Ethereum

Ethereum OG Drives $500M Liquidity Flow Into ConcreteXYZ & Stable Vaults – Details

Credit : www.newsbtc.com

Ethereum is struggling to interrupt above the $4,000 degree as market sentiment stays unsure and volatility retains traders cautious. Regardless of a number of makes an attempt, the bulls have failed to take care of momentum, indicating hesitation at key resistance ranges. Nevertheless, new on-chain information is drawing consideration to doubtlessly large-scale liquidity strikes that might affect Ethereum’s subsequent path.

Associated studying

In response to Lookonchain, an Ethereum OG holding 736,316 ETH (value roughly $2.89 billion) not too long ago deposited $500 million USDT into the vaults launched by ConcreteXYZ and Secure, simply forward of their official announcement. This has aroused nice curiosity throughout the crypto group, because the transaction seems to be strategically timed and will sign preparation for main return or liquidity exercise.

ConcreteXYZ is a next-generation liquidity protocol designed to attach institutional and DeFi capital by tokenized vaults. It permits customers to allocate stablecoins and crypto property to yield-bearing methods, whereas sustaining full transparency and composability throughout the Ethereum ecosystem.

The huge deposition of the whale – previous to public unveiling – suggests potential insider positioning or high-conviction participation in these vaults. Such giant inflows typically act as early indicators of fixing liquidity dynamics, particularly when aligned with tasks on the intersection of DeFi infrastructure and institutional finance.

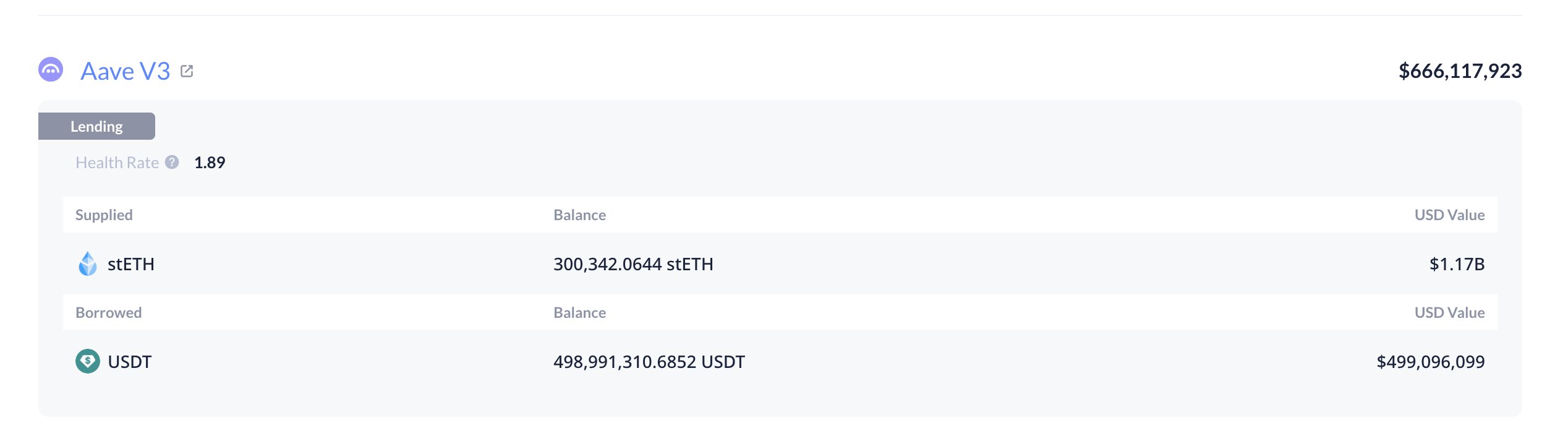

Whale dominance within the Aave and Stablecoin vaults raises strategic questions

In response to Lookonchain, the identical Ethereum OG that not too long ago interacted with ConcreteXYZ and Secure deposited 300,000 ETH in Aave and borrowed $500 million USDT. Of the whole $775 million USDT deposited into the brand new vaults, this single whale was liable for 64.5% of the whole liquidity, underscoring their dominant function on this sudden market exercise.

This transfer represents a sophisticated on-chain technique typically seen amongst skilled whales. By collateralizing ETH on Aave – one of many largest decentralized lending protocols – and borrowing USDT in opposition to it, the whale successfully unlocks liquidity with out promoting its Ethereum holdings. This permits them to commit giant quantities to yield alternatives, such because the not too long ago launched ConcreteXYZ vaults, whereas remaining uncovered to the long-term upside of ETH.

Such focus of liquidity from one entity can have a number of penalties for the broader market. On the one hand, it highlights the rising confidence amongst deep-pocketed gamers within the stability and profitability of the DeFi ecosystem. However, it raises questions on market affect and systemic dangers, given {that a} single participant accounts for such a big portion of capital inflows.

Associated studying

If this borrowed liquidity is used for yield farming or strategic positioning fairly than short-term hypothesis, it might strengthen Ethereum’s ecosystem foundations by growing DeFi exercise and on-chain engagement. Nevertheless, if market situations deteriorate and collateral values decline, liquidations can improve volatility.

Basically, this large Aave-ConcreteXYZ commerce exhibits how whales are utilizing the DeFi infrastructure to take care of dominance, optimize liquidity, and affect capital flows throughout the ecosystem – making this some of the important strikes on the chain of the quarter.

Ethereum is recovering, however is going through resistance round $4,000

Ethereum’s value is at present buying and selling round $3,964, displaying indicators of a modest restoration after latest volatility. The every day chart signifies that ETH is attempting to get well from the October lows. However stays trapped under the important thing resistance at $4,000-$4,200, the place each the 50-day and 100-day transferring averages meet. This can be a zone that usually acts as a powerful rejection zone throughout consolidation phases.

Regardless of the short-term good points, Ethereum’s broader construction nonetheless displays uncertainty. The 200-day transferring common, which is round $3,200, continues to supply sturdy dynamic assist, stopping a deeper downturn. Nevertheless, the shortcoming to interrupt above $4,000 has left the asset weak to renewed promoting stress if momentum weakens.

Associated studying

Quantity patterns point out restricted conviction amongst patrons as every rally try was met with waning power. To regain a sustainable bullish outlook, Ethereum wants a decisive shut above $4,200. This could point out a potential continuation in the direction of $4,500 and above. Conversely, failure to regain that vary might result in a retest of $3,600-$3,500.

Featured picture of ChatGPT, chart from TradingView.com

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024