Ethereum

Ethereum MVRV Ratio Nears 160-Day MA Crossover – Accumulation Trend Ahead?

Credit : www.newsbtc.com

Motive to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by specialists from the trade and punctiliously assessed

The very best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Ethereum is once more below heavy gross sales strain after shedding the crucial degree of $ 2,000 – a psychological and technical zone that Bulls has had hassle defending in current weeks. With value motion that’s changing into increasingly Bearish, the investor sentiment weakens and analysts warn {that a} deeper correction might be on the horizon. As Ethereum glides decrease, the troubles in regards to the wider crypto market develop, which regularly will depend on the facility of ETH to guide restoration phases.

Associated lecture

The present state of affairs is each tense and delicate. The shortcoming of Ethereum to take care of necessary help ranges has rattled quick -term holders and is now testing the willpower of lengthy -term buyers. Many now look carefully at indicators of stabilization or contemporary accumulation.

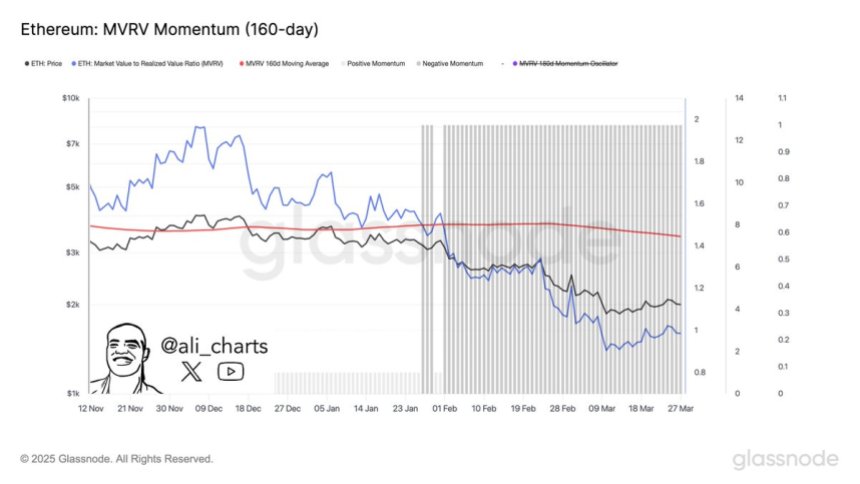

A promising sign on the chain comes from the MVRV meter of Glassnode (market worth to realized worth). Traditionally, a crossover of the MVRV ratio above its 160-day on common common has the beginning of robust Ethereum accumulation zones marked, typically previous to vital value rebounds. That sign is now approaching once more, and if confirmed, it may possibly provide a glimmer of hope that ready for a shift in Momentum. Till then, Ethereum will stay in a fragile state.

Ethereum is confronted with a crucial breakdown as the buildup sign approaches

Ethereum is now in a crucial place, the place Bulls proceed to lose management whereas a very powerful help ranges break one after the other. The gross sales strain has been intensified in current weeks, and the ETH additional dragged to a protracted -term downward development that began on the finish of December. Macro -economic uncertainty, rising rates of interest and elevated world tensions proceed to create a hostile atmosphere for danger belongings – and the cryptomarkt has felt the affect essentially the most critically.

Ethereum 55% is at the moment being traded below its native peak of $ 4,100, earlier this cycle is reached. The sharp decline has shaken the belief of buyers and the fixed demolition within the value construction leaves little room for errors. With out a fast restoration and robust protection of help zones, Ethereum dangers additional down, the place analysts warn of steady weak point resembling sentiment doesn’t shift rapidly.

Within the midst of the decline, some analysts pay shut consideration to indicators of a possible soil. Prime analyst Ali Martinez shared one Important insight into XPointing to the MVRV ratio (market worth and realized worth) as a dependable indicator of accumulation zones. In keeping with Martinez, when the MVRV ratio crosses above its 160-day advancing common, it has historically been extremely accumulative phases on which buyers begin to quietly place for the subsequent leg in the long run.

This crossover has not occurred but, however it’s approaching. If confirmed, this will point out that Ethereum enters a high-quality zone regardless of the present Bearish circumstances. Though the market stays fragile, such statistics within the chain provide a spark of hope that accumulation is stopping gang-even if a value motion stays on the floor. Bulls has to behave rapidly to reverse the development, however for now the prospects of Ethereum stay sharp.

Associated lecture

Bulls defend essential help of $ 1,800

Ethereum acts at $ 1,830 after a pointy fall of 14% since final Monday, which is a mirrored image of renewed gross sales strain within the cryptomarkt. The steep decline has pushed ETH to a crucial degree of help at $ 1,800-one zone that now stands as a should for bulls. This degree has traditionally seen as a robust pivot level and shedding it may possibly trigger a deeper correction.

If ETH doesn’t exceed $ 1,800, the subsequent necessary help is near the $ 1500 zone, which might mark a dramatic shift available in the market construction and doubtless speed up the Bearish sentiment. A breakdown to this degree would erase a big a part of the income of the 12 months and trigger a critical blow to the belief of buyers.

Nonetheless, if Bulls achieve efficiently defending $ 1,800, a rebound may observe, in order that ETH could also be above $ 2,000. Reclaiming this psychological degree would assist to revive the momentum and open the door for a broader restoration.

Associated lecture

Within the coming days will likely be essential for the within the quick time period of Ethereum. With macro -economic uncertainty that’s nonetheless looming, Bulls need to intervene with conviction – as a result of if $ 1,800 breaks, the autumn might be quick and steep.

Featured picture of Dall-E, graph of TradingView

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024