Ethereum

Ethereum Open Interest Sees Sharpest Reset Since 2024 As Price Drops Below $4,000

Credit : www.newsbtc.com

Ethereum undergoes probably the most necessary resets in additional than a 12 months, attributable to breaking the worth under $ 4,000. This retest is most seen within the open curiosity of futures, the place billions of {dollars} of positions have been worn out over giant inventory exchanges. This speedy settlement comes as a correction that’s moved to weeks of extreme leverage throughout uptrends that had pushed the exercise of derivatives to non -durable ranges.

Associated lecture

Strong open curiosity wipeout over giant inventory exchanges

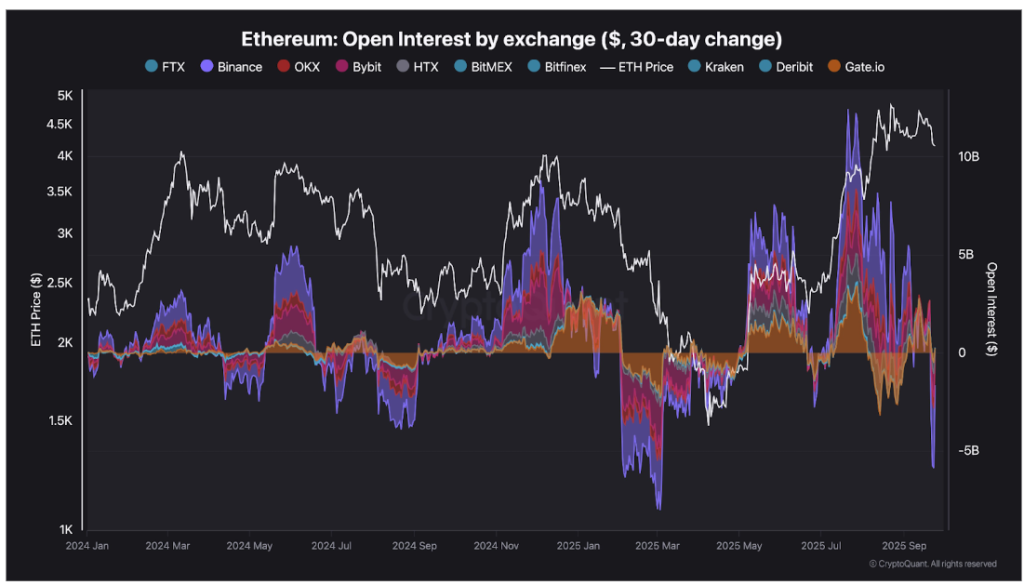

The newest Ethereum -Worth Correction was a wider market set as a substitute of only a dip, with lever merchants confronted with the losses. Information reveals that the open curiosity of Ethereum had skilled a steep downfall concerning the week that has simply been closed in a number of crypto festivals. Based on data of Cryptoquant of the chain evaluation platform, billions of Ethereum positions had been worn out final week, with Binance liding the recession with the steepest month-to-month common lower.

Ethereum’s slide beneath $ 4,000 turned out to be the breaking point for Heers about livered merchants. The motion unleashed a wave of liquidations on the derivatives markets, which put the gross sales stress compiled.

Information reveals that greater than $ 3 billion on 23 September was already deleted through Binance alone, adopted by greater than $ 1 billion solely a day later. Bybit additionally set $ 1.2 billion in positions, whereas OKX registered a lower of $ 580 million. The sharp discount is seen in aggregated open curiosity, which has dropped to the bottom stage for the reason that starting of 2024.

Because the map knowledge demonstrates, Futures -Hefarage and Open curiosity had been intently linked to the worth rally in July and August, and on the similar time the worth fell in Lockstep.

Ethereum Open Interest by Exchange

Spot Ethereum ETF retailers contribute to Marktstam

The pause of Ethereum under $ 4,000 and the lower in open rate of interest falls together with per week of heavy outskirts of Spot Etereum ETFs in the US. Based on to data from Fines -Traders, $ 795.56 million threw out for 5 buying and selling days final week, which is the largest weekly exodus for the reason that launched merchandise.

The Explanation is intensified In the direction of the tip of the week, with $ 251.2 million on Thursday, adopted by one other $ 248.4 million on Friday. Institutinal participation alternating contributed en masse to the gross sales stress, whereby traders present warning within the midst of uncertainty about whether or not regulators will be set in these ETFs. This synchronized output of each derivatives and institutional merchandise has strengthened volatility, making a convergence of stress within the Ethereum commerce ecosystem.

Associated lecture

After falling as little as $ 3,845, ETH Bulls have succeeded in holding above $ 3,800. On the time of writing, Ethereum acts at $ 4.002. Regardless of this try and regain stability, the main Altcoin has nonetheless fallen by round 10% in a weekly interval, on condition that round $ 4,490 was buying and selling final week. The Bullish Situation is now within the query of whether or not ETH is feasible reclaim and help a motion above $ 4,000.

Featured picture of Unsplash, graph of TradingView

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024