Ethereum

Ethereum open interest, RSI hit multi-month high – Is $3,000 near?

Credit : ambcrypto.com

- Ethereum has hit an eight-week excessive because the RSI exhibits a rise in shopping for strain.

- The $14 billion open curiosity exhibits elevated market participation by derivatives merchants.

Ethereum [ETH] buying and selling at an 8-week excessive of $2,735 on the time of writing, after gaining nearly 4% in 24 hours. In line with CoinMarketCapbuying and selling volumes have elevated by greater than 100%, indicating rising market curiosity.

The achieve noticed ETH report the best variety of brief liquidations within the crypto market. On the time of writing, over $23 million value of ETH shorts had been worn out Mint glass.

A excessive variety of brief liquidations is a bullish signal because it signifies that brief sellers are turning into patrons to shut out their positions. A have a look at Ethereum’s one-day chart means that these bullish tendencies might proceed.

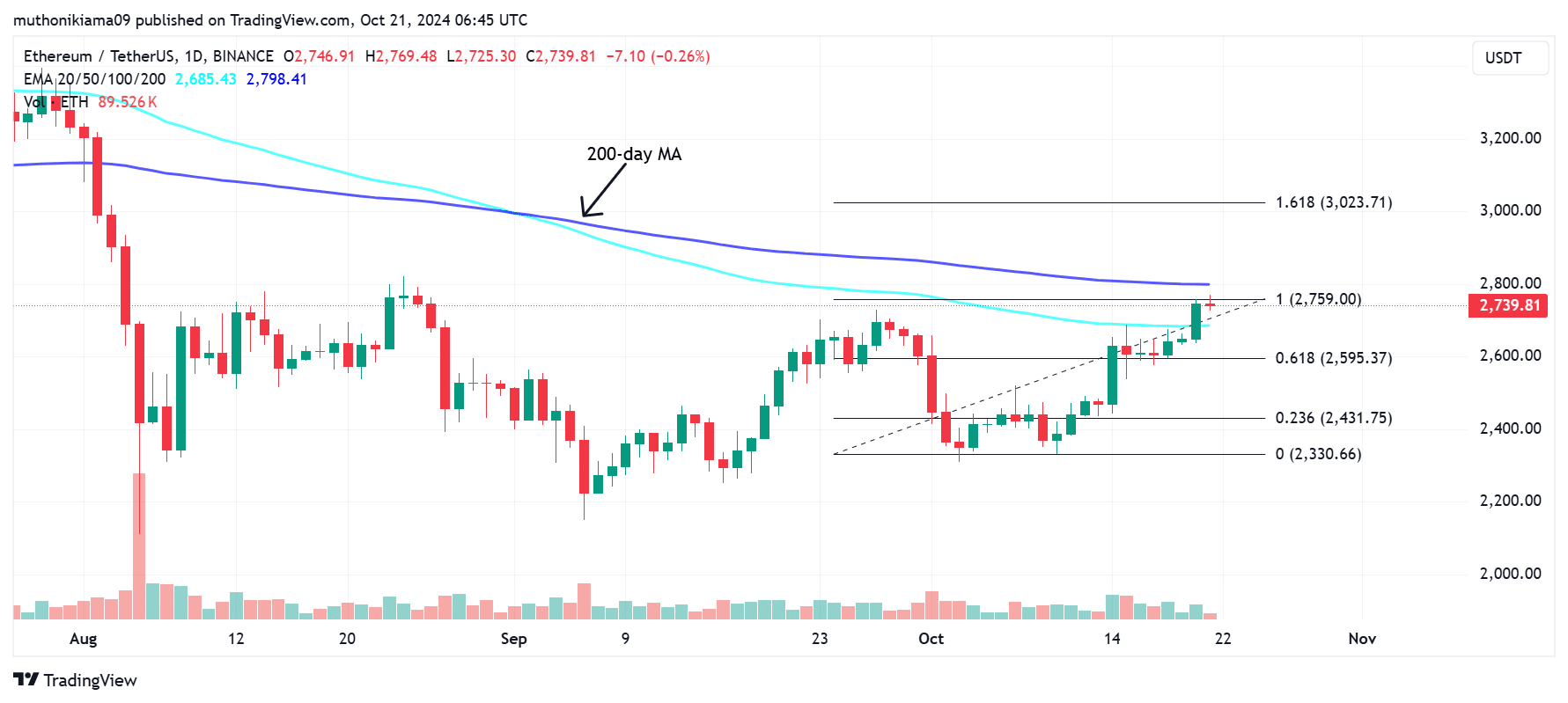

Ethereum is exhibiting bullish indicators

ETH reversed the 100-day exponential shifting common (EMA) to $2,685 because the uptrend gained momentum. The uptrend later confronted resistance as ETH approached the 200-day EMA.

The 200-day EMA, which is at present round $2,800, is a psychological stage for merchants. If ETH makes a decisive break above this resistance, the altcoin may have entered a long-term bullish development, which might see it rise to the 1.618 Fibonacci stage above $3,000.

Supply: Tradingview

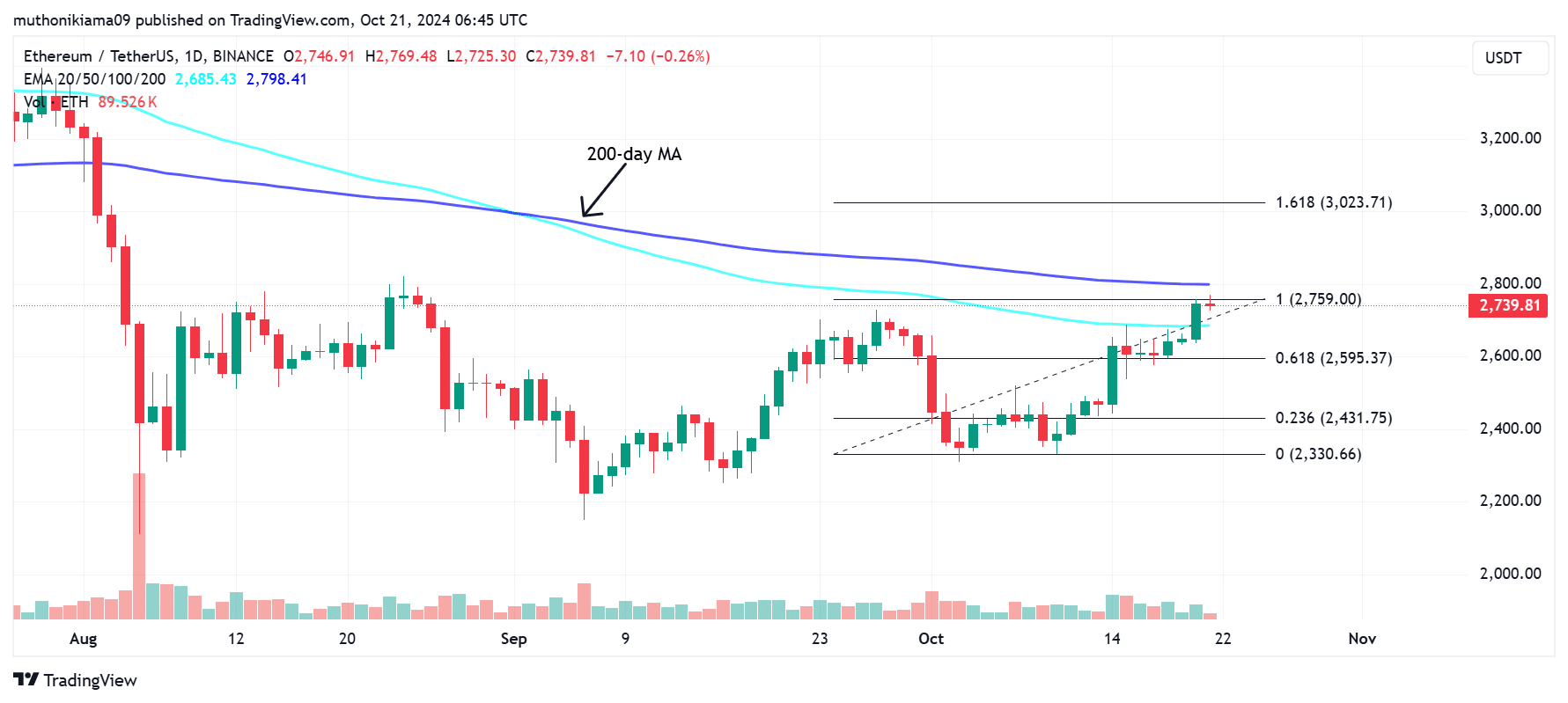

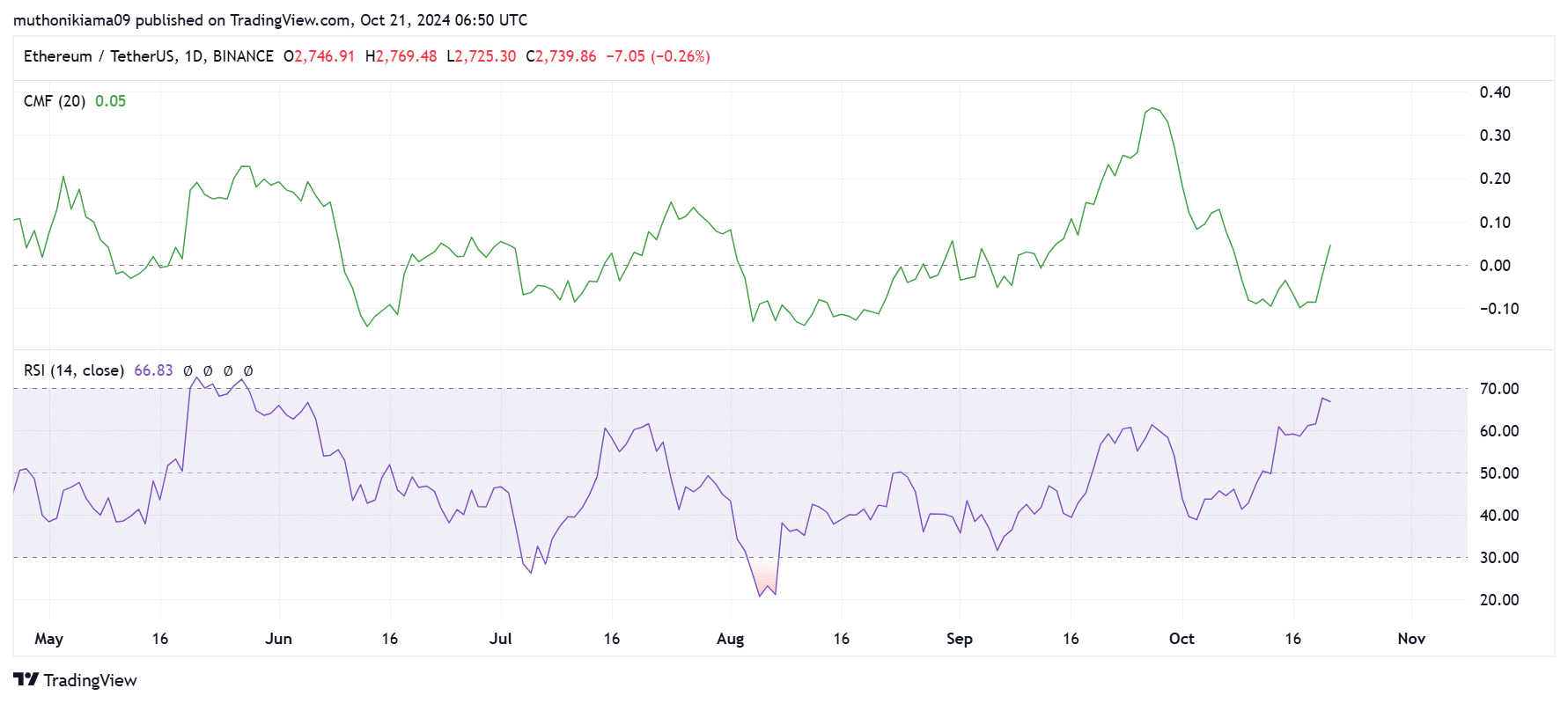

Technical indicators recommend {that a} break above the 200-day EMA is probably going. The Chaikin Cash Movement (CMF) has turned constructive for the primary time in nearly two weeks, exhibiting that extra capital is flowing into ETH.

Moreover, the Relative Energy Index (RSI) has reached increased highs and reached its highest stage since June, indicating excessive shopping for strain.

Supply: Tradingview

Regardless of an inflow of patrons, Ethereum’s RSI at 66 exhibits it’s not overbought. This means that there’s room for development.

Open curiosity and leverage ratio spikes

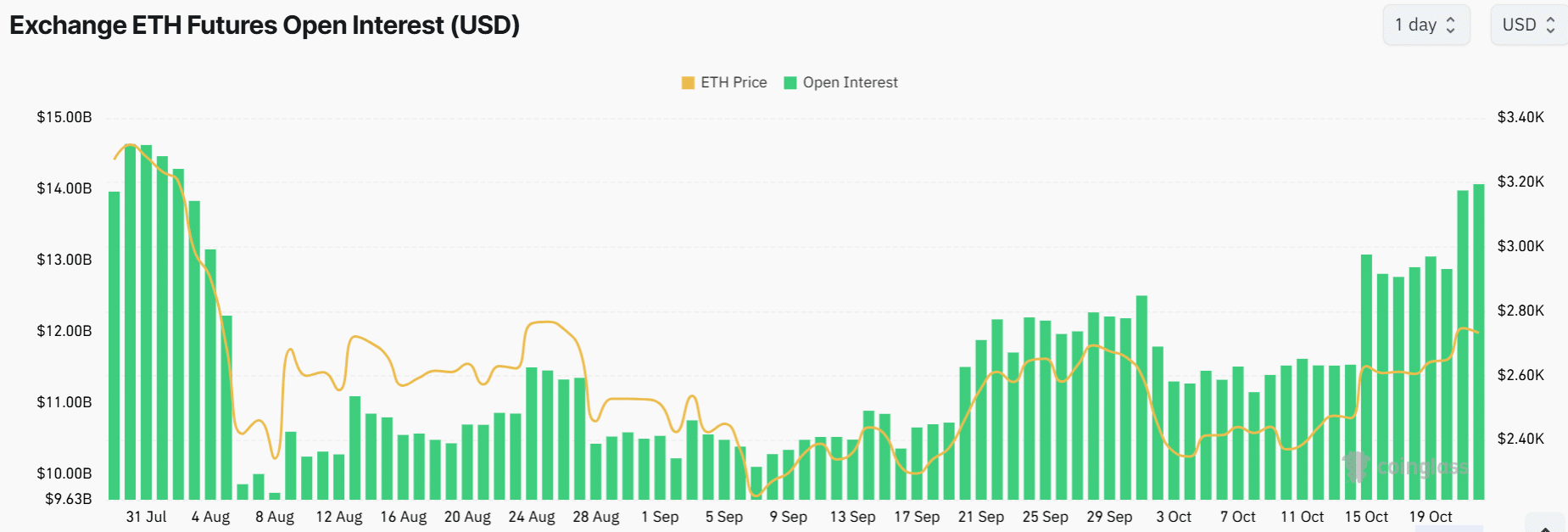

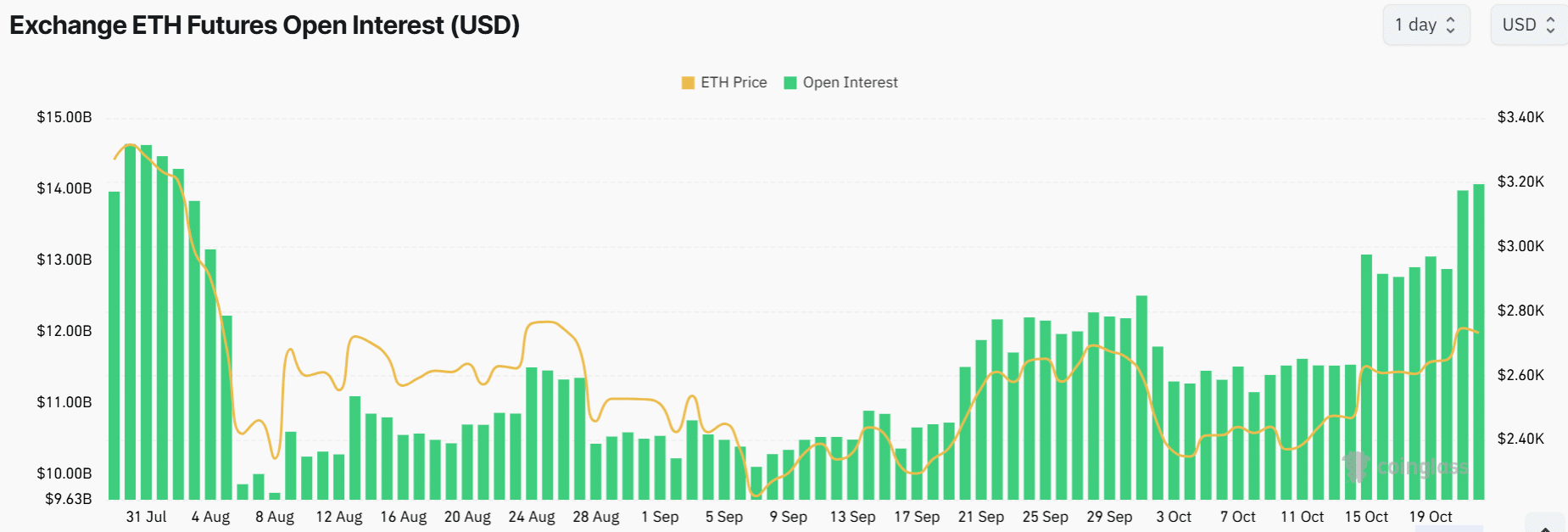

Ethereum open curiosity has risen to its highest stage since August, as proven by knowledge from Coinglass. This metric stood at $14 billion on the time of writing, indicating numerous market individuals and capital are flowing into ETH.

Supply: Coinglass

An increase in open curiosity is normally bullish when merchants open lengthy positions. Nonetheless, this improve also can result in worth volatility.

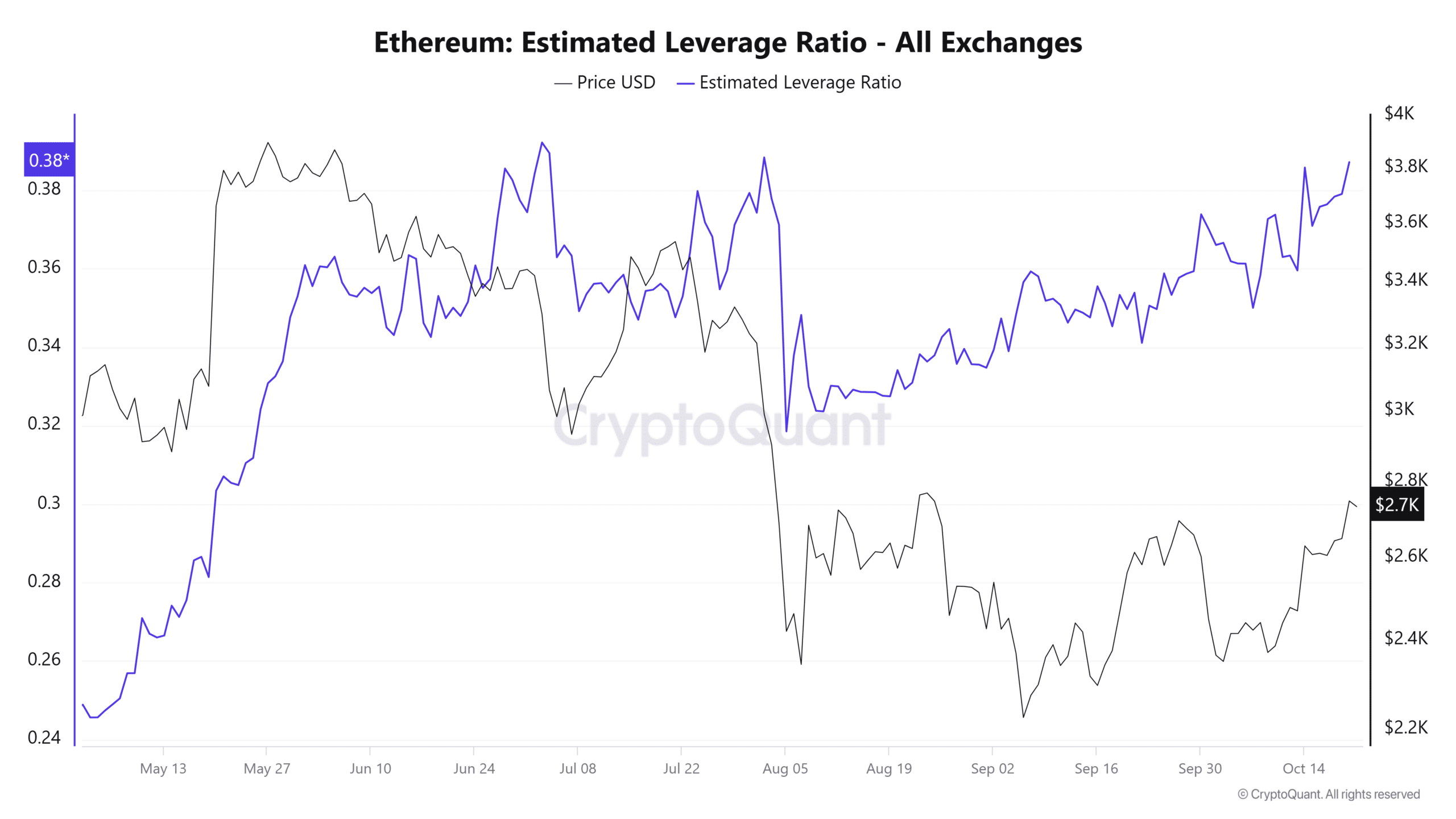

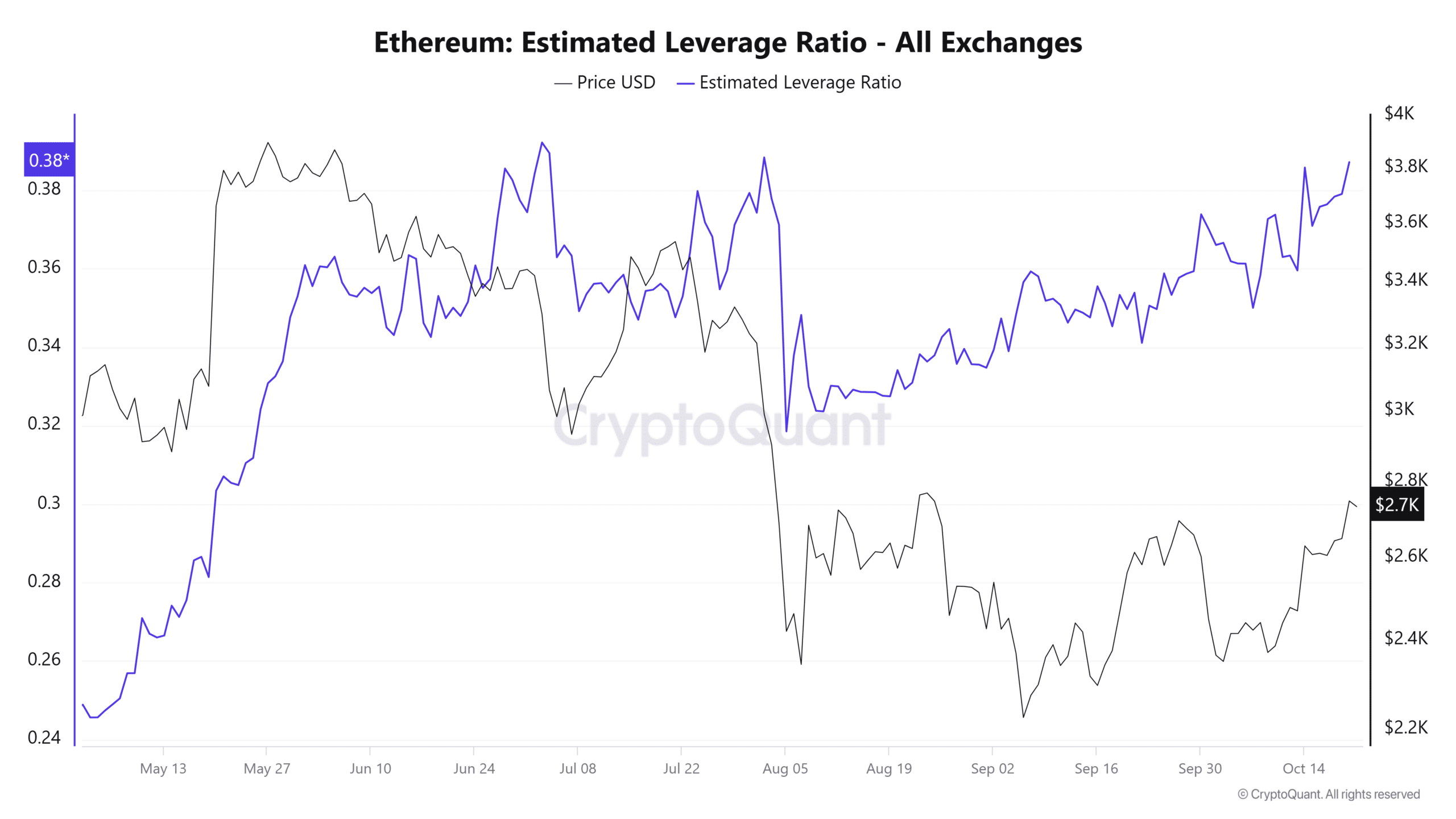

Ethereum’s estimated leverage ratio is nearing a three-month excessive, indicating an inflow of borrowed capital. If ETH makes sudden strikes, it might end in numerous compelled liquidations, inflicting volatility.

Supply: CryptoQuant

Ethereum wallets in revenue

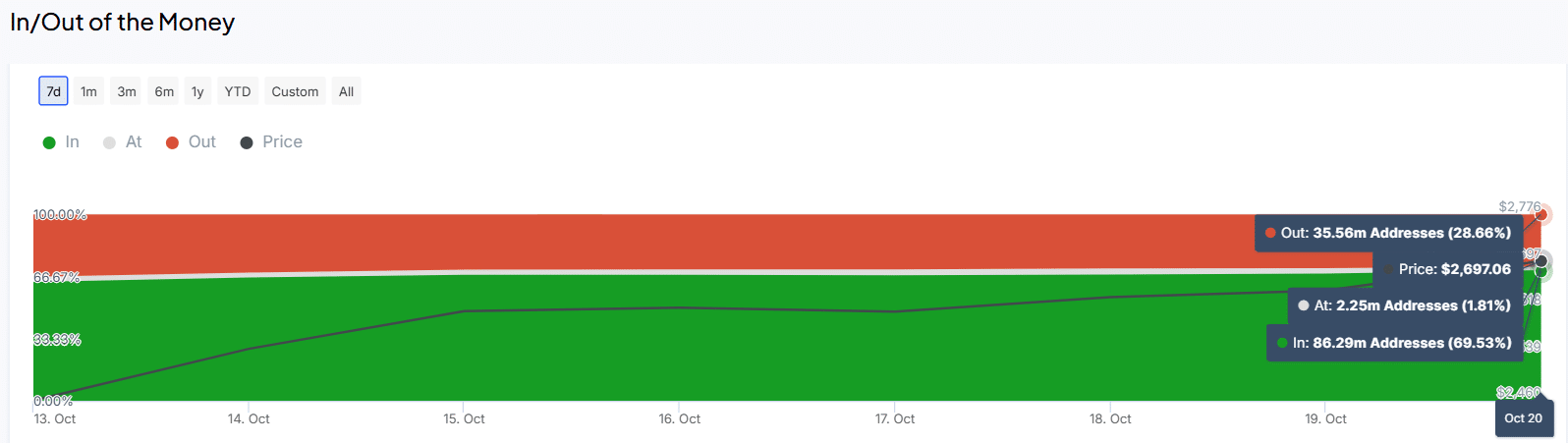

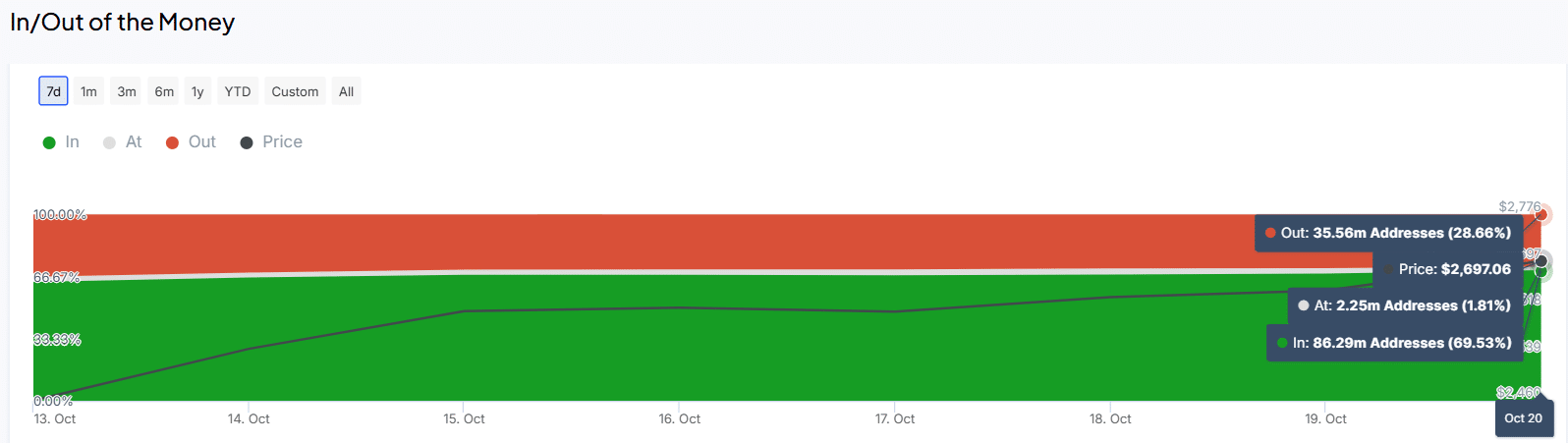

Ethereum’s current features have additionally resulted in a spike in wallets being In The Cash (in income). On the time of writing, 69% of all ETH addresses have been worthwhile, representing a 6% improve over the previous seven days.

Supply: IntoTheBlock

Learn Ethereum’s [ETH] Worth forecast 2024–2025

However, shedding wallets on the time of writing stood at 35 million addresses, a notable drop from 42 million addresses in only one week.

As extra Ethereum wallets turn into worthwhile, this might end in constructive sentiment round ETH.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now