Ethereum

Ethereum Price Analysis: Can ETH Climb to $6,000 in the Coming Weeks?

Credit : coinpedia.org

The submit Ethereum Value Evaluation: Can ETH Rise to $6,000 within the Coming Weeks? appeared first on Coinpedia Fintech Information

This month, the Ethereum market opened with a giant purple candlestick. On October 3, the worth fell to a low of $2,351.01. Presently, the market seems to be considerably bullish. The shopping for stress got here into impact on October 4. The newly acquired momentum is at the moment pushing the worth greater. Can this newfound energy take the worth to new heights? Sure technical evaluation specialists have made some constructive feedback in regards to the future prospects of the market. Interested by what they noticed? Learn on!

Ethereum is following Bitcoin’s restoration

The sudden escalation of the Israel-Iran disaster pushed the worth of Bitcoin to a low of $60,628 in the course of the first days of this month – much like what was noticed within the Ethereum market. Like ETH, BTC consumers took management of the market on the fourth day of October, growing its worth from $60,776.02 to $62,102.19 in someday. Since then, the worth has fluctuated between $62,000 and $62,900. Presently, the BTC worth stands at $62,375.

A comparative evaluation of Bitcoin’s every day chart and Ethereum’s every day chart means that Ethereum is shifting in step with Bitcoin. Like Bitcoin, Ethereum can also be at the moment immersed within the tiring activity of recovering from the latest dip it suffered firstly of the month.

Main technical patterns point out a potential breakthrough in Ethereum

Cryptocurrency technical analyst Dealer Tradigrade claims that Ethereum has been on an upward trendline since June 2022. He provides that Ethereum varieties symmetrical triangles close to this trendline.

The mixture of those two elements factors to the potential for an impending bullish breakout. The chart shared by the crypto analyst signifies {that a} bullish breakout in Ethereum will be anticipated quickly.

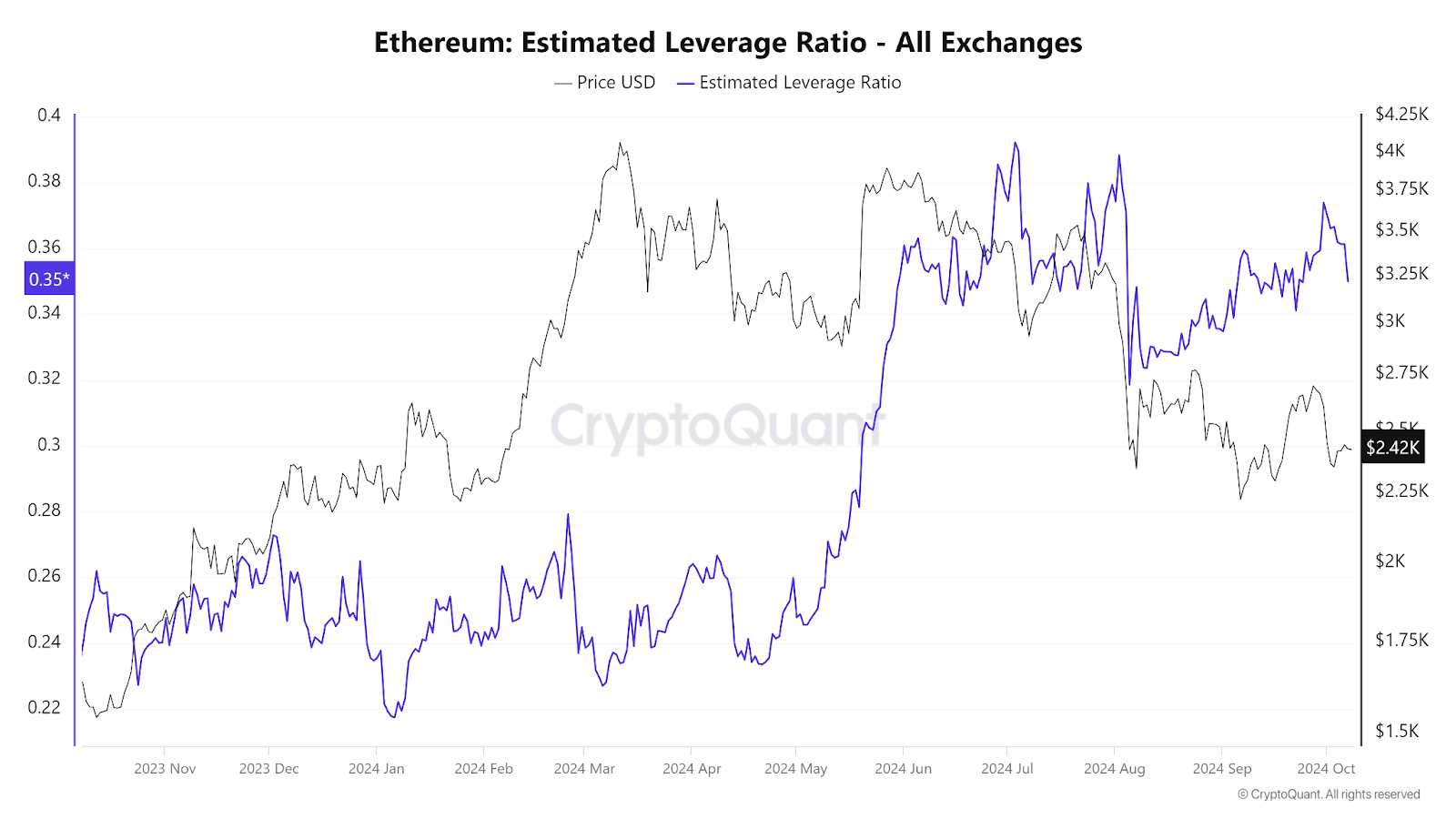

Ethereum’s leverage ratio and market exercise

The Ethereum Estimated Leverage Ratio (All Exchanges) chart exhibits that the ratio has skilled a pointy enhance. On January 4, this was solely 0.21. Between April 22 and June 5 it underwent a steep rise; in that quick interval alone the ratio rose from 0.233 to 0.36. Since then, the ratio has fluctuated between 0.31 and 0.39. Presently the ratio is 0.35.

A excessive estimated leverage ratio is a crystal clear indication of incoming worth volatility. Open curiosity in ETH is down barely, whereas Ethereum buying and selling quantity is up 120%.

What the general evaluation of the main points given above reveals is that merchants are positioning themselves for the subsequent huge worth transfer within the Ethereum market.

Ethereum Analyst Forecast Forecast: Key Assist at $2,300

A submit shared by Ali on X has highlighted the significance of the important thing $2,300 assist stage within the Ethereum market. In keeping with him, the market ought to keep this assist stage. He predicts that if the Ethereum market maintains the important thing assist stage, it might attain $6,000 within the close to future. His submit warns that if the ETH market fails to carry above this key stage, it might fall to $1,600.

In conclusion, there may be nothing at this level to point that the worth of Ethereum will fall under the important thing $2,300 stage. Nevertheless, you will need to preserve a detailed eye on how the market reacts when it breaks the sample noticed by the technical evaluation professional.

.article-inside-link {margin-left: 0!vital; border: 1px stable #0052CC4D; border-left: 0; border-right: 0; padding: 10px 0; align textual content: left; } .entry ul.article-inside-link li {font-size: 14px; lineheight: 21px; font weight: 600; liststyletype: none; margin-bottom: 0; show: inline block; } .entry ul.article-inside-link li:last-child { show: none; }

- Additionally learn:

- Skilled Warns of $10 Billion Bitcoin Quick Squeeze – Will This Trigger a Rally?

- ,

Keep knowledgeable Coinpedia for the newest updates on Ethereum’s worth momentum!

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September