After dropping 3.28% in a single day, Ethereum value is combating promoting stress. Breaking the essential help stage at $4,500 triggered stop-loss orders, triggering a wave of subsequent liquidations. Along with the macroeconomic headwinds ensuing from a stronger US greenback and continued uncertainty about Federal Reserve coverage, market volatility elevated. As merchants pivoted their capital to BNB Chain, in search of decrease prices and elevated exercise on the chain.

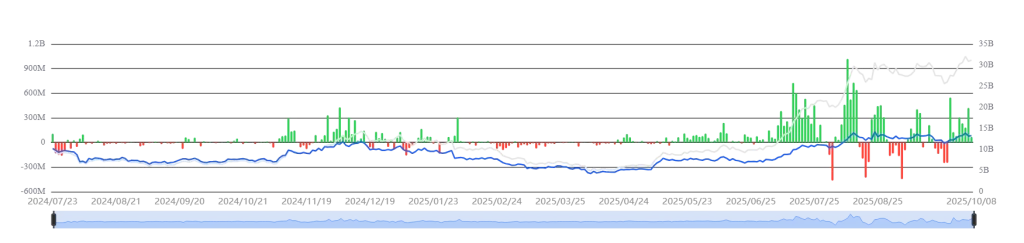

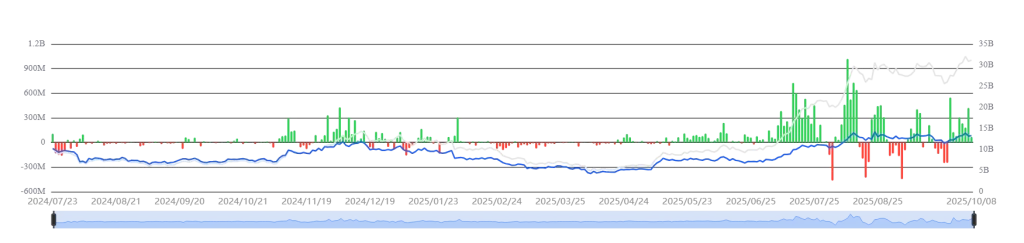

Indicators on the chain: ETF flows and liquidations

Current ETF and liquidation charts paint a grim image of elevated volatility in Ethereum’s derivatives panorama. After failing to reclaim its 7-day SMA at $4,524, the asset plummeted previous the Fibonacci 23.6% retracement stage at $4,542, leading to greater than $109.6 million in lengthy place liquidations inside 24 hours.

ETF inflows seem like stagnating, indicating cautious institutional sentiment. In the meantime, the market capitalization fell to $523.56 billion, a decline of three.4%. The earlier power of demand for ETFs has taken a again seat, and merchants at the moment are adjusting threat in favor of other chains.

ETH Value Evaluation:

Ethereum’s newest sell-off has invalidated a number of technical help zones. The asset is buying and selling close to $4,337.51, at a reduction of three.4% for the day and 1.12% for the week. With the typical true excessive at $4,556.22 and a 24-hour low of $4,324.88, the value is consolidating close to the primary breakdown space. The lack of help at $4,500 exposes the Ethereum value to an additional decline, with instant help anticipated at $4,308.81. That stated, better threat in the direction of $4,101.88 is feasible if bearish momentum continues.

The RSI is at present hovering round impartial territory however is trending in the direction of bearishness, indicating potential for additional promoting. If ETH stays under its crucial averages, new exams of month-to-month lows and a broader crypto correction are attainable. The all-time excessive at $4,953.73 stays a great distance off, with a most off the upside except threat sentiment turns.

Steadily requested questions

Given the current collapse under $4,500, Ethereum value faces elevated short-term threat, however its long-term prospects stay tied to fundamentals.

Shopping for after sharp corrections comes with dangers. Ethereum might fall even additional if market sentiment stays bearish. It’s advisable to attend for clear indicators of help or sturdy flows inside the chain.

If bullish tendencies and ETF momentum return, we anticipate Ethereum value to succeed in a excessive of $9,428.11 by the top of 2025.