Altcoin

Ethereum Options Peak: ETH Rises to $3K in December?

Credit : ambcrypto.com

- ETH confirmed renewed curiosity within the choices market.

- Regardless of near-term challenges, it urged a bullish outlook for ETH within the fourth quarter.

Ethereum [ETH] has lagged behind its main friends, similar to Bitcoin [BTC] And Solana [SOL]regardless of approval of the US spot ETF within the second quarter. Nevertheless, on Friday, September 13, there was a robust renewed curiosity within the largest altcoin.

In response to Singapore-based crypto buying and selling agency QCP Capital, ETH choices noticed excessive curiosity in contracts with a $3,000 worth goal by the top of the yr. A part of the corporate’s weekend memo read,

“The choices market witnessed renewed curiosity in ETHwith over 20,000 contracts focusing on the $3,000 degree by December 27. The year-end prospects for ETH might be vital.”

ETH’s bullish rebound

For context, choices information and quantity are forward-looking indicators that mirror future worth expectations and basic market sentiment.

Thus, the above-mentioned rise within the choices market, together with Open Curiosity (OI) charges, indicated bullish expectations and a possible worth enhance within the fourth quarter.

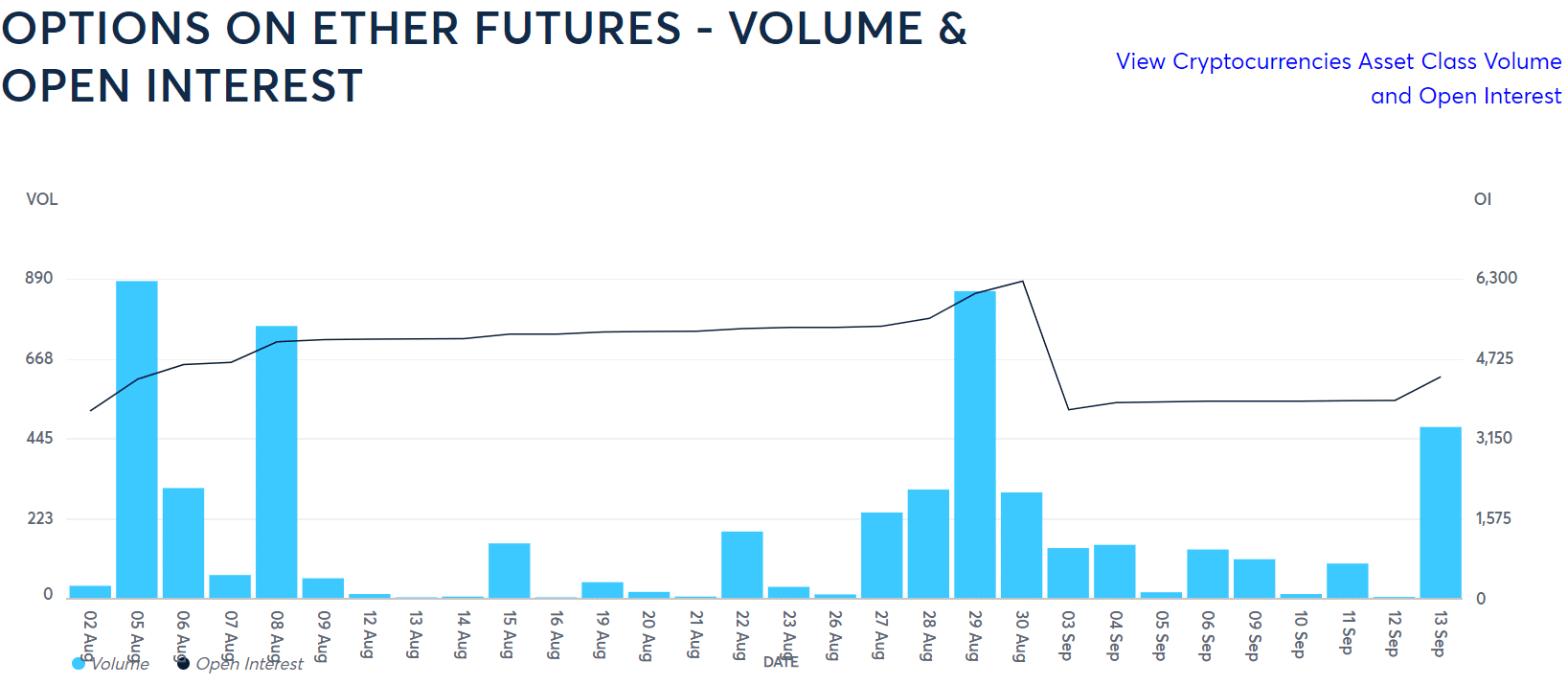

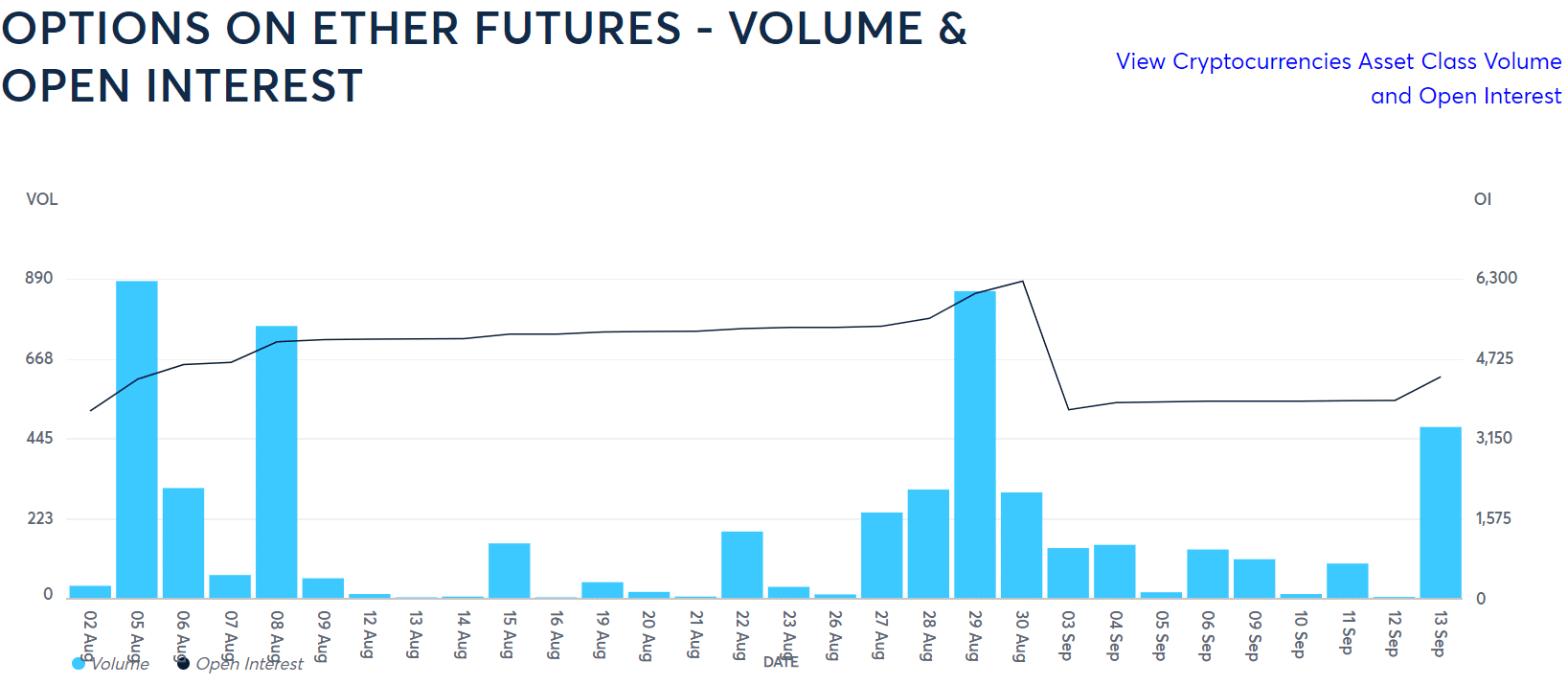

The Chicago Mercantile Change (CME) facts confirmed QCP Capital’s prospects.

On September 13, ETH recorded a pointy enhance in quantity and OI for the primary time this month. OI rose to $3.1 billion, whereas quantity practically rose to $700 million, reinforcing institutional curiosity within the altcoin.

Supply: CME

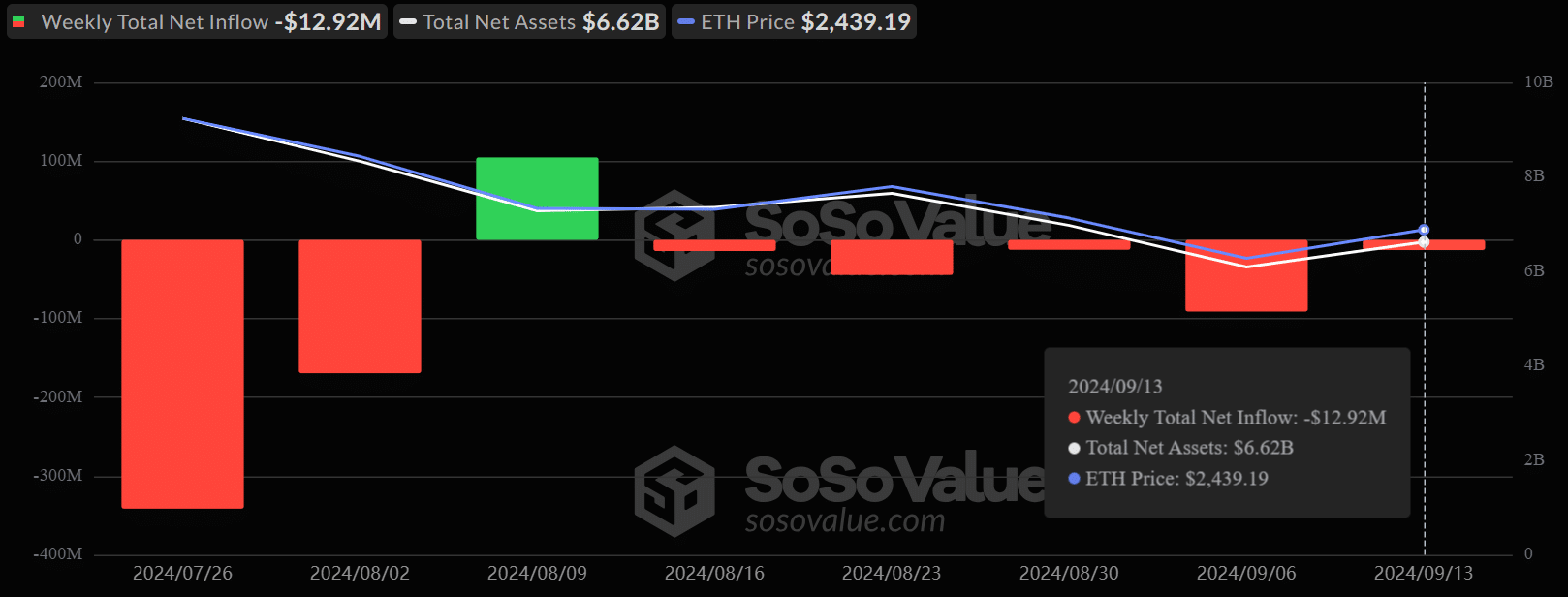

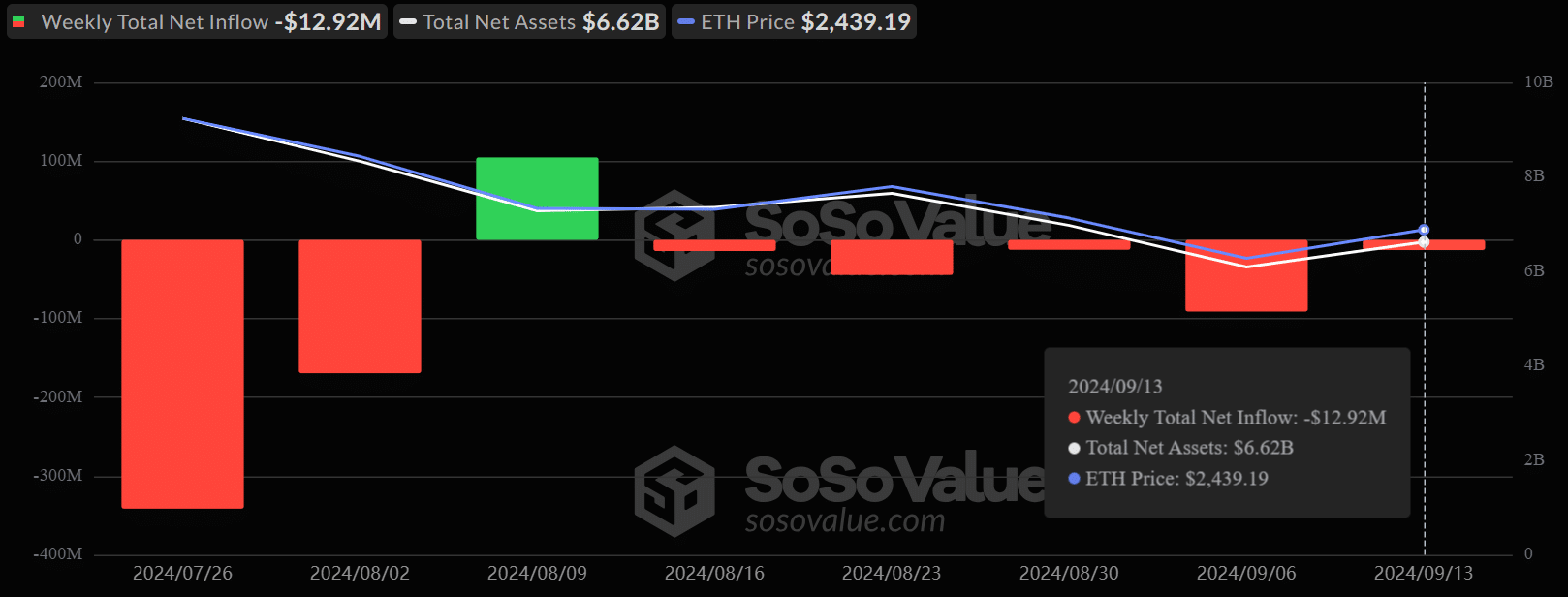

Regardless of elevated choices exercise, the spot market noticed minimal demand for US ETH ETFs on Friday.

The merchandise had cumulative day by day inflows of $1.5 million, however this was web destructive on a weekly foundation. Final week they misplaced $12.92 million, a pattern that has but to be reversed to bolster sturdy investor confidence.

Supply: Sosowaarde

Nevertheless, Coinbase analyst David Duong accused ETH’s average worth efficiency on the present market construction. Duong famous that crypto buyers have been tied to different altcoin positions, limiting the movement of capital into ETH.

One other potential problem to ETH’s worth within the brief time period was a spike in international change reserves. About 100,000 tokens moved on the inventory markets within the run-up to the Fed’s rate of interest choice on September 18.

In the meantime, ETH was valued at $2.4k on the time of writing, up 5% within the final seven buying and selling days.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September