Ethereum

Ethereum price analysis: Strong outflows, MACD hint at a move to…

Credit : ambcrypto.com

- Ethereum’s value resilience and key resistance ranges point out the potential for an impending breakout.

- Robust outflows, a optimistic MACD and dominant lengthy positions point out a supportive bullish setup.

Ethereum [ETH] has once more attracted consideration as a result of there’s a vital extra of the day by day internet outflow 25 millionwhich leads all different blockchains in capital motion. Such a large-scale shift may point out profit-taking or strategic repositioning by main traders.

With ETH buying and selling at $2,618.54, up 3.32% on the time of writing, this development begs the query: can these outflows consolidate liquidity and gas a brand new bullish wave? Let’s take a more in-depth have a look at the technical options and market indicators behind Ethereum’s present value dynamics.

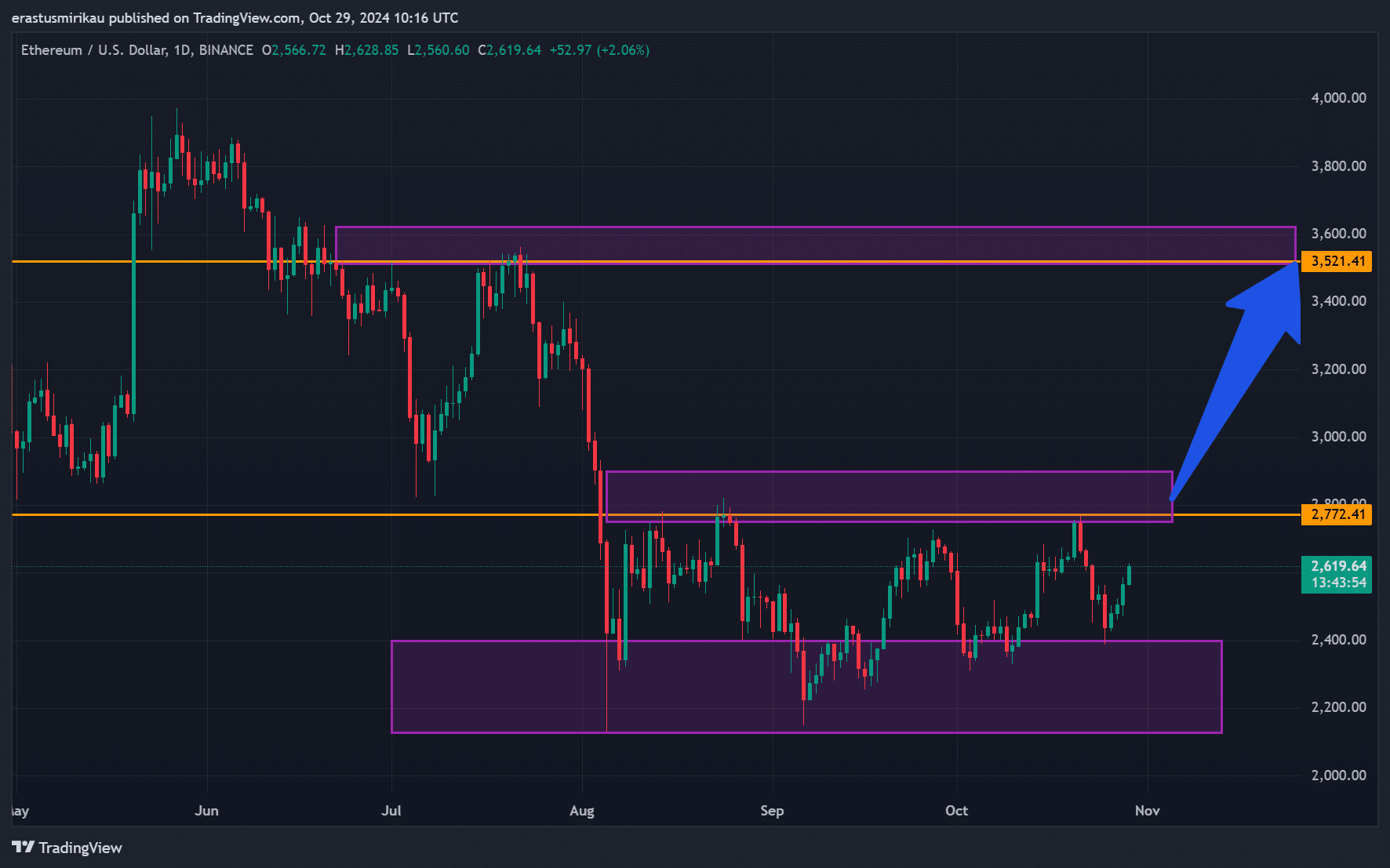

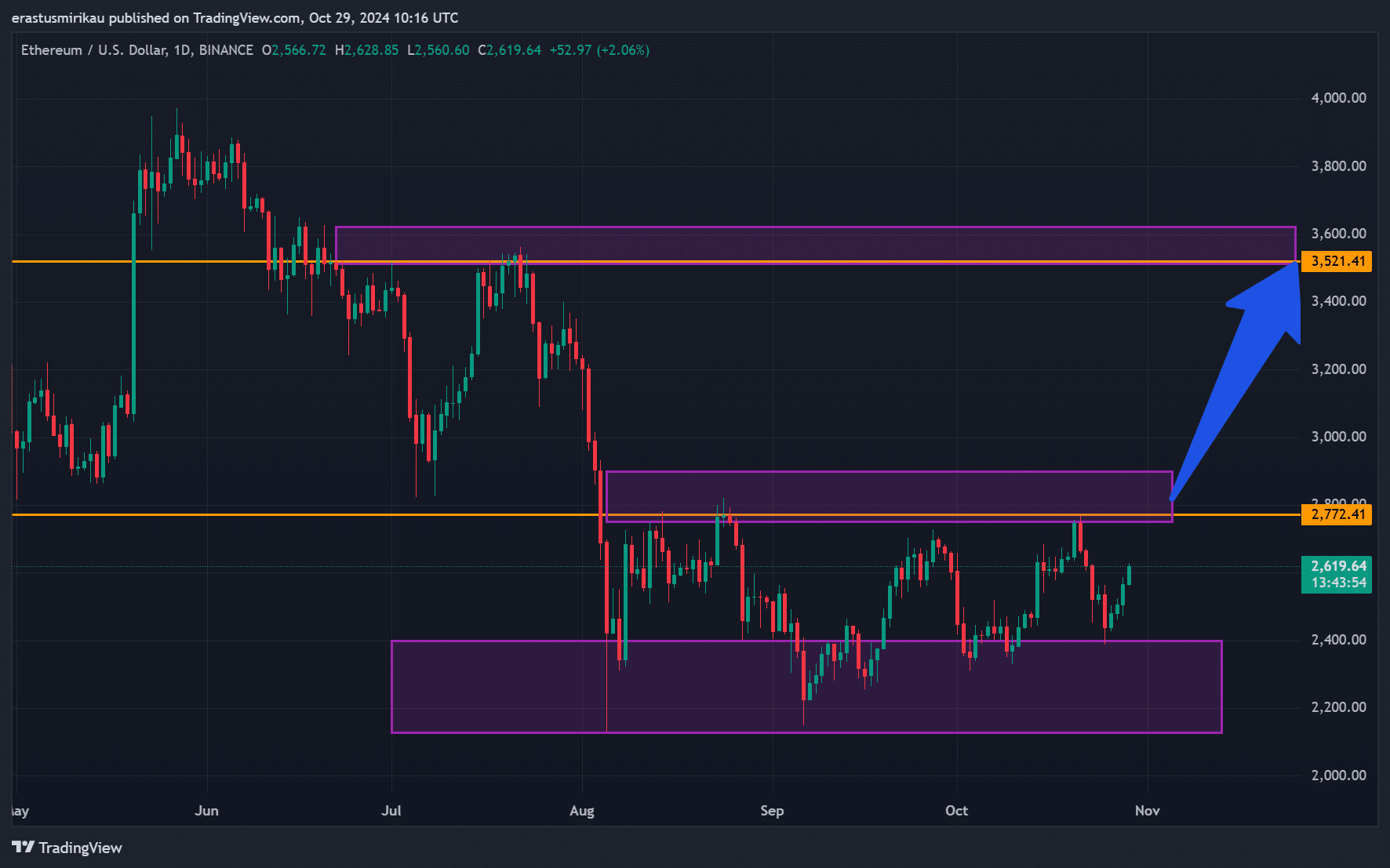

ETH Value Evaluation: Constructing to a Breakout?

Ethereum’s current value actions counsel a breakout could also be within the making. ETH has maintained its energy above $2,500, an essential psychological assist, regardless of market fluctuations.

This stage has confirmed resilient and will act as a launching pad for stronger upside momentum.

Wanting forward, $2,772 serves because the rapid resistance stage, whereas $3,521.41 represents a extra vital barrier that would affirm or halt the bullish momentum.

If Ethereum efficiently reaches these ranges, we may witness a pointy rally. Nevertheless, if resistance holds, ETH may enter a consolidation section, ready for a decisive catalyst.

Supply: TradingView

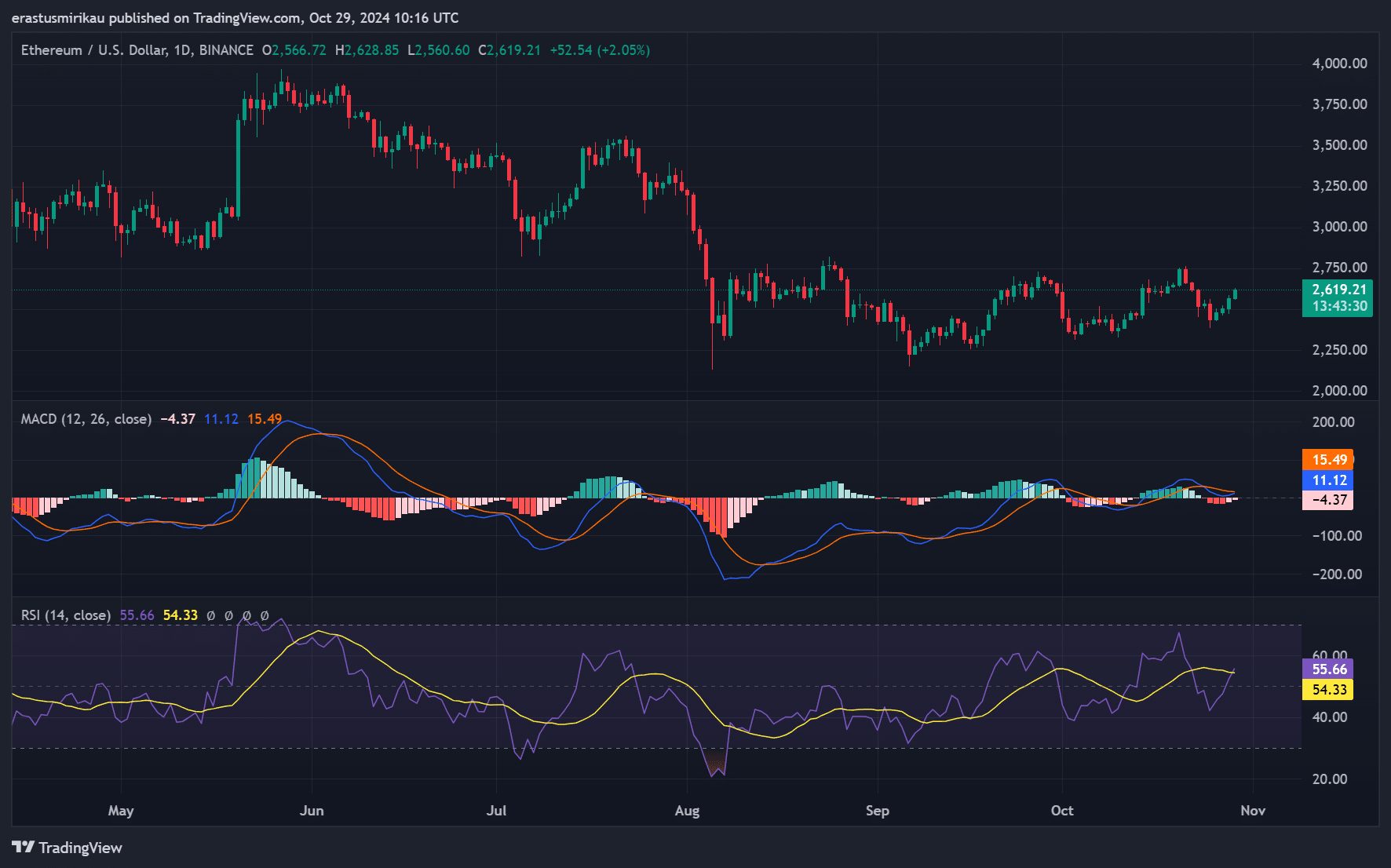

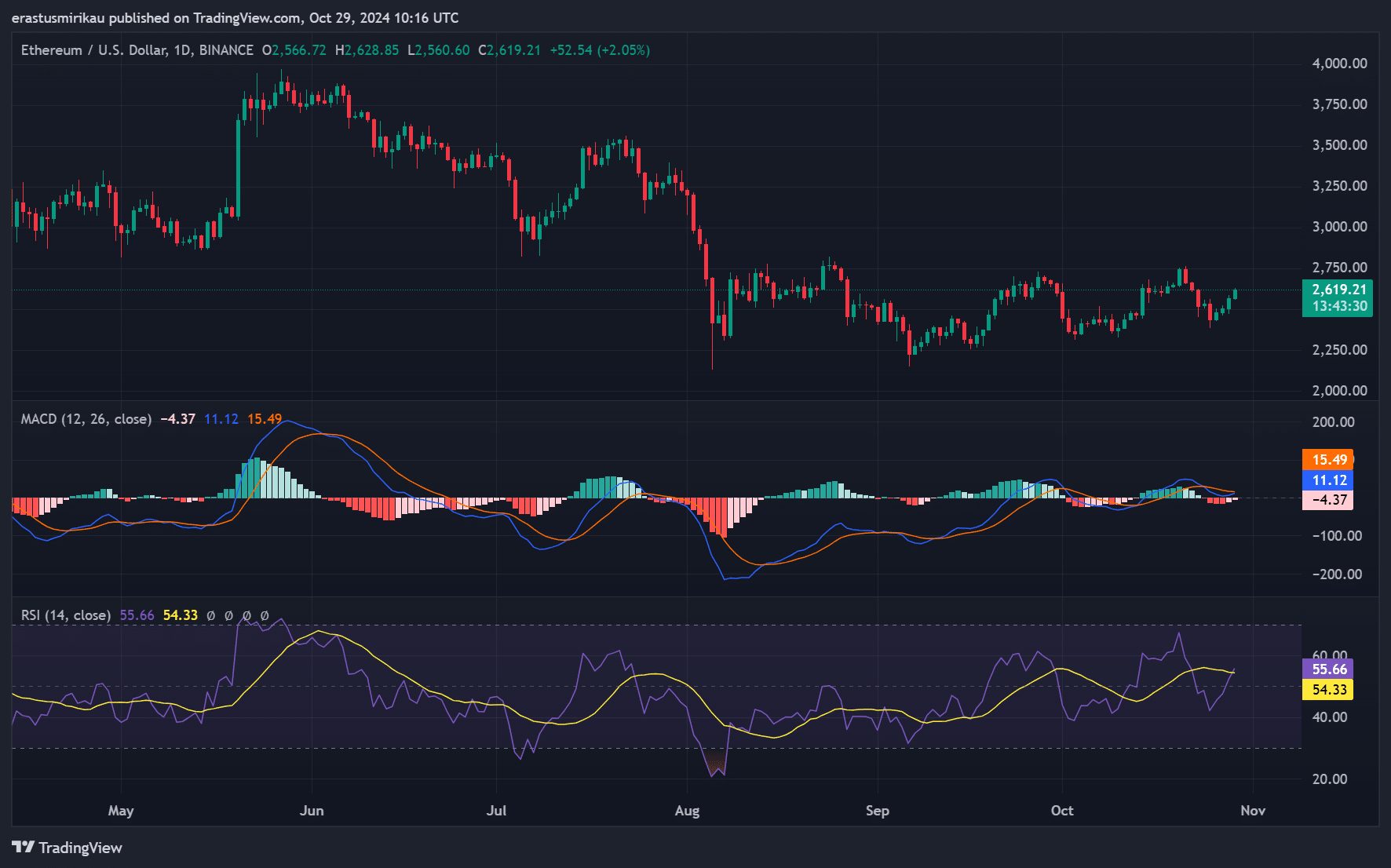

MACD and RSI point out strengthening momentum

Ethereum’s technical indicators additional spotlight the potential for upside. The Transferring Common Convergence Divergence (MACD) indicator is displaying bullish indicators because the MACD line has crossed the sign line, which is usually seen as a precursor to optimistic value motion.

Furthermore, the Relative Power Index (RSI) is at the moment round 54.33, a reasonably bullish stage.

Due to this fact, Ethereum has vital room for upside momentum earlier than approaching the overbought scenario, signaling that patrons can nonetheless drive costs larger within the brief time period.

Supply: TradingView

Giant outflows from inventory markets: an indication of bullish sentiment?

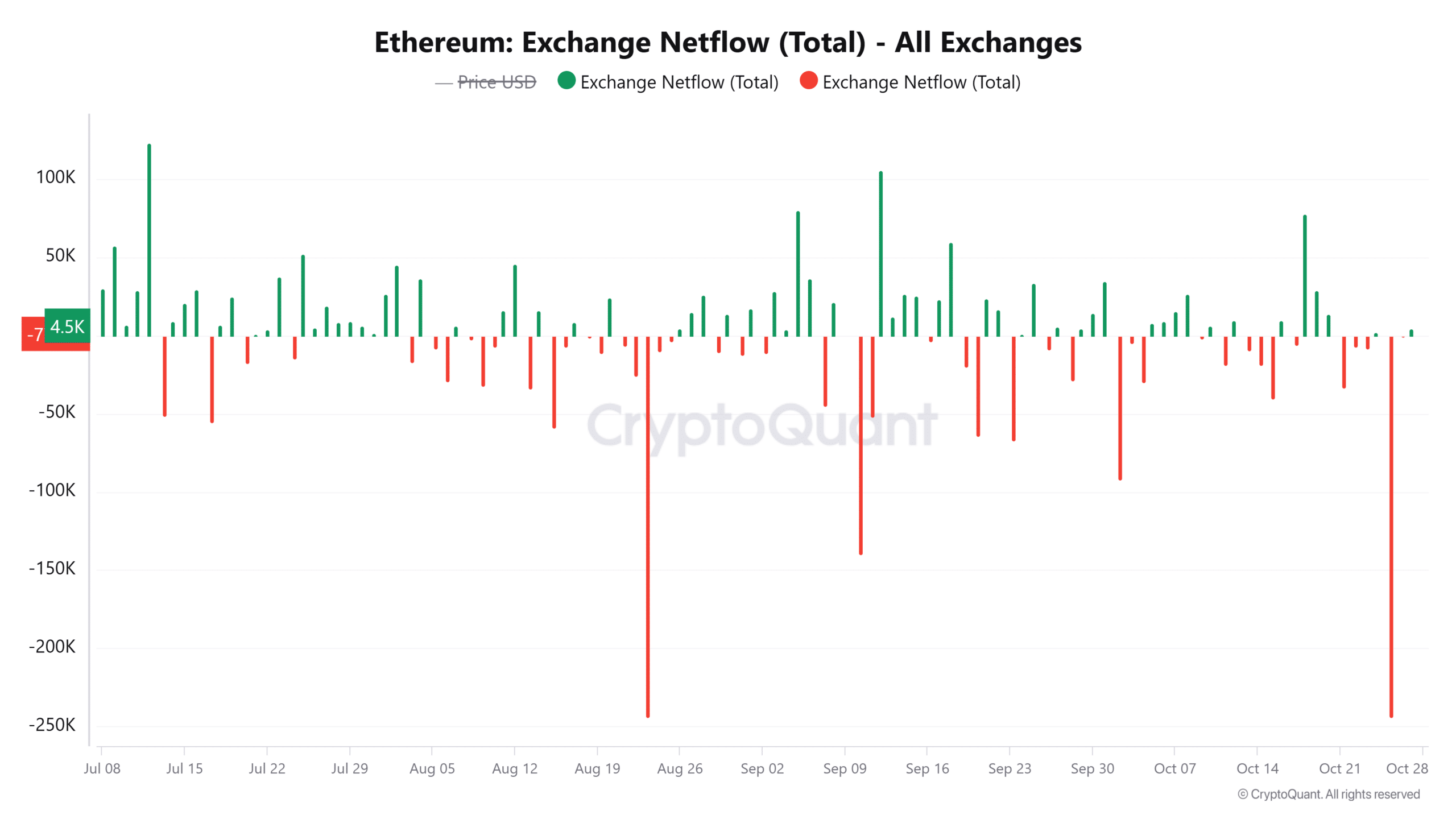

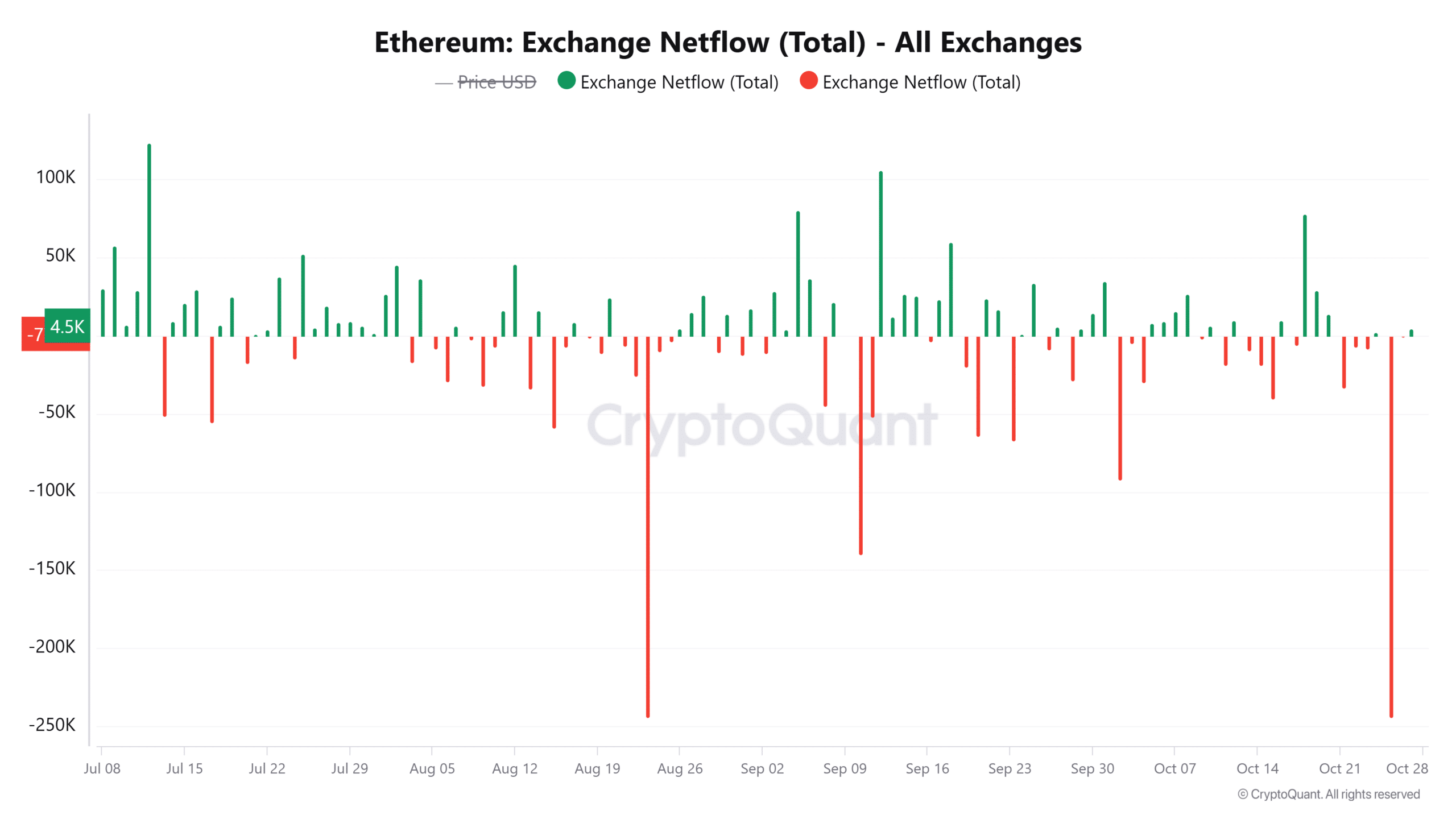

Ethereum’s internet move knowledge exhibits a big outflow of 4.5K ETH within the final 24 hours, representing a 3.03% drop in obtainable change liquidity.

So when massive quantities of ETH disappear from exchanges, it usually signifies that traders are selecting to carry their belongings for the long run or deploy them elsewhere, decreasing rapid promoting stress.

Supply: CryptoQuant

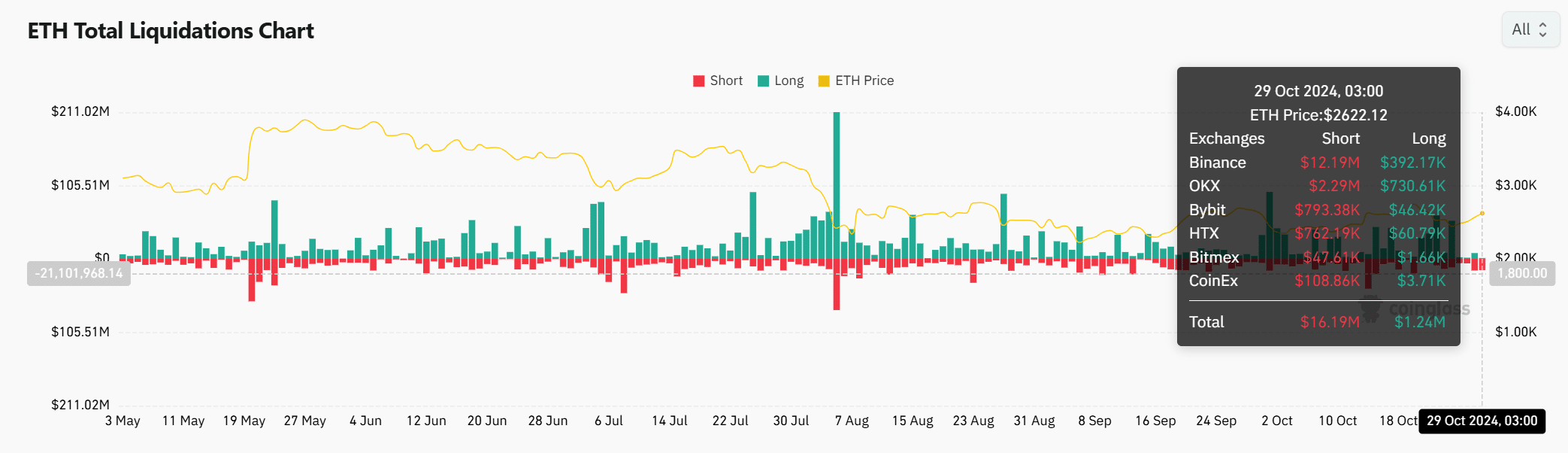

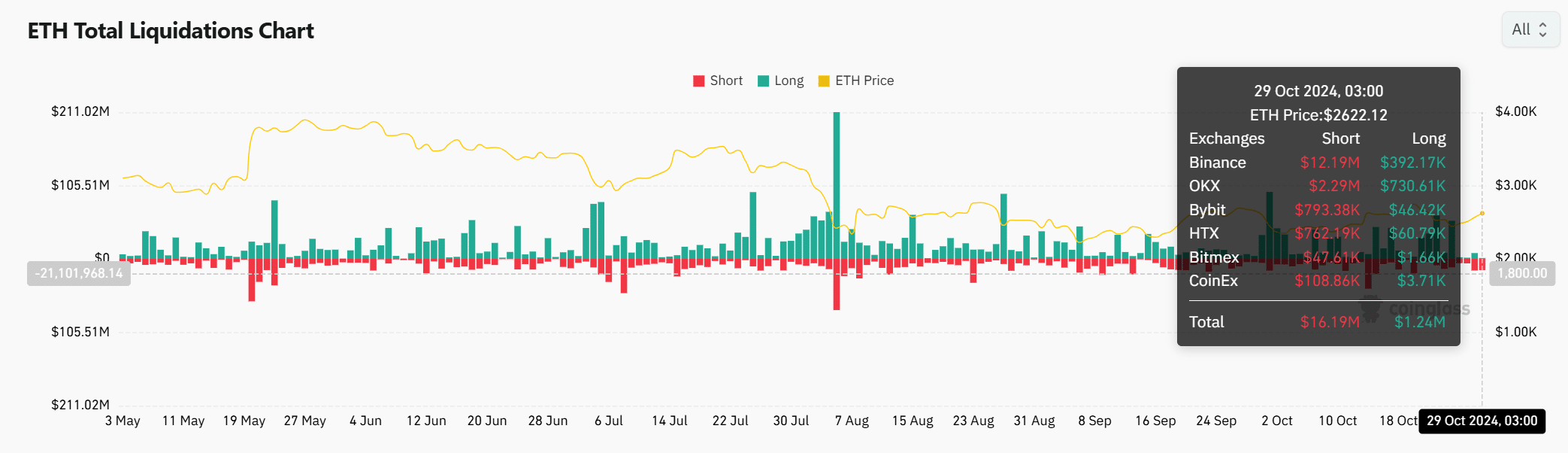

ETH liquidation knowledge highlights the dominance of longs

Ethereum’s liquidation knowledge helps a bullish narrative. Nearly all of liquidations concern brief positions, whereas lengthy positions dominate the scene. This development alerts confidence amongst merchants in Ethereum’s upside potential as lengthy holders count on continued good points.

Consequently, this confidence amongst lengthy positions may create additional upward stress, offering the assist wanted for a sustained rally.

Supply: Coinglass

Learn Ethereum’s [ETH] Value forecast 2024–2025

Ethereum’s vital outflows from the exchanges, coupled with the supportive technical indicators, level to a possible bullish continuation.

Breaking by way of key resistance ranges may very well be the ultimate set off for a robust rally. Ethereum seems properly positioned for an increase as liquidity consolidates, making the approaching days essential for ETH’s value motion.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September