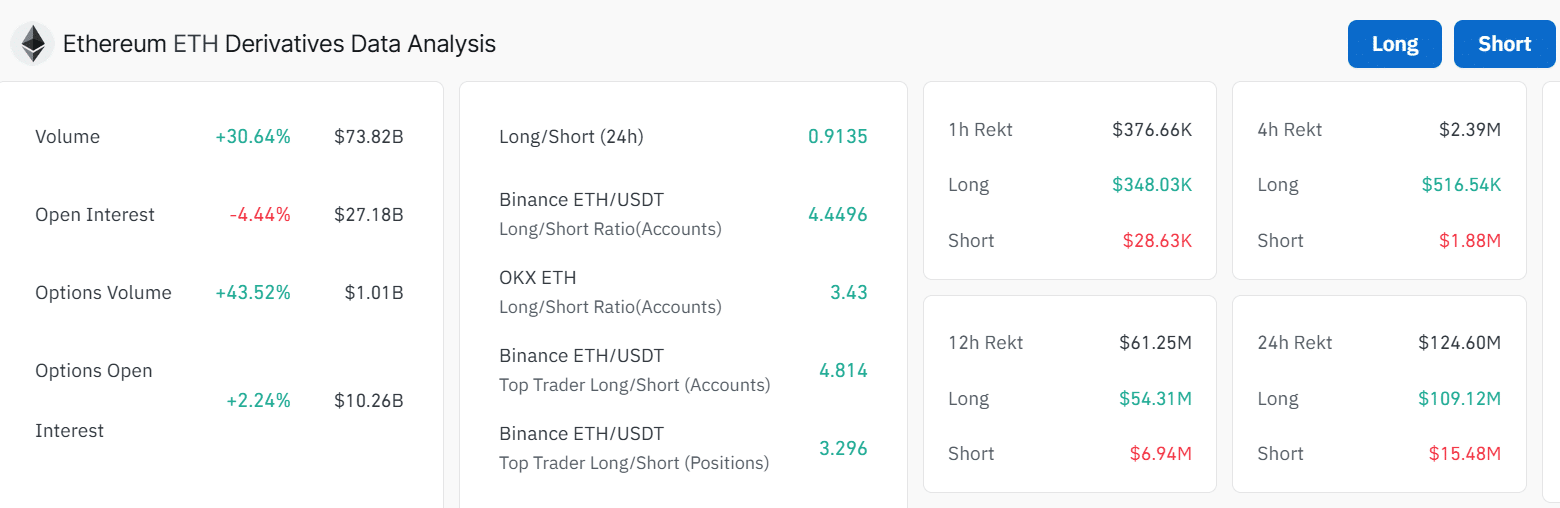

Analyzing derivatives information

In keeping with Coinglass, speculative exercise surrounding ETH within the derivatives market continues to be considerably excessive. Regardless of a 4% drop in open curiosity, derivatives buying and selling volumes have elevated by round 30%.

Moreover, Ethereum’s open curiosity is just 6% decrease than ever at $27 billion.

Supply: Coinglass

Learn Ethereum’s [ETH] Value forecast 2024-25

Nevertheless, most derivatives merchants seem to have taken quick positions as a result of lengthy/quick ratio of $0.91. This means a prevailing bearish sentiment amongst merchants.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now