Ethereum

Ethereum Long-Term Holders Show Signs Of Capitulation – Prime Accumulation Zone?

Credit : www.newsbtc.com

Purpose to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by specialists from the trade and thoroughly assessed

The best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

This week Ethereum noticed a dramatic turnaround and bounced greater than 21% of his latest $ 1,380 low in only a few hours. The sharp restoration got here in response to an sudden shift within the macro-economic coverage: US President Donald Trump introduced a 90-day break for mutual charges for all countries-and-half China, which is now confronted with a steep fee of 125%. The information despatched a wrinkle via world markets, which brought about a brief -term rally in danger property, together with crypto.

Associated lecture

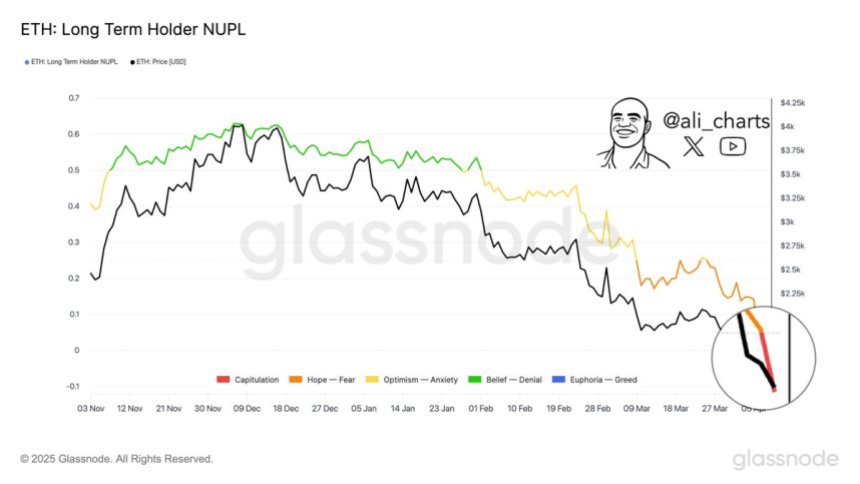

Ethereum, which had been beneath heavy gross sales strain for weeks, appears to have discovered momentary lighting. In response to Glassnode information, long-term Ethereum holders will begin folding, advocacy positions within the occasion of loss after months of decline. Traditionally, these moments of lengthy -term capitulation of the holder usually marked the soil phases and preceded prior helpful rebounds.

Though brief -term volatility stays elevated, some analysts regard this setup as a possible alternative zone, particularly for opposite traders who need to collect throughout peak nervousness. The market is now trying ahead to seeing if ETH can retain its revenue or whether or not broader uncertainty will drag the costs down once more. One factor is obvious: the approaching days might be essential for the pattern of Ethereum on the way in which to the second half of 2025.

Ethereum finds lighting within the midst of chaos, however the market stays sharp

Ethereum is now at a vital intersection after extended weeks of ruthless gross sales strain and uncertainty. The latest improve in sub-$ 1,400 ranges has provided a spark of hope, whereas bulls are beginning to push again towards the downward pattern. This bounce follows aggressive volatility, not solely in crypto, however over world shares, with value motion startled by steady geopolitical unrest and macro -economic instability. The unpredictable perspective of US President Donald Trump in comparison with charges stays a wildcard, in order that the worldwide markets maintain sharp.

Because the peak on the finish of December, Ethereum has paid off greater than 60% of its worth, inflicting the rising concern {that a} full-scaling Berenmarkt could unfold. Many traders have already left positions, whereas others are offside on readability. But some see alternatives.

According to top analyst Ali MartinezLengthy-term holders of Ethereum have now been launched, which is also known as the “capitulation” mode-a stage wherein even most affected person traders begin to fold beneath strain. Martinez believes that this will current a uncommon window for opposite consumers. “For individuals who have a look at dangerous dynamics, this section has traditionally marked an important battery zones,” he shared on X.

Though the trail of Ethereum Voorwaarts continues to be unsure, the present sentiment suggests {that a} vital check is underway – a check that may decide whether or not this restoration has legs, or that additional ache is confused.

Associated lecture

Bulls appear to substantiate the restoration with key outbreak

Ethereum exhibits indicators of short-term power as a result of it’s an “Adam & Eve” bullish reversing sample on the 4-hour graph. This conventional technical formation, which begins with a aggressive V-shaped low level adopted by a rounded soil, usually signifies a possible outbreak if the value motion holds and follows. For Ethereum, recovering the $ 1,820 stage is step one to substantiate this bullish construction.

If Bulls can push ETH above this stage with conviction, the following vital problem lies with the 4-hour 200 Shifting Common (MA) and Exponential Shifting Common (EMA), each of which come collectively round $ 1,900. A decisive outbreak by this zone would validate the restoration setup and a extra persistent motion might begin greater.

Associated lecture

Nevertheless, ETH cannot retain the $ 1,800 stage within the coming days, nonetheless, in a consolidation vary. If rejected, the value might stay accessible between the present ranges and the decrease assist space close to $ 1,300, the place ETH lately bounced. For now, all eyes are geared toward how the value reacts to the resistance ranges that lie in entrance of us, as a result of bulls attempt to get management again and to shift the brief -term momentum to their benefit.

Featured picture of Dall-E, graph of TradingView

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September