Ethereum

Ethereum market split: Whales buying, smart money selling – What’s happening?

Credit : ambcrypto.com

- The entire Netflow from Ethereum skilled a optimistic shift within the final 24 hours and registered a +3.75k ETH change.

- ETH-Walvis accumulation usually precedes bullish actions, and their 24-hour net-buy of $ 1,020,676 supported these prospects.

Ethereum [ETH] Market steadiness between accumulation and sale sure ETHs quick -term motion, whereas lengthy -term tendencies revealed potential outbreak choices.

Within the final 24 hours, whales and Good Dex Merchants (SDT) emerged as internet patrons, signaling of accumulation. Whales registered a purchase order quantity of $ 6,942,812, which exceeds their gross sales quantity of $ 5,922.136.

SDT mirrored this development, with a purchase order quantity of $ 2,803,388 in opposition to a gross sales quantity of $ 1,957,518.

These actions mirrored institutional and skilled confidence of merchants sooner or later prize of ETH.

Supply: ICRYPTO

Nevertheless, Good Cash (SM) displayed contrasting conduct by promoting $ 1,659,691 in comparison with a purchase order quantity of $ 969,774.

Regardless of this gross sales stress, the dominance of the Purchase-Aspect de Beararish Impression restricted. All teams confirmed warning in a shorter 6 -hour timeframe. Whales registered a internet -buy of $ 180.399, SDT positioned $ 84,023 and SM added a smaller internet -buy of $ 44,296. These diminished volumes mirrored market selections.

Whale accumulation, usually a forerunner of bullish actions, was clear with a 24-hour net-buy of $ 1,020,676, which strengthened optimistic prospects. SDTs $ 845,870 Web Purchase additional supported strategic accumulation.

SM’s internet gross sales of $ 689,917, then again, instructed profitably, however missed the amount to alter the market sentiment. If shopping for whale and SDT continues, Ethereum might check crucial resistance ranges. Nevertheless, a rise in SM -sales can point out the beginning of a corrective part.

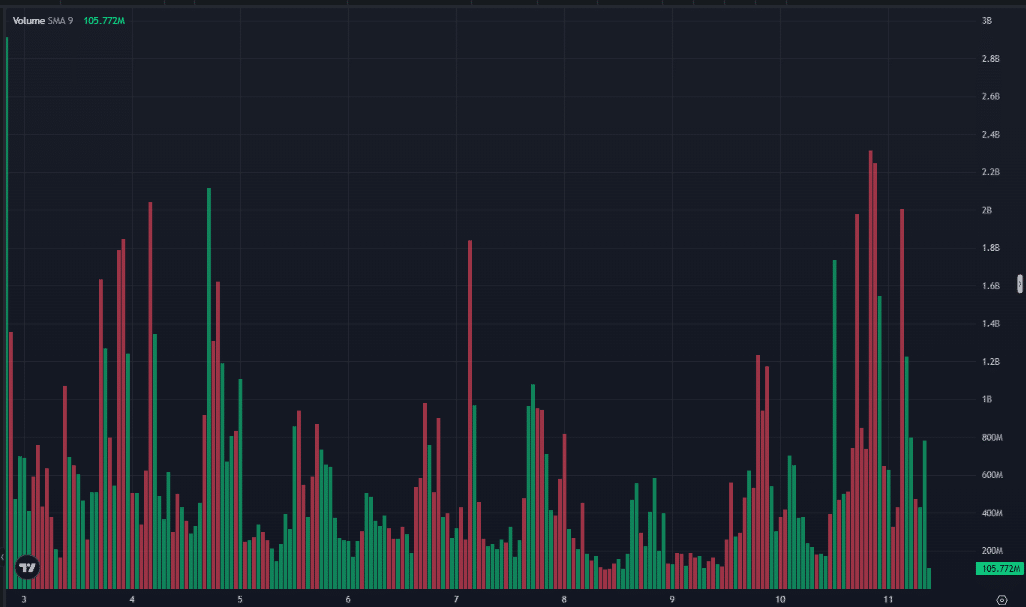

Assessing market momentum

Moreover, the web quantity evaluation bolstered the bullish sentiment that was noticed in massive buying and selling exercise. Greater than 24 hours collected whales a internet buy of $ 1,020,676, which displays sturdy positioning.

SDT adopted with a internet -buy of $ 845,870, whereas SM registered a internet sale of $ 689.917. The online quantity steadiness most well-liked patrons, which strengthens Eth’s quick -term prospects.

Supply: Coinglass

Shorter tendencies point out a diminished aggression of the market. Previously six hours, whales registered a internet buy of $ 180,399, SM contributed $ 44,296 and SDT achieved $ 84,023.

These figures rigorously mirror commerce conduct, as a result of contributors watch for stronger alerts earlier than they make better obligations.

Traditionally, intensive Netto buying ETH has pushed on increased worth goals. Nevertheless, intensive gross sales stress can result in a withdrawal.

Following persistent internet buying is crucial to substantiate a bullish continuation, whereas rising the web gross sales can point out the taking of revenue or probably downward dangers.

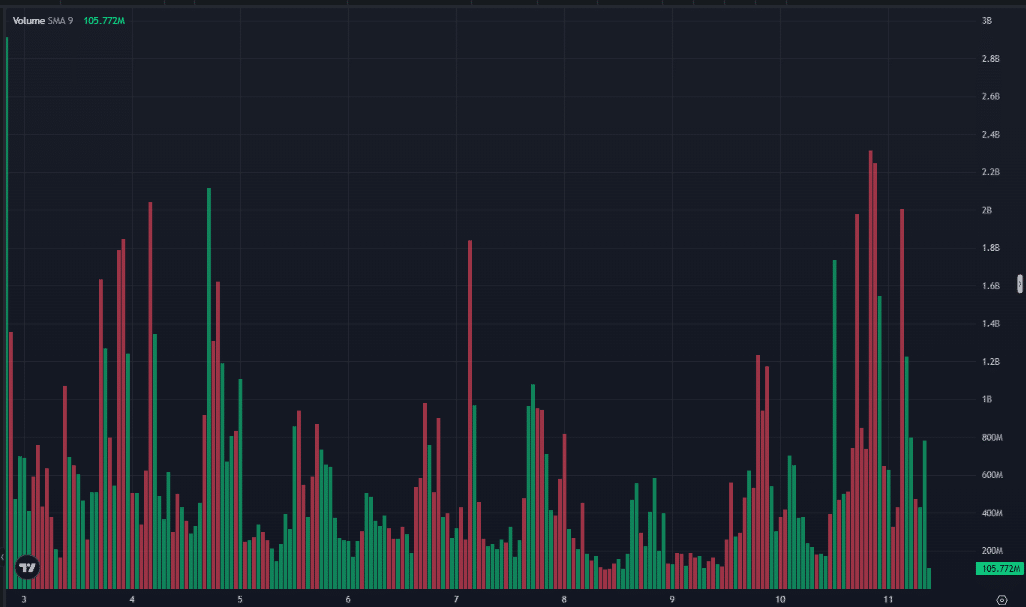

ETH -Market implications

ETH Whole Netflow skilled a optimistic shift within the final 24 hours, with a +3.75k ETH change. Nevertheless, wider tendencies revealed a fancy picture.

Previously three months, Netflows had been on common -430.58k ETH, signaling of persistent outskirts. March 10, 2025, noticed Netflows dip to -215.42k ETH earlier than he returned.

The 7-day Netflow change confirmed a promising +239.52k ETH, whereas the 30-day determine was on -99.69k ETH, which signifies persistent outlook.

Supply: Intotheblock

Netflows for ETH fell from December 2024 to January 2025, soil at -350k ETH. February noticed a restoration and reached a peak of +150k ETH, adopted by elevated volatility.

Latest knowledge present a low level of -250k ETH on February 20, 2025, and a excessive level of +200k ETH on 5 March 2025. The final 24 -hour answer signifies quick -term accumulation.

If 7-day Netflows stay optimistic, ETH can proceed its upward development. Nevertheless, the 30-day downward development suggests broader worthwhile dangers. Persistent influx can help additional worth income, whereas renewed outsource may cause the weak point of the worth.

ETH’s market previews is dependent upon the interaction between Walvissing, sensible cash exercise and liquidity modifications.

Within the final 24 hours, whales and SDT had been internet patrons, which reinforce bullish sentiment, whereas the gross sales stress of SM had minimal impression.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024