Ethereum

Ethereum price crash imminent? $330 million in bearish bet spotted

Credit : ambcrypto.com

- Intraday merchants have positioned $ 330 million on quick positions.

- Regardless of the Bearish Outlook, a crypto -whale for $ 5.27 million has withdrawn from ETH.

Ethereum [ETH] And different cryptocurrencies got here appreciable after the speed announcement of US President Donald Trump.

In accordance with latest knowledge, most nations will now be confronted with a fee of 10%, whereas China, the EU and Japan have been hit more durable with charges of 34%, 20percentand 24percentrespectively.

This improvement has precipitated a pointy lower within the complete cryptocurrency market.

Within the meantime, Ethereum has fallen greater than 4.50% and acted close to the $ 1,800 degree, which appeared to be a make-or-break level for the upcoming value ranges.

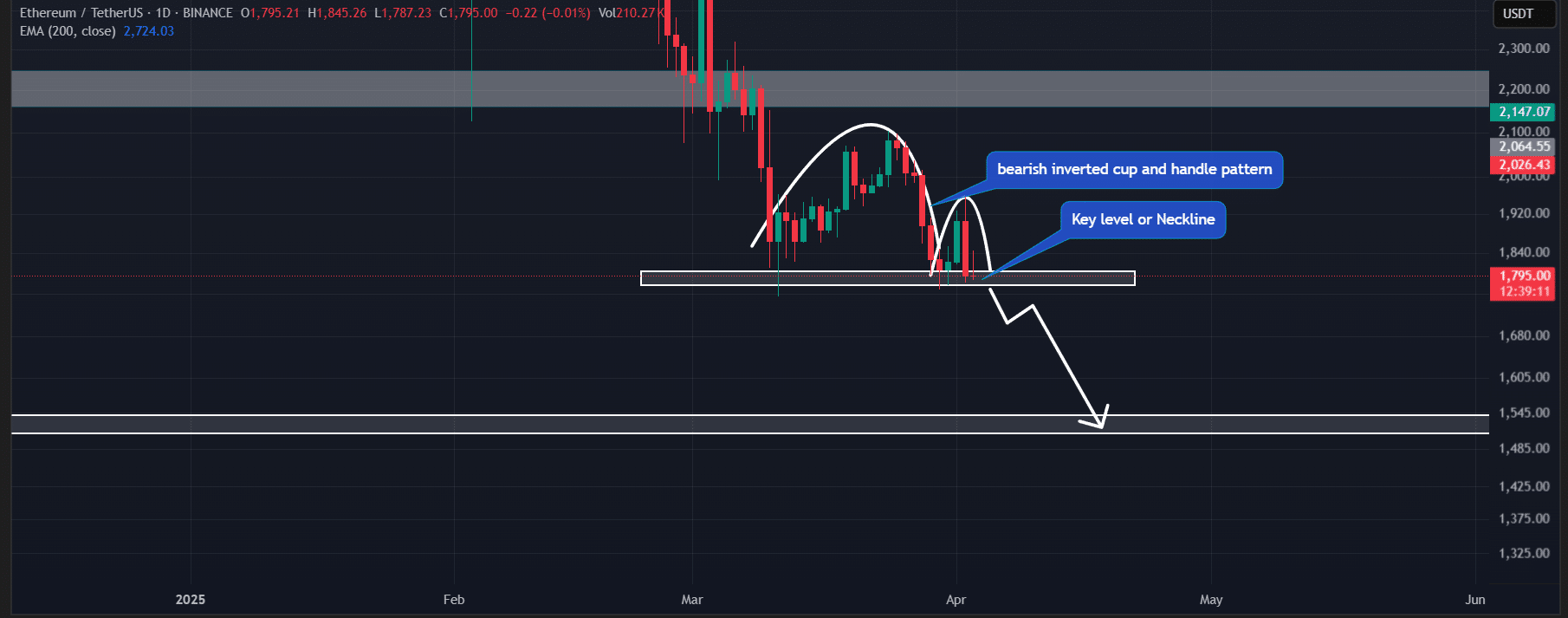

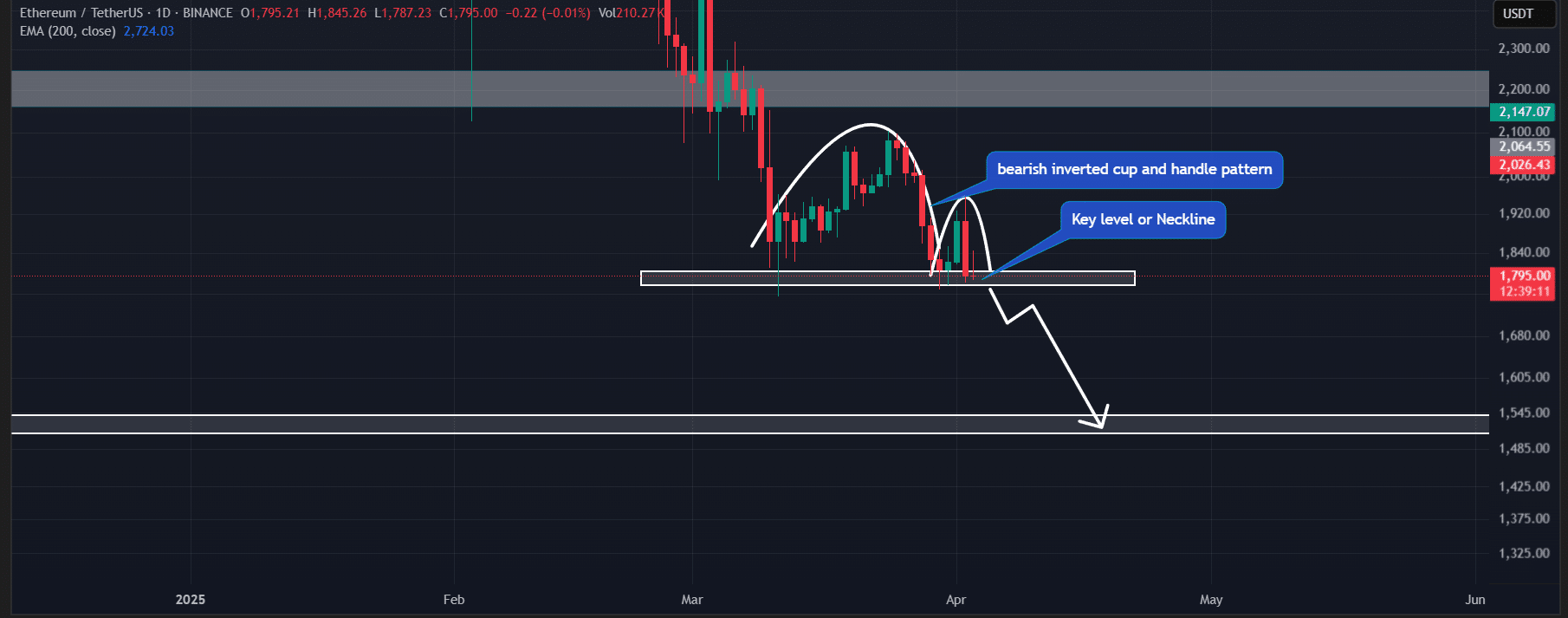

Ethereum pricing and upcoming ranges

In accordance with the technical evaluation of Ambcrypto, Eth Beerarish appeared to be about to have a substantial value lower.

Within the day by day time frame it appeared to have shaped a bearish cup and lever sample and was on the neckline.

Based mostly on the historic value momentum, if ETH infringes the neckline and a day by day candle closes under $ 1,770 Mark, an enormous sale may observe.

The value can fall by 15% till ETH reaches the next assist degree at $ 1500.

Supply: TradingView

ETH was traded on the press common (EMA) below the exponential advancing common (EMA), which indicated a bearish-trend that additional strengthened the Bearish entrance views of the actively.

Whale’s latest exercise

Within the midst of this value decline and Bearish market sentiment appeared to learn traders and whales from the dip and she or he continued to gather tokens.

Lately, blockchain-based transaction tracker Lookonchain revealed on X (previously Twitter) {that a} crypto -walvis has withdrawn a big 2,774 ETH, value $ 5.27 million, of the Binance Cryptocurrency Change.

Furthermore, the identical whale has withdrawn greater than 16,415 ETH, value nearly $ 43.90 million, from Binance at a mean value of $ 2,676.

This means a “buy-the-dip” technique, as a result of regardless of the fixed fall in value, the whale appeared to be their ETH firms at decrease ranges.

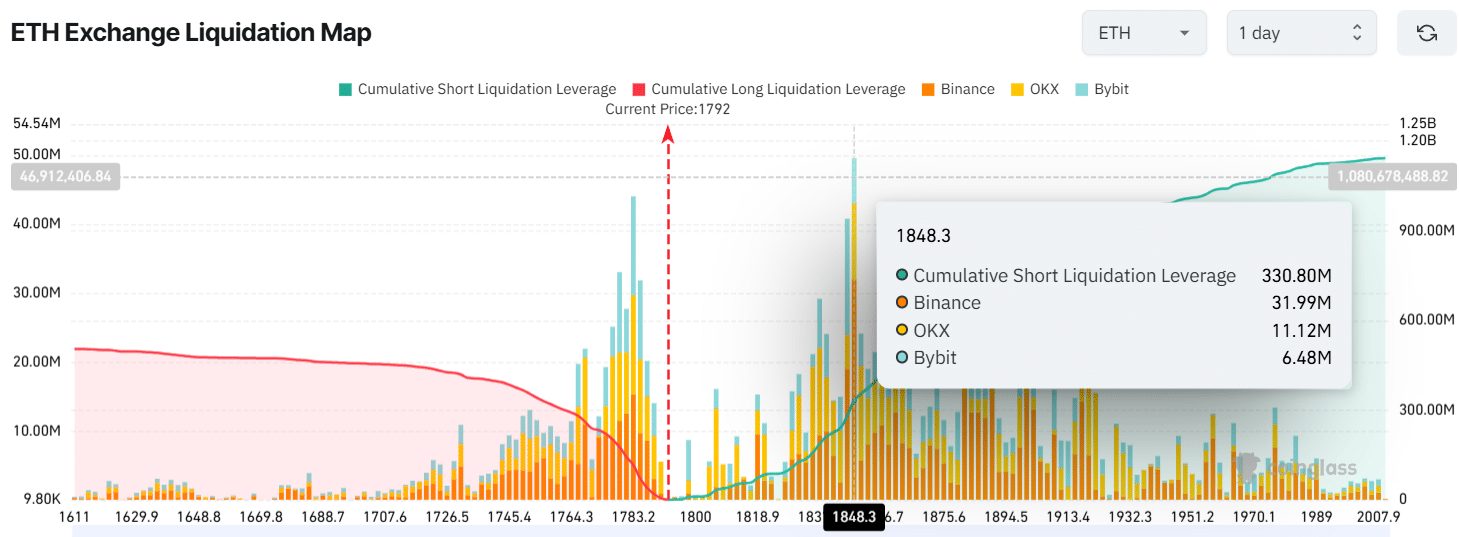

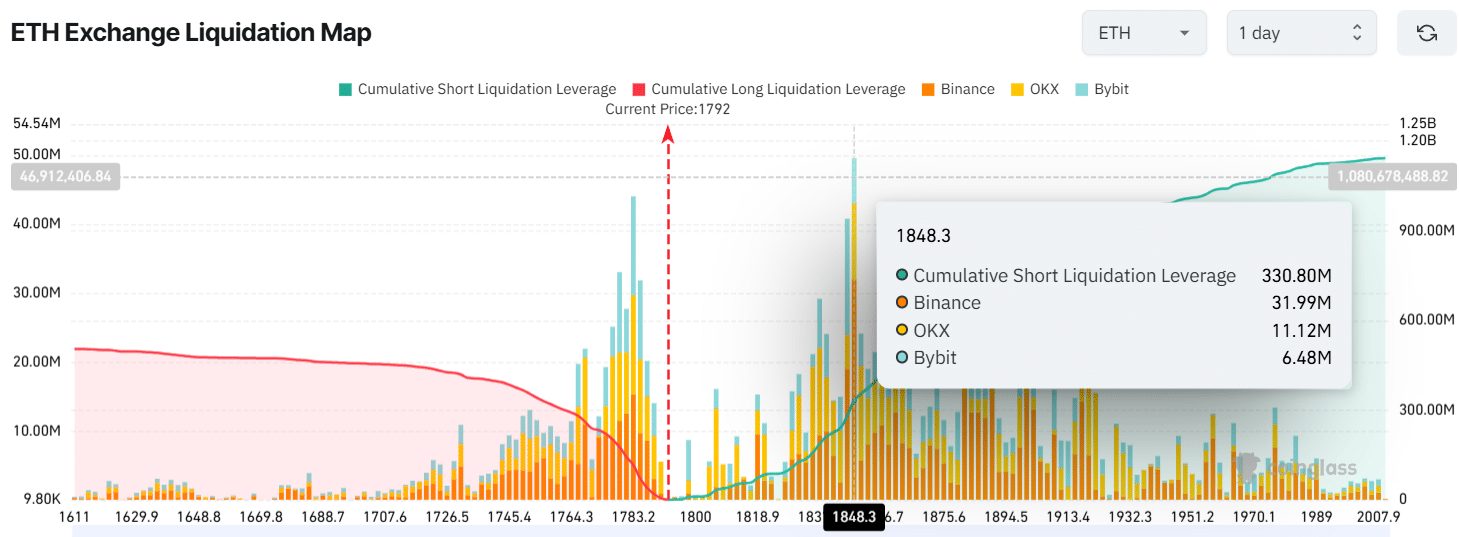

Merchants’ $ 330 million Bearish bets

statistics on-chain, ETH appeared weak and prepared for a value crash. From knowledge from the unchain evaluation firm Coinglass, it confirmed that intraday merchants gambled remarkably on the quick facet.

Supply: Coinglass

On the time of the press, merchants have been equipped an excessive amount of at $ 1,783 on the backside, the place they constructed $ 115 million in lengthy positions, whereas $ 1,848 is once more an over-being degree with $ 330 million briefly positions.

These huge over-paste positions mirror the true market sentiment, which appears Bearish.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024