Ethereum

Ethereum Macro Trend Oscillator Shows Green Might Be On The Horizon

Credit : www.newsbtc.com

Motive to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by consultants from the trade and punctiliously assessed

The best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

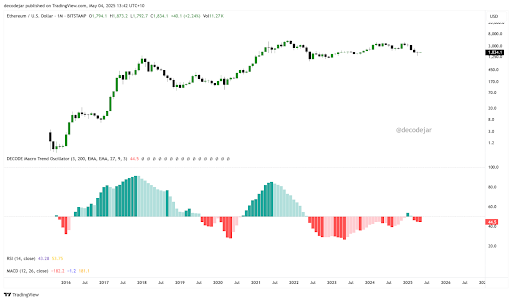

The value promotion of Ethereum Possibly it had bother To get a grip in latest weeks, however exhibits an attention-grabbing macro indicator in the long run Indicators of early restoration beneath the floor. Particularly a macro development -Soscillator made by a crypto analyst often known as Decode on Social Mediaplatform X has begun to show plates From a change after an unusually lengthy -lasting piece of bearish run. If confirmed, this could mark the beginning of a brand new section of energy for the second largest cryptocurrency per market capitalization.

Shallow pink rods are beginning to have interaction the development evaluation of Ethereum

The month-to-month graph of the Oscillator, lined with the worth knowledge of Ethereum in regards to the month-to-month candlestick time-frame, clearly exhibits how deep and sustainably the latest Bearish Momentum has been. The pink histogram stations that mirrored the macro weak point remained far past typical period, and emphasised the broader financial resistance that has weighted on the cryptomarkt.

Associated lecture

It’s attention-grabbing that January of this yr briefly hinted on a return to Bullish Territorium, however the inexperienced print turned out to be a false begin and rapidly light when the cryptocurrency began a brand new decline. Nonetheless, the dimensions of latest pink rods is especially shallow in comparison with decline in 2023 and 2024.

This refined shift is extra clearly on the decrease schedules, specifically the 3-day graph, which exhibits a clear rejection of the unfavourable space and the formation of a small inexperienced bar for the present withdrawal. The analyst, Decode, interprets this as a doable turnaround at an early stage. As quickly because the Oscillator turns inexperienced in an extended -term approach, a fast upward motion in Ethereum and wider crypto costs will in all probability observe, in line with comparable transitions previously.

Inexperienced section will quickly dominate

Looking beyond cryptoThe Oscillator of Decode additionally follows the S&P 500 and wider macrotrends, the place the identical sample applies: inexperienced phases aren’t solely longer but in addition steeper and extra sturdy. This asymmetrical distribution of the momentum over time displays the true bias of belongings for enlargement over contraction. Decode famous that this isn’t solely an indicator with random limitations, however a totally built-in macro -economic index constructed from 17 statistics. These embrace shares, bonds, uncooked supplies, foreign money flows, liquidity of the Central Financial institution (M2) and even sentiment knowledge.

Associated lecture

By translating this into Ethereum, this gradual shift to the inexperienced zone is seen as a sign of incoming worth energy. Though Ethereum doesn’t but need to recuperate fully from its latest correction to $ 1,400, the refined however constant enchancment within the Macro development -Scillator of Decode which will entail a brand new upward development. For the time being the main focus is on the constant printing of inexperienced beams, particularly on a number of timetables.

On the time of writing, Ethereum acts at $ 1,830. The final 24 hours are marked by a Brief break beneath $ 1,800 Earlier than bouncing at $ 1,785. This motion brought about liquidations of roughly $ 35.92 million in ETH positions, with lengthy positions good for $ 28.38 million of that quantity.

Featured picture of Getty Pictures, Chart van TradingView.com

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now