Ethereum

Ethereum Kimchi Premium Spikes To New High — Sign Of Impending Sell-Off?

Credit : www.newsbtc.com

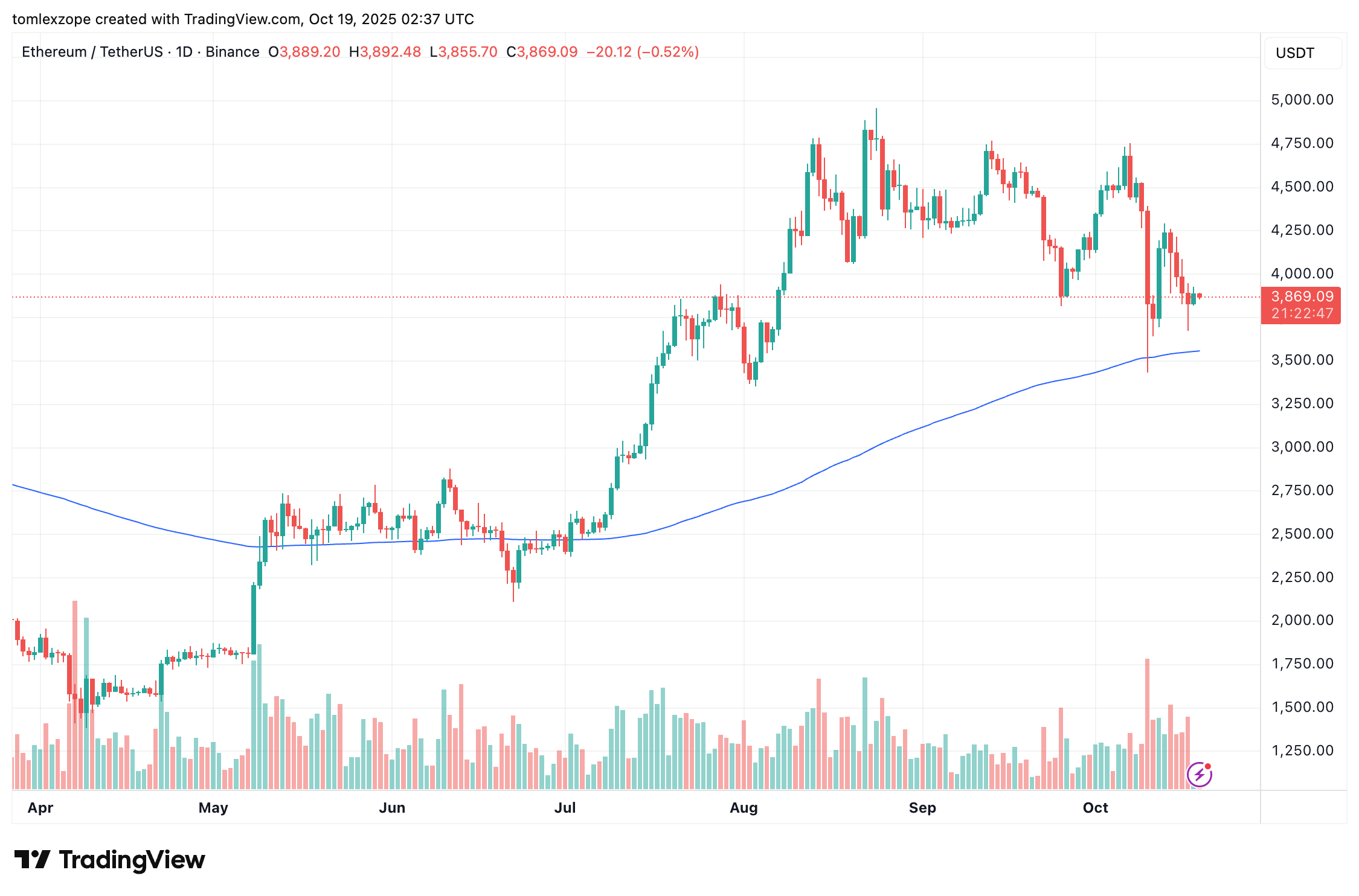

The worth of Ethereum appears to be recovering properly this weekend after a interval of uncertainty amongst traders. The “king of the altcoins”, after what regarded like an aggressive return above the $4,200 degree earlier this week, is now lagging under the psychological $4,000 mark.

Though the Ethereum value has constructed constructive momentum over the previous day, the shadows of the October 10 downturn nonetheless seem to weigh on investor sentiment. A market phenomenon referred to as the “Kimchi Premium” suggests it’ll be a nasty few weeks for the second-largest cryptocurrency.

What occurred the final time Kimchi Premium noticed the same improve

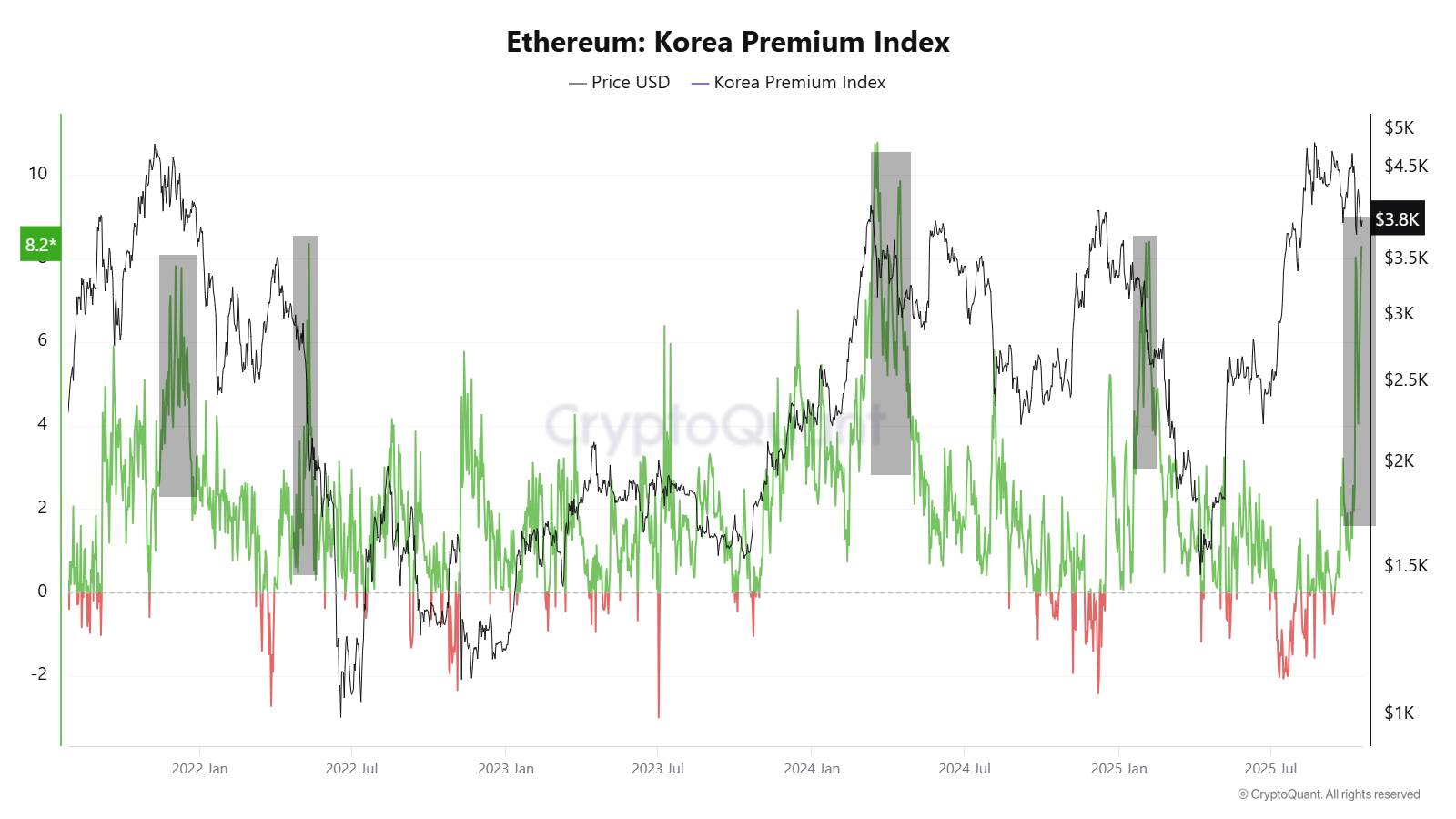

In a latest publish on social media platform X, market analyst CryptoOnchain says revealed that the Kimchi Premium has been on the rise in latest weeks. This statement relies on the motion of the on-chain indicator Korea Premium Index, which measures the value distinction between South Korean exchanges and different international exchanges.

This metric, or the “Kimchi Premium,” exhibits how a lot further Korean merchants are prepared to pay for a given cryptocurrency (on this case, Ethereum). When the index is constructive, it implies that Korean retailers are prepared to pay a premium for the crypto belongings. In the meantime, a unfavourable Korean Premium Index signifies that retailers are solely prepared to purchase the cryptocurrency at a reduction.

In line with CryptoOnchain, the Korea Premium Index for Ethereum lately noticed a notable improve to round 8.2%, the second highest degree this 12 months. The market analyst famous that this degree of Kimchi Premium is a troubling signal because it traditionally factors to excessive retail FOMO (Worry of Lacking Out) and a possible value high.

Usually, whales are inclined to benefit from the value distinction by promoting on Korean exchanges when the Korea Premium Index rises. Because of the elevated promoting strain, the Ethereum value is now at higher threat of correction.

For instance, the final time ETH noticed a Kimchi Premium of this peak was in January, which coincided with the value drop to round $1,500. With this in thoughts, traders ought to be cautious because the chance of a sustained downtrend is considerably greater.

Ethereum value at a look

On the time of writing, ETH’s value is round $3,875, reflecting no vital change previously 24 hours. In what was anticipated to be a bullish interval for the cryptocurrency market, ‘Uptober’ hasn’t precisely met investor expectations. After a constructive begin to the month, the Ethereum value is at present down nearly 10%.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024