Ethereum

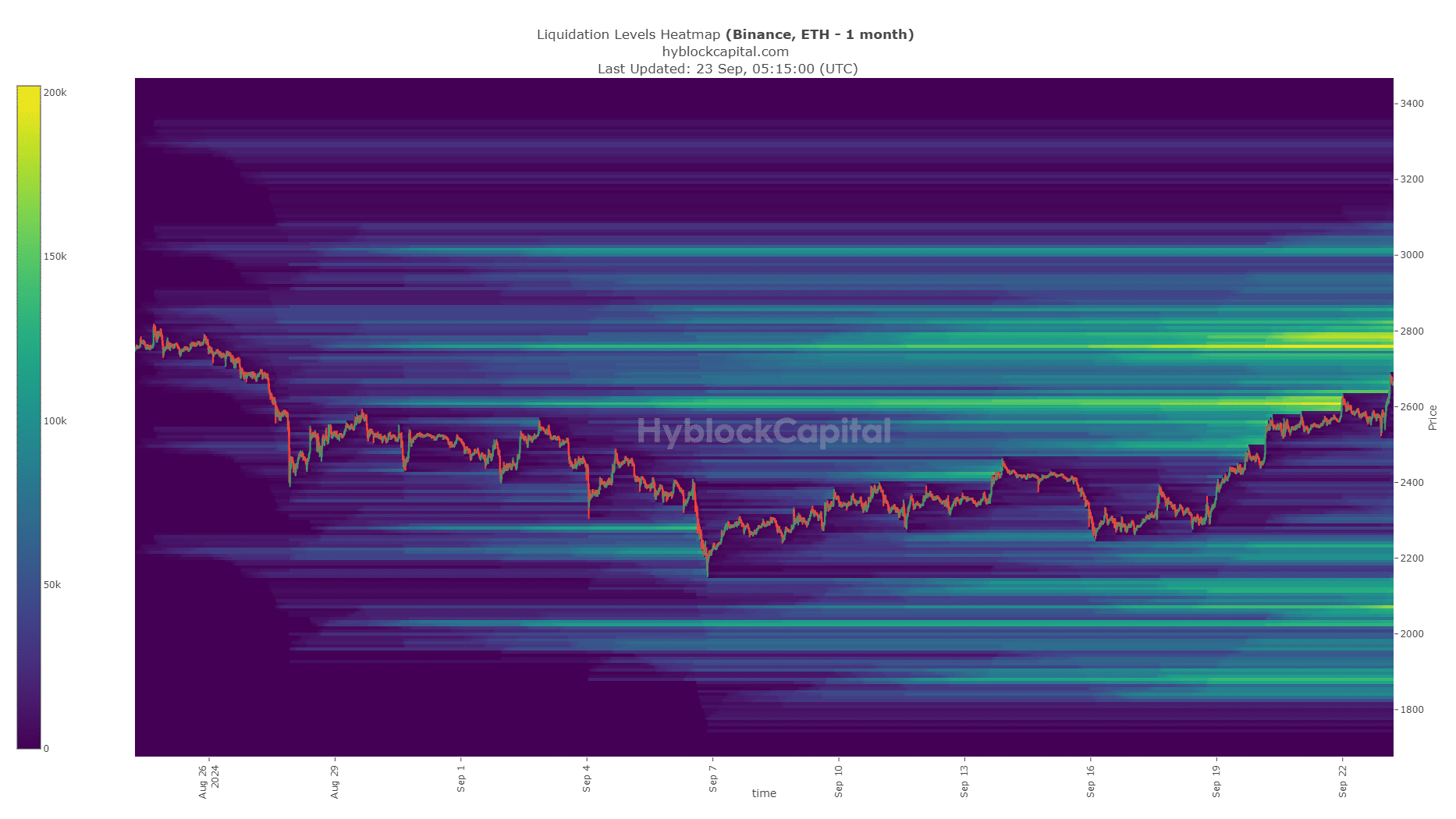

Ethereum: Liquidation levels indicate move toward $2.8k resistance

Credit : ambcrypto.com

- Ethereum regained a bullish construction, however the downtrend was nonetheless in play.

- The previous assist zone of $2.9,000 might be the subsequent value goal.

Ethereum [ETH] has not been in a position to match Bitcoin’s efficiency [BTC]. This was mirrored within the ETH/BTC chart, which might type a neighborhood backside. In comparison with the US greenback, the token is predicted to carry out a lot better within the coming days.

The liquidation ranges and value motion charts indicated {that a} 5% transfer north is probably going, however any positive factors past that will require main intervention from patrons.

Ethereum is approaching a neighborhood excessive and essential resistance zone

Supply: ETH/USDT on TradingView

The market construction on the day by day time-frame was bullish after the worth broke the newest lowest excessive at $2,464. The RSI was additionally above the impartial 50, indicating that momentum has modified path.

Nevertheless, this doesn’t imply that the development is bullish; the development has been bearish since June, after the restoration try in Could failed. The OBV agrees with this assertion and has been on a downward development since March, largely indicating weak shopping for stress.

There was a bearish order block on the $2.8k stage. The market construction had turned bearish from this native excessive in mid-August, marking it as a powerful provide space.

Ethereum is prone to go to this resistance, however a breakout is determined by market-wide sentiment and information developments.

One other testomony to the $2,800 purpose

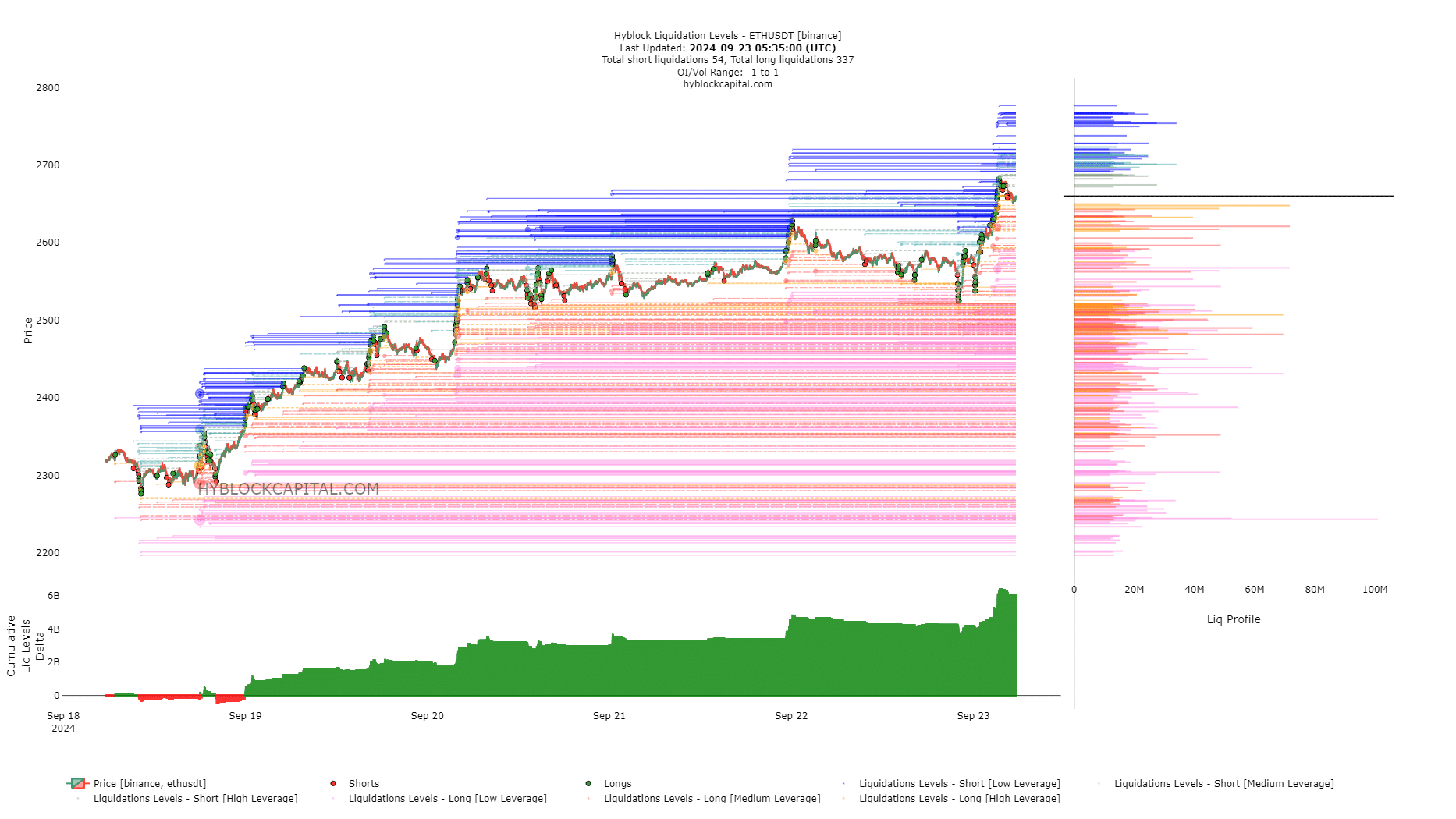

The $2.8k area has a big cluster of liquidation ranges, highlighting this area as a key magnetic zone within the close to time period. Subsequently, Ethereum is predicted to overcome this area on this buying and selling week earlier than a doable reversal.

A reversal is just anticipated as a result of the $2.8k to $3k area has been a key assist/resistance zone since April. There’ll doubtless be many sellers, however bulls might overwhelm them, particularly if Bitcoin continues to maneuver larger.

Within the quick time period, there have been extremely leveraged lengthy positions on the $2,647 and $2,621 ranges that might be focused for a liquidity hunt.

Learn Ethereum’s [ETH] Worth forecast 2024-25

The optimistic cumulative delta of liq ranges advised {that a} near-term value restoration was doable.

The following two weeks are anticipated to be bullish for Ethereum. A transfer in the direction of $2.8k-$2.9k is probably going. Additional positive factors would rely on market sentiment and purchaser energy, which will likely be mirrored in buying and selling quantity.

Disclaimer: The data offered doesn’t represent monetary recommendation, funding recommendation, buying and selling recommendation or another type of recommendation and is solely the opinion of the author

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Solana6 months ago

Solana6 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?