Ethereum

Ethereum Price Gears Up for a Breakout—Can ETH Outperform BTC Into the Year-End?

Credit : coinpedia.org

Ethereum is shrinking just under a crucial resistance band round $3,300-$3,350, even because the broader crypto market stays unsettled by Bitcoin’s uneven worth motion round $43,000-$44,000. Regardless of the volatility, ETH worth has defended help close to $3,050, creating a decent consolidation margin that always precedes larger strikes.

With the ETH/BTC pair hovering close to its personal inflection zone, merchants at the moment are questioning: is that this continued energy an indication of accumulation – or only a pause earlier than one other rejection? And if a breakout does occur, will $3,500 be the subsequent logical goal earlier than year-end?

Two eventualities merchants are taking a look at

Bullish state of affairs: Breakout above USD 3,350 opens the door to USD 3,500

A decisive day by day shut above the $3,300-$3,350 resistance zone, supported by rising quantity, would affirm a breakout from Ethereum’s ongoing consolidation. On this state of affairs, momentum indicators would doubtless improve, with $3,450-$3,500 positioned as the subsequent liquidity goal earlier than year-end.

Potential microcatalysts that help the constructive facet:

- ETH/BTC breaks above short-term resistance, signaling rotation from Bitcoin to large-cap alts

- Bitcoin is holding above $43,000 with out aggressive promoting stress

- Renewed inflows into ETH-related derivatives, indicating directional positioning slightly than hedging

If these align, Ethereum might shift from a range-bound commerce to a short-term pattern, growing the chance of momentary outperformance towards Bitcoin.

Bearish or Sluggish State of affairs: Rejection Close to Resistance Retains ETH Vary Certain

Failure to get well $3,350 – particularly if adopted by lengthy stretches of upper wicks or declining quantity – would point out continued promoting stress. On this case, Ethereum is in peril of sliding again to $3,100-$3,050, strengthening the broader vary slightly than inflicting a collapse.

Catalysts that may gradual or weaken momentum:

- ETH/BTC fails to clear resistance, leaving Bitcoin because the market’s predominant sink of capital

- Bitcoin Rejection Approaches $44,000, Decreasing Threat Sentiment

- Declining spot quantity, indicating a scarcity of conviction amongst patrons

On this state of affairs, ETH might proceed to consolidate by means of the tip of the yr, providing restricted directional alternatives as merchants anticipate a clearer macro or liquidity-driven set off.

What’s subsequent: How will ETH worth commerce by the tip of 2025?

Ethereum worth is as soon as once more at a crucial juncture, consolidating close to $3,120, whereas volatility decreases over longer time frames. Regardless of repeated rejections from the availability zone between $4,300 and $4,600, ETH continues to set increased lows, creating an ascending triangle construction. With the value at the moment caught between the 50-day transferring common round $3,300 and the 200-day transferring common round $2,600, merchants are holding a detailed eye on the value. A decisive break on either side might decide Ethereum’s subsequent large story forward of its annual shut.

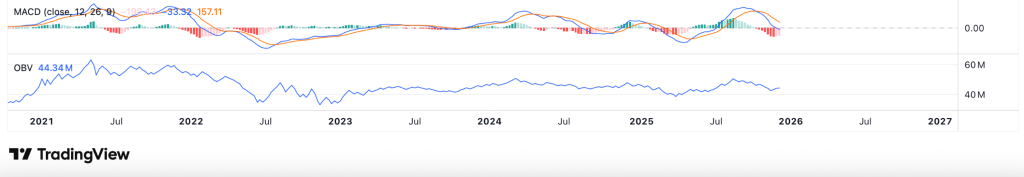

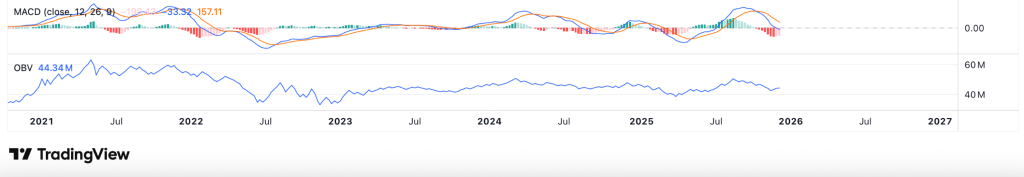

Ethereum’s weekly construction stays constructive as the value strikes inside an ascending triangle supported by increased lows. ETH is at the moment caught between the 50-day MA of close to $3,300 that acts as resistance and the 200-day MA of round $2,600 that serves as sturdy help, holding volatility compressed. The Ichimoku cloud begins to flatten and skinny, a scenario that always precedes directed enlargement. Notably, OBV has proven a bullish divergence, indicating regular accumulation, whereas the MACD histogram reveals a transparent discount in promoting stress. A confirmed break above $3,300 might open the way in which to $3,500 and $4,100, whereas a lack of $2,600 dangers a pullback to $2,300-$2,400.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our professional panel of analysts and journalists, following strict editorial tips primarily based on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our assessment coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We try to supply well timed updates on all the things crypto and blockchain, from startups to business majors.

Funding Disclaimer:

All opinions and insights shared signify the creator’s personal views on present market circumstances. Please do your individual analysis earlier than making any funding selections. Neither the author nor the publication accepts duty to your monetary selections.

Sponsored and Adverts:

Sponsored content material and affiliate hyperlinks might seem on our website. Adverts are clearly marked and our editorial content material stays fully unbiased from our promoting companions.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now