Ethereum

Ethereum OI Jumps +8.2% As Traders Chase The Pump: Leverage Fueling ETH Again

Credit : www.newsbtc.com

Ethereum is displaying early indicators of restoration after a dramatic sell-off on Friday, which despatched costs all the way down to $3,450. The drop got here amid what analysts described as the biggest liquidation occasion in crypto market historical past, wiping out billions in leveraged positions on main exchanges. Whereas bulls briefly misplaced management throughout the panic, ETH has since begun to stabilize, seeing renewed shopping for curiosity close to key demand zones.

Associated studying

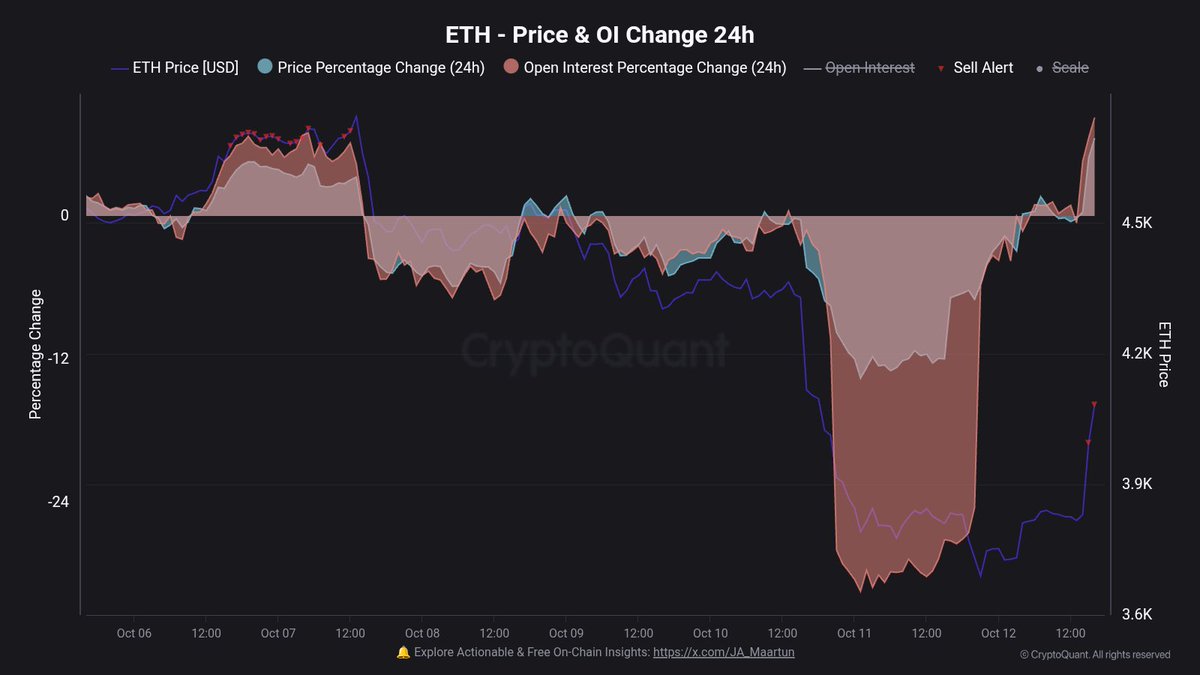

Onchain analyst Maartunn highlighted that leverage on Ethereum is rising once more, indicating that merchants are returning to the market after the reset. In response to his information, open curiosity on ETH has risen considerably over the previous 24 hours – an indication that speculative exercise is resuming as volatility subsides. This renewed leverage might set the stage for one more decisive transfer, which might both gas a near-term rebound or set off additional liquidations if the momentum fades.

The approaching days can be essential for Ethereum as bulls look to reclaim the $4,000 degree to substantiate a sustainable restoration. Market sentiment stays cautious however optimistic, with onchain information displaying main holders and establishments persevering with to build up ETH regardless of the current turbulence – a possible sign of long-term confidence within the property’ resilience.

Leverage Returns to Ethereum: A Dangerous Resurgence in Market Exercise

In response to Maartunn, Ethereum Open Curiosity is up +8.2% over the previous 24 hours – a transparent signal of leverage returning to the market. This speedy rise comes simply days after the biggest liquidation occasion in crypto historical past, the place over-indebted merchants had been worn out within the sudden crash. Now it seems many try to ‘commerce their a refund’, reigniting short-term volatility and hypothesis within the inventory markets.

Maartunn notes that whereas these so-called “revenge pumps” typically drive sturdy intraday rallies, they hardly ever keep long-term momentum. Traditionally, about 75% of comparable debt-driven recoveries are likely to reverse, resulting in new pullbacks as soon as liquidity and funding charges normalize. Solely about 25% handle to take care of a sustainable upward pattern, often supported by new spot purchases or renewed institutional inflows.

This information underlines the precarious stability Ethereum at the moment faces. The leap in Open Curiosity alerts renewed market participation, but in addition introduces the danger of a brand new wave of pressured liquidations if merchants broaden their positions an excessive amount of. For now, ETH’s short-term restoration stays largely fueled by derivatives exercise quite than spot demand.

The approaching days can be essential in figuring out Ethereum’s path. If the worth stays above $4,000 on continued quantity, it might affirm that the bulls are regaining management. Nevertheless, a sudden drop in Open Curiosity or sharp funding spikes might point out that the rally is overextended, paving the way in which for one more correction.

Associated studying

Ethereum is recovering, however resistance is looming

Ethereum is displaying a stable restoration after final week’s dramatic sell-off, which despatched costs all the way down to the $3,450 degree. The each day chart exhibits that ETH shortly recovered from the 200-day transferring common (pink line), confirming that ETH is a key demand space. The worth is now consolidating round $4,150, making an attempt to construct momentum after a powerful bullish candle on excessive quantity – a doable signal that patrons are regaining management.

Nevertheless, ETH faces instant resistance close to the $4,250-$4,300 zone, which coincides with the 50-day transferring common (blue line). This space beforehand acted as sturdy help, and regaining it could be important to substantiate a shift to a bullish construction. The 100-day transferring common (inexperienced line) is now leveling off, reflecting the market’s cautious sentiment following the large liquidation.

Associated studying

If the bulls handle to maintain value motion above $4,000, the following targets are round $4,500 and in the end $4,750. Conversely, the lack to carry the 200-day MA might open the door for a deeper retest at $3,600 or decrease. For now, Ethereum’s restoration stays technically constructive, however it wants to beat these resistance ranges to substantiate that the current restoration is greater than only a short-term response to oversold situations.

Featured picture of ChatGPT, chart from TradingView.com

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now