Analysis

Ethereum Price Faces $90 Million Liquidation After Rejection, But Bullish Sentiment Remains Strong

Credit : coinpedia.org

Ethereum value has fallen onerous after a robust rejection across the $4,700 degree. Over the previous 24 hours, Ethereum has tried to interrupt above the resistance channel a number of occasions however failed to fulfill purchaser demand. This resulted in additional than $90 million in liquidations; Nonetheless, the ETH chart sample reveals constructive sentiment together with promising knowledge on the chain.

Ethereum struggles to clear resistance

Over the previous 24 hours, sellers have elevated their dominance to maintain Ethereum under the bullish breakout channel. In consequence, the worth of ETH has fallen sharply, resulting in sturdy liquidation. Coinglass knowledge reveals that ETH skilled practically $90 million in liquidations, with consumers closing roughly $66.4 million price of positions. This liquidation degree strengthened the resistance degree, inflicting the worth to hold.

Analysts spotlight {that a} document $10 billion price of Ethereum (ETH) is now caught within the Ethereum validator exit queue as stakers queue as much as withdraw their funds from the community. This large exit queue alerts rising profit-taking strain as Ethereum trades round $4,500, simply 9.8% under its all-time excessive.

Nonetheless, institutional demand may assist offset bearish strain on ETH as these buyers have a tendency to purchase extra when costs fall. Information from StrategicETHReserve reveals that enterprise house owners now personal about 5.66 million ETH (about 4.68% of complete provide), whereas spot Ethereum ETFs personal about 6.81 million ETH (about 5.63%). Collectively that’s greater than 12.47 million ETH in institutional arms.

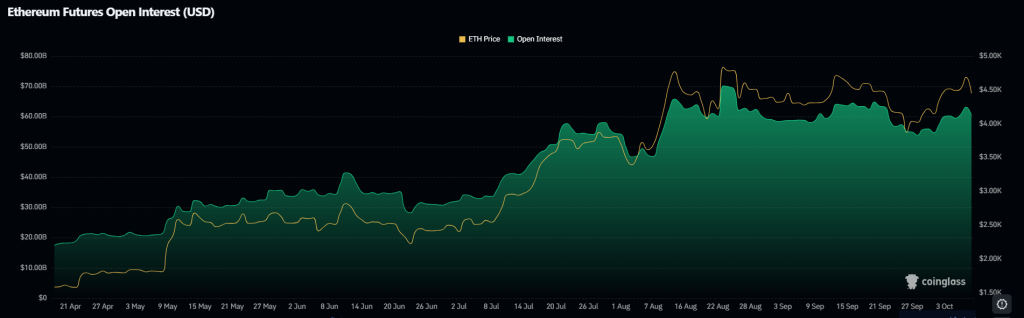

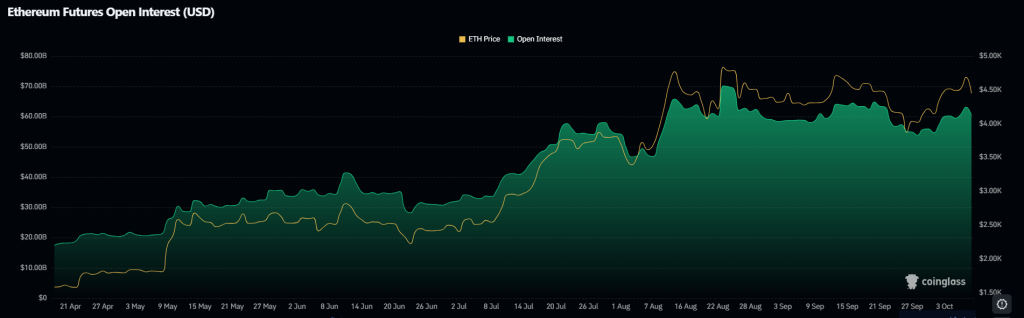

In October alone, US-listed Ether ETFs noticed internet inflows of $621.4 million, greater than double the $285.7 million in September, in response to SoSoValue. Moreover, open curiosity in Ethereum continues to rise as its worth rose from a low of $54 billion to over $60 billion over the previous week. This means that buying and selling exercise continues to extend regardless of Ethereum’s downward correction, signaling a doable restoration.

Additionally Learn: Ethereum Worth Prediction 2025, 2026 – 2030: Can ETH Attain $10,000?

The lengthy/brief ratio has additionally elevated to 1.25, and 55.5% of complete positions now anticipate the ETH value to recuperate, rising the possibilities of a bullish reversal.

What’s subsequent for the ETH value?

Ether broke above its resistance line on Monday, indicating that consumers are beginning to take management. Nonetheless, the latest rejection above $4,700 induced sturdy promoting strain, pushing the worth under the instant Fib degree. On the time of writing, ETH value is buying and selling at $4,466, down greater than 1.6% prior to now 24 hours.

If the worth manages to defend the instant assist at USD 4,400, it may imply the correction section ends. In that case, Ether may attempt to rise above $4,700 once more, and presumably $5,000 after that. Sellers are more likely to vigorously defend the $5,000 degree, but when consumers persist, the worth may rise additional to round $5,500.

However, if the worth continues to come across resistance, it may fall sharply under the 20-day EMA. On this case, it may catch bullish merchants off guard and pull the ETH/USDT pair in direction of the $4,000-$3,700 assist zone.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our knowledgeable panel of analysts and journalists, following strict editorial tips primarily based on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our evaluate coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We goal to supply well timed updates on the whole lot crypto and blockchain, from startups to trade majors.

Funding disclaimer:

All opinions and insights shared symbolize the creator’s personal views on present market circumstances. Please do your individual analysis earlier than making any funding choices. Neither the author nor the publication accepts duty to your monetary selections.

Sponsored and Adverts:

Sponsored content material and affiliate hyperlinks might seem on our website. Adverts are clearly marked and our editorial content material stays fully unbiased from our promoting companions.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024