Ethereum

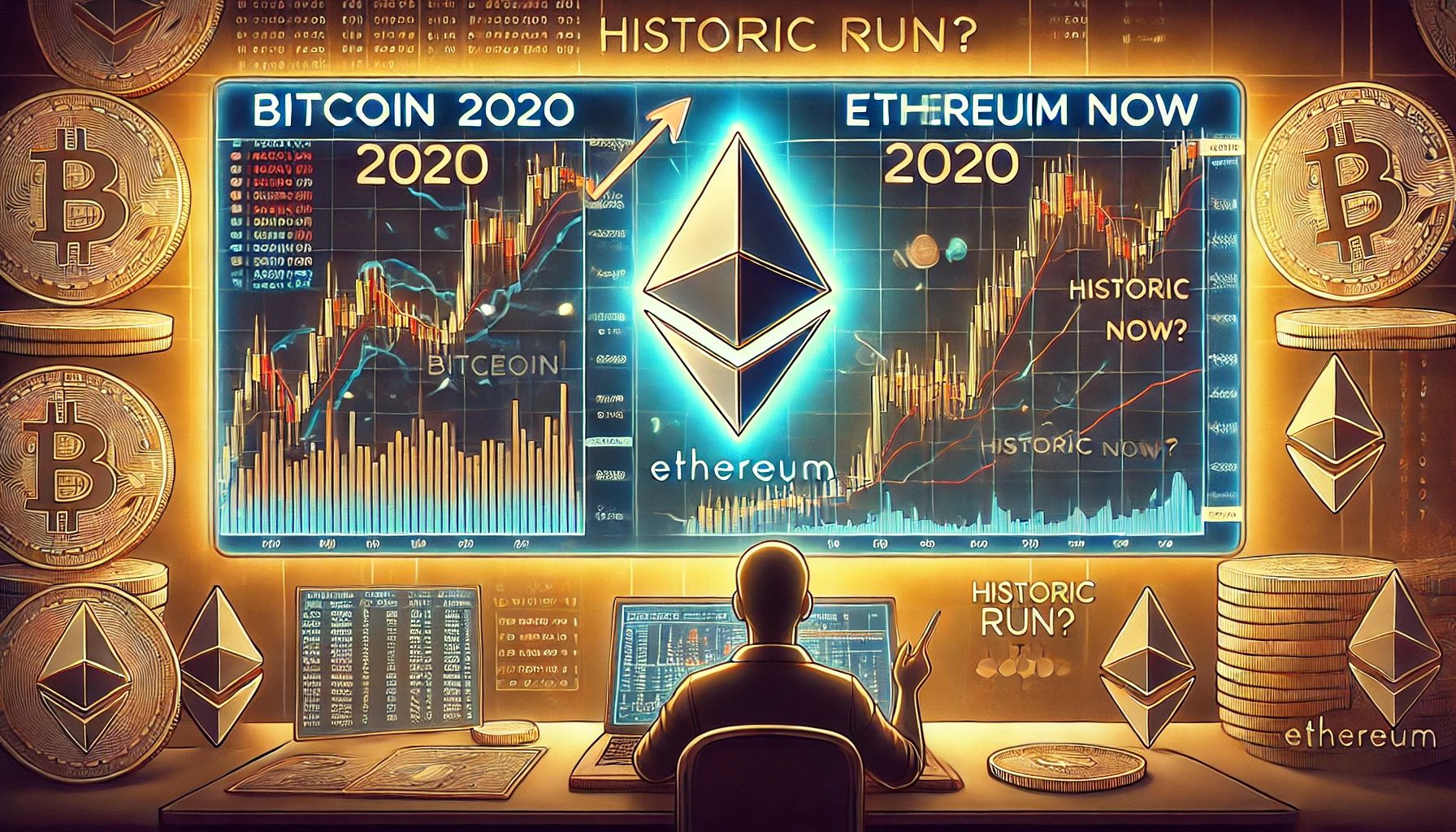

Ethereum Mirrors Bitcoin 2020 Breakout Setup – Historic Run Incoming?

Credit : www.newsbtc.com

Purpose to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by consultants from the trade and punctiliously assessed

The very best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Ethereum is traded at vital ranges after he had crossed the $ 2,500 marking earlier this quarter, now the momentum is making an attempt to reclaim and push it into the next resistance. Regardless of the worldwide macro -economic stress – together with the rising yields of the American treasury and protracted commerce tensions between the US and China – continues to show ETH. Market analysts are of the opinion that Ethereum may result in a protracted -awaited altical season, offered that it has vital ranges and breaks above the present vary.

Associated lecture

Prime Analyst TED cushions just lately pointed to a compelling technical sample: Ethereum has now posted 4 consecutive inexperienced candles of two weeks, a formation that displays at first of 2020 after the Bitcoin crash. That interval marked the beginning of Bitcoin’s legendary bull’s run to $ 69,000.

In keeping with cushions, the similarities between BTC in 2020 and ETH in 2025 are “simply shocked”, which causes renewed curiosity from merchants who see the present consolidation of Ethereum as a bullish continuation. With investor sentiment slowly recovering and technicalities turning into favorable, the market retains an in depth eye on ETH. If historical past is a information, this consolidation can mark calmness earlier than the subsequent giant leg greater from Ethereum. Nevertheless, macro dangers nonetheless stay and the timing might be essential.

Ethereum Resilience Sparks Hope on 2020-like rally

Ethereum holds robust above the extent of $ 2,600 and reveals resilience within the midst of worldwide macro -uncertainty and unstable market situations. This consolidation on vital help has many traders and analysts who anticipate an outbreak that might lead Ethereum to a brand new rally section, which can activate a wider altospair season. Regardless of the rising concern about systemic threat of the bond market and geopolitical tensions between the US and China, Ethereum continues to draw patrons, which signifies confidence in his power in the long run.

Analysts hold an in depth eye on this attain. Many consider that if Ethereum can keep the help and keep resistance within the brief time period, this will get a severe momentum. One of many extra compelling arguments for one Bullish Outlook Comes from TED cushions, which emphasizes a hanging parable between the present construction of Ethereum and the habits of Bitcoin in 2020.

In keeping with pillows, Ethereum has now printed 4 consecutive inexperienced candles of two weeks for the reason that soil, similar to Bitcoin did after the March 2020 crash. That sample marked the beginning of the legendary run from BTC to $ 69,000. The comparability has led to optimism that ETH could also be getting ready for the same outbreak, particularly if it knew resistance within the neighborhood of $ 2,700 – $ 2,800.

Though the macroom surroundings stays tense, this technical construction – accompanied by rising confidence within the energy of ETH – hopes that Bulls hope {that a} huge step is on the horizon.

Associated lecture

ETH -Worth evaluation: Consolidation above Help

Ethereum (ETH) retains steady round $ 2,607 and consolidates simply above 34 interval EMA on the 4-hour graph, which is at the moment virtually $ 2,594. After the robust enhance at the start of Could, noticed the ETH assembly of lower than $ 2,000 to highlights close to $ 2,850, the value has been moved to a decent consolidation vary. This lateral motion displays market choices akin to patrons and sellers battle for management.

Regardless of the latest volatility, ETH continued to publish, which signifies the fixed bullish stress. The SMAs of fifty, 100 and 200 intervals are aligned below the present worth, all trending up, indicating that the broader pattern stays intact. The worth is discovering constant help from the 50-Interval SMA round $ 2,590- $ 2,600 zone, which is a crucial degree to view.

Associated lecture

A decisive break above the brief -term resistance close to $ 2,680 could be essential to verify continuation to $ 2,800 and probably check earlier highlights. Alternatively, a break beneath $ 2,590 can withdraw a withdrawal to $ 2,500 or decrease, particularly if BTC reveals weak spot.

Featured picture of Dall-E, graph of TradingView

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now