Ethereum

Ethereum on sale: As whales buy the dip, is a 2023-style breakout coming?

Credit : ambcrypto.com

- Ethereum displays its breakout cycle in 2023 model, with sensible cash that additional helps this risk.

- Nice headwind nonetheless needs to be confronted.

Ethereum [ETH] exhibits aggressive dip-buzzing of deep-pocket buyers.

Data on chains Confirmed that ETH portfolios of Prime-Class 130,000+ ETH gained solely as much as $ 1,781 as a prize, which signifies sensible cash absorption in a vital demand zone.

Nonetheless, with extreme provide that’s nonetheless current available on the market, the uncertainty stays. Is the present value promotion an actual outbreak, or is ETH solely a soil situated at an essential degree of help earlier than the following step?

Sensible Cash Stream – Drawing of a possible dip

A month in the past Ethereum opened $ 2,147. On the press it had fallen by 15%, in order that the vital $ 2K help was violated for the primary time in two years.

In 2023, ETH underwent a six -month consolidation section earlier than he began an outbreak, with two vital accumulative phases in This autumn, which ultimately reached a peak at $ 4,012.

Some analysts are Predict a potential repeat rallyWith the poor Q1 efficiency of Ethereum, parallels draw as a precedent for a bull’s cycle. Given each micro and macro components, this speculation appears believable.

Firstly, the dangerous sentiment pushed by the financial landfill of Trump may shift Bitcoin’s consideration, making Ethereum attainable for upward momentum.

As well as, massive influx on essential help ranges steered the beginning of a battery section, which strengthens the Bullish case for ETH.

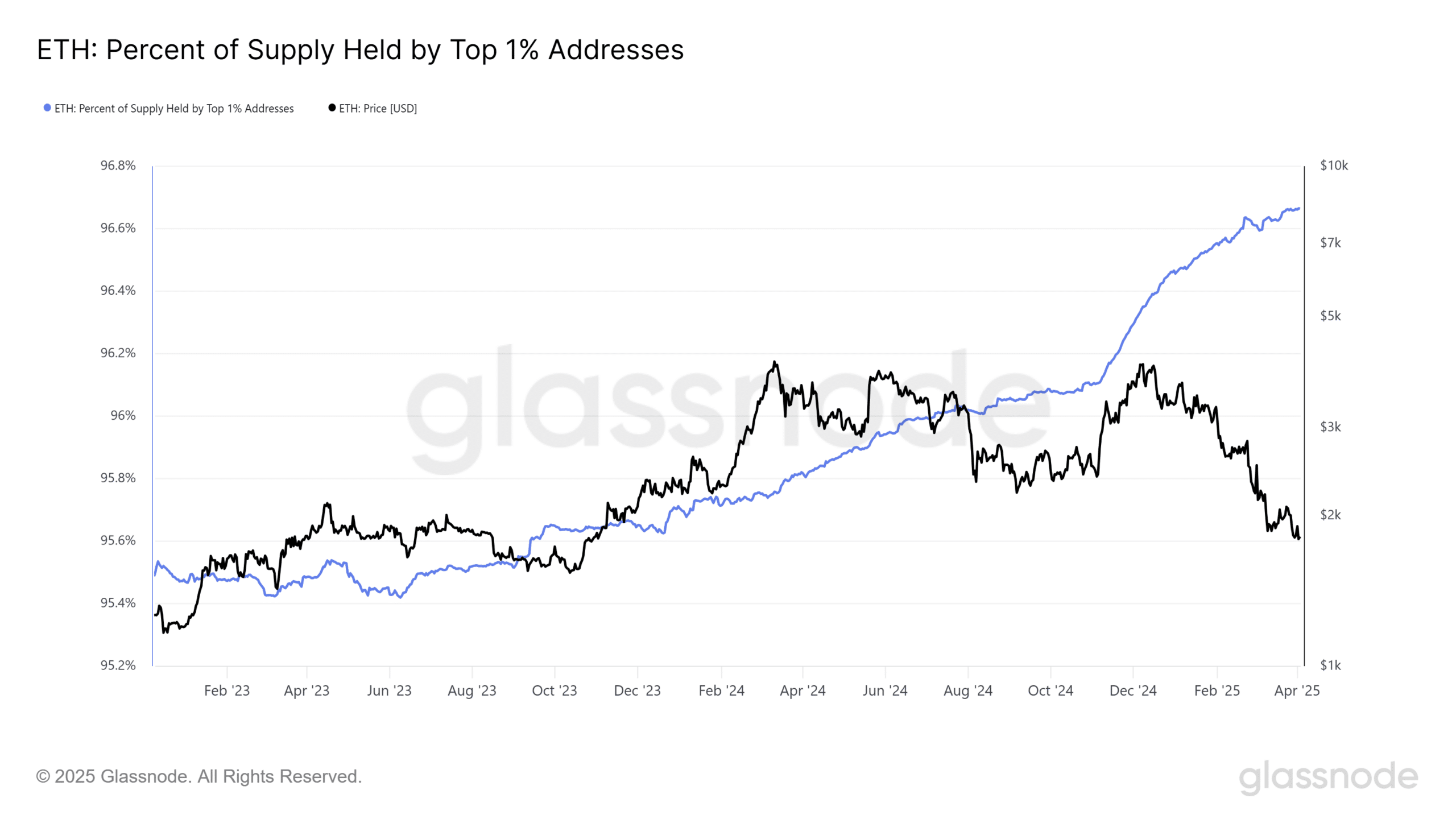

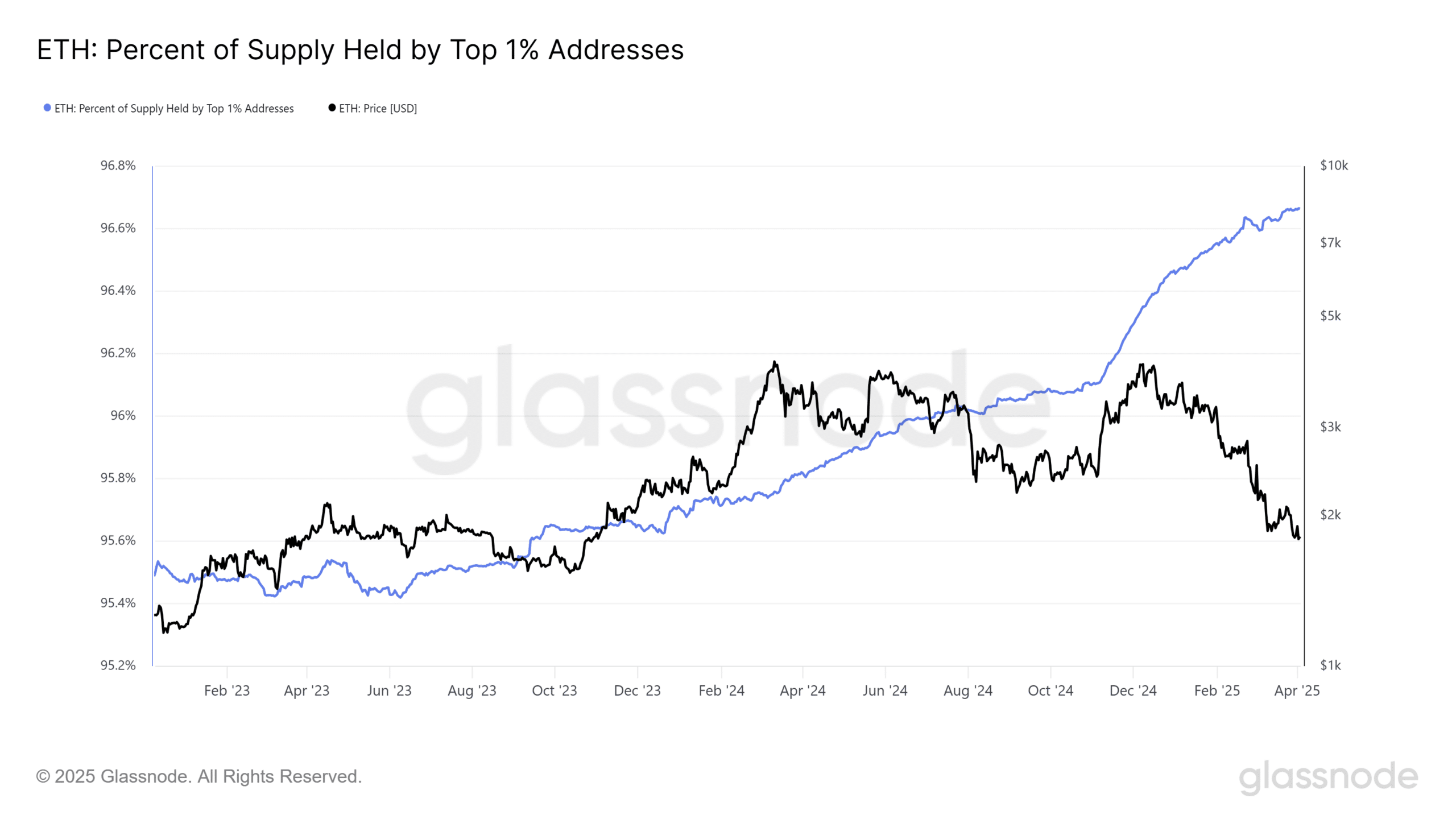

It’s exceptional that the share of Ethereum of the availability of the highest 1% addresses has risen to a file excessive, with a significantly 96.66% of the overall inventory concentrated within the arms of whale holders.

Supply: Glassnode

This focus peaked in the midst of This autumn final 12 months, coinciding with a transparent improve in whale recording, which helps the quarterly rally of the 71% of the ETH Beter than Bitcoin’s higher than that of Bitcoin [BTC] 61% in the identical interval.

Because the whale recording is resumed with ETH immersing to $ 1,780 and a bounce of two% to $ 1,830 exhibits on the press, these historic patterns and accumulation developments strengthen the enterprise for this as a possible market base.

May Ethereum place itself for a possible market takeover if Q2 unfolds?

Ethereum’s alternatives for a repeated rally

In distinction to 2 years in the past, the market situations have turn into extra unstable. That is illustrated by the ETH/BTC purple, which has fallen to a low-five-year low.

Bitcoin’s resilience within the midst of market turbulence has put down on Ethereum, which contributes to the weak Q1 efficiency.

The dominance of Ethereum, which saved steady in double digits in 2023 and within the first quarter of 2025, has now fallen sharply to a file layer of solely 8%.

Supply: Coinmarketcap

Whereas whale exercise performed an important function in Eth’s breakout as much as $ 4K earlier, the simultaneous peak within the ETH/BTC pair capital rotation as key issue emphasizes.

Buyers, away from the dangerous/dangerous profile of Bitcoin, have led capital in Ethereum and added Bullish Momentum to its rally.

Nonetheless, this dynamic is dramatically shifted. The dominance of Bitcoin has risen to a highest peak of 4 years and breaks 61%, inflicting the relative outperformance of Ethereum to suffocate.

Except this shift reverses, the prospect of a repeated rally stays associated to 2023.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024