Altcoin

Ethereum monkeys are 2021 pattern – Will ETH replicate its profit?

Credit : ambcrypto.com

- Ethereum has simply began monkeys of his 2021 sample.

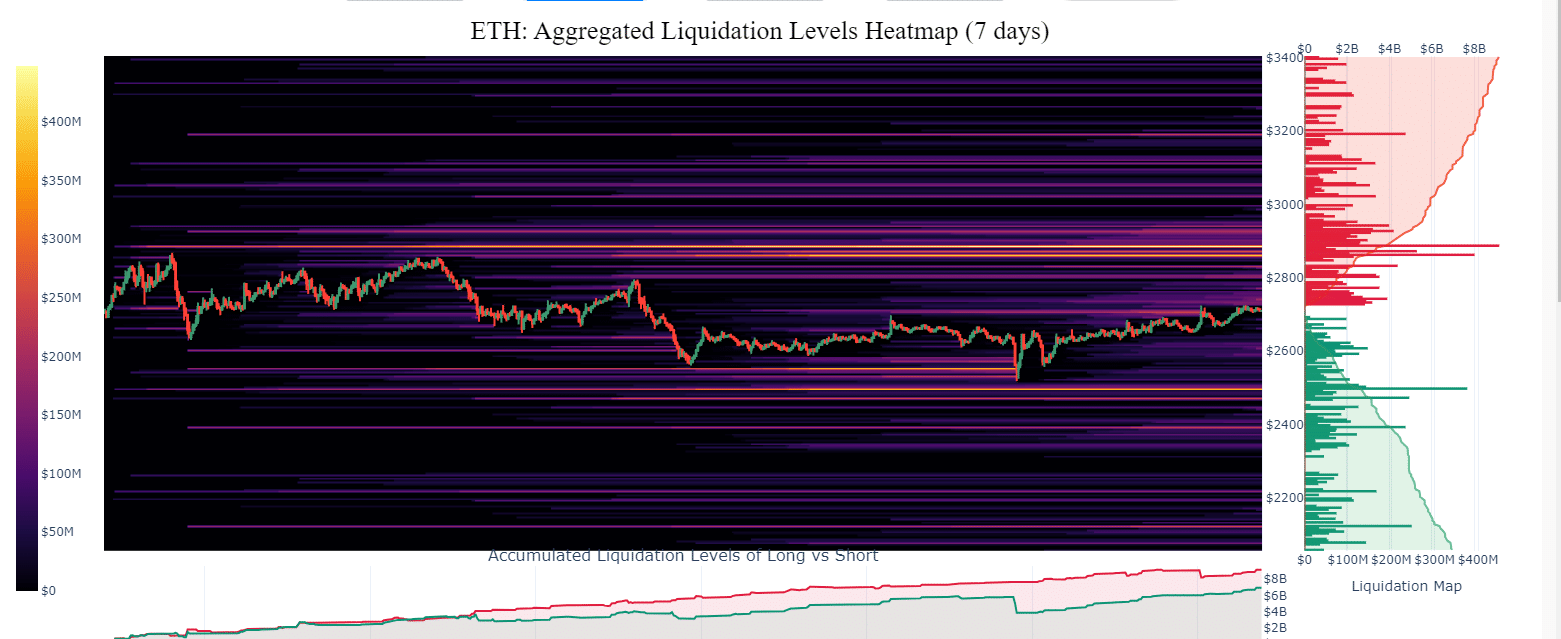

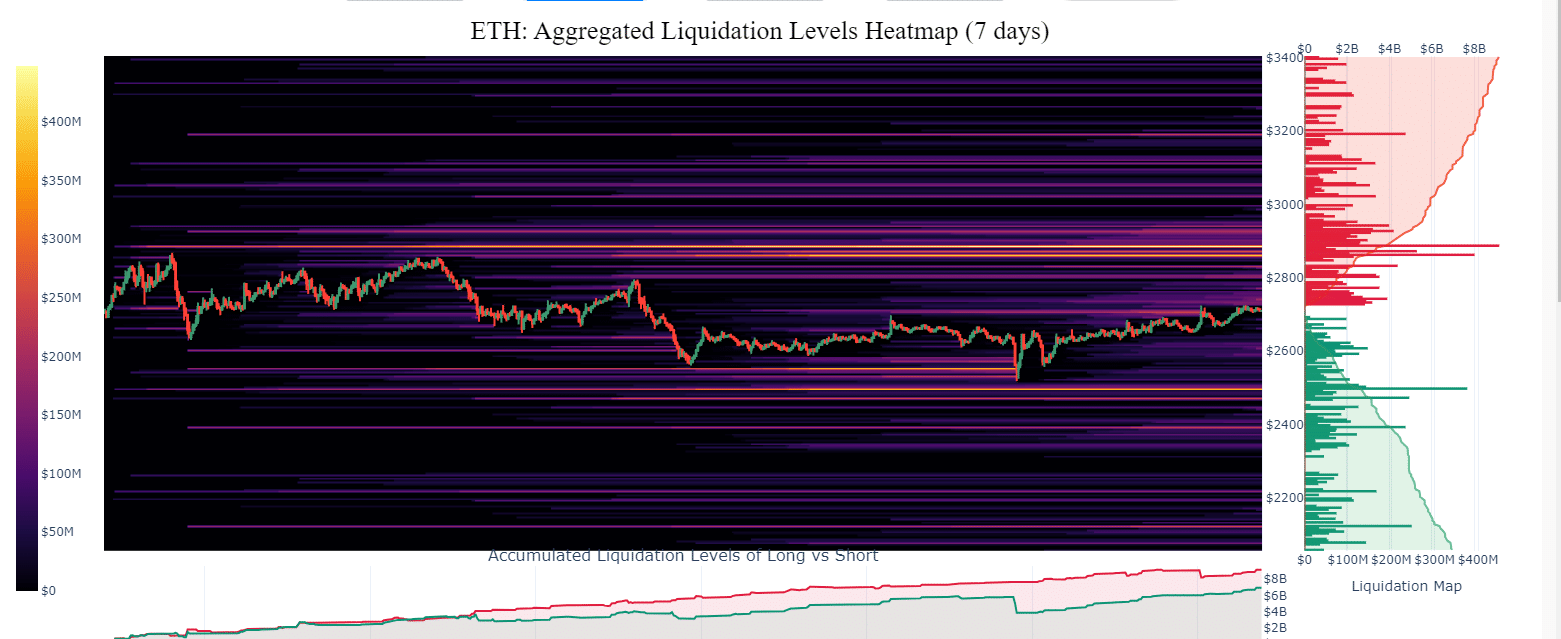

- Liquidity zones within the brief time period emerged at $ 2.8k $ 3k and $ 2.5k because the gross sales strain within the Futuresmarkt decreased.

Ethereum’s [ETH] Graphs from 2021 and 2025 revealed a seductive story for potential future value motion. In 2021, ETH skilled an explosive rise, climbing of sub-$ 500 ranges to a peak round $ 4,500.

This meteorical rise was characterised by a major outbreak after a consolidation interval that began on the finish of 2020.

Quick-Ahead till 2025, and the sample is comparable, with ETH at present floating round $ 2,000 after a outstanding fall of upper ranges.

The climb of 2021 began after ETH had supported $ 500, which led to a rise in buying strain and bullish sentiment, which finally pushed the costs to new highlights.

In 2025, ETH demonstrated resilience at an essential stage of assist above $ 2500, with the early phases of the 2021 route reflecting. If ETH follows the same path, this might replicate from the previous, which can obtain $ 26,000 by the top of 2026.

Supply: X

Conversely, if Ethereum doesn’t preserve the assist of $ 2,000, this may increasingly point out a weakening of the client’s momentum, probably which ends up in additional decreases.

Traders should take into account each the potential for a bullish replication from 2021 and the potential for steady decline that may forestall the same end result.

Everlasting holders improve as gross sales strain decreases

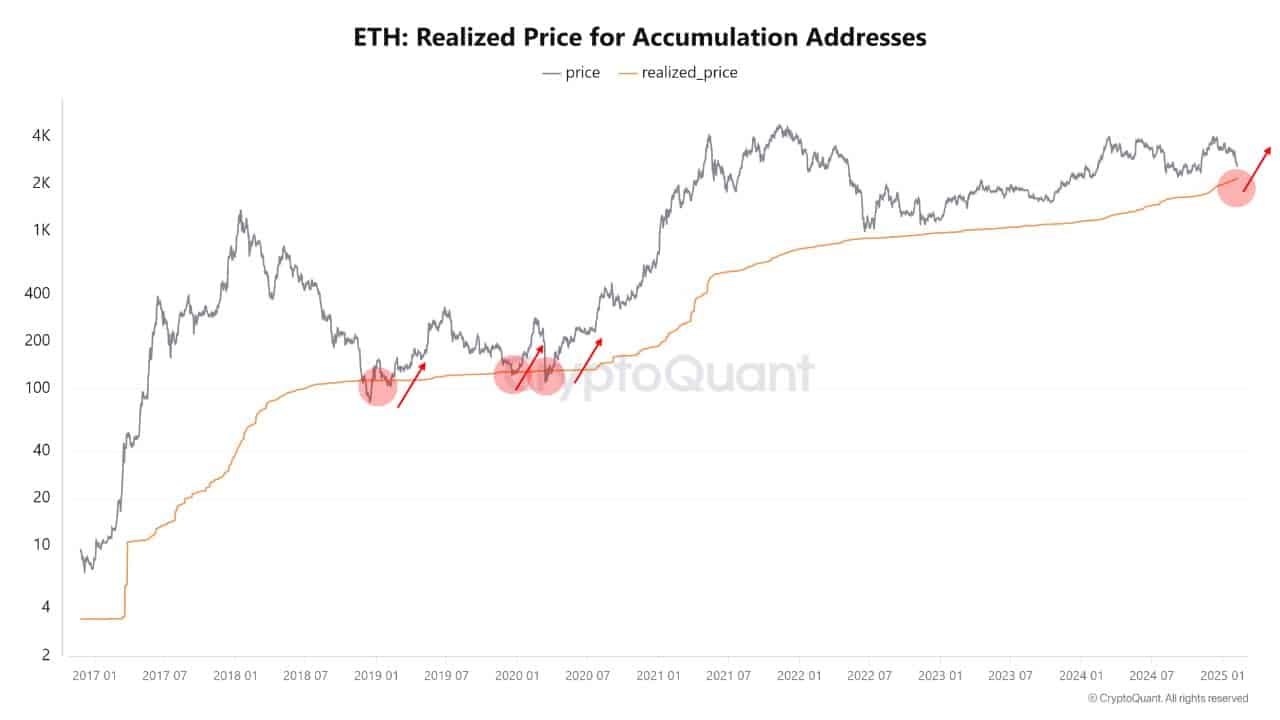

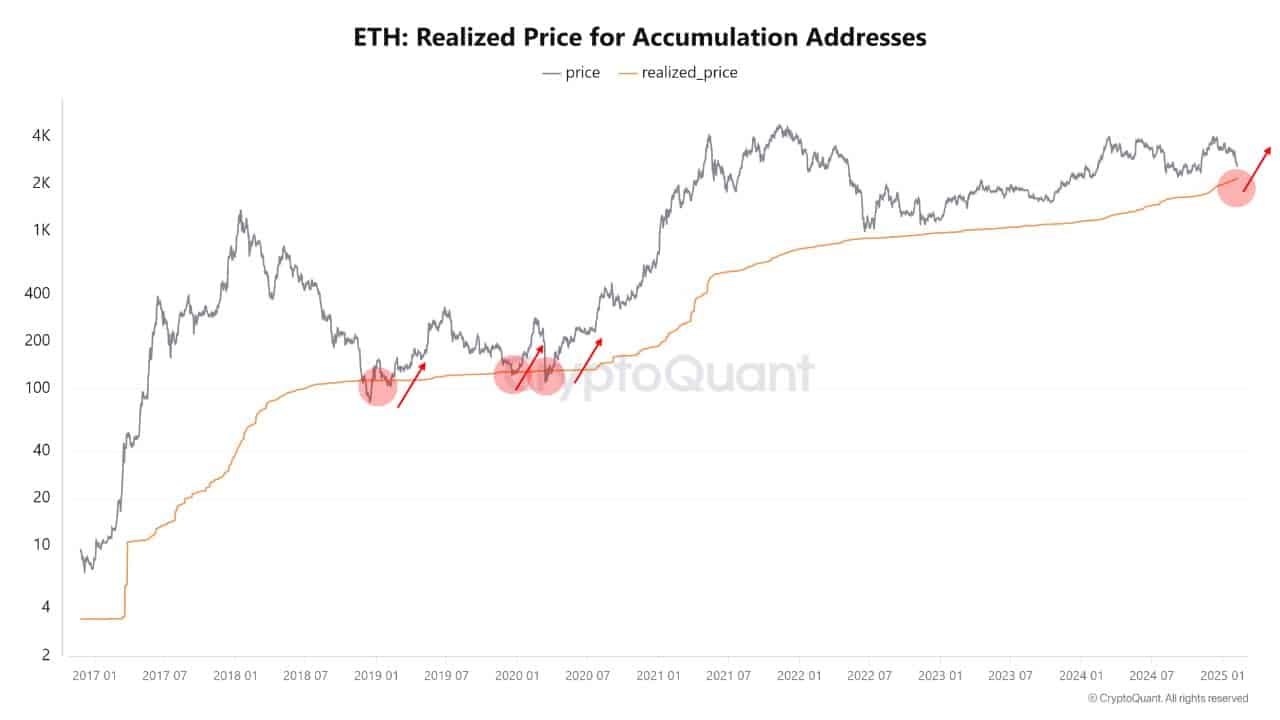

With the potential of ETH to duplicate its 2021 wins, the realized value of $ 2.2k is way beneath the market value of $ 2.6k, indicating undervaluation with the realized value that acts as robust assist.

The MVRV ratio barely above 1 additional emphasizes the potential for appreciation.

Progress in quantity of everlasting holders who’ve purchased and have by no means bought ETH, will increase quickly, The traits of Bitcoin replicate, which means that resilience in opposition to the sale of strain from leaving whales.

Supply: Cryptuquant

As well as, a diminished gross sales strain within the Ethereum Futuresmarkt, in comparison with earlier highlights when EHH $ 4K reached, gave sustainable buy curiosity regardless of value falls.

These collectively counsel that ETH might probably replicate its improve prior to now, though the outcomes depend upon the present market sentiment and stability.

Ethereum’s brief -term liquidity zones

The Ethereum Liquuidity Heatmap indicated that the $ 2.5k to $ 3K zones are essential for each assist and resistance.

Traditionally, these ranges have both pushed up ETH with assist or coated earnings when appearing as a resistance.

The focus of liquidations between ranges, $ 2800 to $ 3000, instructed that this attain was essential for the brief -term actions of ETH.

Supply: X

A secure maintain above $ 3K might replicate the 2021 improve, whereas falling from beneath $ 2.5k can undermine the bullish momentum.

This dynamic have to be shut monitoring as a result of they’ll dictate the flexibility of Ethereum to reflect from the previous or mirror them.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024