Ethereum

Ethereum Key Support: Cost Basis Data Points To $1,890 As Make-Or-Break Level

Credit : www.newsbtc.com

In accordance with giant losses on the crypto market, Ethereum (ETH) fell by 17.08% to $ 2,104 final week. Though the distinguished Altcoin has proven some small revenue for the previous 12 hours, the final market sentiment Beerarish stays.

ETH correction in all probability went to $ 1,890 – This is the reason

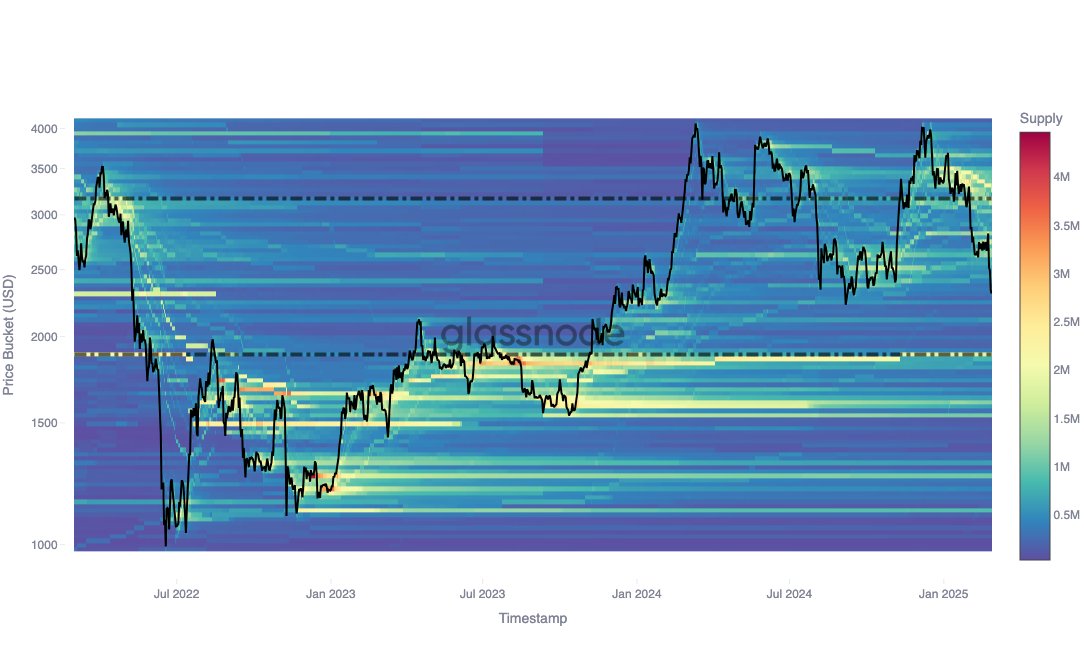

The ETH market is at the moment navigating a powerful market correction with varied analysts who at the moment are bringing potential essential assist ranges to the eye. In response to distinguished unchain evaluation firm Glassnode, knowledge from the fee -based distribution (CBD) metric signifies that Ethereum is prepared for a lower as much as $ 1,890 that represents its subsequent giant accumulation zone.

CBD is used for context to determine vital ranges of accumulation or distribution of an energetic one. These recognized zones typically act as assist or resistance and are influential on value actions. Analysts at Glassnodes stands That a very powerful ETH accumulation zone below the present value is $ 1,890, with traders acquired round 1.82 million ETH in August 2023.

Apparently, a two -year evaluation of the CBD of Ethereum exhibits that a few of these traders who collected ETH in August 2023 will stay energetic. Specifically, a substantial variety of them elevated their value foundation throughout the Cryptomarkt in November 2024, whereas he doesn’t carry out distribution on vary heights and conduct that signifies sturdy belief within the long-term value valuation.

Nonetheless, it’s price saying that $ 1,890 is just not the fast assist zone for the ETH market. Glassnode states that CBD knowledge additionally emphasizes $ 2,100 as the following assist zone if the Ethereum correction continues.

This degree of assist is just round 500,000 ETH, ie significantly decrease than the buildup that’s seen at $ 1890. Though traders anticipate $ 2,100 to supply some within the brief time period assist earlier than ETH experiences a deeper correction as much as $, 1890.

Is ETH accumulation on the worth dip?

In an extra evaluation of the Ethereum market, Glassnode additionally reveals {that a} six-month perspective on the pattern of the fee foundation exhibits a powerful investor exercise with cost-based ranges which might be a lot greater than the present market value, specifically round $ 3,500.

Specifically, this value foundation has proven a gradual lower and on the similar time will increase in focus. This improvement signifies that traders as a substitute of initiating a sale, traders actively soak up the market facility as costs fall pending lengthy -term revenue.

On the time of writing, Ethereum acts at $ 2,250 after a revenue of three.84% within the final day. Within the meantime, the heavy decline of the previous week is shifting to round 30.48%. Nonetheless, market exercise has elevated by 7.74% and is now appreciated at $ 29.91 billion.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now