Ethereum

Ethereum might decline further in short-term: How and why?

Credit : ambcrypto.com

- ETH appeared to kind an inverse head-and-shoulders sample, which frequently precedes important upward motion.

- Promoting strain elevated steadily, presumably delaying any worth restoration.

The previous month has Ethereum [ETH] has struggled and misplaced 12.08% of its worth. Though the inventory briefly rebounded final week with a 2.69% acquire, this momentum seems to be fading.

The mixture of chart patterns and present market sentiment – highlighted by a spike in ETH inflows on exchanges – means that the latest 0.35% decline over the previous 24 hours might prolong additional.

A bullish sample emerges, however…

In accordance with analyst Ali Charts, Ethereum is forming an inverse head-and-shoulders sample on the day by day chart. This sample consists of a left shoulder, a head and a proper shoulder.

The inverted heads and shoulders are a basic bullish sample. It sometimes signifies a chronic interval of worth consolidation earlier than important upward motion happens.

ETH is at present creating the appropriate shoulder of the sample. This displays the left shoulder, with the worth trending downward alongside a downward pattern. If this trajectory continues, ETH might fall additional in the direction of the $2,800 area.

At this stage, it could actually consolidate for as much as 37 days, similar to the left shoulder, earlier than breaking the descending resistance line.

Supply: TradingView

A profitable completion of this sample could lead on ETH to its first main resistance zone between $3,850 and $4,100. Moreover, ETH might goal for a brand new all-time excessive, presumably above the $6,750 mark, as indicated on the chart.

AMBCrypto additionally famous that present market sentiment signifies that ETH’s near-term draw back threat stays excessive.

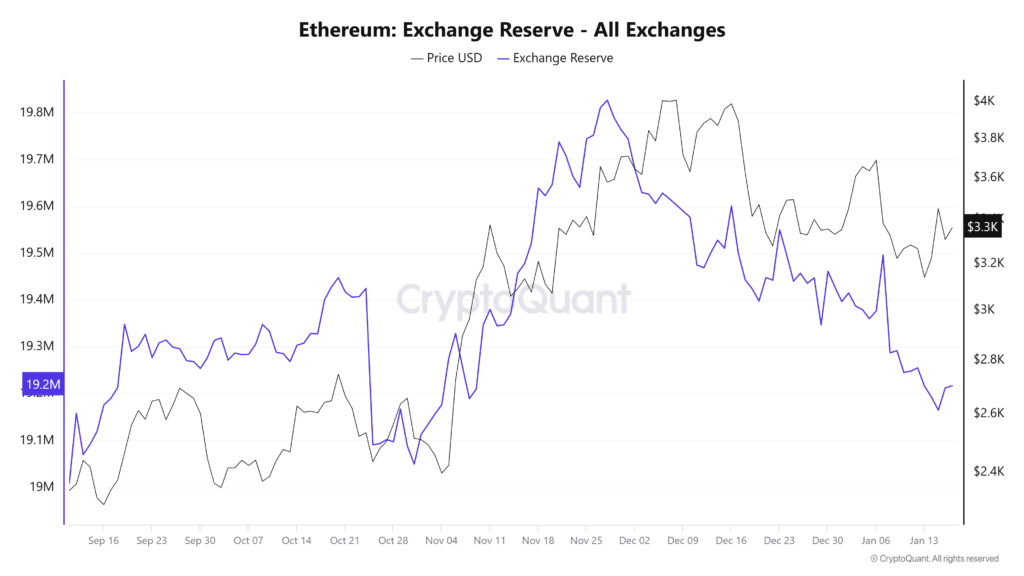

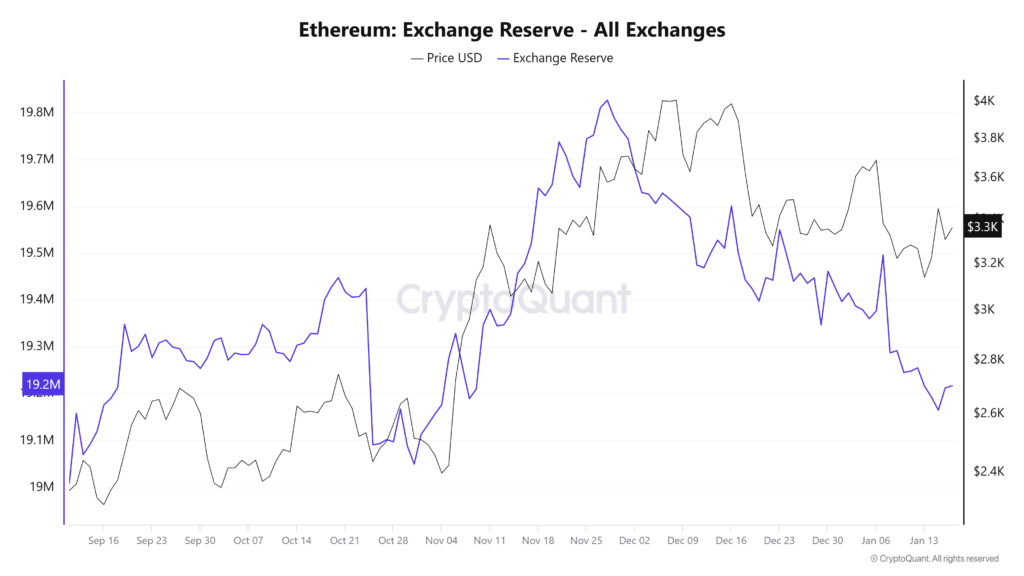

The rising forex provide might trigger ETH’s decline

The availability of ETH on cryptocurrency exchanges has steadily elevated, elevating considerations about potential worth strain.

On January 15, the quantity of ETH held on exchanges grew considerably, from roughly 19,164,848 to 19,214,253 ETH on the time of writing – a rise of 49,405 ETH.

Supply: CryptoQuant

Such a rise in belongings held on the inventory change often implies rising promoting strain. Merchants could also be making ready to lose their belongings.

Change web circulation knowledge, which monitor the steadiness of inflows and outflows on the exchanges, help this outlook.

Over the previous 24 hours, ETH recorded a constructive web circulation of roughly 47,761 ETH. This pattern signifies a probable enhance out there sell-off, probably driving the worth of ETH decrease.

If promoting strain continues, ETH might fall in the direction of the $2,800 area, as evidenced by latest chart patterns.

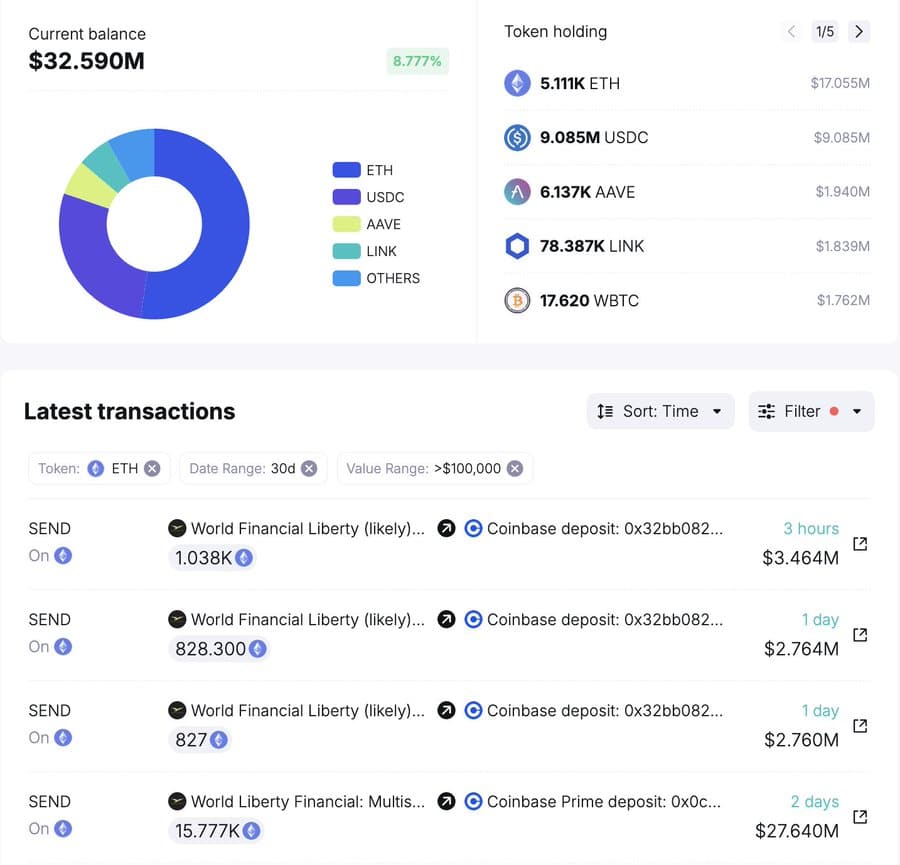

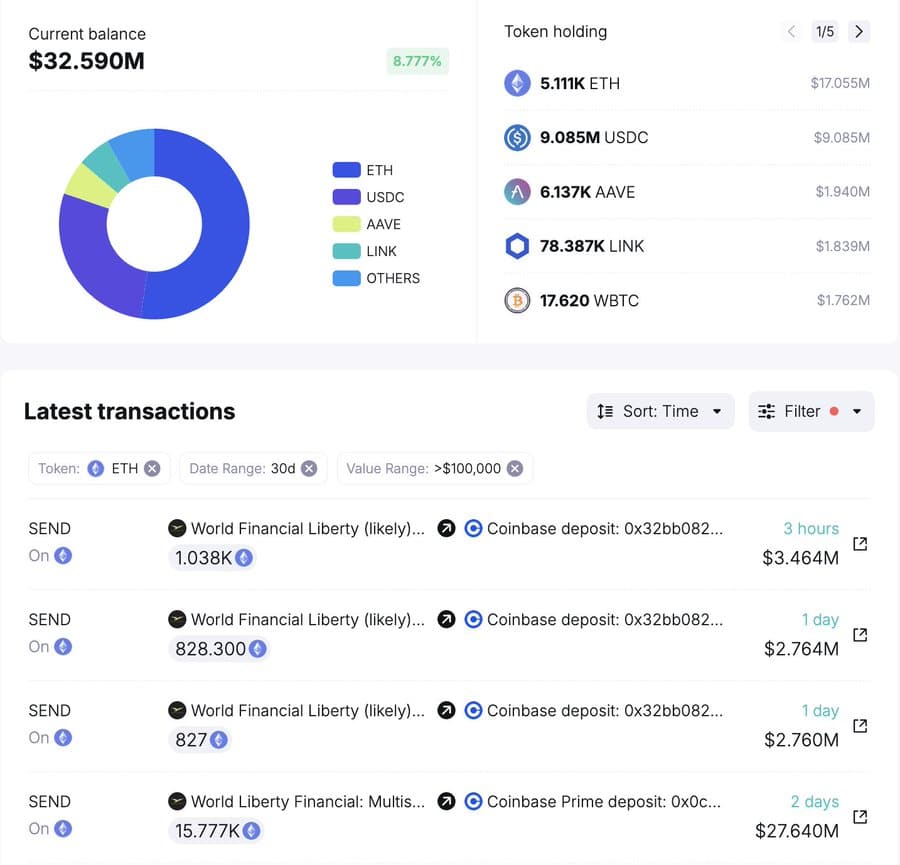

Institutional gross sales create additional strain

Institutional buyers have contributed to the rising promoting strain on ETH, with World Liberty Finance main the best way by transferring a major quantity of Ethereum to exchanges.

In its newest exercise, World Liberty Finance moved 1,038 ETH – value $3.44 million – to Coinbase, lowering its complete ETH holdings to five,111 ETH, value roughly $17.21 million.

Supply: SpotOnChain

Learn Ethereum’s [ETH] Worth forecast 2025–2026

This follows a bigger transaction over the previous two days, the place the identical establishment deposited 18,536 ETH into Coinbase. The cumulative transfers underscored a possible sell-off technique, which if executed might intensify downward strain on ETH’s worth.

As establishments modify their positions and market sentiment stays fragile, ETH’s worth may even see additional declines within the close to time period.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024